Table of Contents

Some traders and investors criticize technical analysis because they believe that fundamental analysis only matters while technical analysis is pseudoscience. Misconceptions regarding technical analysis can be traced back to a lack of basic knowledge, high expectations, and wrong assumptions.

Is Technical Analysis Pseudoscience?

No, technical analysis is not pseudoscience because technical analysis uses statistical scientific methods, real price levels, and various mathematical models. Technical analyses of past price behavior define possible outcomes like risk analysis.

The stock market and forex market have a reputation for being highly volatile places. Any security can benefit from a technical examination (stocks, bonds, derivatives, etc.) if you’ve had a price and volume data from previous trades. The use of technical analysis in stock trading is not as widespread as in forex and commodities trading. However, it may still be beneficial and help investors better understand the market. Over-reliance on numbers instead of fundamentals is a bad idea.

Please see the video that I created related to pseudoscience and technical analysis on youtube:

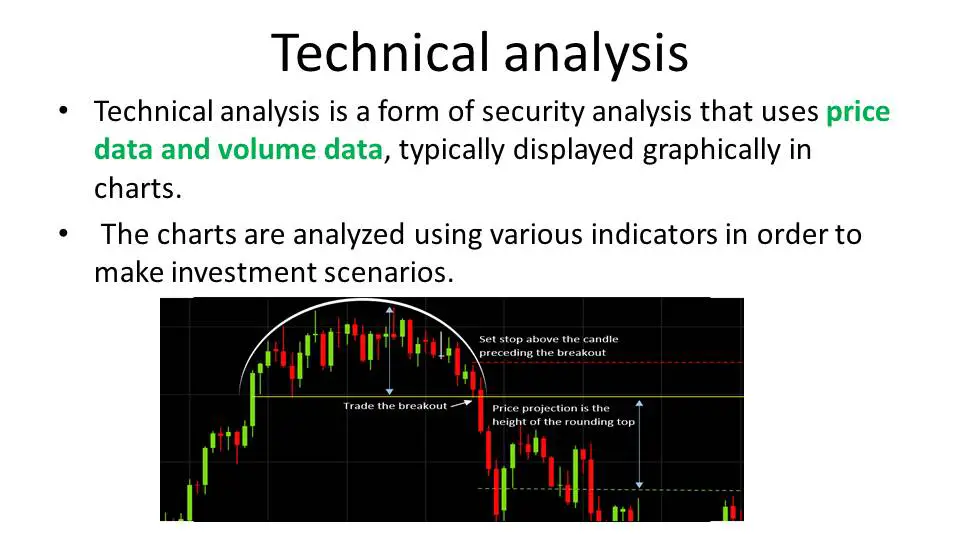

What is Technical Analysis?

Technical analysis represents a systematic financial method that analyzes assets such as securities, forex, and futures, using market information (price, volume, and time). The goal of technical analysis is to identify potential trading opportunities.

According to contemporary portfolio theory, many of the same methods used in behavioral economics and quantitative analysis are also used in technical analysis. According to the efficient-market hypothesis, both technical and fundamental analysis is ineffective, which holds that stock prices are unpredictable. Research on whether technical analysis provides any advantage has yielded inconsistent findings.

Technical analysis assumptions are:

- The market discounts everything – Meaning that all information is already priced into the market. This assumption is based on the idea that the market is efficient and that all information is reflected in the price.

- Prices move in trends and countertrends – Prices trend up and down, sometimes forming channels or ranges.

- Price action is repetitive, with specific patterns reoccurring – Patterns such as head and shoulders, double tops/bottoms, wedges, and flags are all common price formations that can predict future prices.

Technical analysis is based on the premise that markets are efficient and that all factors that impact an instrument are represented in the price. As a result, patterns and trends tend to reoccur throughout time. Consequently, technical analysts think that all market aspects are reflected, including market sentiment and the underlying fundamentals. For short-, medium, and long-term trends, traders merely need to evaluate price fluctuations to identify possible supply and demand regions or the beginning of new trends. It supports the assumption that an asset’s price is more likely to continue or begin a trend than to remain in a range. Technical analysts, like most others, are convinced that the past will inevitably repeat itself in the future.

Why do people think that technical analysis is pseudoscience?

People think technical analysis is pseudoscience if analysis can not accurately predict future prices. Additionally, the expectation to predict future prices with high accuracy from historical data create a false picture in traders’ mind.

The first problem is expectation. Some traders believe that technical analysis is a prediction tool, so they think that if you determine a bullish trend on the chart, 80% of that trend will continue to rise. However, the truth is different. Trend continuation has an increased probability in that case, but how much?

Using technical analysis, we make scenarios or prediction models. Suppose we have a model where we risk $1 and try to target $1. We aim to create a 53% accurate or 55% winning model in both cases. If someone develops an 80% win percent model, that person will be a billionaire in less than a month. So, a low level of accuracy is normal in short-term trading.

So, for example, weather prediction can be wrong often if you expect to guess the right temperature each day or to predict the weather for next week. That not means that meteorology is pseudoscience if the accuracy prediction level is low.

The technical analysis is not pseudoscience because:

- Technical analysis uses scientific modeling and statistics to present historical data

- Technical analysis uses machine learning models and AI to create models based on actual data

- Low probability level models (around 50% accuracy for $1 risk and $1 target) do not mean that technical analysis is pseudoscience

- Pseudoscience does not use experiments or scientific evidence, while technical analysis uses previous data and tests.

There is one more fact:

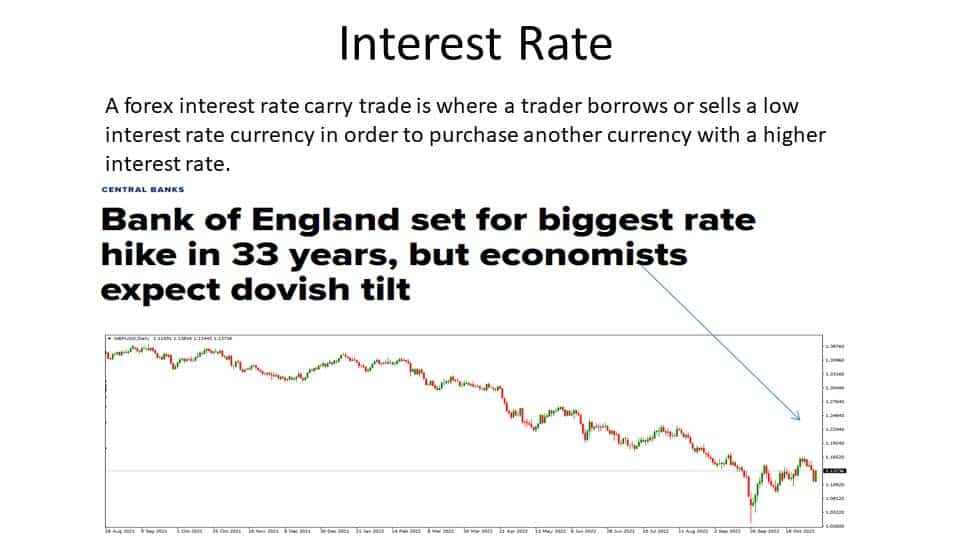

Fundamental analysis prediction models do not have a higher probability than technical analysis. Both approaches are not part of pseudoscience. The future price depends on market sentiment and what big traders want to do in the market. If the fundamental analysis shows interest rate increase prices, that does not mean that 100% of the price will go up for that currency.

See example:

Is Technical Analysis Scientific?

Technical analysis has a foundation in scientific methods and is part of science. The technical analysis goal is to analyze behavior, create scenarios of future price movement and basic price levels, and determine entry, stop loss, and target price levels.

All oscillators and major trading indicators are based on time, volume, and price and use basic statistical equations (part of the science).

Patterns in asset movements, such as a stock’s or currency’s movement, are used by traders as indicators of future moves. They may notice, for example, that an asset never climbs more than a particular number of points before it begins to decline and never falls over a certain number of points before it rises again. That pattern will help them determine when to purchase and when to sell. Technical analysis is based on the notion that assets react predictably. In other words, the globe isn’t a one-way street.

After paying the broker’s fee, the earnings on modest moves are much lower. Speculators employ leverage in their short-term bets to profit. When borrowing money to trade, they use their investment as collateral. If the deal succeeds, you can make a higher profit, and the investment can be repaid with interest if necessary. However, if investors lose, they stand to lose much more money. You might lose a trader’s absolute position if they utilize leverage. Although many schools claim to teach day trading with technical analysis, it can take months or even years to become proficient enough to make a consistent profit. Skilled traders may expect to lose at least 40% of their trades if they’re competent. As a result, a majority of short-term businesses fail.

Conclusion

Market movements are studied using a highly subjective method known as technical analysis, which relies on assumptions and practices that have been scientifically confirmed to be true. Technical analysis is not pseudoscience, only traders’ expectations are too high.