Table of Contents

Forex trading can be fascinating. You can do it even if you are new to instrument training. However, traders and investors need a small capital and an internet-enabled device to jump on this bandwagon. You will also need a broker who will offer you a trading platform that you can use to trade. Most of these trading platforms offer different features that can help traders, especially the new ones, manage their activities and keep losses on the other side. One such brilliant feature is an FX stop-loss order. When used right, this feature can save you from losing every penny.

Stop-loss meaning

What is a Stop-Loss Order?

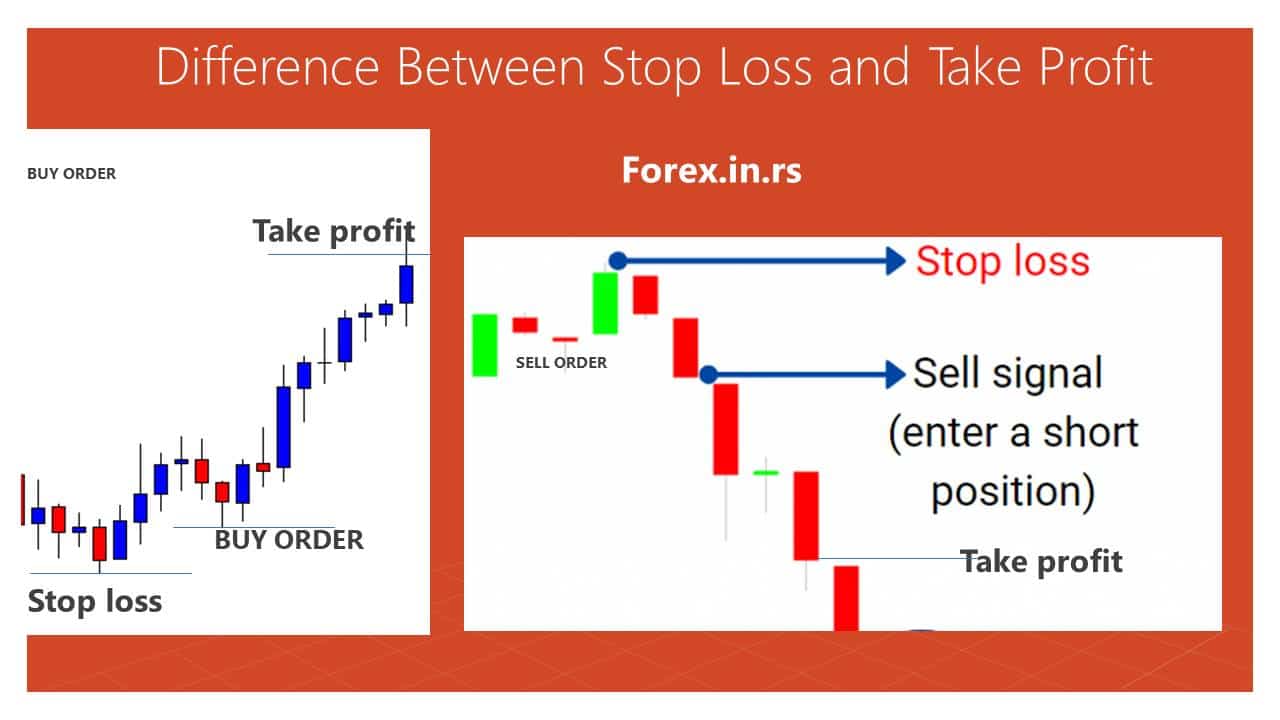

A Stop-loss order is an instruction placed with a broker to buy or sell a security by setting a stop loss level, a specified amount of pips away from the entry price. The Stop-loss order aims to prevent additional losses if the price goes against the trading position.

If traders have a BUY order, Stop-loss is an order instruction that tells the trader’s broker to sell the security when it reaches your stop-loss level price. Traders are encouraged to put a stop-loss against the price beyond which they would not like to take the risk. As soon as the prices reach your stop-loss order, your broker will sell your securities before the prices move further down, saving you from bearing enormous losses.

How does stop loss work?

Using stop-loss is based on the trader’s behavior in making a buy or sell position. The stop-loss level for the BUY position is below the entry price, and the target is above the entry price. The Stop-loss level for the SELL position is the price level above the entry price and the target below the entry price. After an entry order is made, the market price fluctuates between stop loss and target price. In one moment, the trade will be closed if the reach stops loss or target price level.

Stop-loss order losing trade example:

BUY EURUSD at 1.30, stop loss at 1.29, target at 1.31. Trade will be close with profit if it reaches 1.31 and with a loss if it touches 1.29.

SELL EURUSD at 1.30, stop loss at 1.31, target at 1.29. Trade will be close with profit if it reaches 1.29 and with a loss if it touches 1.31.

When close prices reach stop-loss, that is not constantly losing trade. Sometimes, traders move stop-loss orders when the trade is profitable, and stop-loss and target bring profit for the trader.

Stop-loss order winning trade example:

Example:

BUY EURUSD at 1.3. SL in forex is 1.29. Target 1.31. When the price is 1.305, traders can move the stop loss to 1.302. If the trade doesn’t reach the target, the trader will profit from 20 pips (trade reaches stop loss 1.302).

Importance of stop-loss

Currency prices fluctuate every day, if not every minute. As a result, forex trading is seldom the full-time job of every trader and investor. Since it is impossible for traders to stay hooked to the market every time, a stop-loss order will mitigate the trader’s loss by informing their broker that they must sell the securities before the prices go further down. After analyzing your risk-taking capacity, you can decide where to put a stop-loss order. This feature is available to both long- and short-term position holders.

The importance of stop loss for trading is high, based on scientific research, experiments, and traders’ practical experience. A well-defined exit strategy and stop-loss are essential to any forex trading strategy. Market conditions change over time, and a strong market reaction can ruin trading performance without a correctly estimated stop-loss level.

Forex without stop loss

Forex no-stop loss strategies are dangerous strategies based on the assumption that the order will be profitable at some point. Unfortunately, the market can be overbought and oversold for an extended period, and traders often lose money when they risk more than they can afford. Therefore, instruction for closing trade at some price level is mandatory for the practice of experienced traders.

This feature not only saves your tangible capital but keeps you away from emotional turmoil as well. When you know that your losses will not go beyond a manageable limit, you can make trading decisions that are not burdened or clouded. The one thing that is certain about the Forex market is its uncertainty. The market can move in any direction, and there is no way that anyone can predict it with utmost surety. Therefore, even if you keep an eye on the fundamental and technical aspects that can affect the value of a currency, you still cannot control the market. In such an unpredictable market, a feature like stop-loss can save you from drowning in debt.

A good trading strategy followed by lousy money management can still leave you in troubled waters. Novice traders often go ahead with safe currency pairings like USD/JPY and EUR/USD but still lose money because they don’t know how to manage money. In this situation, simply putting a stop-loss order will not suffice. You must know how to calculate a stop-loss order altered to your financial needs. This has been explained further in this article.

A stop-loss is an essential tool that facilitates trading by helping traders manage their capital and psychology. You don’t need to get trapped in the vicious circle of worrying about the unknown. It helps many traders to remain calm and make decisions that are not tainted by fear. Moreover, it will keep you level-headed, an essential virtue for any trader or investor.

Types of Stop Losses

In our article, we already wrote about MT4 order types in simple words.

- Static stop loss

The word ‘static’ means stationary, which this type is about. You can put a stop at a static price and not change or move its position until the trades hit the stop-loss price. This is an uncomplicated mechanism that even new traders can easily understand. In addition, the static stop-loss allows the traders to establish that they are looking for a minimum 1:1 risk-reward ratio.

This example will help you in understanding how to use a static stop-loss. Let’s assume a swing trader in LA who wants to initiate a position during the Asian session. He expects that volatility during the North American or European sessions will influence his preferred trades. He knows he could be wrong, but he does not want to give up too much equity and still wants to give his trade a chance to grow. In this case, he sets a static stop-loss of 50 pips every time he triggers a position. He wants his take-profit to be at least equivalent to the stop distance. Thus, he sets each limit order for 50 pips. This is a 1:1 risk-reward ratio. He wanted to take more risk and accept a 1:2 risk-reward ratio; he would set the static stop at 50 pips and raise the static limit to 100 pips for each trade he would start.

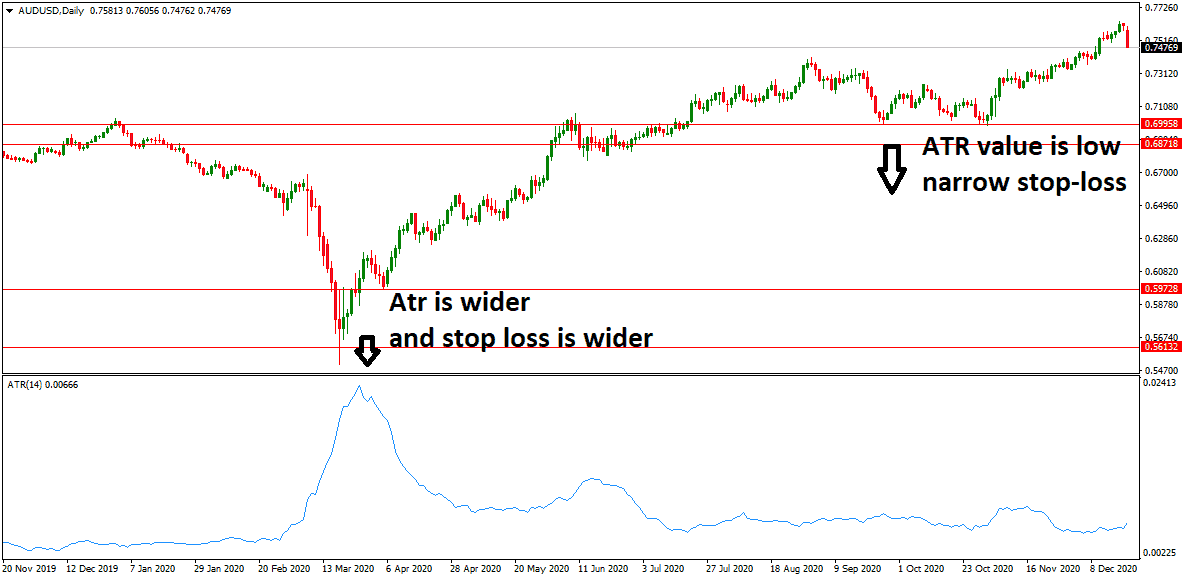

In addition to the risk-reward ratio you are comfortable with, indicators influence how a trader would like to use a static stop-loss. For example, some Forex traders put a static stop distance on a technical indicator, the Average True Range. This is beneficial because traders use actual market information to define their stops or limits rather than relying on their judgments.

Isolating the concept of pips will not give you a clear picture. First, one must know about the kind of market that they are trading in. In the above example, we talked about a static stop of 50 pips and a static limit of 100 pips, but we don’t know the kind of market that the trader was dealing in. It could be a volatile or a quiet market. The difference is that the 50 pips are not a significant move in a volatile market but quiet. Additionally, technical indicators like pivot points, price swings, and Average True Range allow traders to utilize more recent information to devise risk-management strategies. Therefore, you must consider these factors before putting a static stop-loss.

- Trailing stop loss

A trailing stop-loss order is an order that is not fixed or static during the trading period. For example, if traders have bought a security position and the market price rises, the stop price rises by the trial amount, but the stop-loss price doesn’t change if the security price falls (BUY order).

Trailing stop-loss orders are created to reduce risk and increase profit in the moments when live positions follow the current trend.

How to calculate the stop-out level

The stop-loss level in trading is usually calculated based on previous highs and lows, which are essential price levels. Essential price levels can be previous highs, previous lows, Fibonacci, and pivot points.

Calculating the stop-out level in trading involves identifying key price points and levels that signal when a trade should be closed to prevent further losses. Here’s a detailed breakdown using bullet points:

- Identify Key Price Levels:

- Previous Highs and Lows: Look at historical chart data to find previous significant highs (resistance) and lows (support), indicating potential reversal points.

- Fibonacci Levels: Use Fibonacci retracement tools to identify potential support and resistance levels based on Fibonacci ratios.

- Pivot Points: Calculate pivot points, which are used to determine potential support and resistance levels based on an average of the high, low, and closing prices from the previous trading session.

- Determine Support or Resistance Levels:

- For a long position (buy): Identify nearby support levels. These are prices at which the asset has historically had difficulty falling below.

- For a short position (sell): Look for resistance levels where the price has previously struggled to break above.

- Set the Stop-Loss:

- Below Support for Long Trades: Place the stop-loss below a support level for long positions. If the price breaks below this level, the trade is closed to prevent further losses.

- Above Resistance for Short Trades: Set the stop-loss just above a resistance level for short trades. If the price breaks above this level, it suggests the downtrend may be reversing, and the trade is closed.

- Consider the Asset’s Volatility:

- Adjust the stop-loss distance to account for the asset’s typical volatility. More volatile assets might require a broader stop-loss to avoid being stopped out by normal price fluctuations.

- Calculate Entry Point and Target Price:

- Entry Point: Choose an entry point that aligns with your analysis, such as a breakout from a support or resistance level or a reversal signal.

- Target Price: Set a target price level where you plan to take profits, often at the next significant resistance (for long trades) or support level (for short trades).

- Risk-Reward Ratio Consideration:

- Ensure the potential reward justifies the risk. A common approach is to aim for a risk-reward ratio where the potential profit is at least twice the potential loss.

- Use Technical Indicators for Confirmation:

- Consider using additional technical indicators (like moving averages, RSI, MACD) to confirm the support or resistance levels further further.

- Backtest and Adjust Strategy:

- Backtest your strategy using historical data to see how your stop-loss level would have performed. Adjust based on the results and your risk tolerance.

Usually, traders find support or resistance levels or critical levels and then set stop loss, entry point, and target price level using those levels.

Conclusion

Stop-loss is a resourceful tool that traders can use to keep themselves from losing their capital and to manage their risks. No one can stay glued to the screen; even if you can commit to it, various other factors can work against you. For example, there could be internet problems, or you might not be able to reach your broker on time. Therefore, using this tool to eliminate such risks is always better.

Yes, your trading strategy should dictate how you would employ this tool, but our recommendation would be to refrain from trading without using a stop-loss, especially if you are a new trader.