Table of Contents

How do you find a broker for forex trading? First, check our forex broker rating list when choosing the right forex broker.

So, what is a trading broker? A broker is an individual or firm that acts as an intermediary between an investor and a securities exchange.

What are Forex Brokers?

Trading brokers are financial intermediaries that facilitate the buying and selling of currency pairs and various CFD’s financial instruments on behalf of traders and investors. They provide access to financial markets, execute trades, and offer various services and tools to assist traders in their investment activities.

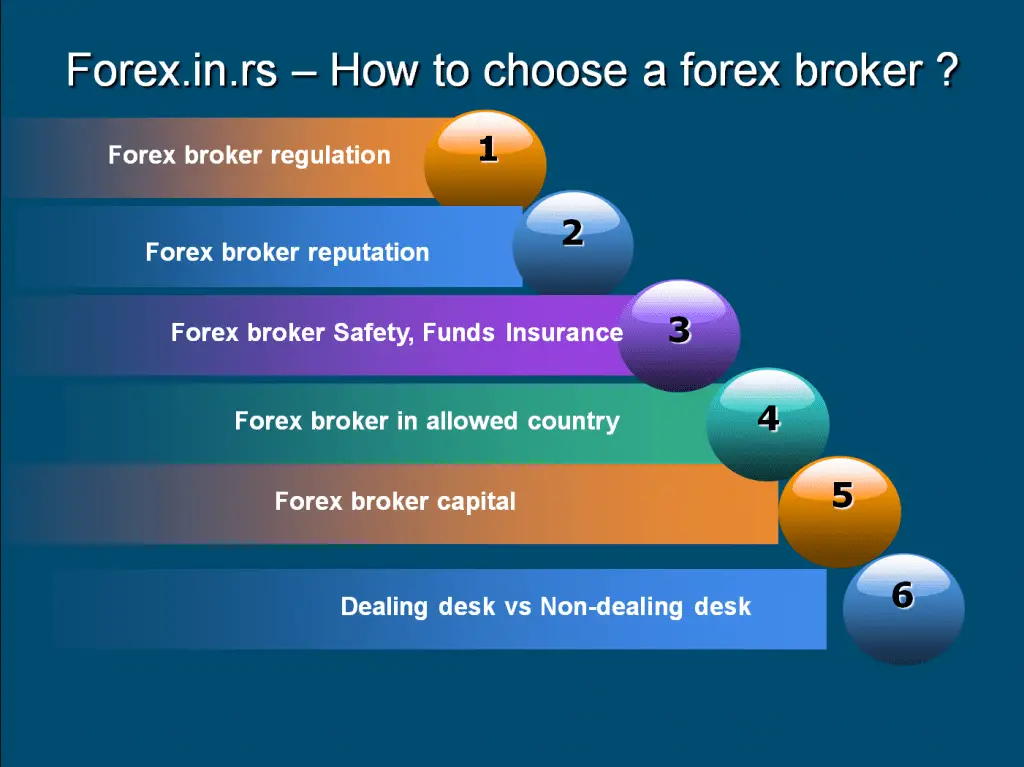

How to Choose Forex Broker?

To choose the proper forex broker, you must find a regulated brokerage company by a reputable financial authority that offers high leverage, multiple payment options, and a fast deposit and withdrawal service. It would also help to choose a broker that offers either tight spreads accounts or low commission zero spread accounts.

VISIT HFMThere are a few critical things to consider when finding a good broker.

Choose Regulated Forex Brokers

Regulatory bodies monitor regulated brokers. These regulatory bodies are government agencies or independent organizations that oversee and supervise the financial markets to ensure fair practices, investor protection, and market integrity.

For example, HF Markets broker is regulated by five regulatory bodies.

Not all regulatory bodies are the same. While they share the common goal of overseeing financial markets and ensuring investor protection, there can be variations in their regulatory frameworks, scope of authority, and enforcement practices. Don’t have similar regulatory environments and fiscal registration requirements. So, every trader/investor must select a foreign exchange broker based on where regulatory agencies observe their actions. You can check each regulation in our regulated forex brokers’ ranking list.

Forex regulation is based on several governmental and independent supervisory bodies, such as :

- Commodity Futures Trading Commission (CFTC) – United States

- National Futures Association (NFA) – United States

- Financial Conduct Authority (FCA) – United Kingdom

- Australian Securities and Investments Commission (ASIC) – Australia

- Cyprus Securities and Exchange Commission (CySEC) – Cyprus

- Financial Services Agency (FSA) – Japan

- Monetary Authority of Singapore (MAS) – Singapore

- Swiss Financial Market Supervisory Authority (FINMA) – Switzerland

- Financial Markets Authority (FMA) – New Zealand

- Financial Supervisory Authority (FSA) – Sweden

- Financial Services Authority (FSA) – Seychelles

- Dubai Financial Services Authority (DFSA) – United Arab Emirates

- Securities and Exchange Board of India (SEBI) – India

- Financial Services Commission (FSC) – Mauritius

- Autorité des marchés financiers (AMF) – France

- Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) – Germany

If you select to do business with an unregulated broker, you’re creating potential problems. But, of course, I know a few unregulated brokers who deal with excellent clients.

For example, if you’ve’ to dispute the trade on an action helped by a broker. There are’ a few countries where legal protection and law are strict and dependable, like the United States, Australia, and the United Kingdom but most EU countries.

Check Forex broker reputation.

When researching a forex broker’s reputation, several reliable resources are available to assess its credibility. Firstly, you can visit the official website of the regulatory body overseeing forex brokers in your jurisdiction or the jurisdiction where the broker is regulated. These websites often provide information on licensed brokers, any regulatory actions taken against them, and client complaints.

In addition to regulatory bodies, numerous independent online platforms are dedicated to reviewing and rating forex brokers. Websites such as Forex Peace Army, Trustpilot, and Forex.com offer comprehensive broker reviews, including user ratings, trading conditions, customer support, and overall reputation. These platforms allow you to gain insights from real traders and their experiences with various brokers.

Participating in forex forums and communities can also be beneficial. By joining these online communities, you can engage in discussions with fellow traders who share their experiences and opinions on different brokers. These forums provide valuable insights into the reputation and performance of brokers based on real user experiences.

Furthermore, seeking guidance from professional traders or industry experts can provide valuable insights. These individuals often have extensive knowledge and experience in the forex market and can offer recommendations on reputable brokers based on their research or personal experiences.

Conducting your online research is crucial as well. Visit the broker’s official website, carefully review their terms and conditions, and search for any news or press releases related to the broker. Look for any red flags or negative feedback from users.

Customer testimonials and reviews also play a significant role in assessing a broker’s reputation. Check for testimonials and reviews on various online platforms, including social media, broker websites, or independent review websites. However, exercising caution and considering the overall patterns and feedback is essential rather than relying solely on individual reviews.

Check Forex broker capital.

Investing money with a large broker can offer several advantages over a small broker. Large brokers often have more excellent financial stability, robust regulatory oversight, and access to a broader range of financial instruments. They typically have established infrastructure, better technology, and dedicated customer support. Moreover, larger brokers are more likely to offer competitive pricing, enhanced liquidity, and robust risk management measures, providing higher security and reliability for investors.

In our article Largest Forex Brokers by Volume, you can see large brokers list.

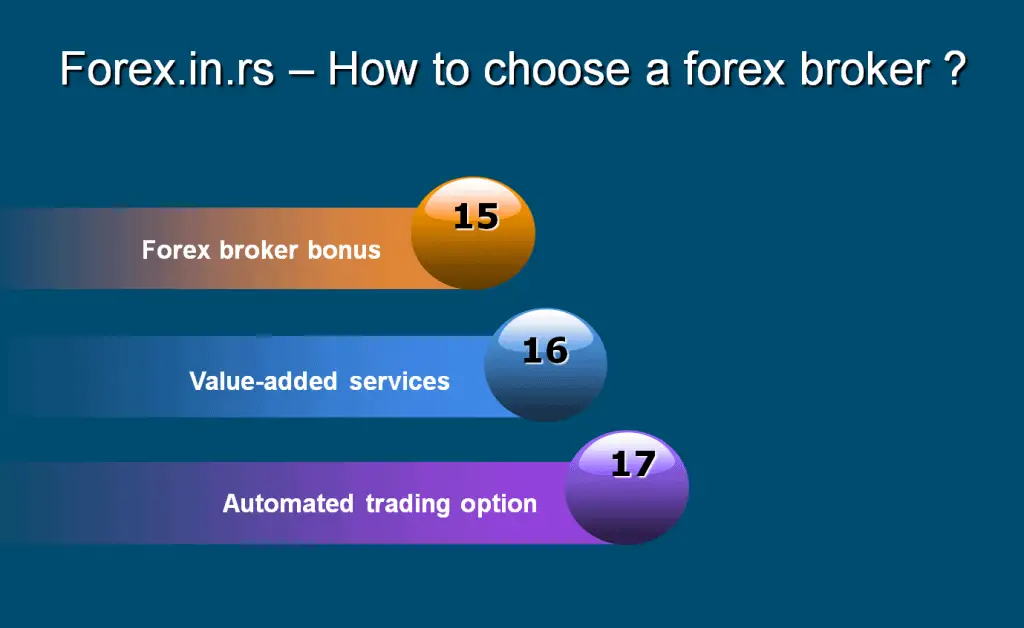

Forex broker deposit and withdrawal methods

Forex broker deposit and withdrawal methods refer to the various options for traders to fund their trading accounts and withdraw their profits or remaining funds. Here’s an explanation of each point:

- Deposit Amount: The minimum deposit amount required by forex brokers can vary. Some brokers have no minimum deposit requirement, while others may specify a minimum value, such as $500 or $1,000. When choosing a broker, considering the minimum deposit amount is essential, as it can affect access to the trading platform and services.

- Deposit Methods: Forex brokers typically offer a range of deposit methods to accommodate different preferences and locations. Online payment services providers like PayPal, Skrill (formerly MoneyBookers), Neteller, Ukash, and WebMoney have gained popularity as they offer fast and secure transactions. These services often have lower commissions compared to traditional bank wire transfers. When selecting a broker, checking if your preferred payment option is available in their deposit methods is advisable.

- Withdrawal Methods: The methods available for withdrawing funds from your trading account may not always be the same as the deposit options. Brokers may have specific withdrawal methods, such as bank wire transfers, credit/debit card refunds, or e-wallet withdrawals. Reviewing the broker’s withdrawal policies and ensuring that the available methods align with your preferences and requirements is important.

For me, the best deposit and withdrawal option is the Skrill payment option because you can fast deposit and withdraw, and most forex brokers use this payment method as the number one.

Dealing desk vs. Non-dealing desk

Dealing Desk (DD) and Non-Dealing Desk (NDD) are different execution models forex brokers use. Here’s an explanation of the difference between the two:

- Dealing Desk (DD): The broker is the counterparty to their clients’ trades in the Dealing Desk model. When a client places an order, the broker executes it internally within their dealing desk. This means the broker takes the opposite position to the client’s trade, potentially creating a conflict of interest. DD brokers may engage in practices such as requotes, order delays, or slippage, which can impact trade execution and pricing.

- Non-Dealing Desk (NDD): In the Non-Dealing Desk model, the broker acts as an intermediary, connecting the client’s trades directly with liquidity providers, such as banks, financial institutions, or other market participants. NDD brokers aim to provide direct market access and typically offer two types of execution: a. Straight Through Processing (STP): STP brokers automatically forward client orders to liquidity providers without intervention. This allows for faster trade execution and potentially tighter spreads, as the broker doesn’t act as a counterparty.b. Electronic Communication Network (ECN): ECN brokers aggregate buy and sell orders from various participants in the market, including traders, banks, and liquidity providers. Clients can interact with this network by placing their orders, and trades are executed based on the best available bid and ask prices from the network. This model often offers transparent pricing and increased liquidity.

Many forex brokers use a combination of the DD and NDD models. This factor in choosing a broker is not essential in 2023. anymore.

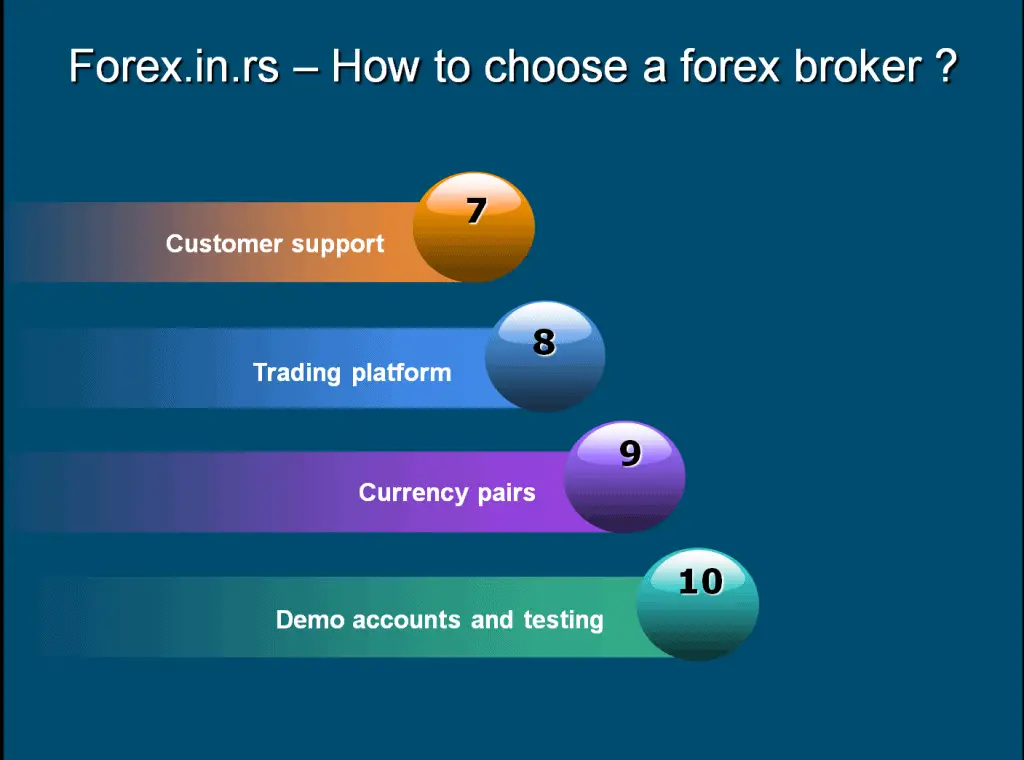

Support and customer service

This is another crucial criterion when you select a forex broker. The website’s chat option is significant and fast (less than 24/48 hours) broker email response. Of course, traders usually have problems with account verification and payments. Therefore, it is essential to have an excellent relationship with the forex broker-agent or support operator in that communication.

Chat, email, Skype is standard tools for communication with a forex broker. You need to find all this information on the website.

Support at forex brokers is crucial for practical reasons. The support teams offer assistance with various aspects of your trading account, including setup, verification, and management. They can help resolve technical issues like platform glitches or connectivity problems. Additionally, they can address queries related to order execution, trade confirmations, and settlements. Support teams also provide educational resources and guidance on trading strategies and risk management.

They play a role in ensuring account security, compliance with regulations, and resolving any issues or disputes that may arise. Access to reliable and responsive support enhances the trading experience, providing timely assistance and a sense of security. When choosing a forex broker, it’s essential to consider the quality and availability of their customer support.

Trading platforms

Forex brokers offering the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms is crucial due to their widespread adoption and popularity among traders. These feature-rich platforms provide comprehensive tools for technical analysis, order execution, and automated trading.

Their user-friendly interface caters to traders of all experience levels and offers mobile and web-based versions for convenient access. The extensive marketplace for plugins and expert advisors allows traders to enhance their trading strategies. With a large community and broad broker support, MT4 and MT5 have become the standard platforms in forex trading, offering a consistent and reliable trading experience for traders worldwide.

So, when you choose a forex broker, it should offer MT4 and MT5 platforms. For example, check how HF Markets offers platforms or Fxpro platforms.

Currency pairs list

When a forex broker offers a wide variety of forex pairs, it brings several benefits for traders. Firstly, it allows for the diversification of trading strategies, spreading the risk across different currency pairs and potentially capturing various market opportunities. Secondly, a broad selection of forex pairs ensures access to a more comprehensive range of global currency markets, enabling traders to capitalize on different regions and countries.

Additionally, many forex pairs typically mean better market coverage, liquidity, and competitive pricing. It caters to different trading strategies specific to certain currency pairs or regions. Moreover, brokers offering exotic currency pairs provide unique trading opportunities and the potential for higher returns. Lastly, having a diverse range of forex pairs accommodates individual trader preferences, allowing them to focus on the pairs they are most comfortable with. Overall, a wide selection of forex pairs enhances trading opportunities, flexibility, and the ability to tailor trading approaches to specific preferences and market conditions.

Most traders trade only major forex pairs, some forex and major stocks, and significant indices. But there are many exotic forex pairs, and if you like to trade USDMXN or USDNOK or some other pairs, it is wise to check how many currencies the forex broker offers.

Check HF Markets trading instruments.

Demo accounts and testing

The forex broker must offer demo accounts for trading and EA platform testing. This is very important if you trade using a new platform or a new beginner trader.

For several reasons, using a demo account provided by a forex broker before making your first deposit and choosing a broker is crucial. It allows you to become familiar with the trading platform, test and refine your trading strategies in a risk-free environment, assess the broker’s trading conditions, understand market dynamics, and gain experience without the fear of losing real money.

It also enables you to compare different brokers and make an informed decision based on your preferences and needs. Utilizing a demo account is essential in building confidence, honing your skills, and preparing yourself for live trading with real funds.

Spread or commission

When choosing a broker, it is essential to consider the spreads and the option of zero-spread accounts that charge commissions instead. Here’s an explanation of why wide spreads and large fees/commissions can impact your trading success:

- Spreads: Spreads refer to the difference between a currency pair’s bid (selling) and ask (buying) prices. Brokers typically make money by offering currency pairs at slightly different prices. Wide spreads mean a more significant difference between the bid and ask prices, which can increase the cost of entering and exiting trades. Higher spreads can eat into potential profits and make it more challenging to achieve favorable trade outcomes.

- Zero Spread Accounts with Commissions: Some brokers offer zero spread accounts where the spread is set at 0, but instead, they charge a commission on each trade. This can benefit traders who prefer lower spreads and are willing to pay a fixed commission. It allows for greater transparency in trading costs and can be more cost-effective, especially for frequent traders or those who execute larger trade volumes.

- Impact on Trading Success: Wide spreads and large fees/commissions can reduce trading success in several ways: a. Increased Trading Costs: Wide spreads mean traders must overcome a more significant cost hurdle before they can profit from a trade. Similarly, high fees or commissions add to the overall cost of trading. These costs can eat into potential profits and make it more challenging to achieve desired returns.b. Difficulty in Scalping or Short-Term Trading: For traders who employ scalping or short-term trading strategies, where quick entry and exit are crucial, wide spreads can be detrimental. The wider the spread, the larger the movement required to cover the costs and generate a profit. High fees or commissions can also diminish the gains from frequent trades.c. Impact on Risk-to-Reward Ratio: Wide spreads and high fees/commissions can affect the risk-to-reward ratio of trades. A wider spread means the trade needs to move further in your favor to achieve a favorable risk-to-reward ratio. Hefty fees or commissions can increase the breakeven point for a trade, making it more challenging to achieve a profitable outcome.d. Limiting Profit Potential: Wide spreads and high fees/commissions can limit profit potential, especially when small price movements are expected. If a trade only generates a small profit, the impact of wider spreads or significant fees/commissions can significantly reduce the overall profitability.

Therefore, when choosing a broker, it is essential to consider the spreads and fee structures they offer. Opting for narrower spreads or zero-spread accounts with reasonable commissions can help minimize trading costs and enhance your trading success. It is essential to balance spreads, fees/commissions, and the broker’s overall quality of services.

Lots and accounts

When selecting a broker, the availability of micro lots is crucial for several reasons. Firstly, micro lots facilitate effective risk management by allowing precise position sizing. Traders can allocate a specific percentage of their capital to each trade, resulting in better control over risk exposure and portfolio management.

Secondly, trading with micro lots helps preserve capital, particularly for traders with limited funds or those aiming to minimize risk per trade. By trading more minor positions, potential losses can be mitigated, safeguarding capital for future opportunities. Additionally, micro lots create an ideal learning environment, enabling traders to gain real-time experience and refine their strategies without risking substantial amounts of capital.

This fosters skill development and confidence-building over time. Moreover, offering micro lots enhances market accessibility and inclusivity, catering to traders with smaller account sizes who may otherwise find larger contract sizes impractical.

Micro lots also facilitate testing trading systems and strategies, allowing traders to assess their effectiveness before scaling up their trades. Finally, starting with micro lots gradually increases position sizes as traders’ skills and accounts grow, facilitating a smoother transition to larger trades and higher volumes.

Overall, brokers offering micro lots provide risk management flexibility, capital preservation, learning opportunities, accessibility, and scalability, contributing to a more inclusive and adaptable trading environment.

Margin and Leverage

When brokers offer ample leverage, it can benefit traders in several ways. Firstly, it increases trading power by allowing control of more prominent positions with a smaller amount of capital. This amplifies potential profits. Secondly, it provides greater market exposure, allowing traders to participate in a broader range of trading opportunities across various instruments. Additionally, ample leverage offers flexibility in position sizing, accommodating different risk appetites and trading strategies. It also reduces the capital required to enter trades, making forex trading more accessible.

However, it’s essential to recognize that high leverage carries risks, as it magnifies both profits and losses. Risk management and understanding leverage are crucial to prevent excessive exposure. Traders should assess their risk tolerance and experience level before using high leverage. Regulatory bodies often impose restrictions on leverage to protect retail traders.

Large leverage offers increased trading power, market exposure, flexibility, and accessibility but required responsible usage and risk management.

You can choose brokers with 1:500 and 1:1000 leverage, but you must risk a small portion of your portfolio and never trade on margin. For example, HF Markets offers excellent leverage.

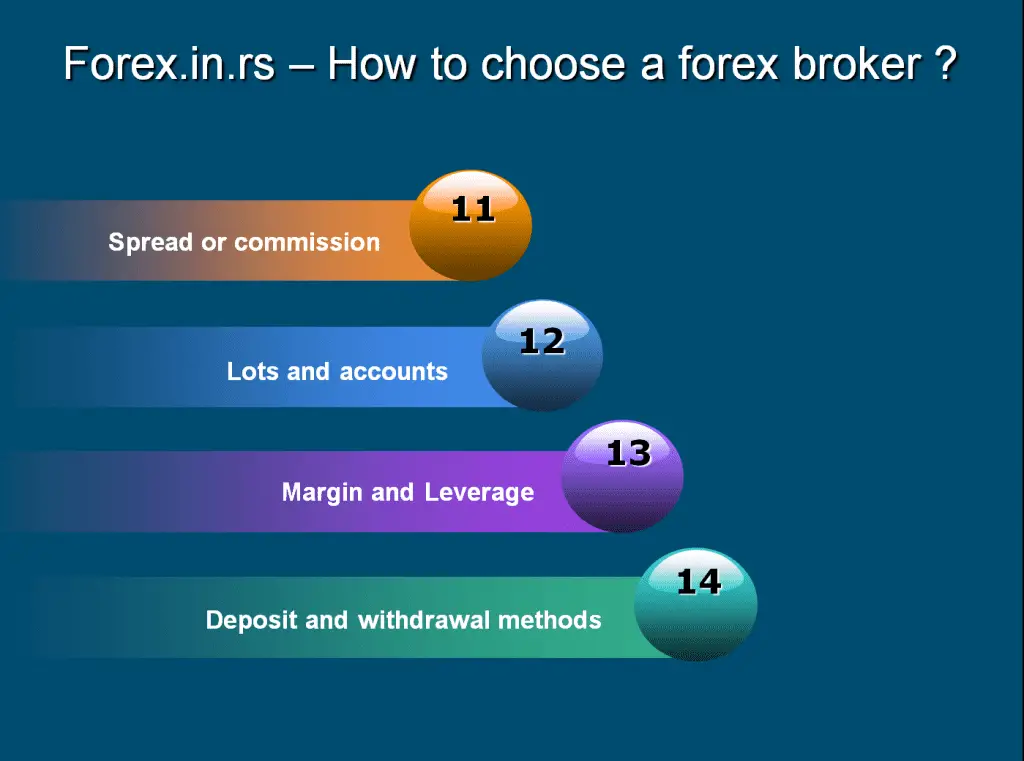

Forex broker bonus

When a forex broker offers a bonus, such as the 100% HF Markets bonus, it can benefit traders in several ways. Firstly, the bonus provides additional trading capital by matching the trader’s deposit, doubling their available funds. This increased capital allows for more extensive trade sizes and potentially higher profits. Secondly, the bonus can serve as a buffer or additional margin, protecting against potential losses and enhancing risk management. With more trading capital, traders have more flexibility in managing their risk exposure.

VISIT HFMThe bonus also offers ample trading opportunities, allowing traders to explore various trading opportunities and strategies. With a more extensive account balance, they can potentially take advantage of more trades and market movements. However, it is essential to review the terms and conditions associated with the bonus carefully.

Some traders like to get forex bonuses. You can read my article about a free funded Forex account without a deposit.

Factors such as minimum trading volumes, withdrawal conditions, and potential restrictions should be considered. Traders should ensure that the bonus aligns with their trading goals and preferences. Responsible assessment and understanding of bonus offers can help traders make informed decisions and maximize the benefits while managing any associated limitations.

Forex Broker’s Value-added services

Value-added services at forex brokers refer to additional offerings or features provided to clients beyond the essential trading services. These services aim to enhance the overall trading experience and provide added value to traders. Here are some common examples of value-added services:

- Educational Resources: Forex brokers may offer educational materials, such as trading guides, video tutorials, webinars, and market analysis. These resources help traders improve their knowledge, learn new trading strategies, and stay updated with market trends.

- Research and Analysis: Some brokers provide research reports, market insights, and technical analysis to assist traders in making informed trading decisions. These resources can include daily or weekly market summaries, economic calendars, and expert commentary on market events.

- Trading Tools and Platforms: Value-added services often include access to advanced trading platforms with a wide range of features and tools. These platforms may offer advanced charting capabilities, customizable indicators, automated trading options, and risk management tools. Additionally, brokers may provide mobile trading apps for trading on the go.

- Customer Support: Responsive and knowledgeable customer support is an essential value-added service. Brokers may offer multilingual support through various channels, including phone, email, live chat, or dedicated account managers. Prompt and efficient customer support can assist traders with account-related queries, technical issues, and general assistance.

- Account Types and Benefits: Forex brokers may offer different account types with varying benefits and features. These include premium or VIP accounts with lower spreads, higher leverage, priority customer support, personalized services, or exclusive trading resources.

- Social Trading and Copy Trading: Some brokers provide social trading platforms or copy trading services, allowing traders to follow and replicate the trades of successful traders. This feature enables beginners to learn from experienced traders and potentially improve their trading performance.

- Economic Calendar and News Feeds: Brokers may provide access to economic calendars that display critical economic events and their potential impact on the markets. Real-time news feeds can also inform traders about market-moving news and announcements.

Value-added services can vary among brokers, and not all offer the same services. When selecting a forex broker, evaluating the value-added services they provide and determining which ones align with your trading goals, preferences, and educational needs is essential. These additional services can contribute to a more comprehensive and satisfying trading experience, supporting traders in their journey toward success.

Automated trading option

Many forex brokers offer automated or mirror trading, PAMM accounts, MAMM accounts, or signals to provide services. In a word, some other experts trade for you. In this case, the most effective providing service is Zulutrade than Tradency and others. Here you will receive forex signals, and you will follow. For PAMM and MAMM accounts, the trader will get the fund manager, and how a fund manager’s equity grows, your equity will also grow.

Conclusion

Prioritize regulated brokers with a strong reputation and reliable customer feedback. Evaluate trading conditions such as spreads, leverage, and commissions, aiming for competitive rates that align with your trading strategy. Look for brokers offering diverse account types, value-added services, and responsive customer support. Test the trading platform using a demo account to ensure it meets your needs and preferences.

Verify the broker’s fund safety measures and consider the impact of spreads, fees, and commissions on your trading performance. Assess the availability of micro lots for precise position sizing and responsible risk management. Consider your preferences and trading goals while considering the importance of safety, support, and a user-friendly trading environment. By carefully evaluating these factors, you can make an informed decision when selecting a forex broker that best suits your needs.

VISIT HFM