Table of Contents

Making a life decision to become a forex trader is not easy, as it requires dedication, discipline, and the ability to make quick, informed decisions in a fast-paced environment.

Forex traders make money by buying and selling currencies, either on behalf of clients or on their behalf. They make profits by taking advantage of the fluctuations in currency exchange rates, which are influenced by various factors, such as economic news, political events, and market sentiment.

To become a successful forex trader, one must have a solid understanding of technical analysis, fundamental analysis, and risk management. Technical analysis involves studying price charts and using indicators to identify patterns and potential trading opportunities. Fundamental analysis involves analyzing economic data and news to understand the factors influencing currency exchange rates. Finally, risk management is essential for protecting capital and minimizing losses, which can be done through strategies such as stop-loss orders and position sizing.

It’s important to note that forex trading carries a high level of risk, and traders must be prepared to lose money. However, with the proper education and experience, it can be a highly profitable career. Many successful traders have started with small investments and gradually built up their trading skills and capital.

I will present my 12 steps on how to start a forex trader as a beginner:

Please watch my video from the Fxigor youtube channel:

How to Start Forex Trading?

- Make a trading decision: First, you must become a forex trader. Then, set aside a few weekly hours for learning and practical training.

- Learn technical analysis concepts: For example, you can read Technical Analysis of the Financial Markets by John J. Murphy).

- Learn fundamental analysis concepts: How and which economic factors impact forex price.

- Open a forex demo account: Choose a regulated forex broker and open a demo account.

- Make the first trading position in MT4: Start the first in the MetaTrader platform on a demo account.

- Analyze higher timeframes: As a beginner, use H4 or Daily charts to generate trades following the leading Daily or Weekly trend.

- Develop an easy trading strategy: Develop a trading strategy where you will enter into trades when the market breaks essential lows or highs on the chart. This can teach you to make actual trades.

- Analyze lower timeframes: Use a lower timeframe to trigger the trade. For example, buy low and sell high on a lower timeframe (5 minutes, 15 minutes, or 30 minutes) but follow the primary H1, H4, Daily, or Weekly trend. For example, buy 15 minutes low with a Daily and H4 bullish trend.

- Improve multi-timeframe trading: Monitor price using several timeframes and improve multi-timeframe analysis skills.

- Specialize in a few assets: Choose only several and track technical and fundamental data—for example, EURUSD, GBPUSD, and Gold.

- Put it all together: Finally, combine trading news, technical analysis, and multi-timeframe trading to become better.

- Start live account trading: Start trading on a live account when you see several months of profitable accounts.

Make a trading decision.

Many novice traders make the mistake of jumping into live trading without thoroughly understanding how the markets operate. They assume that trading is all about buying low and selling high without realizing the complexities involved. This approach often leads to substantial losses, denting their confidence and morale.

Here, the importance of reserving a few hours per day to study forex trading theory and practice comes in. By dedicating time to learning the fundamentals of trading, traders can gain the knowledge and skills required to make informed decisions. This enables them to confidently navigate the markets, manage risks effectively, and maximize profits.

One of the primary benefits of studying forex trading theory is that it enhances traders’ understanding of market fundamentals. In addition, it helps them grasp various technical indicators used in trading, such as candlestick charts, moving averages, and RSI, among others. These tools enable traders to analyze market trends and identify potential entry and exit points.

Another essential aspect of studying forex trading theory is that it enables traders to develop a solid trading strategy. This includes identifying trading objectives, establishing risk-reward ratios, and developing sound money management principles. A robust trading strategy ensures that traders enter and exit trades with clear goals and minimize the impact of emotional decision-making.

On the other hand, studying forex trading practice involves applying theoretical concepts to real-life situations.

Learn technical analysis concepts.

Technical analysis in Forex trading is a method of analyzing the market using past data from charts. It involves studying price movements, patterns, trends, and various technical indicators, to help traders make more accurate predictions of future price movements. As a result, technical analysis gives traders a comprehensive view of the market, increasing their chances of making sound trading decisions.

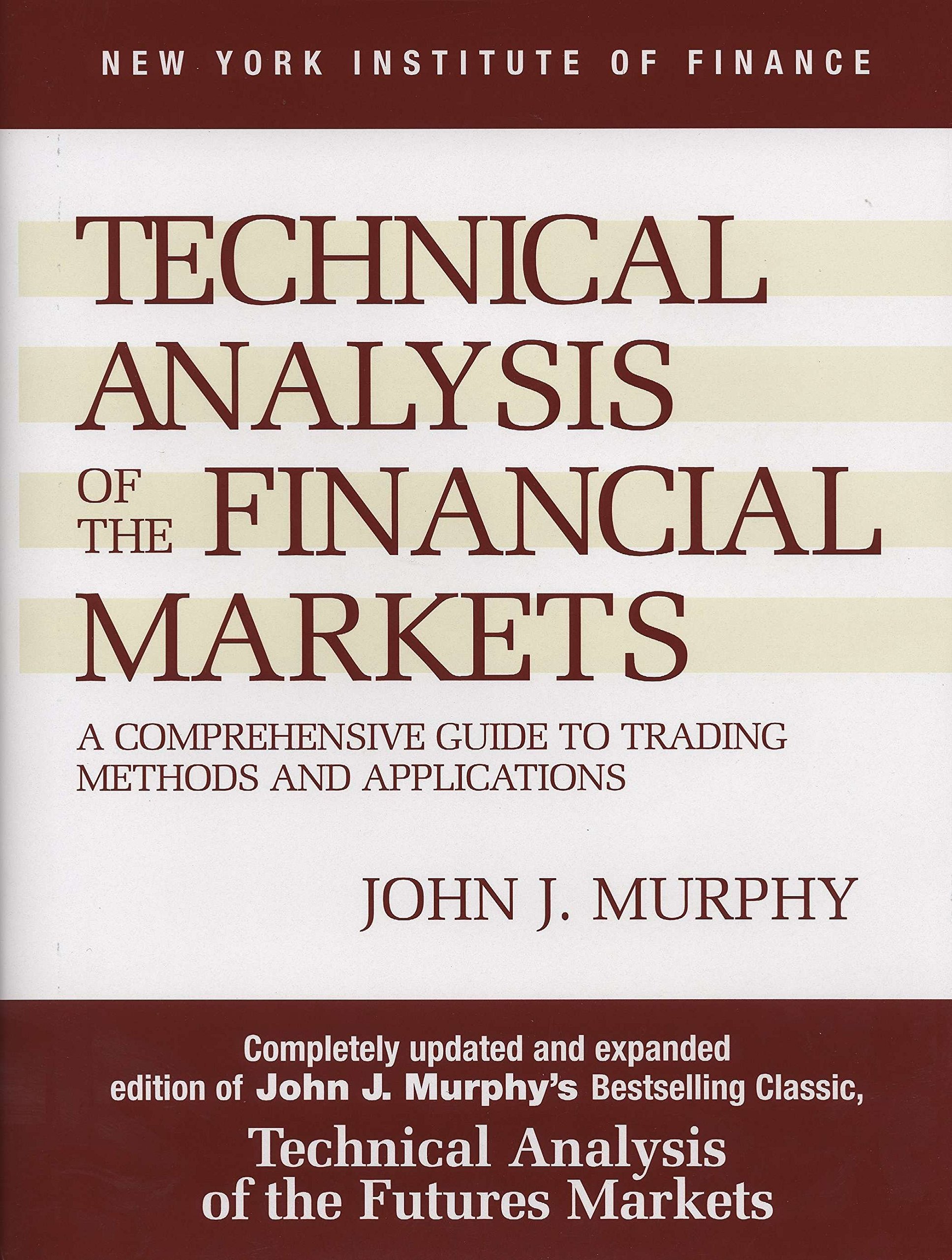

The book “Technical analysis in Financial Markets” by John Murphy is an excellent resource for beginner Forex traders. It contains a wealth of knowledge on technical analysis and how it can be used in the financial markets. The book covers various topics, including market trends, chart patterns, oscillators, and various technical indicators. In addition, it is written in an easy-to-understand language, making it ideal for anyone new to Forex trading.

The book’s author, John Murphy, is a respected authority on technical analysis, having over 40 years of experience in the field. He has authored several books on technical analysis, and his works are renowned for their clarity and practicality. John Murphy’s expertise and experience are reflected in every chapter of the book, making it one of the best resources for Forex traders who want to learn technical analysis.

Beginners in Forex trading often make the mistake of relying on instinct and luck, which frequently leads to losses. Technical analysis is essential for better understanding the market and making more conscious decisions. Investing in John Murphy’s “Technical analysis in Financial Markets” book is an intelligent move for traders who want to understand technical analysis in Forex trading better. It is an investment in oneself, which can provide invaluable knowledge and strategies to help navigate the Forex market more effectively.

Learn fundamental analysis concepts.

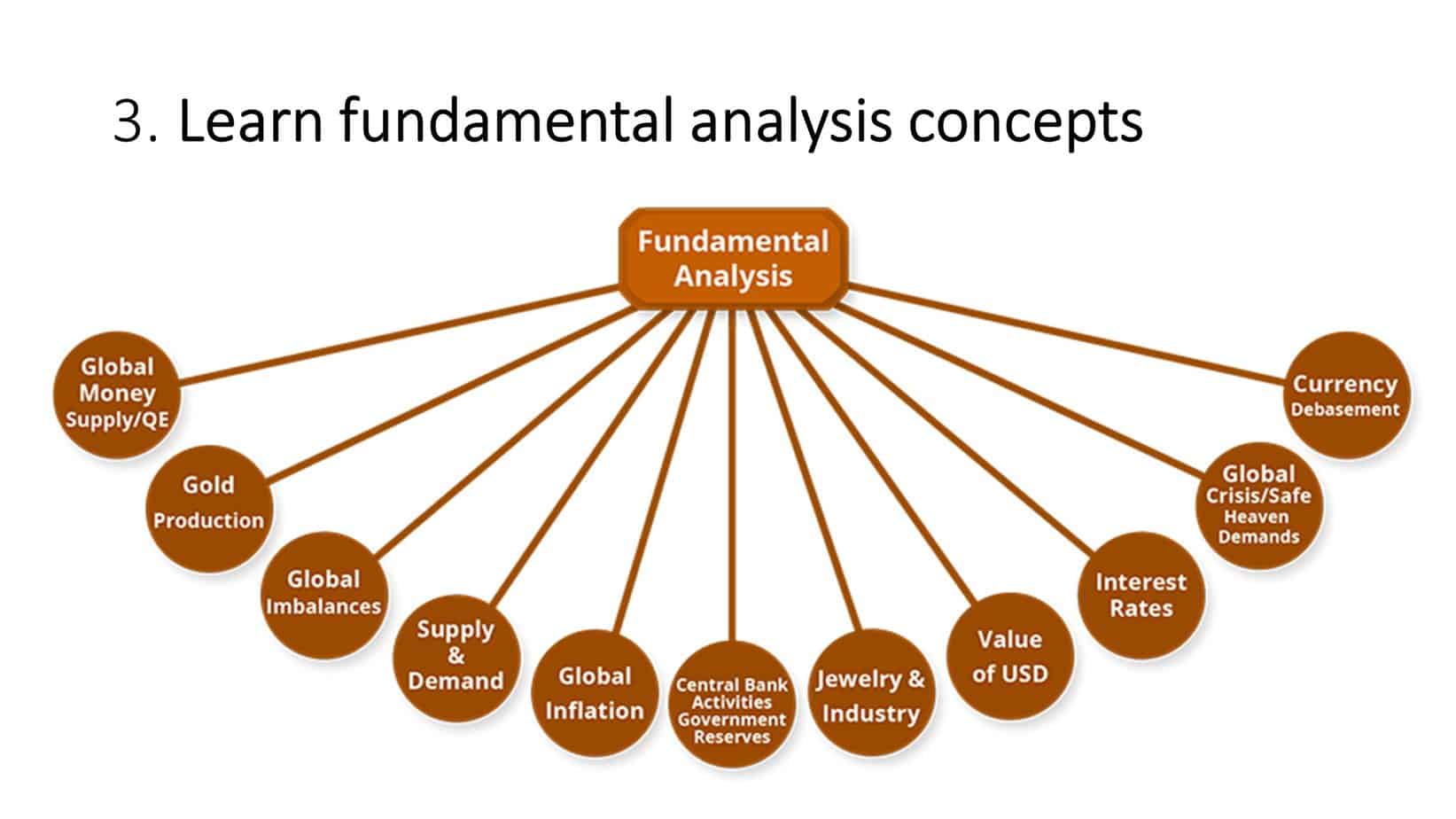

The importance of learning fundamental analysis cannot be overstated in the trading world. Fundamental analysis is a method traders use to analyze and evaluate economic, financial, and other qualitative and quantitative factors that can affect the price of an asset. It is a crucial component of trading that enables traders to make informed decisions and, ultimately, maximize their profits.

Several economic reports are essential to understanding the fundamentals of trading. One of the most important economic indicators is the Non-Farm Payrolls (NFP) report, released monthly by the U.S. Bureau of Labor Statistics. The NFP report provides valuable information on employment trends in the United States, including the number of non-farm jobs created or lost in the previous month. Traders closely monitor this data, as it significantly impacts the value of the U.S. dollar and other major currencies.

Another crucial economic report is the Gross Domestic Product (GDP) report. The GDP measures the total value of all goods and services produced within a country’s borders. It is an indicator of a country’s economic health and is closely watched by traders as it can influence the value of its currency. A rising GDP is usually associated with a strong national currency, whereas a decline in GDP can cause a currency to weaken.

Interest rates are yet another significant economic factor that can influence trading decisions. This is because changes in interest rates can have a direct impact on the value of a currency. For example, if a country’s central bank raises interest rates, it can attract foreign investment and boost the currency’s value. Conversely, if interest rates are lowered, it can have the opposite effect.

However, each asset has its vital reports. For example, look how fundamental analysis for Gold looks like:

Open a forex demo account.

The first step to open a Forex demo account is to select a trustworthy Forex broker, which should be regulated by a recognized agency such as the Financial Conduct Authority (FCA) or the Australian Securities Exchange (ASIC). A simple online search or referral from a friend can help you find a suitable broker. Once the broker is selected, a trader can complete a registration form and visit the broker’s website. Some brokers may require identity verification, which can be done by uploading a passport or driver’s license.

When choosing a Forex broker to open a demo account with, there are a few essential factors to consider. Firstly, a trader should look at the trading platforms the broker offers. The trading platform should be user-friendly and provide access to financial instruments such as Forex, stocks, commodities, and cryptocurrencies. Secondly, a trader should consider the fees charged by the broker, including spreads and commissions. Thirdly, a trader should look at the customer service offered by the broker. Good customer support can be crucial in resolving any issues while trading.

Once the Forex demo account is set up, traders can practice trading using virtual money in a simulated market environment. Essentially, demo accounts replicate actual market conditions without trading with real money. This allows traders to learn how to place trades, test strategies, and understand how the market functions without risking capital.

But why is a Forex demo account so crucial for beginner traders? The answer to this question is straightforward – because trading Forex is complex and risky. Forex traders must understand various market forces affecting currency values and the risks associated with different trading strategies. This requires knowledge, skills, and experience, which can be gained through practice.

Using a Forex demo account, traders can learn trading concepts such as technical analysis, chart patterns, price action, risk management, and trading psychology. They can also test various trading strategies without risking any real money. As a result, demo accounts are an excellent tool for gaining confidence in trading and understanding one’s strengths and weaknesses.

You can choose the best forex brokers from our page.

| Forex broker Review | Visit | Min. lot size | Max. leverage | Min. deposit |

|---|---|---|---|---|

HFM | VISIT HFM | 0.01 | 1:1000 | $1 |

Avatrade | VISIT AVATRADE | 0.01 | 1:400 | $1 |

Instaforex | VISIT INSTAFOREX | 0.0001 | 1:1000 | $10 |

FxPro | VISIT FXPRO | 0.01 | 1:500 | $100 |

IC Markets | VISIT IC MARKETS | 0.01 | 1:500 | $200 |

XM.com | VISIT XM | 0.01 | 1:1000 | $5 |

| VISIT EXNESS | 0.01 | 1:2000 | $10 | |

| Octafx review | VISIT OCTAFX | 0.01 | 1:400 | $50 |

Another critical aspect of a Forex demo account is that it helps select the right trading platform and broker. Demo accounts allow traders to test different platforms and brokers to find the best option. This can be crucial in avoiding unnecessary costs in the future due to switching brokers and platforms.

To sum up, opening a Forex demo account is essential for beginner traders as it provides an opportunity to gain practical experience in the market without risking real money. Through a demo account, traders can practice trading strategies, learn crucial trading concepts, and gain confidence in their trading abilities. In addition, demo accounts are essential to selecting the right broker and trading platform. So, if you’re a beginner trader, don’t hesitate to open a Forex demo account today to start your trading journey.

Make the first trading position in MT4.

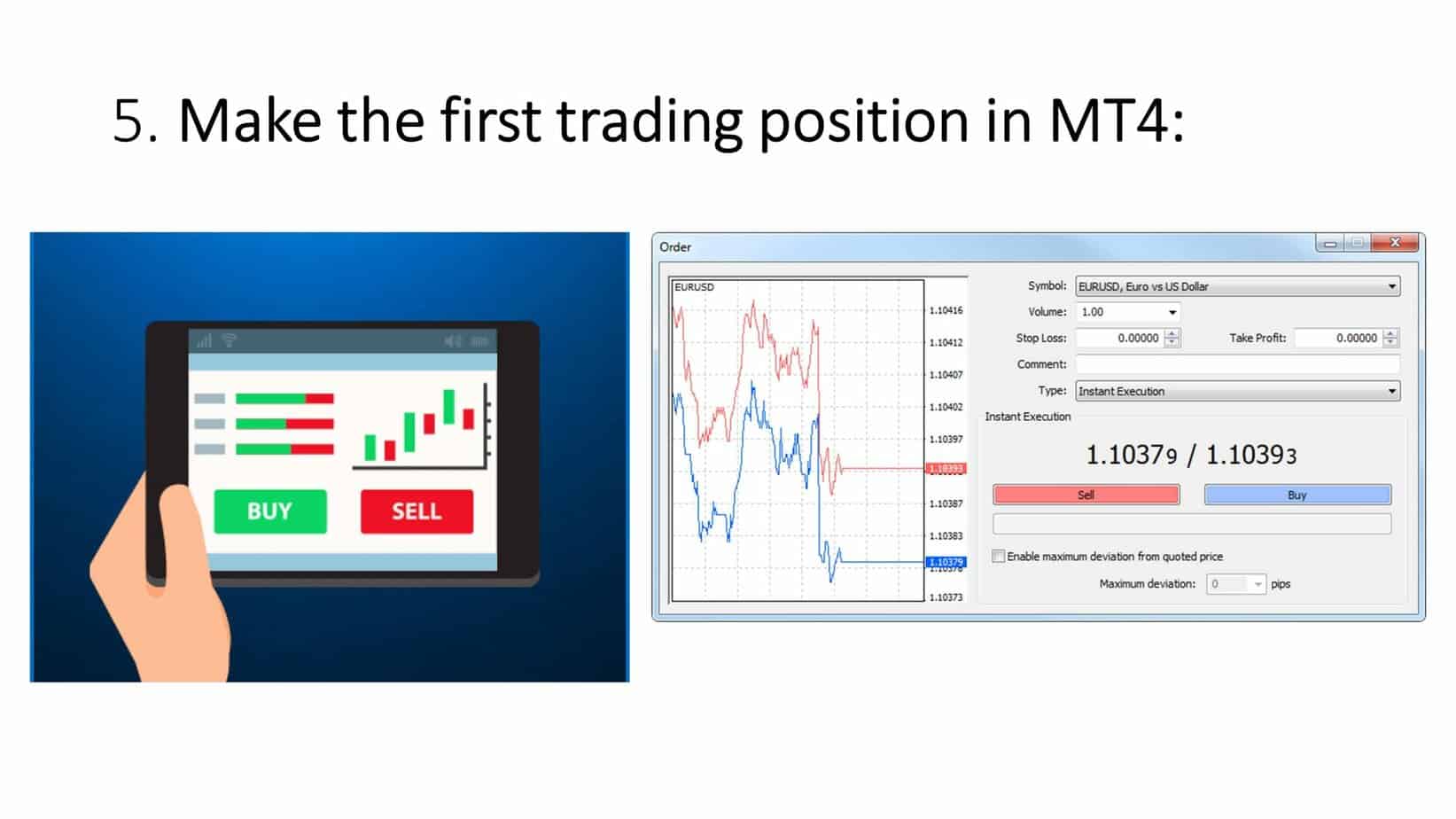

Practice and skill development are crucial for success in forex trading. Considering the volatile nature of the forex market, it is essential to have a solid understanding of trading strategies, risk management, and market analysis to succeed as a trader. To achieve these skills, traders must utilize MetaTrader 4 (MT4) demo accounts to build their expertise.

The first position in the MT4 trading demo account helps traders develop the necessary skills and experience to analyze market trends and make the most profitable decisions. It offers a mock trading environment that mimics a real trading account but without the emotional stress of dealing with actual funds. When a trader aims to make the first position, they must research and analyze the market, consider the risk factors, and calculate their potential earnings. This process is essential because it helps traders recognize their strengths and weaknesses before using actual funds.

Moreover, in today’s fast-paced forex trading world, traders must continually adapt to new strategies and stay ahead of the curve. Utilizing the demo account as a training ground to develop trading skills enables traders to keep up with the changes and build resilience that will serve them well.

The first position in an MT4 trading demo account is also an opportunity to practice disciplined trading. One of the most significant challenges facing traders is staying disciplined when trading, and this is an area in which demo accounts can provide valuable assistance. With demo accounts, traders can establish the discipline required to stick to a trading plan, such as setting stop-losses or taking profits. The first position in demo accounts offers an excellent opportunity to monitor market trends and establish disciplined trading habits before moving on to the live trading account.

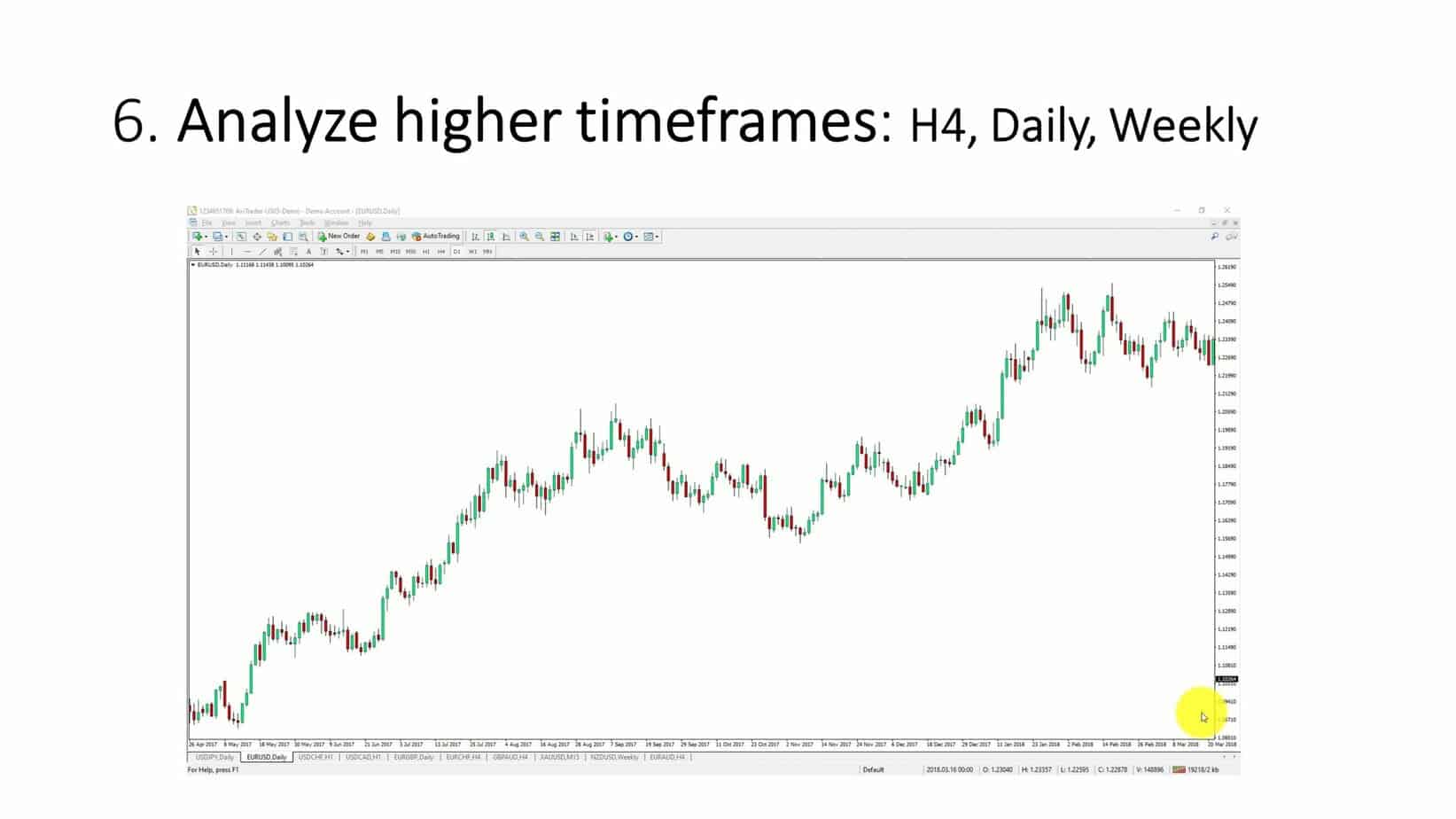

Analyze higher timeframes

While there are a variety of time frames that traders can use to analyze the markets, higher time frames, such as H4, Daily, and Weekly charts, provide a unique advantage to traders regarding demo trading.

One of the main benefits of trading on higher time frames is that time flows at a slower pace. This means traders have more time to analyze price movements and make informed trading decisions without rushing. With a longer-term view, traders can more accurately assess market trends and patterns. Unlike lower time frames, which can often move quickly and unpredictably, higher ones provide a more stable and reliable market picture.

Another advantage of trading on higher time frames is a wider stop loss and target levels. This means traders have more room to maneuver and adjust their positions if necessary. By having a more comprehensive stop loss and target, traders can avoid being stopped out of a trade prematurely while ensuring that they have enough cushion to ride out any short-term fluctuations in the market. Additionally, wider stop loss and target levels help to minimize the impact of market noise and reduce the risks associated with volatility.

You can make simple buy-and-sell trades that can last several days or weeks. Excellent for beginner traders!

Develop an easy trading strategy

Try to create 1 rule easy forex strategy!

We will explore how you can develop an easy forex trading strategy based on one rule condition using chart patterns, moving average crosses, or oscillators such as RSI or MACD.

Trading based on chart patterns is one popular trading approach. Charts show patterns in price movements that can help you identify potential trading opportunities. There are different chart patterns, including those that indicate a trend reversal (such as head and shoulders, double tops, or double bottoms) and those that show a continuation of the current trend (such as flags or pennants). By learning to recognize these patterns, you may be able to identify potential trading opportunities and enter or exit the market at the right time.

Another approach to forex trading is based on moving averages. Moving averages are a simple but effective tool for measuring the trend direction of a currency pair. The aim is to identify the trend’s direction and to ride it until it reverses. For example, long-term traders may use the 50-day and 200-day moving averages to identify the trend, while short-term traders may use the 20-day and 50-day moving averages. This approach aims to help traders to stay on the right side of the market and to avoid trading against the trend.

Oscillators such as RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) can also help develop a successful forex trading strategy. These indicators work by measuring the strength of price movements and trending behavior. The RSI indicator, for example, measures the strength of an asset’s price movements and indicates whether the asset is overbought or oversold. Meanwhile, the MACD indicator measures, compares, and analyzes price actions in the forex market. These indicators may be helpful for traders who want to identify potential entry or exit points for their trades.

Regardless of your chosen approach, creating rules that help you stay disciplined and focused on your trading strategy is essential. For example, you might set up specific criteria for entering and exiting your trades or specify how much money you will risk on each trade. You might also focus on one currency pair to better develop expertise and understand its specific market dynamics.

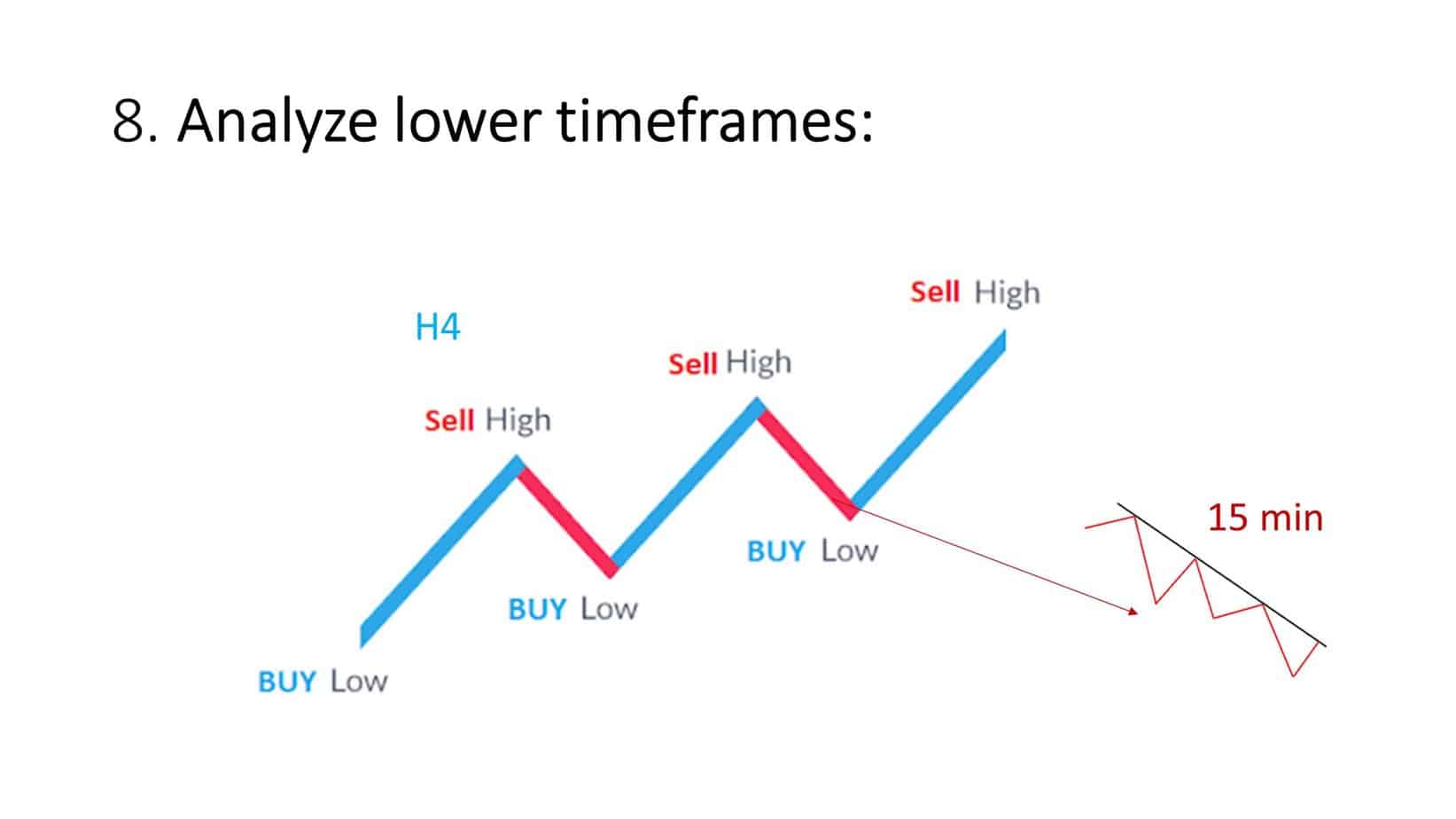

Analyze lower timeframes

Trading with multiple time frames has become a widely accepted practice for forex traders who want to increase their chances of making profitable trades. This technique involves looking at charts with different time intervals, such as the one-minute, five-minute, or fifteen-minute intervals for lower time frames and daily, weekly, or monthly intervals for higher ones. By analyzing different timeframes, traders can get a comprehensive view of the market and obtain valuable data that can be used to make educated decisions.

One of the most efficient ways of applying this technique is by buying when the price is on support in lower time frames and following bullish trends in higher times. For instance, if the one-minute chart shows that the price is at support, it is essential to identify the trend direction in a higher time frame. On the other hand, if the higher time frame indicates the presence of a bullish trend, trading is recommended based on the bullish trend signals.

Another common application sells on lower-timeframe resistance when there is a bearish trend on the higher time frame. Once the resistance is identified on the one-minute chart, traders should look at the signals on a higher time frame to ensure the trend is bearish. If the higher time-frame signals match a bearish trend, traders can shorten their positions to take advantage of the downtrend.

Let us see the strategy in the Figure below. We have a major bullish trend on the H4 chart. However, we can buy when the price is on the 15-minute chart on support:

Implementing this strategy involves considerable effort and even a certain degree of luck. However, traders can become successful with consistent implementation and proper risk management. Properly executed, a forex trading plan based on this strategy can soothe the anxieties of traders who fear the risks of the market. It is worth noting that traders must thoroughly analyze market data before making any significant moves in the market.

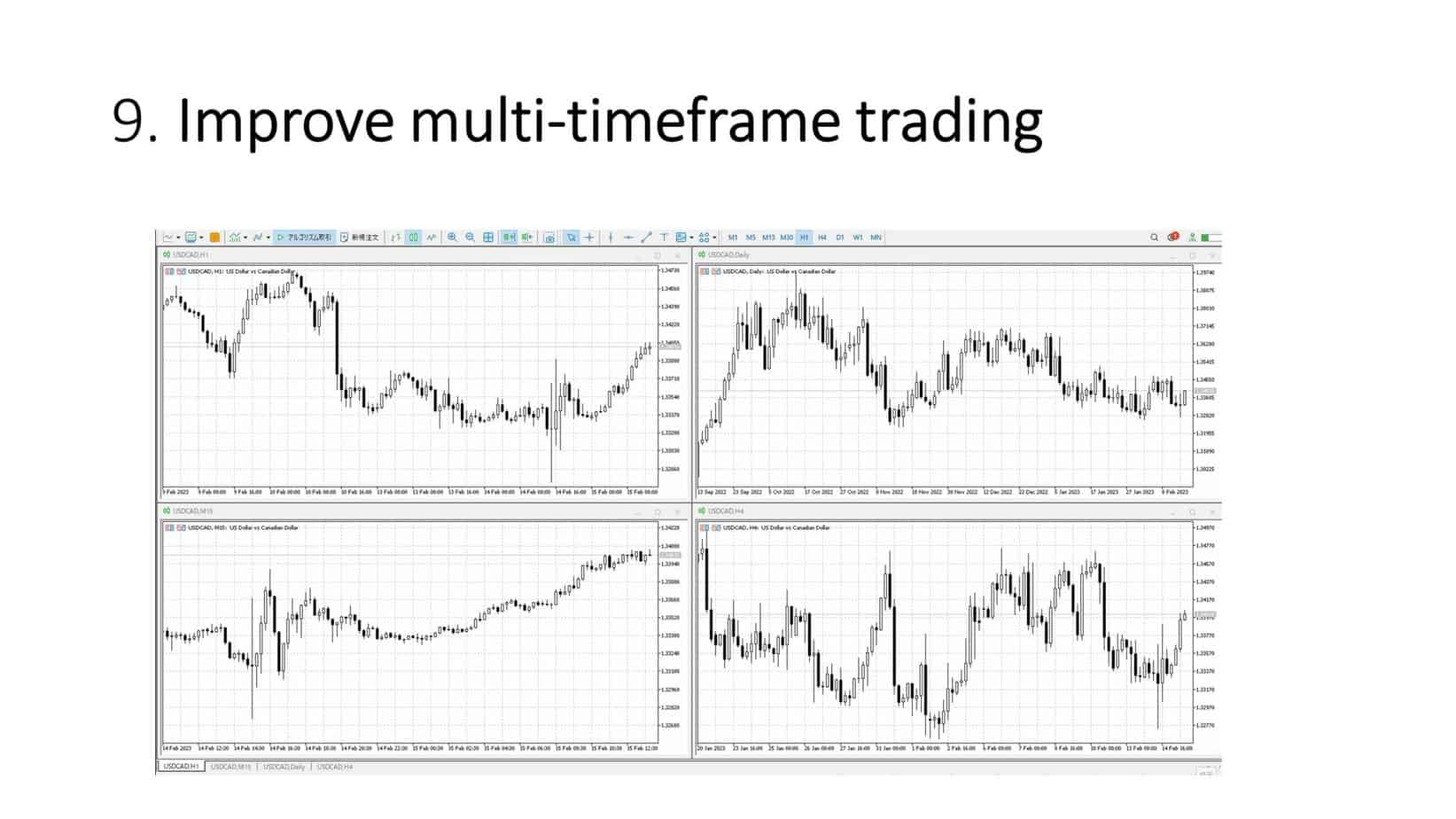

Improve multi-timeframe trading

Multi-time frame analysis involves analyzing the market from different time frames to determine the long-term trend and identify potential trading opportunities in the short term. Therefore, the second step is to define the time frames you want to use for analysis. For example, you can use a daily chart to identify the long-term trend and a 4-hour chart to find short-term opportunities.

You can use the Daily and H1 chart in combination, H4 and M30, or H1 and M15 to practice multi-timeframe analysis.

The next step in the multi-time frame analysis is to analyze each time frame individually. Start with the longest timeframe you have chosen and look for the overall trend. For example, is the market in an uptrend, downtrend, or range? Next, move to the shorter timeframe and look for trading opportunities that align with the longer-term trend.

Specialize in a few assets.

Overtrading is one of the most common mistakes traders make in financial markets. Trading too frequently without a solid strategy can lead to losses and decreased profitability. Analyzing too many assets can also be counterproductive for any trader, limiting their ability to focus and make informed decisions.

The key to success in trading is to maintain a disciplined approach and specialize in a few assets you know about, like EURUSD and GBPUSD.

Specializing in a few carefully selected assets can help traders develop expertise in those particular markets, allowing them to anticipate market movement and analyze potential risks and rewards. By focusing on two to four assets, traders can become proficient in the intricacies of those markets, ultimately improving their trading performance and generating consistent profits.

In addition, allocating trading capital to fewer markets enables traders to better manage their positions and risks. Diversification may be necessary for most areas of investment. However, over-diversification can hurt traders if they cannot handle increased exposure or adapt to fast market dynamics affecting multiple assets simultaneously.

Moreover, traders can benefit from performing in-depth and comprehensive analyses to monitor economic news, central bank policies, and technical indicators in their specialized markets. However, monitoring too many assets can cloud their judgment and have a negative impact on their ability to concentrate on their core markets.

The trading world is full of information and swift changes. Therefore, as a trader, it is essential not to be influenced by the hype or the latest trends. Instead, it is necessary to have a robust strategy and core position. A trader who analyzes too many things will have more potential risks, which can ultimately lead to lost opportunities.

Put it all together

Technical analysis is an essential aspect of forex trading, and it involves using charts and other technical indicators to predict price movements. Technical analysis uses historical data to identify patterns in the market, which can be used to predict future price movements. Technical traders rely on charts to identify trends and momentum. In addition, they use indicators such as moving averages, Fibonacci retracements, and MACD (Moving Average Convergence/Divergence) to help them make trading decisions. You can read our article to learn about the best momentum indicator.

Fundamental analysis, on the other hand, is a method of analyzing economic and financial data to study the intrinsic value of an asset. For example, in the case of forex trading, fundamental analysis involves monitoring economic data such as GDP growth rates, employment data, and inflation levels to predict a currency’s performance. Fundamental traders use these factors to identify undervalued or overvalued currencies and to make trading decisions based on their analysis.

Multi-time frame analysis is a method of analyzing price movements across different time frames. This approach considers short, medium, and long-term price trends, and traders use it to spot patterns that may not be visible in shorter time frames. For example, multi-timeframe analysis can help traders identify important support and resistance levels and potential breakout opportunities.

Technical analysis can provide traders with precise entry and exit points, while fundamental analysis can give traders an idea of the long-term value of a currency. In addition, multi-timeframe research can help traders identify long-term trends to establish positions that can lead to higher profits.

However, it is essential to note that using these skills alone does not guarantee success in forex trading. It requires patience, discipline, and a lot of practice. Traders must be willing to put in the time and effort to study the market and develop their skills. They must also be prepared to manage risk effectively by setting stop losses and limiting their exposure to any single trade.

Start Live Trading

Many novice traders make the mistake of jumping straight into live trading without prior experience or preparation. They assume that since they have studied the market and read books on the subject, they are ready to start making trades and earning profits. Unfortunately, this is not the case. Forex trading requires practice, patience, and a willingness to learn from mistakes.

Working on a demo account before opening a live one is highly recommended by financial experts. However, as valuable as demo accounts may be, they can never completely replicate the experience of trading in a live account. Trades on a demo account can be executed seamlessly; however, when it comes to real live trades, unexpected volatility may be suspected, which can only be experienced live. Hence, forex traders should use a demo and live trading accounts as a continuous learning and self-evaluation tool.

Most experienced Forex traders advise that a trader should spend at least six months on a demo account before he can begin trading on a live account. These six months should be used to fine-tune your trading strategy, learn about market movements, and practice risk management. A demo account is also helpful for practicing placing trades, using different technical analysis tools, and understanding the nuances of various currency pairs.

Closing a successful trade on a demo account could give traders a fleeting sense of a trading experience, but opening a similar trade live may differ. The psychology behind trading can vary from virtual to actual trading. Thus, traders are advised to learn to control their emotions, especially when prices don’t go in their favor.

So, if you are ready, try a live account.