Table of Contents

Exness is a well-established Forex broker that offers online trading services to individuals and institutional clients globally. The company has provided services since 2008 and is known for its reliable trading platform, competitive spreads, and high-quality customer support.

2023 marked a significant milestone for Exness, celebrating its 15th anniversary, a year that underscored its ambitious journey from inception to becoming the world’s largest retail broker. Their commitment to creating a fairer marketplace with trader-centric conditions and innovative features was evident as they reached a record $4.8 trillion monthly trading volume in October 2023. This growth was paralleled by expanding their community and workforce, with over 60,000 partners and a team of 2,100 people from 100 countries, reflecting their global influence and commitment to continual innovation and excellence in the online trading industry.

Exness has a multi-national presence with offices located across different continents. These include:

- Cyprus: The company’s main office is at 1 Siafi Street, Porto Bello, Office 401, Limassol.

- United Kingdom: They have a strategically positioned office in the heart of London at 107 Cheapside.

- Seychelles: Exness is on the beautiful island of Seychelles, at 9A CT House, 2nd Floor, Providence, Mahe.

- South Africa: Catering to the African continent, Exness has offices at Offices 307 & 308, Third Floor, North Wing, Granger Bay Court, and V&A Waterfront in Cape Town.

- Curaçao: This island location is at Emancipatie Boulevard Dominico F. “Don” Martina 31.

- British Virgin Islands: The broker operates from Trinity Chambers, P.O. Box 4301, Road Town, Tortola.

- Kenya: Exness is in the capital of Kenya at Courtyard, 2nd Floor, General Mathenge Road, Westlands, Nairobi.

Exness provides various trading options, including Forex, metals, indices, energies, and stocks. The company is regulated by multiple financial regulatory bodies, ensuring it adheres to the strictest customer protection standards, making it a trusted choice for traders worldwide.

Exness Review

In summary, Exness is a well-regulated broker from 8 regulatory authorities that offers instant withdrawals for clients and fast deposits. Exness offers excellent support and reliable platforms and accounts, from standard, professional, to zero-spread trading accounts.

VISIT EXNESSExness Forex Broker Regulation

- Exness (SC) Ltd is authorized and regulated by the Seychelles Financial Services Authority (FSA), license number SD025.

- Exness B.V. is regulated by the Central Bank of Curaçao and Sint Maarten, license number 0003LSI.

- Exness (VG) Ltd is authorized by the Financial Services Commission (FSC) in the British Virgin Islands (BVI), with registration number 2032226 and license number SIBA/L/20/1133.

- Exness (MU) Ltd is authorized by the Financial Services Commission (FSC) in Mauritius, with registration number 176967 and license number GB20025294.

- Exness ZA (PTY) Ltd is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa, FSP number 51024.

- Exness (Cy) Ltd is a Cyprus Investment Firm authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 178/12.

- Exness (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) in the UK, Financial Services Register number 730729.

- Tadenex Limited, a subsidiary of Exness, is authorized by the Capital Markets Authority (CMA) in Kenya, license number 162.

Exness demonstrates its commitment to high standards and a solid ethical code by regularly undergoing external audits by well-known audit firms. These audits ensure the company’s financial health and the security of client funds and further validate the transparency and integrity of Exness’s trading services.

Moreover, the Exness Group maintains a policy of segregating client funds from its operational funds. This means that the funds traders deposit into their Exness accounts are held in separate bank accounts and cannot be used by the company for its operational expenses. This segregation provides an additional layer of security for traders’ assets.

Exness is also a member of the Financial Commission, an independent dispute resolution organization dedicated to Forex. The Financial Commission provides its customers with protection and legal support. Under the Financial Commission rules, the Financial Commission’s Compensation Fund provides up to €20,000 per case for eligible clients.

Exness also offers educational resources to help traders navigate the financial markets, including webinars, seminars, trading guides, and a comprehensive FAQ section. The company empowers traders to make informed decisions and trade confidently by promoting financial literacy.

Exness Trading Accounts

Exness is a popular online broker that provides a wide range of account types, each with distinct features, to cater to the unique needs of different traders, from beginners to professionals. Let’s delve into the various account types offered by Exness.

Please watch my video on how to connect Exness with the MT4 or MT5 platform:

Standard Accounts

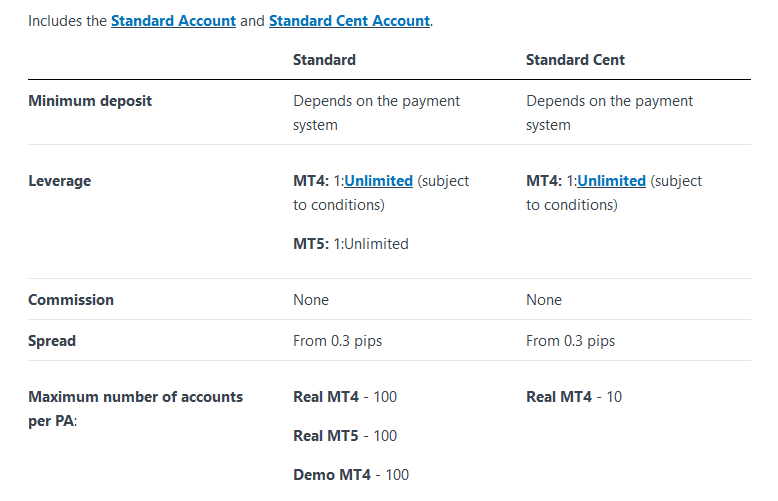

Standard accounts, which include Standard and Standard Cent, are recommended for all traders due to their simplicity and accessibility.

Standard Account

- Minimum deposit: Depends on the payment system

- Leverage: MT4 and MT5 – 1:Unlimited (subject to conditions)

- Commission: None

- Spread: From 0.3 pips

- Maximum number of accounts per Personal Area (PA): Real MT4, Real MT5, Demo MT4, Demo MT5 – 100 each

- Minimum and maximum volume per order: Min 0.01 lots (1K) / Max 200 lots during 07:00 – 20:59 (GMT+0) and 20 lots during 21:00 – 6:59 (GMT+0)

- Maximum volume of concurrent orders: MT4 Demo – 1,000, MT4 Real – 1,000, MT5 Demo – 1,024, MT5 Real – Unlimited

- Margin call: 60%

- Stop out: 0%** (100% during daily break hours of stock trading)

- Order execution: Market Execution

Standard Cent Account

- Minimum deposit: Depends on the payment system

- Leverage: MT4 – 1:Unlimited (subject to conditions)

- Commission: None

- Spread: From 0.3 pips

- Maximum number of accounts per PA: Real MT4 – 10

- Minimum and maximum volume per order: Min 0.01 cent lots (1K cents) / Max 200 cent lots 24 hours a day

- Maximum volume of concurrent orders: Pending orders – 50, Market orders – 1,000

- Margin call: 60%

- Stop out: 0%

- Order execution: Market Execution

Note: Demo Accounts are not available for the Standard Cent account type.

Professional Accounts

Professional accounts are designed for experienced traders and offer unique features such as instant order executions. There are three types of accounts: Pro, Zero, and Raw Spread.

Pro Account

- Minimum initial deposit*: Starts from USD 200 (depending on your country of residence)

- Leverage: MT4 and MT5 – 1:Unlimited (subject to conditions)

- Commission: None

- Spread: From 0.1 pips

- Maximum number of accounts per PA: Real MT4, Real MT5, Demo MT4, Demo MT5 – 100 each

- Minimum and maximum volume per order: Min 0.01 lots (1K) / Max 200 lots during 07:00 – 20:59 (GMT+0) and 20 lots during 21:00 – 6:59 (GMT+0)

- Maximum volume of concurrent orders: MT4 Demo – 1,000, MT4 Real – 1,000, MT5 Demo – 1,024, MT5 Real – Unlimited

- Margin call: 30%

- Stop out: 0%***

- Order execution: Instant**** for Forex, Metals, Indices, Energies, and Stocks. Market for Cryptocurrency

Zero Account

- Minimum initial deposit*: Starts from USD 200 (depending on your country of residence)

- Leverage: MT4 and MT5 – 1:Unlimited (subject to conditions)

- Commission: From USD 0.2/lot in one direction, based on the trading instrument

- Spread: From 0.0 pips**

- Maximum number of accounts per PA: Real MT4, Real MT5, Demo MT4, Demo MT5 – 100 each

- Minimum and maximum volume per order: Min 0.01 lots (1K) / Max 200 lots during 07:00 – 20:59 (GMT+0) and 20 lots during 21:00 – 6:59 (GMT+0)

- Maximum volume of concurrent orders: MT4 Demo – 1,000, MT4 Real – 1,000

- Margin call: 30%

- Stop out: 0%***

- Order execution: Market Execution

Raw Spread Account

- Minimum initial deposit*: Starts from USD 200 (depending on your country of residence)

- Leverage: MT4 and MT5 – 1:Unlimited (subject to conditions)

- Commission: Up to USD 3.5/lot in one direction, based on the trading instrument

- Spread: From 0.0 pips (Floating, low spread)

- Maximum number of accounts per PA: Real MT4, Real MT5, Demo MT4, Demo MT5 – 100 each

- Minimum and maximum volume per order: Min 0.01 lots (1K) / Max 200 lots during 07:00 – 20:59 (GMT+0) and 20 lots during 21:00 – 6:59 (GMT+0)

- Maximum volume of concurrent orders: MT4 Demo – 1,000, MT4 Real – 1,000

- Margin call: 30%

- Stop out: 0%***

- Order execution: Market Execution

Note: The minimum initial deposit for Professional accounts is only required for the first deposit; from then on, you may deposit any amount more than the minimum requirements of your chosen payment system.

Each Exness account type offers a unique blend of features to fit different trading styles and levels of experience, ensuring traders can choose an account type that best suits their needs.

You can trade six different assets at Exness:

Exness Payment Methods

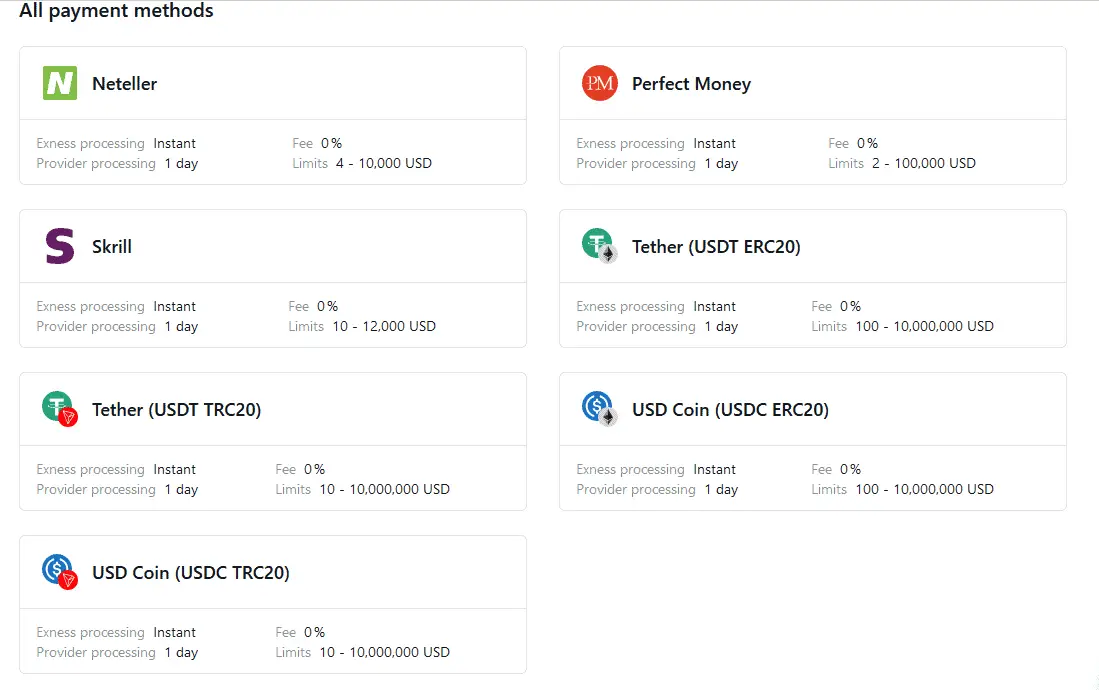

Exness is a well-known Forex trading platform that offers users a wide range of payment methods. These methods provide different transactional boundaries and operate under different processing times. Let’s look into the detailed breakdown of these methods:

- Neteller

- Exness Processing: Instant

- Provider Processing: 1 day

- Fee: 0%

- Limits: 4 – 10,000 USD

- Perfect Money

- Exness Processing: Instant

- Provider Processing: 1 day

- Fee: 0%

- Limits: 2 – 100,000 USD

- Skrill

- Exness Processing: Instant

- Provider Processing: 1 day

- Fee: 0%

- Limits: 10 – 12,000 USD

- Tether (USDT ERC20)

- Exness Processing: Instant

- Provider Processing: 1 day

- Fee: 0%

- Limits: 100 – 10,000,000 USD

- Tether (USDT TRC20)

- Exness Processing: Instant

- Provider Processing: 1 day

- Fee: 0%

- Limits: 10 – 10,000,000 USD

- USD Coin (USDC ERC20)

- Exness Processing: Instant

- Provider Processing: 1 day

- Fee: 0%

- Limits: 100 – 10,000,000 USD

- USD Coin (USDC TRC20)

- Exness Processing: Instant

- Provider Processing: 1 day

- Fee: 0%

- Limits: 10 – 10,000,000 USD

These options make Exness a versatile platform for users worldwide, accommodating traditional payment methods like Neteller, Perfect Money, and Skrill and newer cryptocurrency options such as Tether and USD Coin.

Please check Exness payment methods from my Exness account:

Exness Pricing solutions

- Quality Price Sources:

- Exness emphasizes the importance of quality, diversity, and the number of price sources.

- They work with multiple reputable exchanges, data vendors, and trading venues.

- Continuous monitoring ensures high-quality feeds for each instrument.

- Fastest Connections to Price Sources:

- Custom-built solutions are used for fast connection to price sources, minimizing latency.

- Examples include cross-connecting in LD4 for immediate price updates.

- Advanced In-House Aggregation:

- Raw prices undergo analysis and careful selection for each instrument.

- Proprietary algorithms aggregate data to create Exness’s price with their spread.

- Spreads are independent, kept low, and stable, regardless of providers’ pricing.

- Comprehensive Pricing Protocol:

- Control over each step of the price-provider-connection and aggregation chain.

- Tailored logic for each instrument to align with reputable market participants.

- Focus on representing actual market levels with competitive and stable spreads.

- Off-Market Pricing Protocol:

- Immediate response and responsibility are taken for any off-market prices received.

- Compensation for clients negatively affected, without removing profits from those benefiting.

- Continuous improvement of pricing models to prevent similar incidents.

- Better-Than-Market Pricing Approach:

- Minimal interruption of pricing aftermarket news, diverse price sources, and redundant connections.

- Skilled quantitative researchers developed in-house logic for pricing.

- Creation of own pricing models during poor liquidity and price quality in the market.

- Efforts to keep spreads stable are often tighter than the actual market.

- Active listening to client feedback to improve the product.

- A dedicated team is responsible for the constant monitoring and enhancement of pricing.

- Overall Impact:

- Carefully crafted pricing reflects the actual market state.

- It reduced the spread of reactions to volatility, illiquidity, or significant market news.

- Over 700K active traders enjoy these benefits, resulting in a seamless trading experience.

Conclusion

Exness is renowned for its excellent customer support, which enhances the user experience. The platform’s customer service is available 24/7, so no matter what timezone you’re in or when you prefer to trade, you will always have someone to turn to if you encounter any issues or questions.

The support team is highly trained and knowledgeable about all aspects of the platform, so they’re well-equipped to deal with a wide range of issues, from technical problems to account queries. Users can contact support through various channels, including live chat, email, and telephone, ensuring that help is available most conveniently. This commitment to outstanding customer service has resulted in high customer satisfaction and cemented Exness’s reputation as a reliable and trustworthy trading platform.

Additionally, Exness stands out for its integration of social trading features. Social trading is a relatively new development in online trading that allows traders to follow and copy the trades of experienced, successful investors. This innovative approach to trading is particularly appealing for beginners, as it allows them to learn from the strategies of more experienced traders and potentially benefit from their success.

At Exness, users can use these features to enhance their trading strategies. They can follow the trading activity of experienced traders, learn from their strategies, and even mimic their trades. This can be particularly beneficial for novice traders still learning the ropes or for more experienced traders looking to diversify their strategies. With the help of Exness’s advanced social trading features, traders of all levels can gain insights from their peers and make more informed trading decisions.

Please visit more of the best forex brokers: