Table of Contents

Trading rules and regulations can be complicated, and if you make too many trades, you may be subject to restrictions.

Does Stop Loss Count as a Day Trade?

Yes, if you enter a trading position and then make a stop loss order during the same day, that stop loss order counts as a day trade. However, if you set stop loss the next day or any other day, that position will not be flagged as a day trade. If a trader has four consecutive stop losses, the trader may be flagged as a pattern day trader.

This article aims to explain what a stop loss is, how stop losses may affect pattern day trading regulations, and what happens when one is a pattern day trader. Some resources may be shared to help you learn more about being a great day trader and properly managing stop losses in day trading.

What is a Stop Loss?

When traders want to purchase or sell a security at a specific price, they issue a stop-loss order. When you put a stop-loss order, the order may automatically be executed when the price hits the stop price, the price you specified to buy or sell the security. Investors may use stop-loss orders when trading equities to reduce their losses. Investors may also use stop-loss orders to determine the lowest price they are ready to sell or the highest price they are prepared to buy security to avert a significant loss.

For example, a stop-loss order can sell a security at a price 20% less than the original purchase price. Hypothetically, If one buys a stock for $300 and places a 20% stop-loss order, the stock may sell if the price falls to $240, resulting in a 20% loss. Percentages or dollar amounts may be used when ordering stop losses.

The only time the market may not execute a transaction at the set price is if the security price unexpectedly drops below the stop-loss price.

Consider the following scenario: a stock now trading at $500, and you place a stop-loss order to sell it at $400. The stop loss may sell your stock at $300 if the stock price drops to $300 unexpectedly, thereby skipping your stop-loss target.

Can Using a Stop Loss Affect Pattern Day Trading?

Stop loss may be a day trade if one places a stop loss on the same day the security is bought. It may not be considered a day trade if the stop loss does not happen on the same day or if the stop loss is placed after the trading day has ended.

If the stop loss is carried out after the trading day has ended, the stop loss will be based on the price of the following trading day.

In four or more days, a pattern day trader may execute a trade by buying and selling securities on the same day over five days. Pattern day trading may be done using a margin account, where one can borrow money to invest against existing investments.

Pattern day trading may be affected differently by long-term and daily stop losses. Daily stop losses are more likely to be counted as pattern day trades.

Stop loss may be a day trade if an individual sets a daily stop loss order on stock acquired or sold and executed the same day.

On the flip side, a long-term stop loss may not be considered a day trade because the possibility of being executed on the same day as the initial trade may be extremely slim. Because a long-term stop loss may have a more significant disparity between the buy and selling price than a daily stop loss, it is unlikely to occur on the same day.

Check below TD Ameritrade’s video on YouTube describing pattern day trading in greater detail:

What Happens If You are Labeled A Pattern Day Trader?

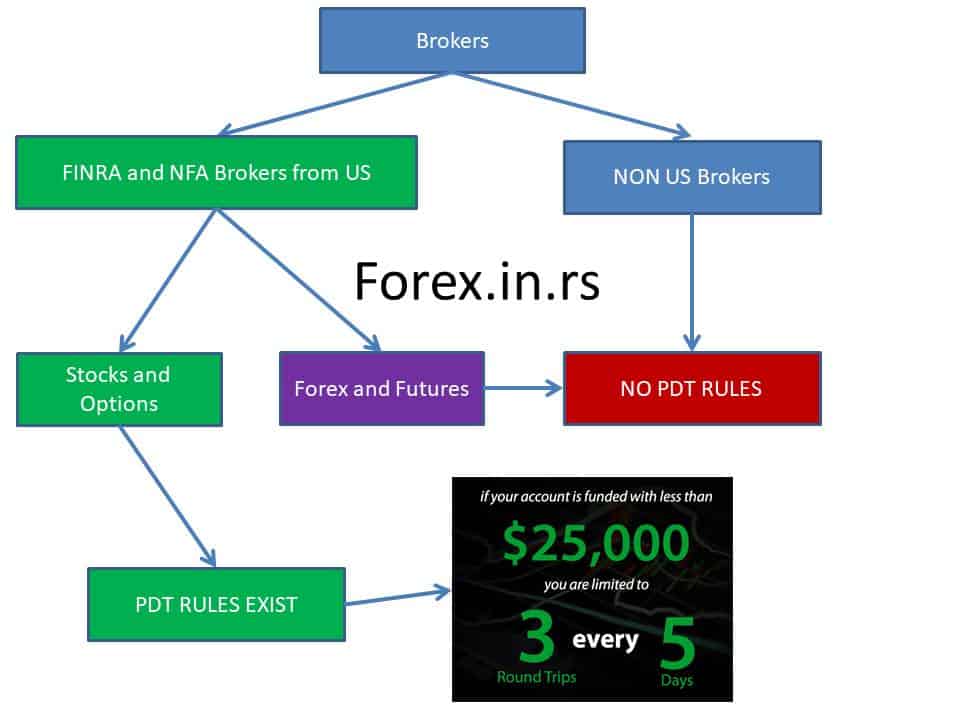

If you are a Pattern Day Trader and make four or more day trades weekly, your account may be identified as a PDT ( pattern day trader). Your account may eventually be restricted if specified as a PDT. These accounts are marked to prevent investors from trading excessively.

However, an investor may still be able to trade, and as long as they don’t get identified as a PDT again, they will be good. But, after being labeled a PDT, the previous trading patterns may cause them to be labeled even more.

A PDT is expected to have more than $25,000 in a margin account to trade and borrow for investing. The account’s minimum balance can be made up of cash and securities.

If your account is reported violating the PDT rule, the broker may give a margin call if you do not have the required PDT equity. You may have five days to deposit funds into your account to meet the deadline. Your trading may be restricted but not suspended if the deadline is not met.

Spending extra time knowing the rules governing trading and investment before getting flagged could be beneficial if an individual wants to profit from stop-loss day trading.

Conclusion

As a pattern day trader, stopping losses can be pretty helpful, but you must be careful how you utilize them to avoid limits. Remember that the stop loss may not be considered a day trade if the stop loss is not executed on the same trading day as the initial transaction. Placing a stop-loss order may not be considered a day trade in and of itself. But, if the stop-loss order is activated on the same day as the position is opened, this may be referred to as a day trade.

If you’ve been flagged as a PDT, you might still be able to trade, but you may be subject to various restrictions, such as account minimums.

Before entering into a new investing technique or trading practice, do your homework. Make sure to know how the brokerage can assist in managing a trade. Whether you’re a seasoned trader or just getting started, keep polishing your investment abilities and staying up to date on all things day trading.