Table of Contents

Different trading strategies can be used in forex to benefit the most from it. Read with us to know the most successful forex trading strategies, which include carrying trade strategy, swing trading, forex scalping strategy, day trading strategy, position trading, trend trading strategy, range trading strategy, price action trading, and some other forex trading tips that will benefit you as a trader.

Forex trading plan

Forex trading investment plans usually imply long-term position trades where traders plan to invest in some currency and hold trades for several weeks or months. However, there are many ways to strategize forex trading investment plans, like tracking trade trends, day trading, or looking for fundamentals in trading; a trader can mix and match to attain investment targets.

It is a system by which a forex trader ascertains when best to buy and sell a currency pair. A trader must use many trading strategies to analyze the forex market and minimize risk factors. The strategies that can be used include technical and fundamental analysis to determine the market trend.

The Best Four h Trading Strategy – Reversal

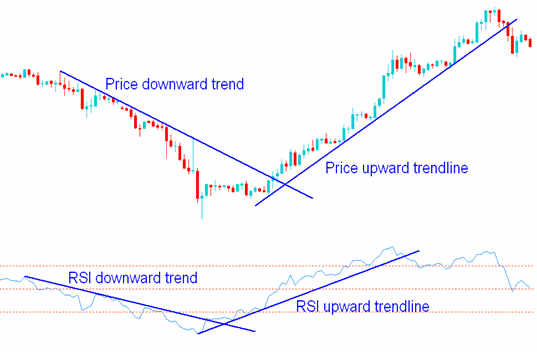

The best four-hour forex strategy is the breakout system when the RSI trendline is broken and increased volume and economic news follow the current breakout. Usually, a 4-hour time frame strategy is perfect for swing traders, where the average trade duration is from several hours to a few days.

The best trading strategy can vary from person to person, depending on their needs and resources. Every new individual can work by a different process; all that is necessary is to be comfortable with the used strategy. The best way to go about it is to eventually figure out a strategy that works the best for you per your goals and assets. However, to aid you in the process, here is a list of factors that you must consider while deciding on the perfect forex trading strategy for yourself:

- How frequently do you get an opportunity to trade using the strategy?

- What is the average distance that you can aim at?

- What time resources would you have to put in?

We can now look at the different strategies in detail to provide you with a better sense of their functioning.

- Overview:

- It’s a breakout system centered around the four-hour (4h) forex time frame.

- It is best suited for swing traders.

- Average trade duration varies from several hours to a few days.

- Key Features:

- The strategy activates when the RSI (Relative Strength Index) trendline breaks.

- The breakout must be supported by:

- Increased trading volume.

- Economic news that aligns with the direction of the breakout.

- Personal Variation:

- The “best” strategy is subjective and can differ among individuals.

- Every trader might have a unique approach.

- Finding a strategy that aligns with one’s comfort level, goals, and resources is crucial.

- Factors to Consider when Deciding on a four h Trading Strategy:

- Trade Frequency: How often does the strategy present trading opportunities?

- Target Distance: What’s the typical profit target or distance you aim for in each trade?

- Time Commitment: How much time will you need to dedicate to this strategy in terms of research and actual trading?

- Diving Deeper:

- To truly grasp the efficacy of this strategy (or any strategy), one should delve deeper into its mechanics, potential setups, and historical performance.

While the four h reversal strategy based on RSI breakout has its merits, traders must assess its suitability for their trading style, risk tolerance, and objectives.

Price Action 4h Trading Strategy

Price action represents price movement with aggressive initiation activity and strong price rejection of higher or lower prices. Strong movement when the price creates rejection on the 4-hour chart, usually on a daily high or daily low level, can be an exciting opportunity for traders.

In this strategy, historical prices are considered to build trading strategies. It is possible to use price as the only indicator or combine it with others to determine the feasibility. Economic events are also used as a factor in this strategy. Different techniques fall under this category as well that you can examine.

The span of trade: The best part about this forex trading strategy is that it can be used over different time frames ranging from short intervals and medium intervals to extended intervals. This is a reason why a lot of traders make use of this trading strategy.

Points of the way in and way out: Different methods are used to ascertain the entry as well as exit points in the process, which may include oscillators, Fibonacci retracement, trend identification measures, indicators, and the method of using candle wicks.

Different combinations of these strategies and methods can offer different trading experiences. There are other subcategories within the broad category of price action, such as trend, swing, range, scalping, position trading, and day.

Summary:

- Definition:

- Price action refers to the movement of prices driven by aggressive initiation activity and decisive rejection of higher or lower prices.

- A pronounced movement is often observed when there’s a rejection on the 4-hour chart, typically at daily high or low levels.

- Such movements present lucrative opportunities for traders.

- Strategy Basis:

- Historical prices form the foundation of this strategy.

- Traders can either:

- Rely solely on price as the indicator.

- Combine price with other indicators to gauge feasibility.

- Economic events also play a role in shaping this strategy.

- Techniques Within Price Action:

- Several techniques and approaches fall under the umbrella of price action trading.

- Trade Duration Flexibility:

- Suitable for varying time frames:

- Short intervals (e.g., minutes, hours).

- Medium intervals (e.g., daily, weekly).

- Long intervals (e.g., monthly, yearly).

- This versatility makes it popular among traders.

- Suitable for varying time frames:

- Entry and Exit Strategies:

- Multiple methods can determine entry and exit points, such as:

- Oscillators (e.g., RSI, Stochastic).

- Fibonacci retracement.

- Trend identification measures.

- Various indicators (e.g., MACD, Bollinger Bands). (Read our article about MACD 2 line indicator for MT4)

- We are utilizing candle wicks for insights.

- Multiple methods can determine entry and exit points, such as:

- Combinatorial Approach:

- Traders can mix and match different methods and strategies for a unique trading experience.

- Subcategories within Price Action:

- Trend trading: Following established market trends.

- Swing trading: Capitalizing on market swings.

- Range trading: Trading within a specific price range.

- Scalping: Taking advantage of small price movements for quick profits.

- Position trading: Holding onto trades for extended periods based on macro events or trends.

- Day trading: Opening and closing positions within the same trading day.

Price action trading is a holistic approach that can be tailored to individual trading styles and preferences by choosing from various techniques and time frames.

Four-Range Trading Strategy

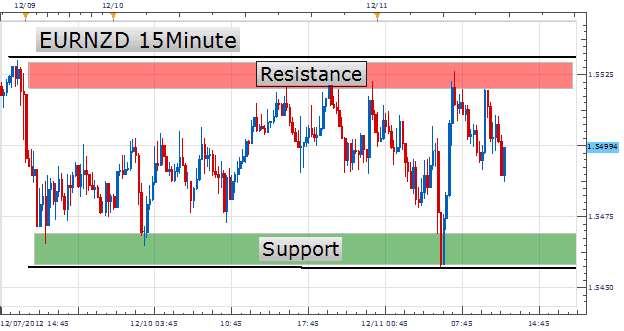

Forex ranges daily strategy represents strategy based on the average daily true range and low volume where the previous high and daily low determine support and resistance. Usually, low volatility pairs are perfect for any range trading strategy, such as EURGBP, EURCHF, etc.

This strategy mainly combines technical analysis and identifies the support and resistance points close to the key levels. The best use of this strategy can be made in volatile markets where there isn’t any discernible trend.

The span of trade: There is no fixation in terms of the length of this strategy. It can be used for varied time frames. However, one thing to be cautious of is the risks occurring due to breakouts, making risk management an essential part of this strategy.

Points of the way in and way out: Oscillators are the best timing tools used along with a range trading strategy. Some oscillators that you can make use of include stochastics as well as the Commodity Channel Index. There is also a possibility of using price action better to ascertain the breakouts and the signals of range bounds.

Sample 1: Range Trading of EURGBP

Over the past years, it has been observed that EURGBP has been portraying a long price level based on range-bound. With the increased risk, trading based on the range can also bring you exhilarating rewards if you invest in a long time frame.

To further understand whether this trading strategy would be the right choice for you, look at the pros and cons below.

Advantages:

- Significant trading opportunities would be available.

- A good ratio of risk and reward.

Disadvantages:

- Investment in long time frames is needed.

- A good understanding of technical analysis is required.

Overview of strategy:

- Definition:

- Range trading focuses on identifying and capitalizing on price movements within a defined range.

- It’s based on the average daily true range and low trading volume.

- Key Features:

- Support and Resistance: Established based on previous daily highs and lows.

- Preferred Currency Pairs: Low volatility pairs are most suitable, e.g., EURGBP and EURCHF.

- Analysis Type:

- Primarily relies on technical analysis.

- Focuses on identifying support and resistance points close to critical levels.

- Market Condition Suitability:

- It is best applied in markets experiencing sideways movement or no discernible trend.

- Inconsistent or absent strong upward/downward momentum makes this strategy more effective.

- Trade Duration:

- Flexibility: No fixed time frame; can be applied across short, medium, or long intervals.

- Risk Management: Essential due to potential breakout risks, which can lead to rapid price movements outside the range.

- Entry and Exit Points:

- Oscillators: Serve as timing tools for this strategy.

- Examples include stochastics and the Commodity Channel Index (CCI).

- Price Action: This can be used to better detect breakouts and identify signals that define the range bounds.

- Oscillators: Serve as timing tools for this strategy.

In essence, range trading is a strategy to exploit price oscillations within a defined horizontal range. The focus is on capitalizing on the predictable bounce of prices between support and resistance levels rather than riding solid trends. Proper risk management and tools are crucial to ensure successful and sustainable trades within the range.

4-hour Trend Trading Strategy

A four-hour trend trading strategy represents a strategy where the best performance traders get using channels either bullish or bearish. Buying from the bottom of the rising trend or selling from the top of the bearish trend is a strategy where traders follow the primary trend.

Using the directional momentum in the market, this strategy aims to gather the maximum positive returns. It is a strategy used by numerous trailers of all backgrounds and experiences because of its ease.

The span of trade: The most common time frame for this strategy is medium-term or long-term horizon since the trends mainly change in length. There is also a possibility of following an analysis of multiple time frames under this strategy, just like price trading.

Points of the way in and out: The entry points are generally ascertained based on oscillators such as RSI and CCI, while the exit points are ascertained based on the risk and reward ratio. By employing stop-level distances, it is possible either to equate the distance or go beyond it and maintain a favorable ratio of risk and reward.

- Definition:

- A trading strategy focused on the 4-hour time frame to exploit directional momentum.

- Traders capitalize on bullish or bearish channels to maximize returns.

- Trading Approach:

- Buy at the bottom of a rising trend (bullish channel) or sell at the top of a descending trend (bearish channel).

- The core principle is to align with and trade in the direction of the predominant trend.

- Benefits:

- Capitalizes on the inherent momentum in the market.

- It is suitable for traders of all levels due to its simplicity.

- Trade Duration:

- Typically Medium to Long-Term: Trends can span varying lengths of time, and longer-term trends can offer more significant profit opportunities.

- Multiple Time Frame Analysis: Traders can cross-reference other time frames for a more holistic view, similar to price trading strategies.

- Entry and Exit Points:

- Entry Points:

- It was determined using oscillators like the RSI (Relative Strength Index) and CCI (Commodity Channel Index).

- It helps identify when a trend might start or if a currency is overbought/oversold.

- Exit Points:

- Based on the risk-to-reward ratio.

- Using stop-level distances, traders can match or surpass the distance to ensure a positive risk-to-reward ratio.

- Entry Points:

In essence, the 4-hour trend trading strategy is about harnessing the power of market momentum in a medium-term time frame. Proper entry and exit points and diligent risk management are crucial for its success.

Sample 2: Recognition of a trend

The best strategy to employ here is to trade in the direction of the most robust trend in the market. For example, with the trend being followed, a dip makes many traders enter the market, which eventually causes a rise in the price. Therefore, all that is required is to identify a strong trend dominating the market and trade to fetch the maximum profit. There is, however, a lot of effort that goes into employing this strategy. You can read the advantages and disadvantages of the strategy to make your final decision.

Advantages:

- Significant trading opportunities would be available.

- A good ratio of risk and reward.

Disadvantages:

- Investment in long time frames is needed.

- A good understanding of technical analysis is required.

Four-Position Trading Strategy

This strategy is based on fundamental factors, but specific technical methods, such as Eliot’s wave theory, could also be used. It is a major strategy that is employed in the long term. It is possible to apply this strategy to different markets, be it stock or forex. Additionally, the monitor fluctuations in the market do not account for much since they do not alter the more extensive market picture.

The span of trade: There is a need to understand the technical aspects of forecasting ideas. This strategy runs over a long time, from a month to a year. Therefore, you must be careful before going ahead with the strategy.

Points of the way in and out: The only way to judge the points of entry and exit is by using technical analysis in different strategies. There is a need to have a comprehensive reading of the market and the trends to exploit this strategy’s advantages fully.

- Definition:

- A trading strategy primarily based on fundamental analysis.

- It can be applied across various markets, including stocks and forex.

- Focuses on long-term market moves and disregards short-term market fluctuations.

- Technical Tools:

- While rooted in fundamental analysis, technical tools like the Eliot Wave Theory can be incorporated.

- Duration:

- Long-Term Approach: Typically spans from one month to over a year.

- It is not suitable for those seeking quick trades or short-term gains.

- Market Fluctuations:

- Minor market shifts are often overlooked, as they don’t usually affect the broader market trajectory.

- Emphasis on capturing significant market moves over extended periods.

- Trade Initiation and Termination:

- Entry and Exit Points:

- They are primarily determined through technical analysis methods used in various strategies.

- Requires a thorough understanding of market trends and patterns.

- Complexity:

- It is essential to grasp technical aspects for accurate forecasting.

- Comprehensive market analysis is vital to leverage the full benefits of the strategy.

- Entry and Exit Points:

Position trading is a strategy designed for those willing to commit to trade for longer durations, focusing on capturing significant market trends. It requires patience, thorough analysis, and a willingness to ignore minor market fluctuations in favor of the larger market picture.

Sample 3: Position Trading of Germany 30 (DAX)

By the end of 2018, Germany had undergone a technical recession with the trade war between the US and China, damaging the automotive industry. Brexit negotiations did not help the situation since the UK leaving the European Union negatively impacted the German economy. This example made it possible to ascertain the market trend using technical and fundamental analysis, creating an undefeatable business strategy.

You can read the advantages and disadvantages of the strategy to make your final decision.

Advantages:

- A lot of time investment is not required.

- A perfect ratio of risk and reward.

Disadvantages:

- Minimal opportunities for trading.

- A good understanding of technical as well as fundamental analysis is required.

Dollar-cost averaging forex strategy.

A dollar-cost averaging forex strategy represents a long-term forex strategy where the trader splits trade into several positions instead of one trading position and then creates several trading positions in an equal schedule. Usually, the average duration of the dollar-cost averaging forex strategy is several months.

For example, a dollar-cost averaging forex strategy can be a strategy where a trader, after fundamental analysis, wants to buy EURUSD. Every 30 days, the trader creates one trading position, and the final goal is to hold trades for several months and catch significant gains.

Swing Trading 4h Strategy

Swing is a style that attempts to capture gains in any financial instrument over a few days (more than one day) to several weeks.

In this strategy, the focus rests on taking advantage of the range and the trending markets. Simply by choosing tops and bottoms, the trader can make an entry into the long as well as short positions.

The span of trade: The Swing trading strategy is considered a medium time frame strategy since it can take a few hours to a few days. There also rests a possibility of investing in long time frames since it allows capitalizing on varied trends along with the trend over time.

Points of the way in and out: Like in the case of range-bound strategy, you can also use oscillators, strategies, and indicators to ascertain the best points of entry and exit. The only variation that can be seen in this case is that swing trading is applicable in trending markets and range-bound markets.

Sample 6: GBP/USD Swing Trading Strategy

This example uses a stochastic oscillator, moving average, and the ATR indicator to determine a complete swing trading strategy. We can observe how traders enter long positions when there is an uptrend, considering the philosophy of buying low and selling high.

The final level of risk management occurs when the ATR indicates stop levels. Specific technical uses necessarily have to be made in following this strategy.

You can read the advantages and disadvantages of the strategy to make your final decision.

Advantages:

- Significant trading opportunities would be available.

- A median ratio of risk and reward.

Disadvantages:

- There is a lot of time investment required.

- A good understanding of technical analysis is required.

Carry Trade Strategy

In this strategy, the process is to borrow a currency at a decreased rate and then invest in another currency at an increased yielding rate. The result of this strategy would be a positive trade made. It is a strategy best made for use in the forex market.

The span of trade: The central dependence of this strategy is on the fluctuations in the interest rates among the associated currencies. Therefore, the perfect trade length under this strategy would be a medium to long-term time frame, lasting from a week to a year.

Points of the way in and way out:

The best use of this strategy is in strong trending markets since the time frame here is relatively lengthier. The first step before an entry point is to confirm the trend. There are two points that you must focus on, namely, exchange rate risk and interest rate risk. Based on this strategy, the best time to invest is to invest at the beginning of the trend to benefit from the exchange rate fluctuations. The interest rate component will be unchanged despite the trend since the trader will receive the interest rate differential. This strategy has got a lot of benefits if exploited fully.

You can read the advantages and disadvantages of the strategy to make your final decision.

Advantages:

- There is very little investment in terms of time required.

- A median ratio of risk and reward.

Disadvantages:

- A good understanding of the forex market is required.

- The trading opportunities that you can come across are infrequent.

The Strategies Of Forex: An Overview

We familiarized you with eight strategies that can be used in the forex market to facilitate the capitalization made in the trading. You can look through the examples and after careful consideration of the pros and cons. Decide on the perfect strategy for yourself, depending on your resources and time. There are different trading strategies for different traders based on their identities. There is one way to start using the right strategy, which is by matching the trading personality. At first, it is best to start with the short time frame strategies and invest little sums while you are learning. Eventually, you can ascertain the best strategy that suits you, invest in long-term gains, and capitalize on the trends over time.

You can start the journey using algorithms to guide you on adequate entry and exit points to avoid becoming vulnerable. At the same time, eventually, you can work out a combination of manual and algorithm settings.