Table of Contents

Due to its complexity, Forex trading can be complicated for beginners and experienced traders. But, like any other investment area, the lighter you consider it, the lighter your pocket will weigh.

What is a forex investment plan?

Forex Investment Plans represent plans where traders define risk, platforms, assets, strategy, entry and exit conditions, monitoring, performance benchmark, stakeholders, and advisors.

Forex trading investment plans usually imply long-term position trades where traders plan to invest in some currency and hold trades for several weeks or months. However, there are many ways to strategize forex trading investment plans, like tracking trade trends, day trading, or looking for fundamentals in trading; a trader can mix and match to attain investment targets. In practice, traders can have a long-term goal or frequent day trading in currencies or indexes.

Forex Investment plans need to have the following:

- Clear Investment Goals: Forex investment plans should have clear and realistic investment goals aligned with the investor’s risk tolerance, investment horizon, and financial objectives.

- Risk Management Strategies: Forex investment plans should have adequate risk management strategies that help to minimize potential losses and protect against market volatility. This can include diversification, stop-loss orders, and hedging strategies.

- Investment Strategy: Forex investment plans should have a well-defined investment strategy that outlines the types of investments that will be made, the markets that will be traded, and the expected returns and risks associated with each investment.

- Performance Benchmarks: Forex investment plans should have clear performance benchmarks that allow investors to measure the success of their investments over time. This can include comparing investment returns to market benchmarks, such as the S&P 500 or Dow Jones Industrial Average.

- Monitoring and Evaluation: Forex investment plans should be regularly monitored and evaluated to ensure they align with the investor’s goals and objectives. This can include reviewing portfolio performance, assessing risk management strategies’ effectiveness, and making necessary adjustments.

- Expert Advice: Forex investment plans can benefit from the advice of experienced professionals, such as financial advisors or investment managers, who can guide investment strategies, risk management, and portfolio diversification.

- Investment Tools: Forex investment plans should have access to a range of investment tools, such as trading platforms, technical analysis software, and real-time market data, that can help investors to make informed investment decisions and optimize their investment returns.

On a broad look, investing in forex for beginners implies depositing money at forex brokers, starting demo trading, learning from books on technical and fundamental analysis, and trading on live accounts.

It all depends on your knowledge, skills, requirements, and willingness. Here are a few strategies to invest in forex for beginners.

A practical example of how to set goals in a Forex investment plan

A practical example of a clear investment goal for a forex trader could be:

Goal: To generate consistent monthly returns of 5% with a maximum drawdown of 10% over 12 months.

Explanation: This goal is clear and specific, with a defined target return and risk tolerance. The trader aims to generate a 5% return on their investment each month while limiting their potential losses to a maximum of 10%. The timeframe of 12 months provides a realistic horizon for achieving this goal. The trader can use this investment goal to guide their investment decisions and evaluate their performance over time.

A practical example of Risk Strategy in Forex investment plan

A practical example of a forex risk management strategy plan could be:

Strategy: Diversification and Stop-Loss Orders

Explanation: This strategy involves diversifying investments across different currency pairs and implementing stop-loss orders to limit potential losses.

- Diversification: By diversifying investments across different currency pairs, the trader can spread their risk and reduce the impact of any one currency pair on their overall portfolio. For example, if the trader invests 50% of their portfolio in EUR/USD and 50% in USD/JPY, they can reduce their exposure to any currency pair.

- Stop-Loss Orders: Stop-loss orders are orders to sell a security when its price falls to a certain level. By setting stop-loss orders at predetermined levels, the trader can limit potential losses and protect against market volatility. For example, suppose the trader sets a stop-loss order at 1.1000 for a long position in EUR/USD. In that case, the order will automatically sell the position if the price falls to or below that level, limiting potential losses.

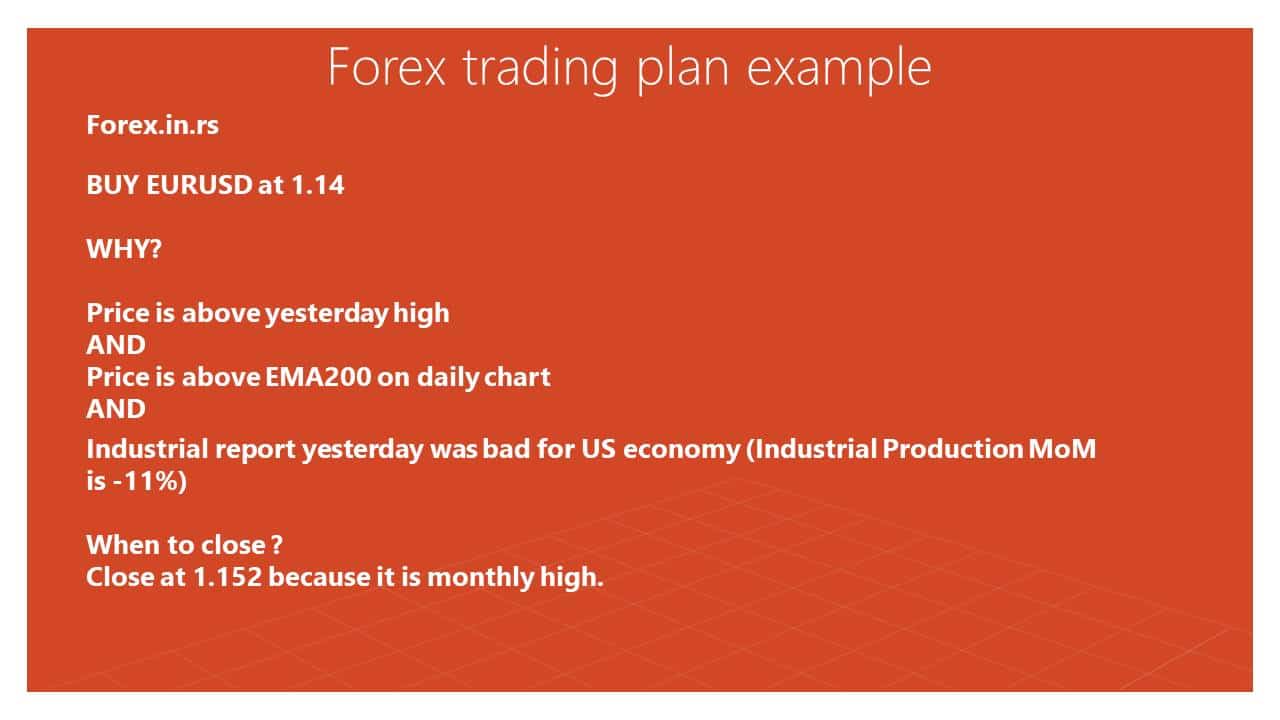

A practical example of Investment Strategy in Forex investment plan

A practical example of an investment strategy plan using EMA200 on a daily chart and volume value could be:

Strategy: EMA200 and Volume Breakout

Explanation: This strategy involves using the EMA200 indicator on a daily chart to identify trends and volume value to confirm trend strength and potential breakouts.

- EMA200 Indicator: The EMA200 is a technical analysis indicator that calculates the average price of a currency pair over the last 200 trading days. This indicator is commonly used to identify trends in currency pairs. For example, if the price of a currency pair is trading above the EMA200, it may indicate an uptrend, and if the price is trading below the EMA200, it may indicate a downtrend.

- Volume Value: Volume is an important indicator of market activity and can be used to confirm trend strength and potential breakouts. High volume can indicate strong buying or selling pressure and confirm a trend or potential breakout.

- Investment Plan: The investment plan involves taking a long position in a currency pair when the price crosses above the EMA200 on a daily chart and the volume value is higher than the average volume over the last 10 trading days. The stop-loss order will be set below the most recent swing low, and the take-profit order will be placed at a predetermined level based on the trader’s risk-reward ratio.

A practical example of a Performance Benchmark in a Forex investment plan

A practical example of a performance benchmark in a forex trading strategy could be to compare the annualized return of the system to the return of a market index such as the S&P 500. For instance, the benchmark could be to generate a higher annualized return than the S&P 500 over three years. The investor would track the performance of the forex trading strategy over the evaluation period and compare it to the S&P 500 over the same period.

They could use portfolio tracking software to measure and compare performance. Risk management would be an essential part of the strategy. The investor would need to ensure that the risk-reward ratio is favorable and that they are comfortable with the risk associated with the trading strategy. If the trading strategy is not meeting the benchmark criteria, adjustments can be made to improve performance.

This could involve adjusting the risk management strategy, adjusting the investment approach, or considering a different trading strategy. Overall, the performance benchmark provides the investor with a clear target to aim for and a means of evaluating the effectiveness of their forex trading strategy.

Forex investment plan Idea

One of the best forex investment plans is when traders trade on several accounts. For example, the trader will use one long-term trading account (positions a few weeks to a few months), accounting for swing trades and day trades. In both accounts, traders will manage a small amount of money and add more in the future if the trading performance is satisfactory. Long-term forex trades can be an excellent investment opportunity.

Traders usually manage trades in long-term accounts every few weeks or once per month. This rebalancing process is essential because of two things. First, the trader will close some currency pairs and add new positions or stop loss and target based on the current market environment.

Every month traders evaluate trading accounts and add or remove money from them.

The Bottom Line

As a beginner wanting to invest in forex, you may find this field tough initially, but with practice and willingness, anyone can do it. If you fear losing money, you can also opt for practice forex accounts available online to give you the same experience, but you won’t gain or lose any real money. As a beginner, you must understand that things take time to work, and nothing will make you rich overnight. You must spend your effort and dedication to succeed and earn lasting money.