Table of Contents

Finding a fund manager is tough. However, one fund management system is straightforward, allowing traders to allocate investments to reliable fund managers.

Watch my video:

Share this Video On Your Site

Share this Video On Your Site

Definition: PAMM Technology

What is PAMM in forex?

The PAMM, or Percentage Allocation Management Module, is a trading platform system that simultaneously administrates an unlimited quantity of managed accounts. At the same time, traders (money managers) create trading positions, PAMM copy trades, and distribute the sizes of trades according to an allocation percentage to the investor’s account.

What is a PAMM account?

A PAMM account is an innovative type of trading account that allows investors to make investments where traders (money managers) trade for them. It is an excellent way for experienced and beginner investors to diversify their portfolios while taking advantage of the expertise and experience of a professional trader (money manager).

A PAMM account is designed to simplify investing in the financial markets. The trading strategy used by the money manager is applied directly to all accounts, so there is no need for individual decisions on each client’s behalf. This can be extremely useful, mainly if you have limited knowledge or experience in trading and investment strategies.

Investing clients could be in their numbers but using a single trader. All this dealing is done using PAMM technology. Funds allocated to a PAMM account are allocated a percentage share, the size of funds from each investor within a single account. This is such that investors could own 25%, 35%, or 20% of the total fund, with the owner (trader) holding the remaining 20%.

How does the PAMM account work?

Therefore, three parts are involved here: A broker firm that owns the trading platform; The trader or account manager responsible for allocating funds to trading products, which are the foreign exchange or forex in the case of PAMM; The investor who gives their money to a trader with the hope of making profits from the activities of the trader.

Traders in a PAMM account are called fund managers or masters, and investors are called followers because they follow their master’s trading strategy or portfolio allocation. The master has limited power of attorney and can act, to a certain degree, on behalf of their followers. A trader or master can simultaneously manage multiple followers’ accounts.

Worth noting is that the trader, in this case, also has their own money in the instrument being traded and remains a client of the broker firm.

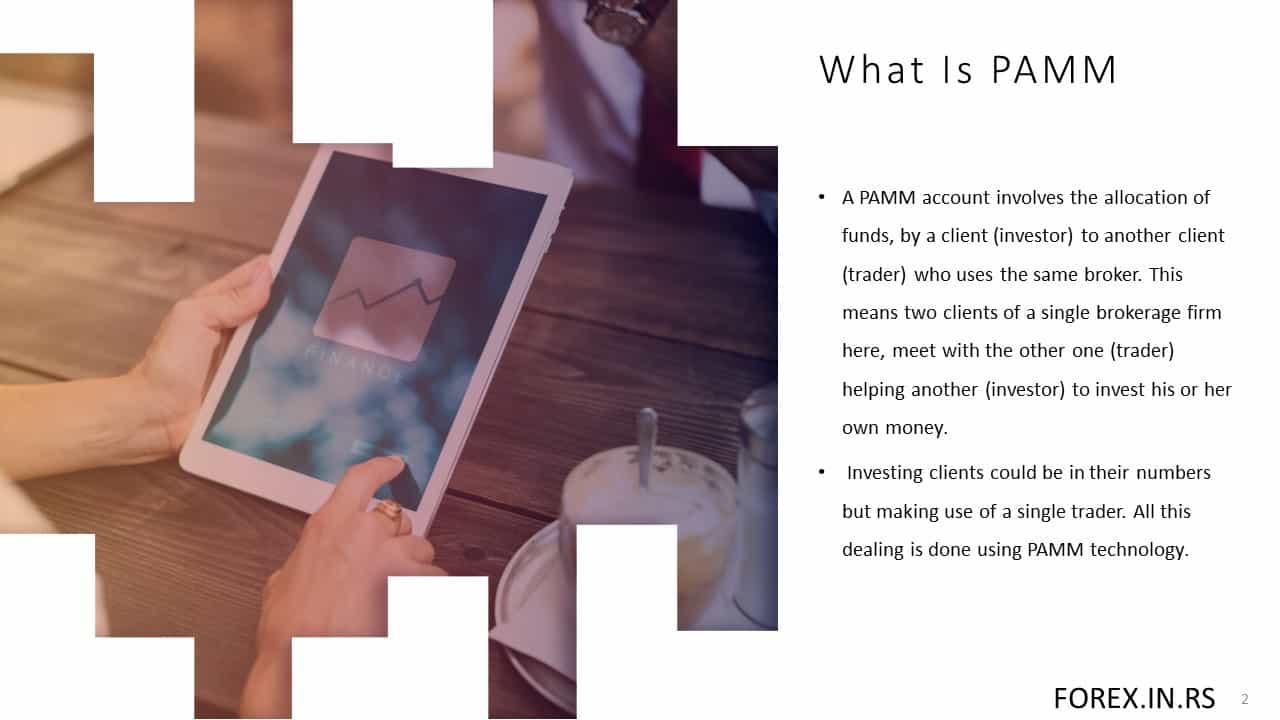

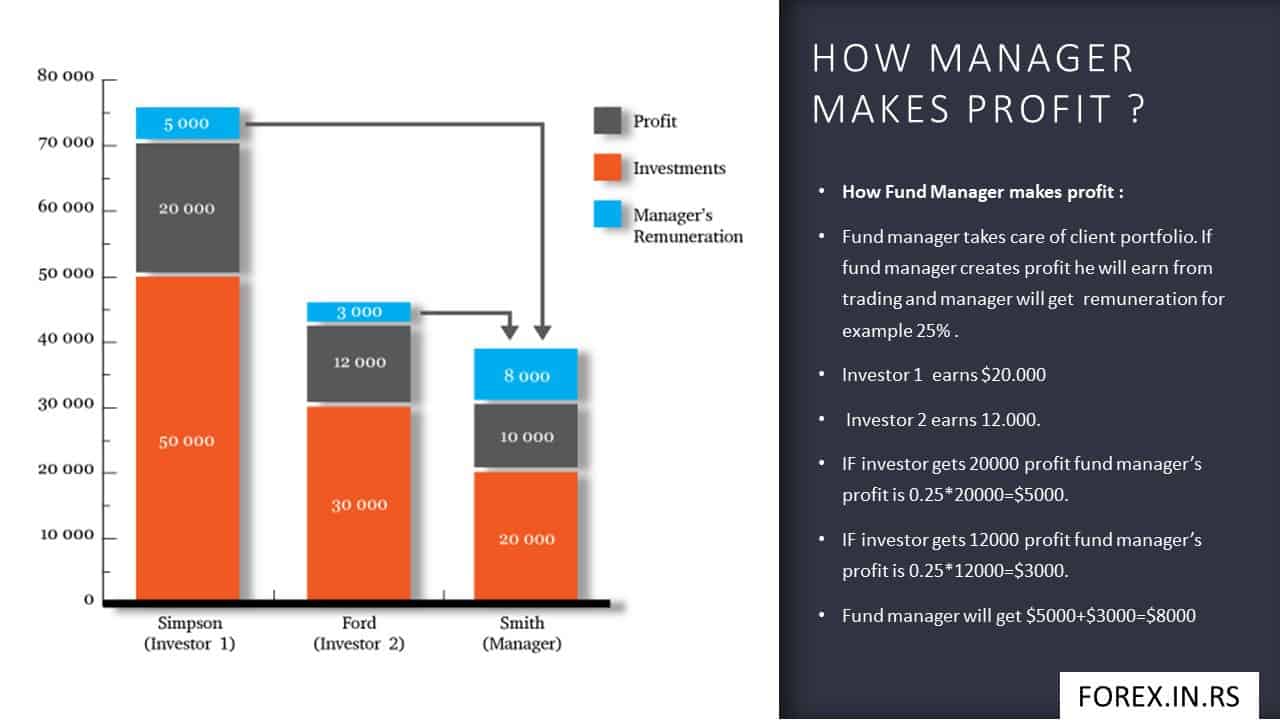

Here we can see another example with one fund manager and two investors :

PAMM MAM Review – The difference between MAM and PAMM-managed accounts

MAM system forex

MAM account (Multi-Account Manager), as a PAMM account, allows traders to use the percentage allocation method but provides greater flexibility to allocate the trades and adjust the risk of each sub-account based on the client’s risk profiles. MAM accounts combine individual trader accounts into a large pool of managed funds. A lot of brokers offer PAMM and MAM accounts.

MAM fx or Multi-Account Manager forex accounts can do as same as PAMM accounts. They will still give you much greater flexibility to allocate the trader trades and adjust each sub-account position’s risk based on the client’s trading risk profiles.

So we can talk about PAMM and MAM technology as one technology.

How to choose a PAMM fund manager?

The forex market attracts clients because it seems easy to get a portion of $5.3 trillion daily deals with high returns, significant volume, and volatility. But, as you guess from the “it seems” part, getting money in this market is not the safest bet for many traders. It probably would be there if it were just a place to collect your invested returns. A large portion of that money comes from quick thinkers, and it goes to smart thinkers. To get the Forex market’s best, you will need to learn as much as possible about the market, its basics, and its technical aspect. However, to get a grip on it, you’ll need to have good fundamentals in financials. If you don’t, then find somebody who does. If you don’t have a financial background, you might want to consider PAMM investing.

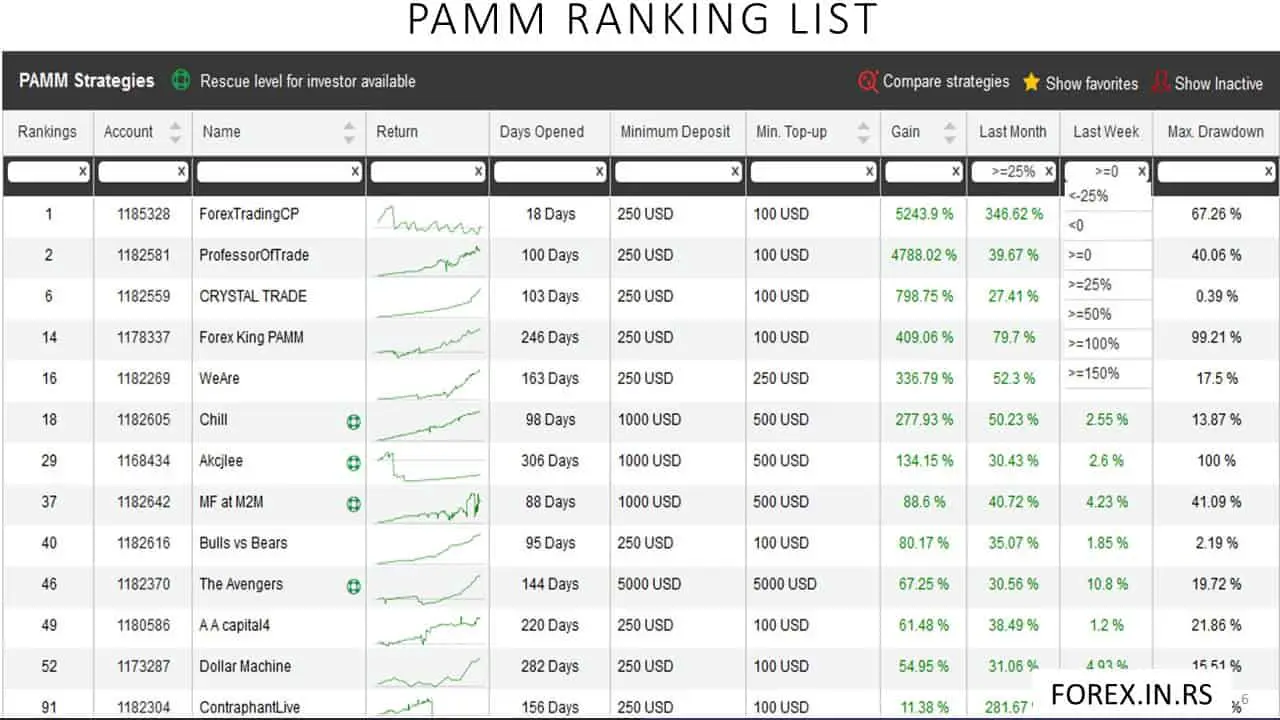

Hotforex PAMM account review

Hotforex PAMM platform is well designed and can be used by all HF clients. Traders can earn money by sharing their trades, and investors can easily pick several providers (PAMM systems). However, PAMM traders risk too much money (significant max drawdown), so investors must be careful when choosing PAMM strategies.

Below is presented HFM PAMM table:

Are PAMM accounts safe?

PAMM accounts are safe as patented technology. However, PAMM accounts are not always profitable if fund managers do not pay attention to risk, huge drawdowns, or bad trading decisions.

PAMM investing is having your money entrusted to a manager who can safely deal with it as if it’s their own. And in a way, it is theirs to operate based on profit/loss. With PAMM investing, there is software that distributes the profits and losses automatically.

Please read our article Are PAMM accounts safe for more detail.

Here are some tips on how to wisely choose your PAMM manager.

One of the first things to consider is the manager’s experience. It’s the same thing with hiring any help. You want to get somebody who has experience. For this sort of help, you want to check the period that the fund manager manages an account. You want to see a bill that has been around for at least three or four years. Only then should you check out the rest of the results of the account. Consistency in performance is what gives away a trader with experience.

After the experience is checked and passed, you want to see how it went with live trades.

If your broker isn’t offering valuable information, you can ask your fund manager to show those results, for example, in my myfxbook. You will see what’s the drawdown like, as it gives you a hint about the risk’s size. If you see a high risk in drawdown, we suggest you avoid those. When that’s passed, you can check how consistent your fund manager is with a particular result. Consistency is better than having big profits with a lack of character, which shows more luck and less strategy.

The next thing to check is the capability of the fund manager to recover. The recovery factor represents the quickness the trader can recover from suffering drawdown. What you want from your manager is to have a significant recovery factor, meaning their reliability.

The recovery passed; check how many investors have their accounts managed by your fund manager. That’s another safe thing upon which you can know if your fund manager is reliable. If several investors trust that particular fund manager, that’s a good reference. If there is a chance, you’ll want to see how good your fund manager is with all those clients.

Total equity is something to check out also for choosing your fund manager. The safest bet is to find somebody who trades at accounts of medium sizes. The reason is that when a fund manager has a lot of capital, they might deal with risky trades. You never know what they would do with the number of funds you have. Therefore, try to find somebody who deals with a similar account you have.

How do you pay your fund manager?

Since a fund manager is a trader but trades with your money, he can only get a portion of your two returns. Fund managers who are successful traders can expect they would ask for more considerable remuneration. However, if your fund manager does have a proven track, don’t bother to negotiate too much about their commission.

You can always make a good deal and discuss all the terms with the broker before investing your capital.

PAMM Advantages

- PAMM accounts provide investors exposure to various asset classes,

- Automated risk management helps investors protect their capital from significant losses

- Greater liquidity allows investors to withdraw funds from their accounts at any given time quickly.

- The flexibility of PAMM accounts also allows investors to adjust their strategy as market conditions change.

- Finally, PAMM accounts are subject to less stringent regulations than other types of investments due to their low-risk nature

The first advantage that PAMM technology brings to the table is that more considerable pooled funds make more profits than smaller invested portions. This is so, especially in forex trading, because trading in foreign exchange has tiny profit margins, making sense when the amount of invested money is higher. Individuals might find it challenging to raise money, hence the need to pool funds together.

In addition to providing a convenient way for clients to manage their funds, PAMM accounts offer investors many advantages that are not available with traditional managed accounts. First, the portfolio manager does not receive any additional payments or fees from their clients’ trading activities; instead, they earn through performance fees based on the profits made by the PAMM account. This ensures that the manager has no incentive to take risks and maximize profits at any cost. Secondly, investors can choose from a wide range of managers specializing in different asset classes, such as stocks, options, currencies, commodities, indices, and more. Finally, PAMM accounts can provide access to markets that may otherwise be inaccessible due to geographical restrictions or country-specific capital controls.

PAMM accounts are also cost-effective compared to traditional managed accounts since they require no minimum capital and no setup costs or commissions associated with opening an account. Furthermore, they offer investors full transparency and comprehensive risk management tools that allow them to monitor their investments closely and make adjustments when necessary. As such, they are an attractive option for those looking for an alternative way to manage their investments without incurring high transaction costs.

The other advantage is taking advantage of an expert trader’s skills to make profits. Investing, especially in forex, is not a piece of cake, and many investors lose out on all their money on their first try. Therefore, PAMM technology enables amateur traders to piggyback an expert trader’s experience and make money while sleeping.

This technology allows investors to make money on almost zero administrative hassles. This is so because all the investor has to allocate funds to the trader’s account and wait for the trader’s reporting. The trader is the one who does all the work and will make sure that everything ticks the boxes regarding the fund.

Another advantage of using a PAMM account is that it is incredibly safe to follow since the involved trader will also have their funds. This allows the same trader to exercise caution with investors’ money since any losses will hit their money hard.

Lastly, in a PAMM account, you get profits equivalent to your percentage ownership of the fund. You can control your earnings by investing more than the rest. For example, when the fund makes $100 000 in profits, the investor who owns 70% of the fund will be guaranteed $70 000 in earnings.

Are there any disadvantages to using a PAMM account?

Risk is always the most significant disadvantage. Some fund managers can be unresponsible and risk too much, which can impact your portfolio.

Using a PAMM account could only hurt an investor if the same investor owns the most significant portion of the fund, say 55%, and the fund goes on and makes a huge loss. Remember that you get or lose what is equivalent to your percentage ownership of the fund. But you cannot worry too much about this since the masters in a PAMM account are vastly experienced traders with proven records.

The PAMM account brokers list is as follows:

| Best PAMM account forex broker | Founded Year |

|---|---|

| HotForex | 2010 |

| AvaTrade | 2006 |

| Alpari | 1998 |

| InstaForex | 2007 |

| FIBO Group | 1998 |

| Grand Capital | 2006 |

| Forex4you | 2007 |

| FreshForex | 2004 |

| IronFX | 2010 |

| LiteForex | 2005 |

| Oanda | 1996 |

The best PAMM account forex brokers are

Conclusion

PAMM accounts for technology as a welcome invention in forex trading. From what we have learned, we realize that traders understand trends better than others. These are more likely to get it right with their portfolio allocation or take positions (Buy or Sell). Therefore, PAMM technology allows less understanding of the trends to profit using the experts’ knowledge.

Using this technology is done through a regulated Broker Firm; hence it is safe and can be trusted, as proved. There is no safest way to make profits than bringing together an experienced trader and other investors through a central brokerage system.

Overall, a PAMM account is an efficient tool for diversifying one’s portfolio while leveraging experienced money managers’ expertise in trading strategies and risk management techniques. It offers convenience at minimal cost while providing access to global markets which may otherwise be inaccessible due to geographical restrictions or country-specific capital controls. Moreover, it delivers transparency and control over investments via risk management tools, enabling investors to identify potential risks quickly and take corrective measures if needed.

So, how to open a PAMM account?