Table of Contents

Jim Simons is an influential figure in the academic and financial worlds, renowned for his dual legacies as a mathematician and founder of the highly successful hedge fund Renaissance Technologies. Born on April 25, 1938, in Massachusetts, he earned his Ph.D. in mathematics from the University of California, Berkeley, and his work in geometry and topology garnered significant respect within the scientific community. Notably, he contributed to breakthroughs in the understanding of manifolds and co-developed the Chern-Simons form, influencing various areas, including string theory.

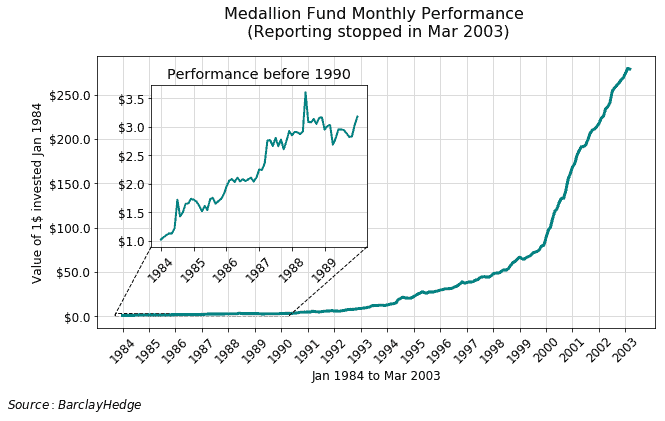

Transitioning from academia, Simons founded Renaissance Technologies in 1982, applying systematic, quantitative trading strategies that leveraged mathematical models and algorithms, radically innovating financial market strategies. Under his leadership, the Medallion Fund achieved remarkable success, earning Simons a reputation as one of the most successful hedge fund managers globally. Besides his professional successes, Simons is a dedicated philanthropist, focusing on scientific research, mathematics, and education through initiatives like Math for America.

How Jim Simons’ Quantitative Approach Delivered a Whopping 66% Annual Return

Jim Simons’ trading strategy at Renaissance Technologies emphasizes modest position sizes compared to the large-scale trades common in macro investing. The approach combines a slightly above 50% success probability for each trade, frequent trading (though not at high-frequency scales), rigorous efforts to reduce market slippages such as the bid-ask spread, and a unified model that accurately captures correlations between FICC and equities.

Jim Simons, the brilliant mind behind Renaissance Technologies, revolutionized the world of equity trading by embracing a quantitative approach three decades ago, long before its mainstream acceptance. Recognizing the power of data, Simons and his team relied heavily on quantitative models to identify market inefficiencies. By mining historical data, they pinpointed recurring anomalies that could be leveraged for profit.

The core of their success lies in portfolio-level statistical arbitrage, which uses statistical and econometric methods to reap profits while managing market risks. It’s worth noting that while many have tried to decipher Simons’ strategies, the exact methods remain closely guarded trade secrets. However, his systematic, data-driven approach allowed Renaissance’s Medallion fund to achieve a staggering average of 66.1% returns before fees from 1988 to 2018. This unmatched success has cemented Simons’ legacy as a pioneer and titan in quantitative finance.

Jim Simons and Renaissance technologies:

Simon’s renaissance technologies have protected the fund for more than two decades. He has employed mathematical models to analyze and execute trades. Renaissance can predict the price change in the financial instrument through computer-based models.

Renaissance also employs specialists and experienced persons from non-financial backgrounds. These backgrounds include physicists, mathematicians, signal processing experts, and statistic specialists.

In the year 2006, Simons was named a Financial Engineer by the International Association of Financial Engineers. In the year 2007, he earned personally $2.8 billion. He heads earned $1.7 billion in the year 2006 and $1.5 billion in the year 2005. So, here is the actual growth rate of his income and earned money.

Jim Simon’s hedge fund returns were 66% ( generated average annual returns) before charging investor fees—and 39% after fees—racking up trading gains of more than $100 billion.

Using his solid mathematical background and extensive data set, Simons wanted to build the computer model. He believed that he could identify and get the profit from patterns in the market. He created his algorithms based on the data 40 years before today. According to Zuckerman, he takes advantage of the smallest and shortest price fluctuations. By crunching data and creating a predictive algorithm, Jim Simons embraced a radical investing approach. These tactics were adopted radically in Silicon Valley and elsewhere.

Today, the protected funds and other quantitative investors are the most significant market players. They can control 31% of all stock trading. They are inspired by the success of Simons and his colleagues. Simons indeed took more than a year to find a formula to beat the market.

Jim Simons’ System at Renaissance & Medallion

Historical Development:

- 1982: Monemetric was renamed to Renaissance.

- 1998: Limroy closed, leading to the launch of the hedge fund Medallion.

- Partnership Dynamics: Initial influential partners included Leonard Baum, James Ax, and Elwyn Berlekamp. Eventually, equilibrium was reached with Henry Laufer and Nick Patterson leading the FICC operations.

- Expansion: By 1992, Medallion’s FICC trading reached total capacity, necessitating new ideas and talent.

Key Personnel Additions:

- Robert Frey: Hired from Morgan Stanley’s trading group.

- Robert Mercer & Peter Brown: Joined from IBM’s Thomas J. Watson Research Center, known for their expertise in hidden Markov chain speech recognition.

- Result: After about three years of collaboration, by 1995, the team successfully launched large-scale equity trading both domestically and globally, enhancing Medallion’s capacity and operations.

- 2010: Mercer and Brown were promoted to co-CEOs of Medallion.

Jim Simons Trading Strategy – Medallion’s Trading Style

- Position Size: Unlike macro investing’s large trades, positions are modest.

- Success Probability: Each trade has a success rate slightly above 50%.

- Trading Frequency: Trades are executed very frequently but not at high-frequency scales.

- Slippage & Market Impact: Every effort is concentrated on reducing slippage, including minimizing the bid-ask spread, to ensure the least possible market impact.

- Unified Market View: Both FICC and equities are guided by a single model, which captures their correlations accurately.

Jim Simons, the brilliant mind behind Renaissance Technologies (RT), built an unparalleled trading strategy based on data and algorithms, hiring top-tier scientists with minimal Wall Street experience. Unlike other hedge funds that keep their strategies compartmentalized, Simons ensured that the codebase at RT was transparent, with all members having access to and contributing to it.

Stringent non-compete and non-disclosure agreements for new hires counterbalanced this open-door policy. Two employees, Belopolsky and Volfbeyn, found themselves in hot water after trying to set up a competing business without signing a non-compete due to an oversight. Despite the global reach of its trades and including all asset classes, the Medallion fund’s capacity remained at ten billion dollars.

One repercussion of this capacity limitation was that Simons effectively turned Medallion into a family office, serving himself, family members, and fund employees. This approach saw the firm venture into tax-saving tactics, such as the use of ‘basket’ options, which transformed short-dated gains into long-dated ones.

Simons capitalized on Medallion’s success by introducing other hedge funds, like the Renaissance Institutional Equities Fund (RIEF), for outside investors, though these didn’t quite achieve Medallion’s stellar performance. While Medallion continued its successful streak, outside investors in funds like RIEF often found themselves disappointed. The contrasting fortunes were highlighted in 2020 when, while Medallion prospered, RIEF underperformed, leading to disgruntled investors and questioning headlines in the media.

Renaissance’s Work Culture:

- Hiring Strategy: Renaissance prioritized hiring top-notch scientists with solid backgrounds in hard sciences but limited or no Wall Street exposure.

- Codebase Transparency: Unlike the compartmentalization seen in many hedge funds, Renaissance maintained a wholly transparent and open codebase, accessible for study and contribution by all team members.

- Protection Measures: New hires must sign stringent non-compete and non-disclosure agreements to protect Medallion’s proprietary knowledge and intellectual property.

- Noteworthy Case: Belopolsky and Volfbeyn failed to sign a non-compete due to a clerical error and tried to start their operation. They faced legal challenges from Simons and were eventually pushed out of business.

Capacity & Returns:

- Despite its global expansion and diverse asset class coverage, Medallion’s trading capacity remained capped at ten billion dollars due to its distinct trading style.

- Zuckerman provided two critical time series showcasing Medallion’s annual returns and size. It’s essential to note that Medallion’s consistent size means its impressive returns should not be compared directly with compound returns from some competing hedge funds.

The Road Less Traveled: Risks and Challenges

Jim Simons, the brilliant mind behind the quantitative revolution, wasn’t immune to challenges. In 1985, as he collaborated with James Ax, another esteemed mathematician, Simons pondered the potential effects of sunspots and lunar phases on the market.

This unorthodox approach took him to California to explore new avenues in trading. But with innovation came setbacks. Zuckerman highlighted various incidents that nearly capsized Simons’ endeavors. His interactions with team members like Baum, Ax, and Berlekamp posed unique challenges, from personal health issues to disagreements, but Simons’ tactful handling ensured he steered clear of most storms.

Triumphs and Legacy

Jim Simons’ journey wasn’t just about the challenges; remarkable accolades equally marked it. His significant contributions to Geometry and Topology earned him the AMS Oswald Veblen Prize in 1976. Recognized as the Financial Engineer of the Year in 2006, Simons’ innovations in quantitative funds by 2019 were revolutionary. But his legacy doesn’t just stop with accolades; it’s his ability to harness raw talent, turning mathematical prowess into unparalleled wealth. By sifting through mountains of data, he brought about some of the most profound changes in the industry, proving his mettle as a genius in mathematics.

Medallion and Beyond

The Medallion fund is perhaps the crowning jewel in Simons’ illustrious career. Growing from $66 million in 1993 to a staggering $10 billion by 2010, its returns between 2011 and 2018 were consistently the best, outpacing market averages. Even after Simons handed over the reins to Mercer and Brown, he remained an influential figure as the fund’s chairman. But beyond Medallion, Simons’ influence permeated other areas, too.

The establishment of the Flatiron Institute in 2016, housing top-tier computational scientists, further cemented his commitment to scientific research. Through the Simons Foundation, he championed causes, from supporting scientific research to contributing billions to autism centers. His establishment of Math of America showcased his commitment to nurturing the next generation of math and science teachers. Throughout his career, Simons merged rigorous data with innovation, reshaping the financial landscape and leaving an indelible mark on science and philanthropy.