Table of Contents

Whether you are a trader or not, everyone has heard of the term ‘Forex Trading.’ Trading or exchanging currencies to make a profit is not a new concept. In 1982, investors realized the potential of exploring currency variations, and the first currency pair was traded. Controlled by a few professionals at that time, Forex trading has come a long way. Today, it is an open market where millions of novice and experienced traders use currencies’ fluctuating strength to profit.

Forex is recognized as the marketplace that allows you to trade many diverse currencies of the world’s nations. The forex market is considered to be the market that is the largest one on the globe at this present time that provides the highest level of liquidity as a result of the many trades being conducted in the number of trillions of dollars daily. For this market, it is noted that there is no existence of location that is centralized. Instead, the forex market is set up to function as an electronic network that connects banks, institutions, brokers, and personal traders who conduct trades primarily via the usage of banks or brokers. So, what is forex?

What is Forex?

Forex or foreign exchange represents the largest and most liquid asset global marketplace for exchanging national currencies against one another. In the foreign exchange process, traders change one currency into another currency for commerce, trading, or tourism.

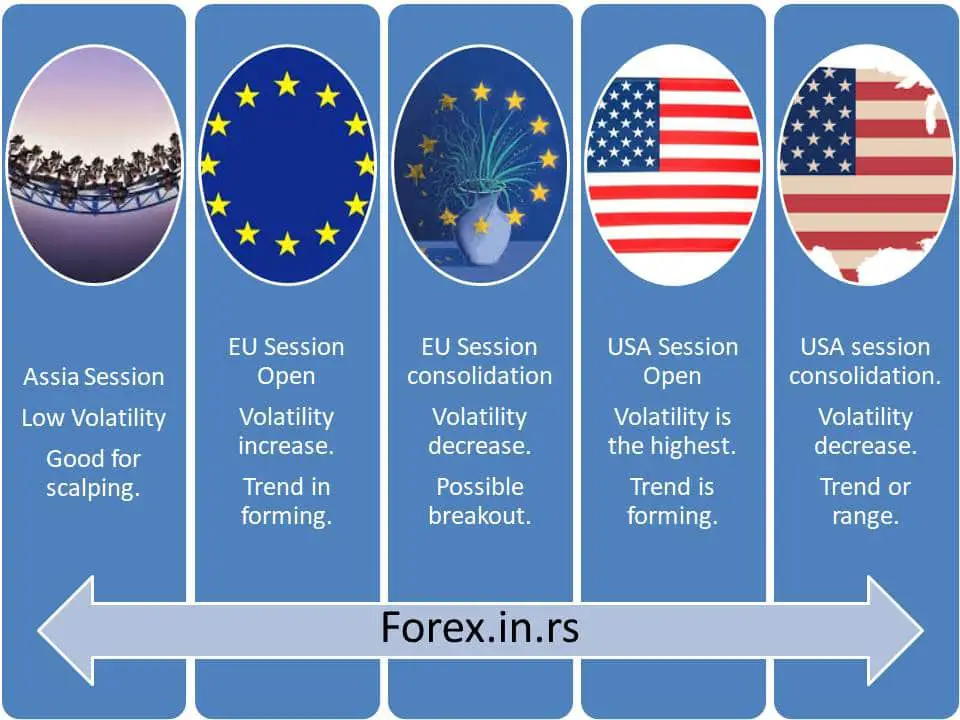

The forex trading market is open 24 hours a day, five days a week, except for holidays. In the trading industry, traders attempt to profit by buying and selling currencies by speculating (predicting) the direction currencies are likely to take in the near or distant future. Forex is not owned or controlled by any single institution.

Please watch my video about the forex definition:

Forex is simply exchanging the currency of one country for the currency of another country. Generally, when you need to travel abroad, you need Forex. You give your home currency to the exchange and use its value to get the country’s currency that you are visiting. For example, if you live in the United States of America and wish to visit France, you will give USD to the exchange and get France used.

Such an exchange is done for a practical purpose. This is how many companies work with overseas clients, individuals, and even central banks to convert currencies. When the same exchange is done with profit-making motives, we call it trading. Forex is also known as FX trading and foreign exchange. Most traders are engaged in FX trading, averaging daily trading at $5 trillion. Let’s explore the term ‘Forex trading’ further.

Many people and organizations, such as personal investors and financial agencies, experience currency needs. These people and organizations may speculate about the movement of a designated pair of currencies. They place their orders to purchase and sell currencies via the forex market to interact with other orders regarding currencies that other people and organizations have set.

What is Forex Trading?

Forex trading generally represents one currency’s conversion process into another. Forex trading as a business means a process when a network of sellers and buyers transfers or exchanges currencies among themselves at an agreed price with the hope of gaining from it.

Learn more about forex trading in our article.

Forex is a volatile asset, with some currencies having more momentum than others. This volatility of currency depends on the amount of currency that is being converted every day. Volatile currencies are desirable as they offer an increased scope of making profits. However, one must remember that volatility furthers the risk involved in trading.

What is the forex market?

So, let us see the forex market meaning forex market definition:

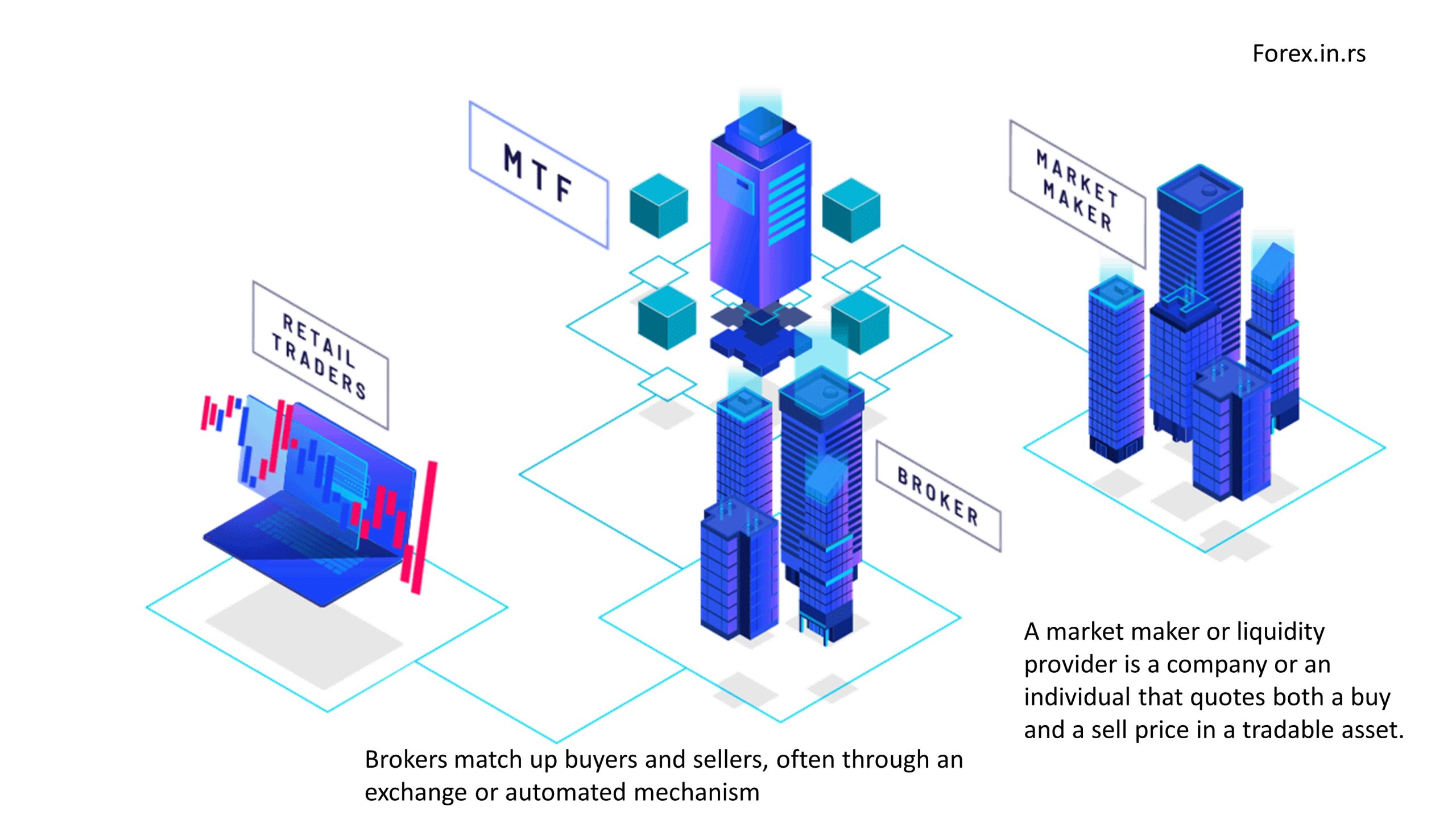

The forex market is a global network of computers and brokers worldwide, and it can be divided into the interbank markets and the over-the-counter (OTC) market. The interbank market is a market where large banks trade currencies on behalf of clients. The OTC market is where individual traders trade through online platforms and brokers.

Foreign exchange is made every single day. Ordinary people and business owners convert currency when they pay for goods and services abroad. For example, if you buy some products from the UK in GBP, you need to convert your dollars to buy that product. You did a foreign exchange.

But if you are a trader, you use a platform for buying and selling currency pairs and are part of the (OTC) market.

Forex trading takes place directly between individuals or parties. There is an over-the-counter, or OTC, different from the exchanges used for commodity or share trading. Legal Forex trading is highly regularized and is run by an international network of banks. There are four major Forex trading centers worldwide in different time zones. These four time zones pertain to London, Sydney, Tokyo, and New York. Forex trading takes place 24*7 as there is a lack of a central location.

Types of Forex Markets

Forex markets can be classified into three categories depending on the types of exchange and contacts. These are:

1. Spot Forex Market

This includes the exchange of physical currencies. This currency pair exchange occurs on the spot, i.e., within a short period. The rates are agreed upon, and the exchange is made. Nothing happens at a later date.

2. Forward Forex Market

In this, two parties enter a contract agreeing to trade a fixed amount of Forex later. They set the exchange price and the date(s) on which the exchange will occur. No trade happens on the spot.

3. Future Forex Market

A futures contract is similar to a forward contract. The parties fix the prices, terms of exchange, and date on which the trade will occur. The most crucial difference between the two is that a futures contract is enforceable by law.

Understanding Currency Pairs

In FX trading, currencies are exchanged in pairs. Every trader selects a currency pair before entering the market. The pair’s first currency is the base currency, and the second is the quote currency. Traders must sell one of the two currencies and buy the other one. A currency pair’s price is determined by how much a first currency unit is worth when converted to the quote currency.

The currencies are represented by three letters; the first two are for their respective regions, and the third stands for the currency’s name. For example;

- GBP – Great Britain pound

- USD – United States dollar

- SGD – Singapore dollar

- JPY – Japanese yen and more

The currency pairs are formed by using these codes of two countries. For example, if you are trading the Great Britain pound and the US dollar, the currency pair will be GBP/USD, with GBP being the base currency and USD being the quote currency.

The Currency Pair

Forex trading is based on buying one currency while selling the other. Let’s see what this is and how this is calculated by taking GBP/USD as our currency pair example.

Let’s assume that it is trading at 1.35361. Since GBP is the base currency and USD is the quote currency, we will say that 1 GBP is equivalent to 1.35361 USD.

The value of the currency pair depends majorly on the base currency. In this example, if GBP strengthens and its value increases against USD, the entire pair’s value will increase. In this situation, traders buy the currency pair. It is called holding an extended position. Similarly, if GBP’s value decreases, traders will prefer to sell the pair with a short position.

Types of Pairs

While you can trade almost every currency, some currency pairs are more popular than the rest. It may be because of their value, volatility, or other aspects. To avoid any confusion, these currency pairs are classified into types. You can choose from the following:

Major Currency pairs

More than 180 currencies are traded globally, but only seven of these currencies account for 80% of the overall trade. The currency pairs made by these currencies are called major pairs, including EUR/USD, GBP/USD, USD/CAD, AUD/USD, USD/CHF, and USD/JPY.

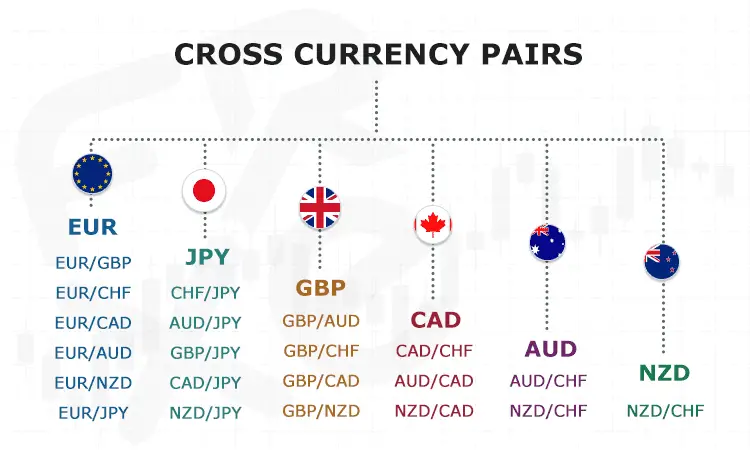

Minor Currency Pairs

These currency pairs may not be traded as frequently as the major currency pairs; these are still considered vital as they feature major currencies. The lack of popularity is because these currency pairs are exclusive of USD. Some minor pairs are EUR/CHF, EUR/GBP, and GBP/JPY.

Exotic Currency Pairs

These are the currency pairs where a popular base currency is paired with a quote currency from an emerging or small economy. For example, GBP/MXN (Sterling vs. Mexican peso), USD/PLN (US dollar vs. Polish zloty), and more.

Regional Currency Pairs

These are the pairs that belong to a region, such as Australasia and Scandinavia. Some currency pairs are AUD/NZD, EUR/NOK, and AUD/SGD.

Factors That Affect the Forex Market

Since there is no central location where the trade occurs, predicting the price movements can be challenging. Understanding the strengths and weaknesses of a currency is more complex than predicting the price movements of stocks and shares. Many variables need to be considered. Although, just like other assets and securities, Forex is also influenced by supply and demand. Therefore, it is essential to understand the supply-demand, which can be done with the help of the following:

- Central Bank Policies: A country’s central bank controls the currency supply. It makes specific policies and takes measures targeted to influence the strength of the currency. For example, quantitive easing is done to drop the price of a currency. It involves pushing more money into the country, decreasing the demand.

- News Reports: You cannot write an email to the country’s president if you have doubts about the currency. To know whether you are putting your money in the right trade, you need to learn more about the economy and its strength. You can economy-related information from the news reports. Positive information increases the demand for the currency as more people are willing to invest. This will increase the price of that currency, given that there isn’t a parallel increase in the supply.

- Market Sentiment: Market sentiment, a reaction to the news report, plays a vital role in deciding a currency’s price movement. By buying or selling a currency in large numbers, traders can convince others to follow in their footsteps, thus, driving the demand in their chosen direction.

- Economic Data: Every country releases financial data integral to fundamental analysis. This data is crucial when analyzing how the country is performing. This is crucial for traders, facilitating them while understanding the central bank’s next move.

- For example, suppose inflation has risen above 2% in the Eurozone, which the ECB wants to maintain. This can be done by increasing interest rates. Traders can use this information, and they will buy more euros with the hope that its price will increase.

- Credit Ratings: Every investor wishes to maximize profits while minimizing the risk involved. They would not want to invest in the currency of a country that has a poor reputation when it comes to repaying debts. Therefore, they will look at the country’s credit rating. Higher credit ratings are associated with lower risk.

I suggest you read our article to learn more about is forex trading is profitable!

Forex payment methods

To start forex trading, you must choose the best forex broker and deposit your money into a brokerage account.

Forex payment methods that traders usually use to deposit and withdraw brokerage accounts are:

- Bank wire

- Credit Cards (Visa, Mastercard, Union Pay, Maestro, Diners, etc.)

- Skrill

- Neteller

- Web Money

- PayPal

- Sofort,

- GiroPay

- Cheques (US)

Forex brokers accepting credit cards are 99% of all brokerage companies worldwide. Credit cards are the most used way of payment for all traders; all major cards are usually accepted. Forex brokers accept major credit cards: Visa, Mastercard, Union Pay, Diners, etc.

Forex Lot Trading Size

You might be trading a few currency units, but they are traded in lots or batches. The standard size of a lot is 100,000 units of the first currency. This is too much for an individual trader. This is why most of the Forex trades are leveraged.

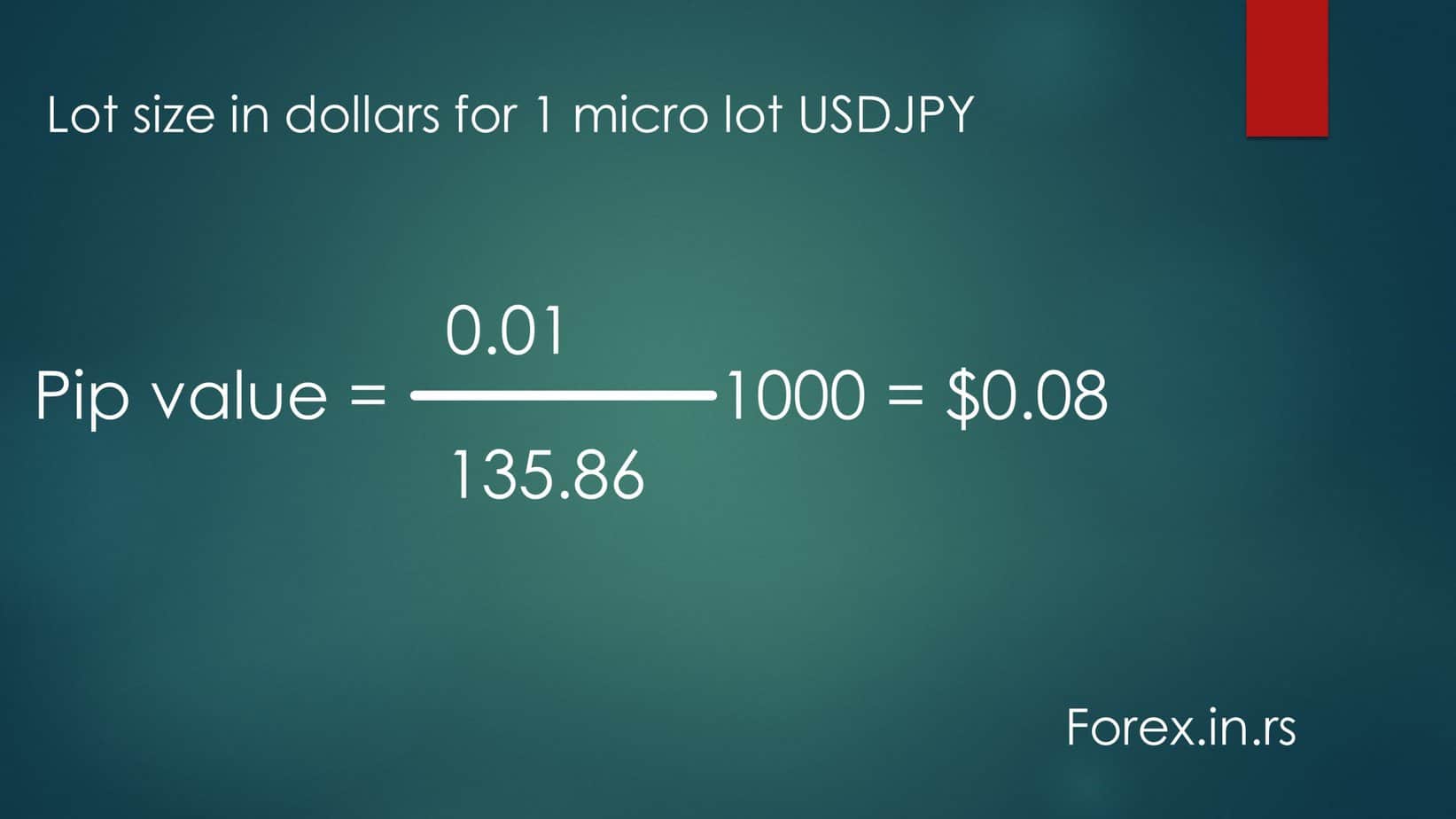

When trades are conducted on the forex market, this happens in lots. They are referred to as micro lots, mini lots, and standard lots. A micro lot is categorized as being a value of 1000 of a particular currency. Then a mini lot is categorized as being a value of 10.000 concerning a designated currency. Finally, it is noted that a standard lot is regarded as being a value of 100,000 of a particular currency.

This is not the same as when you enter a bank to conduct the transaction of exchanging four hundred and fifty dollars for a trip. In such cases where there is the conducting of trades on the forex market, which are done electronically, set blocks of currency are applied for the trades’ placement. However, you can conduct the trading of any number of blocks according to your desires and preferences. For example, it is possible to conduct trades for seven micro-lots, a total of seven thousand, or three mini-lots for a total of thirty thousand. Or you can also conduct trades of seventy-five standard lots for a total of seven hundred and fifty thousand.

Leverage in Forex trading

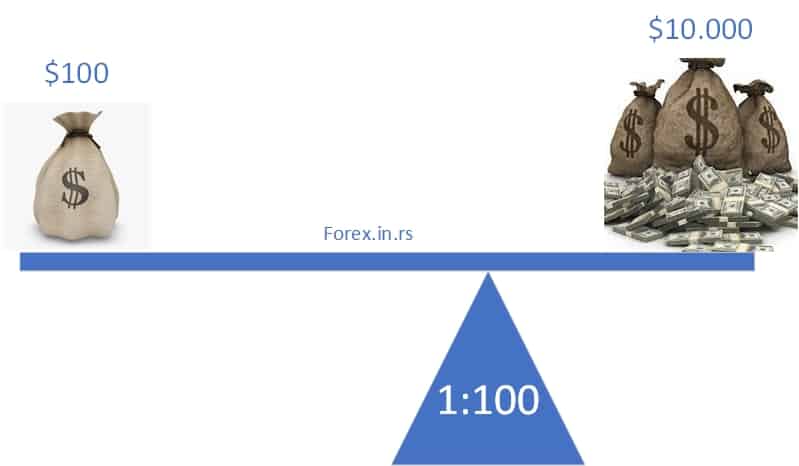

Leverage in forex represents the ability to make more significant positions with a smaller amount of actual trading funds using borrowed capital from the broker.

Since currencies are not traded in small batches and paying a considerable amount is impossible for every individual, trades are made by employing leverage. It allows you to operate a more significant amount in the market by investing a smaller amount. It means you are not expected to pay for the total value of the trade upfront. You have to keep a minimum deposit with your broker, also known as margin, based on which you can open a position with a more significant amount. When a position is closed, you take home the profit or loss you made on the amount you were operating in the market. Let’s understand each of these components:

Margin: Margin is a prerequisite for availing leverage. This is the minimum deposit that you have to keep with a broker while opening an account. You will get leverage on this deposit, which needs to be maintained until you close a position or account. The margin amount requirement differs from broker to broker. It could even be as low as $100.

Leverage Ratio: The leverage ratio decides how much you can operate in the market by your margin amount. For example, let’s assume that a broker offers you a leverage ratio of 1:10, with $500 being your minimum deposit. A leverage ratio of 1:10 means you can operate $10 in the market for every dollar you deposit with your broker. In over case, you can use 10 times $500, that is $5000. This ratio is also subjective. The broker decides it.

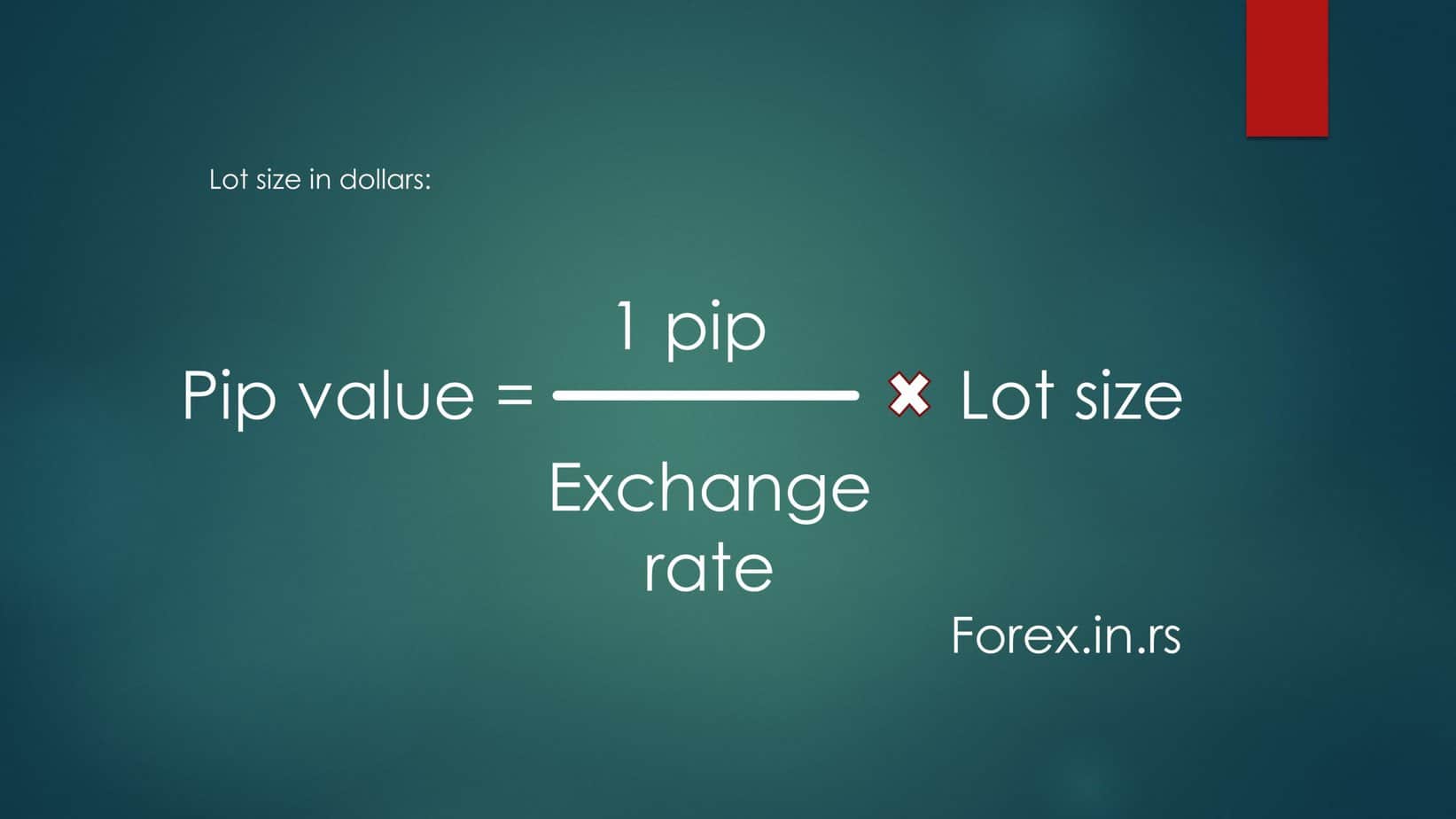

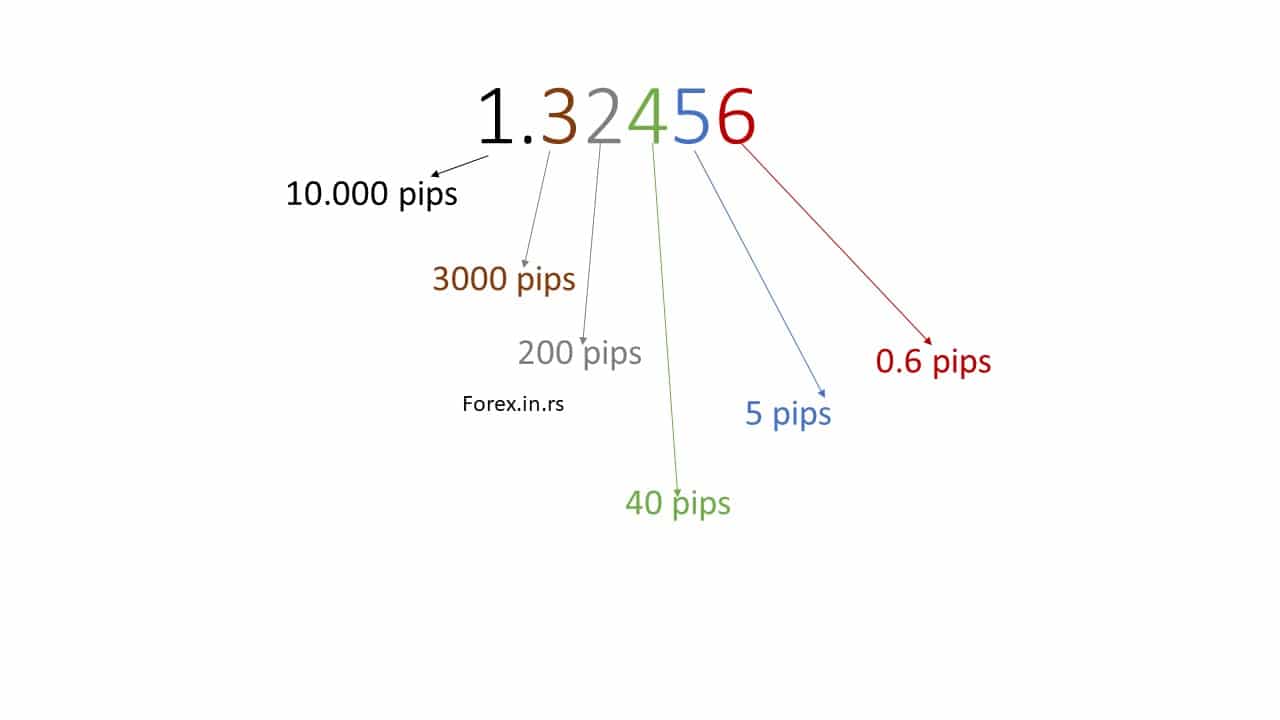

Pips in Forex trading

A pip is a minor change in the price of a currency pair. This change takes place at the fourth decimal place of the price. For example, if GBP/USD is currently priced at $1.34351, which moves to $1.34361 tomorrow, we will say that this currency’s price has increased by one pip. The units after the fourth decimal place are called pipettes or fractional pips.

The rule of considering the fourth decimal place is overlooked when the quote currency is in a significantly smaller denomination, like in the EUR/JPY currency pair. For this pair, we consider the second decimal place as one pip. For example, if the prices move from ¥106.472 to ¥106.482, it will be regarded as one pip movement.

Frequently Asked Questions

Q1. Who regulates the Forex market?

Since there is no central office where the trade place and this market operate 24/7, no one agency or authority can regulate this expansive market. Several individual regulatory bodies regulate Forex trading in their respective countries.

Q2. What is the volume of daily Forex trading

Forex trading is a very active market with 24/7 engagement. The approximate worth of daily transactions is $5 trillion, equivalent to $220 billion an hour.

Q4: Forex trading time

The forex market operates twenty-four hours per day for five days each week. But it is to be noted that these operational hours do not apply to holidays. Yet, the reality is that there may be the conducting of trades for some currency types during a holiday time in such cases that the country or global market is regarded as being open for the sake of business purposes.

Those who are retail traders have the option to engage in opening an account on the forex market. They are then equipped to purchase and sell various currencies and trade two currencies against each other. The difference in the price that the pair of currencies bought or sold for will determine if there is a profit or loss provision.

There is another manner in which participation in the forex market can become a reality via forwards and futures. It is noted that there is the customization of forwards regarding currencies being exchanged following expiration times. On the other hand, applying any form of customization to futures is impossible, and those conducting speculations more widely use them. At the same time, it is understood that the positions frequently experience closure before the expiration time to prevent settlement formation.

It is comprehended that the market in the financial sector, which is ranked as the largest on the globe, is recognized as the forex market. Retail traders do not desire to conduct the complete sum of currency they are executing trades. They instead desire to profit concerning the differences between the various currencies over some time. Since this is the case, brokers conduct the rolling over of placements daily.

Foreign exchange in modern times

The forex market operates twenty-four hours daily, five days per week, within critical finance centers worldwide. This denotes the reality that you can purchase and sell currencies at your preferred time during the week.

From the historical perspective, it is realized that in past times, trading regarding foreign exchange was only made possible for hedge funds, major corporations, and governments. However, in modern society at this present time, it is relatively easy to conduct the trading of various currencies with simply the click of a mouse. Therefore, access to the ability to trade on the forex is no longer a complex problem. This means that anyone who desires to engage in the conducting of trades on the forex market has the opportunity to do so. A wide range of banks offers individuals the opportunity, investment agencies, and retail forex brokers the to open accounts for the sake of conducting trades of various forms of currency.