Table of Contents

MT4 is an exchange platform that was introduced in 2005 by Metaquotes. The mainstream trading on this platform involves forex trading, but it can also be used for investing in cryptocurrencies, indices, CFDs, and commodities.

The MT4 client terminal helps inform the broker about the implementation of various trading processes and operations, along with the creation and preparation of requests. Terminal controls and keeps track of the position that is open. These orders bind the clients on the platform with the brokerage company to indulge in trade operations.

MT4 Order Types

The different types of MT4 orders that exist in the Metatrader terminal are:

- Market order

- Pending order

- Buy limit order

- Sell limit order

- Buy stop order

- Sell stop order

- Stop limit order

Market Order

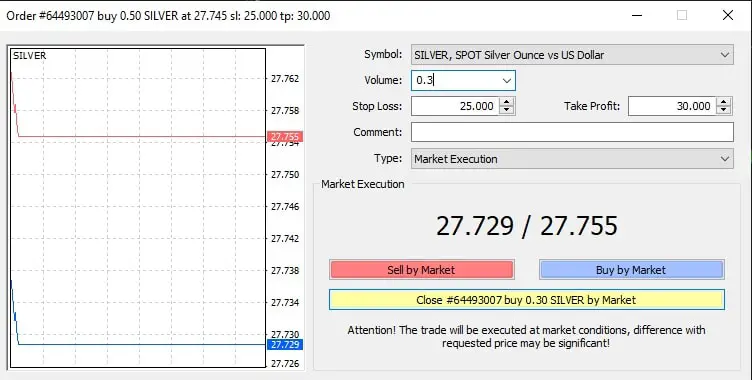

Market order represents trading order instruction placed with a broker that will be executed at current live price levels.MT4 platform will execute market orders less than the second.

When a promise or commitment is made with the brokerage company to sell and purchase the securities at the current price, it is known as a market order. The execution is completely independent of the type of security involved in the exchange—this type of order results in the creation of a trade position. The criteria for this process involve purchasing at ASK price and selling at BID price. Additionally, Stop loss and take orders can also be a part of the market order.

Pending Order

Pending order represents an instruction placed with a broker to buy or sell assets at a pre-defined price level in the future. For example, a buy pending order in forex is BUY EURUSD at 1.32 if the current price is 1.31.

This is the contrast of market order. This order implies that the customers promise the company to purchase or sell the securities at a predetermined price in the coming future. Pending orders have the eccentric feature where they create the trade position only when the price reaches a level that you specified in the future. The terminal consists of 4 types of pending orders-

Buy Limit

A Buy limit order is an instruction placed with a broker to buy a security by setting entry-level, a specified amount of pips below the current price. For example, a buy limit order is when you BUY EURUSD at 1.32 if now price level is 1.325.

A buy limit is based on future predictions and allows the client to trade below the market price. For example- If the current market price is $25 and your price is $22, then a buy position will open at $22. The basic criteria are that the future ‘ASK’ price is equal to the decided price.

Buy Stop

A Buy Stop order is an instruction placed with a broker to buy a security by setting a stop loss level, a specified amount of pips below the entry price. The Stop-loss order’s purpose is to prevent additional losses if the price goes against the trading position.

This is the reverse of the buy limit order. In MT4 buy stop order, the securities are bought upon the speculation that the price will keep on rising in the future. Here, the anticipation price is always higher than the current price, and the market position is opened when the price reaches the required hike. Here the ‘ASK’ price is equal to the value determined. Read more about stop-loss orders.

Sell Limit

A Sell limit order is an instruction placed with a broker to sell a security by setting entry-level, a specified amount of pips above the current price. For example, a sell limit order is when you SELL EURUSD at 1.32 if now price level is 1.318.

Much like the buying orders, the ‘BID’ price is the main concern here. In the sell limit, the selling price is equal to the predetermined value. Here the current price falls below the speculated price, and the main assumption is that after rising to a certain limit, the selling prices will fall.

Sell Stop

A Sell Stop order is an instruction placed with a broker to sell a security by setting a stop loss level, a specified amount of pips above the entry price. The Stop-loss order’s purpose is to prevent additional losses if the price goes against the trading position.

In a sell stop order, the ‘BID’ price will be in the predetermined price range. In Mt4 sell stop, the market position is created when the current price level that is higher than the provided value falls and reaches the anticipated value.

Whenever a MetaTrader 4 pending order is executed, the Stop Loss and Take Profit immediately attaches itself to the open market position.

Stop-limit order

A stop-limit order is an order where traders define two prices: stop-loss price and the limit price. If the price reaches the stop price level, a new limit order will automatically trigger buying or selling the asset.

You can read in detail everything about the stop-limit order strategy in our article.

Pending order MT4 iPhone

To set stop loss on an MT4 iPhone phone go to the “Quotes” tab and then pick the instrument. The trader can then choose the option “New order” and pending execution type (buy limit, sell limit, buy stop and sell stop). After that trader will set volume, stop loss, and target. In the last step, traders can choose from BUY or SELL option.

You can read more in our article on how to set stop loss on Android phones. On the Android or iPhone cell phone setting pending orders procedure is the same.

The Difference Between Stop Loss And Take Profit

MetaTrader Stop Loss

Nobody wants to incur losses when they are trading. The motive of stop loss is directly about that aspect. This stop-loss order aims to minimize the losses in case the prices of security spike in a direction that is not beneficial for the client. Whenever such a situation arises, the position will close on its own, prohibiting any losses.

These types of orders are always a part of the pending order or open position. The requirement is that the brokerage company has to post these orders together to reap their benefits and put them to use. For short positions, ASK price is used where the order is always determined at a higher price than the current price. At the same time, the BID price is used for long positions where the anticipated price is always lower than the BID price.

MetaTrader Take Profit

As evident from the name, this order aims to gain profit from the security price levels. Like the stop profit order, the implementation of this order also leads to the closing of position if the price falls. Its requisite is that a take-profit order should always be attached with the open position or pending order.

The terminal uses BID price for long positions like the former (where the price is always determined above the current price), and ASK order is used for short positions ( the price is always set below the current price)

Things To Keep In Mind

- A broker is always in charge of setting up the price for trading operations

- Stop Loss and Take Profit orders cannot be executed for pending orders

- In a history chart, BID price is the main concern while some part of the chart is allotted to the ASK price.

Conclusion

MT4 is a highly customizable platform that can be altered according to the different trading preferences of individuals. It is also helpful in speculating the prices of various financial markets. It contains live prices and charts, which help you keep an eye on the trends and existing prices.