Table of Contents

The US Federal Reserve (Fed) will meet eight times in 2024 to set interest rates. These meetings are essential in determining the economy’s direction and the status of current and future US economic policies. The Fed’s announcement schedule is usually released around the beginning of a new year, and this year was no different. As such, we now have the dates for each of the Fed’s eight interest rate announcements throughout the year.

Please watch my video about FED and FOMC and How To Trade The FOMC FED Announcement:

When is the next Fed interest rate decision?

The next Fed interest rate decision will be on Wednesday, January 29. 2025, at 2 p.m. Based on experts ‘ projections, If inflation remains close to the Fed’s target of 2%, they will likely maintain a neutral stance.

Please check the FOMC trading strategy example:

These predictions aside, investors should still pay close attention to all eight meetings throughout 2023, as any changes by The Fed can have ripple effects across global markets and economies. From pension funds to individual investors, understanding how The Fed’s decisions affect you can help you plan your financial strategy accordingly and prepare for future risks or opportunities when necessary.

Let us see the US Central Bank meetings:

When is the Fed rate announcement?

For 2025, the Federal Reserve’s FOMC (Federal Open Market Committee) meetings are scheduled as follows, along with the expected rate announcement dates:

- January 28-29, 2025 – Rate Announcement: January 29

- March 18-19, 2025 – Rate Announcement: March 19

- April 29-30, 2025 – Rate Announcement: April 30

- June 17-18, 2025 – Rate Announcement: June 18

- July 29-30, 2025 – Rate Announcement: July 30

- September 16-17, 2025 – Rate Announcement: September 17

- October 28-29, 2025 – Rate Announcement: October 29

- December 9-10, 2025 – Rate Announcement: December 10

These are the official dates for the FOMC meetings, with rate announcements typically following the last day of the meeting. Be sure to check for any changes or updates as the year progresses.

When does the Fed meet this month?

The next Fed meeting will be on June 12., 2024. During 2024, the Fed will not make any rate announcements in February, April, August, and October.

During these meetings, the Federal Open Market Committee (FOMC) members review economic data and make recommendations for adjustments to interest rates and policies. The main focus of these meetings is to assess whether inflation remains within a desirable range and whether further economic stimulus is needed to maintain financial stability.

The United States economy has experienced unprecedented growth in recent months despite the lingering COVID-19 pandemic. This has been credited to massive federal stimulus packages passed earlier, allowing Americans to maintain their spending and investing habits during this crisis. As such, it’s expected that members of the FOMC will discuss potential changes to the existing policy to keep this growth going.

During meetings, the Fed also typically reviews data about employment numbers and consumer confidence levels. In particular, they are likely to look at jobless claims figures in light of recent announcements from major companies announcing layoffs or furloughs due to the pandemic. Additionally, they may consider other measures such as housing starts, retail sales figures, and commercial bank lending activity when making decisions about current policy.

After two days of deliberations over this month’s meeting, members of the FOMC will decide what actions should be taken based on their findings. Once these actions are agreed upon – such as raising interest rates or maintaining them at existing levels – they are communicated publicly through press conferences and statements by Chairman Jerome Powell and other committee members.

It will again review economic data before deciding to change policy or interest rate levels accordingly. However, all eyes will be on how consumers and businesses respond to this month’s decision—particularly if further economic relief efforts become necessary due to increased cases or another wave of lockdowns across America during winter months.

Let us see the Fed Interest Rate Decision Today:

Fed interest rate decision projection

The Federal Open Market Committee (FOMC) kept U.S. interest rates unchanged, maintaining the federal funds rate at 5.25-5.50%.

The FOMC has signaled expectations for three rate cuts in 2024. These cuts would likely be gradual, depending on the inflation trajectory, economic growth, and labor market conditions. If inflation trends downward sustainably, the decision to cut rates would aim to support economic growth.

FOMC decision importance

The FOMC’s decisions regarding interest rates are critically important for several reasons:

- Monetary Policy Instrument: The FOMC sets the target range for the federal funds rate, which is the interest rate at which banks lend money to each other overnight. This rate indirectly influences interest rates throughout the economy, including the rates on loans and savings.

- Economic Growth: Changes in interest rates can either stimulate or cool down the economy. Lower interest rates tend to stimulate economic growth because they make borrowing cheaper for households and businesses, which can lead to increased spending and investment. Conversely, higher rates can slow the economy by making borrowing more expensive.

- Inflation Control: One of the Federal Reserve’s main goals is to control inflation. If the economy grows too quickly and inflation rises, the FOMC might increase interest rates, spending, and borrowing. If the economy slows and unemployment rises, the FOMC might lower rates to stimulate growth.

- Expectations and Predictability: Financial markets, businesses, and consumers closely watch the FOMC’s decisions and statements. They provide signals about the future direction of the U.S. economy and monetary policy. Even the anticipation of a rate change can cause shifts in behavior.

- Currency Value: Interest rates influence the strength and value of a country’s currency. Higher interest rates tend to attract foreign capital and increase the currency’s value because they offer lenders a higher return than other currencies. Conversely, lower rates can lead to a decline in the currency’s value.

- Global Impact: Because the U.S. economy and the U.S. dominate global markets, FOMC decisions can have significant repercussions worldwide. Changes in U.S. interest rates can influence global capital flows, foreign exchange rates, and economic conditions in other countries.

- Financial Stability: The FOMC helps ensure financial stability. When financial markets are turbulent or threaten the financial system, the FOMC’s actions and communications can help stabilize the situation.

- Communications Tool: Beyond the actual decision on interest rates, the FOMC’s post-meeting statement provides insights into its views on the state of the economy, risks, and its outlook on future policy actions. This can give market participants and the public a clearer understanding of the FOMC’s policy stance and expectations.

Given the above, it’s evident that the FOMC’s interest rate decisions and meetings play a pivotal role in shaping the economic trajectory of the U.S. and, by extension, have ripple effects across the global economy.

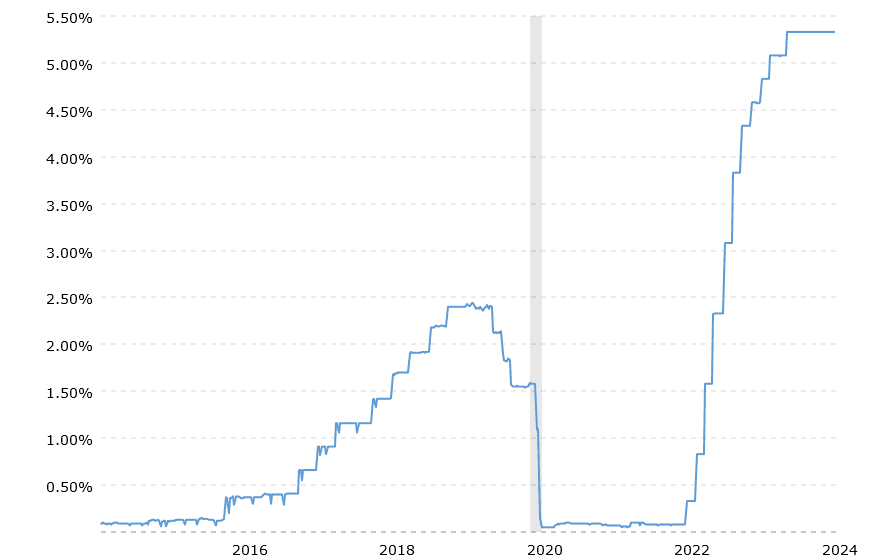

US interest rate charts

US Interest Rate Table

| Rate Release Date | Time EST | Actual interest rate |

|---|---|---|

| Nov. 1.2023. | 14:00 | 5.5% |

| Sep. 20. 2023. | 14:00 | 5.5% |

| July 26. 2023 | 14:00 | 5.5% |

| June 14. 2023. | 14:00 | 5.25% |

| May 3.2023 | 14:00 | 5.25% |

| Mar 22.2023 | 14:00 | 5.00% |

| Feb 1.2023 | 14:00 | 4.75% |

| Dec 14, 2022 | 14:00 | 4.50% |

| Nov 02, 2022 | 13:00 | 4.00% |

| Sep 21, 2022 | 13:00 | 3.25% |

| Jul 27, 2022 | 13:00 | 2.50% |

| Jun 15, 2022 | 13:00 | 1.75% |

| May 04, 2022 | 13:00 | 1.00% |

| Mar 16, 2022 | 13:00 | 0.50% |

| Jan 26, 2022 | 14:00 | 0.25% |

| Dec 15, 2021 | 14:00 | 0.25% |

| Nov 03, 2021 | 13:00 | 0.25% |

| Sep 22, 2021 | 13:00 | 0.25% |

| Jul 28, 2021 | 13:00 | 0.25% |

| Jun 16, 2021 | 13:00 | 0.25% |

| Apr 28, 2021 | 13:00 | 0.25% |

| Mar 17, 2021 | 13:00 | 0.25% |

| Jan 27, 2021 | 14:00 | 0.25% |

| Dec 16, 2020 | 14:00 | 0.25% |

| Nov 05, 2020 | 14:00 | 0.25% |

| Sep 16, 2020 | 13:00 | 0.25% |

| Jul 29, 2020 | 13:00 | 0.25% |

| Jun 10, 2020 | 13:00 | 0.25% |

| Apr 29, 2020 | 13:00 | 0.25% |

| Mar 15, 2020 | 16:00 | 0.25% |

| Mar 03, 2020 | 10:00 | 1.25% |

| Jan 29, 2020 | 14:00 | 1.75% |

| Dec 11, 2019 | 14:00 | 1.75% |

| Oct 30, 2019 | 13:00 | 1.75% |

| Sep 18, 2019 | 13:00 | 2.00% |

| Jul 31, 2019 | 13:00 | 2.25% |

| Jun 19, 2019 | 13:00 | 2.50% |

| May 01, 2019 | 13:00 | 2.50% |

| Mar 20, 2019 | 13:00 | 2.50% |

| Jan 30, 2019 | 14:00 | 2.50% |

| Dec 19, 2018 | 14:00 | 2.50% |

| Nov 08, 2018 | 14:00 | 2.25% |

| Sep 26, 2018 | 13:00 | 2.25% |

| Aug 01, 2018 | 13:00 | 2.00% |

| Jun 13, 2018 | 13:00 | 2.00% |

| May 02, 2018 | 13:00 | 1.75% |

| Mar 21, 2018 | 13:00 | 1.75% |

| Jan 31, 2018 | 14:00 | 1.50% |

| Dec 13, 2017 | 14:00 | 1.50% |

| Nov 01, 2017 | 13:00 | 1.25% |

| Sep 20, 2017 | 13:00 | 1.25% |

| Jul 26, 2017 | 13:00 | 1.25% |

| Jun 14, 2017 | 13:00 | 1.25% |

| May 03, 2017 | 13:00 | 1.00% |

| Mar 15, 2017 | 13:00 | 1.00% |

| Feb 01, 2017 | 14:00 | 0.75% |

| Dec 14, 2016 | 14:00 | 0.75% |

| Nov 02, 2016 | 13:00 | 0.50% |

| Sep 21, 2016 | 13:00 | 0.50% |

| Jul 27, 2016 | 13:00 | 0.50% |

| Jun 15, 2016 | 13:00 | 0.50% |

| Apr 27, 2016 | 13:00 | 0.50% |

| Mar 16, 2016 | 13:00 | 0.50% |

| Jan 27, 2016 | 14:00 | 0.50% |

| Dec 16, 2015 | 14:00 | 0.50% |

| Oct 28, 2015 | 13:00 | 0.25% |

| Sep 17, 2015 | 13:00 | 0.25% |

| Jul 29, 2015 | 13:00 | 0.25% |

| Jun 17, 2015 | 13:00 | 0.25% |

| Apr 29, 2015 | 13:00 | 0.25% |

| Mar 18, 2015 | 13:00 | 0.25% |

| Jan 28, 2015 | 14:00 | 0.25% |

| Dec 17, 2014 | 14:00 | 0.25% |

| Oct 29, 2014 | 13:00 | 0.25% |

| Sep 17, 2014 | 13:00 | 0.25% |

| Jul 30, 2014 | 13:00 | 0.25% |

| Jun 18, 2014 | 13:00 | 0.25% |

| Apr 30, 2014 | 13:00 | 0.25% |

| Mar 19, 2014 | 13:00 | 0.25% |

| Jan 29, 2014 | 14:00 | 0.25% |

| Dec 18, 2013 | 14:00 | 0.25% |

| Oct 30, 2013 | 13:00 | 0.25% |

| Sep 18, 2013 | 13:00 | 0.25% |

| Jul 31, 2013 | 13:00 | 0.25% |

| Jun 19, 2013 | 13:00 | 0.25% |

| May 01, 2013 | 13:00 | 0.25% |

| Mar 20, 2013 | 13:00 | 0.25% |

| Jan 30, 2013 | 14:15 | 0.25% |

| Dec 12, 2012 | 12:30 | 0.25% |

| Oct 24, 2012 | 13:15 | 0.25% |

| Sep 13, 2012 | 11:30 | 0.25% |