Table of Contents

One question in trading gives headaches to many traders: How to Determine Stop Loss in Forex?

It seems easy – traders should place stop loss for each position when they trade. The critical manner to assure that the account does not undergo such a damaging situation is to apply an order for stop-loss that will provide limitations concerning the level of exposure to risk factors. But knowing where to place an order to stop loss about each trade is not considered ample to make you a profitable trader. This is based on the premise that it is also needful to possess the correct size regarding the distance of a designated stop loss to permit you to remain for an extended period in the trade session to view the price’s movement in the direction you select.

How to calculate stop loss?

To calculate stop-loss levels and size of the position, traders need the following steps:

- To define stop-loss price level.

- To calculate forex size position based on dollars per pip, traders need to divide the risk per dollar by several pips.

- To calculate stop loss in pips and convert in dollars, traders need in the first step to find the difference (absolute value) between the entry price level and stop-loss price level. In the next step, traders need to multiply Pips at risk, Pip value and position size to calculate risk in dollars.

- To find lot size, In the first step, we need to calculate risk in dollars, then calculated dollars per pip, and in the last step, calculate the number of units.

To learn how to calculate position size, visit our page.

The downside is that there is no easy answer concerning the spot (exactly price level) where you should place the stop loss when you are engaging in forex trading.

How to determine to stop loss in forex? How to define stop-loss price level?

There is no clear consensus on how to determine a stop-loss price level for exact trade. The largest group of traders advises that the stop loss should be set as close to the entry-level as possible (tight stop-loss), while the other group suggests a greater stop loss distance (wider stop-loss).

How to set stop loss in Metatrader 4?

First, let us see the easy part. How can we place stop loss in the Metatrader platform?

In this video below, we can learn what is stop loss and how to set stop-loss:

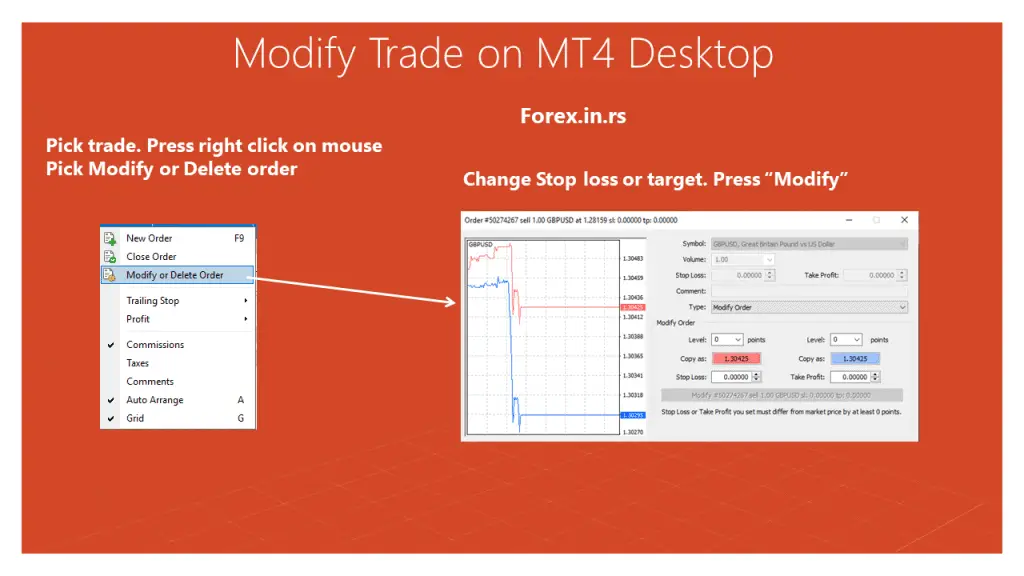

In the image below, you can see how to place stop-loss orders and modify stop-loss orders in the MT4 platform:

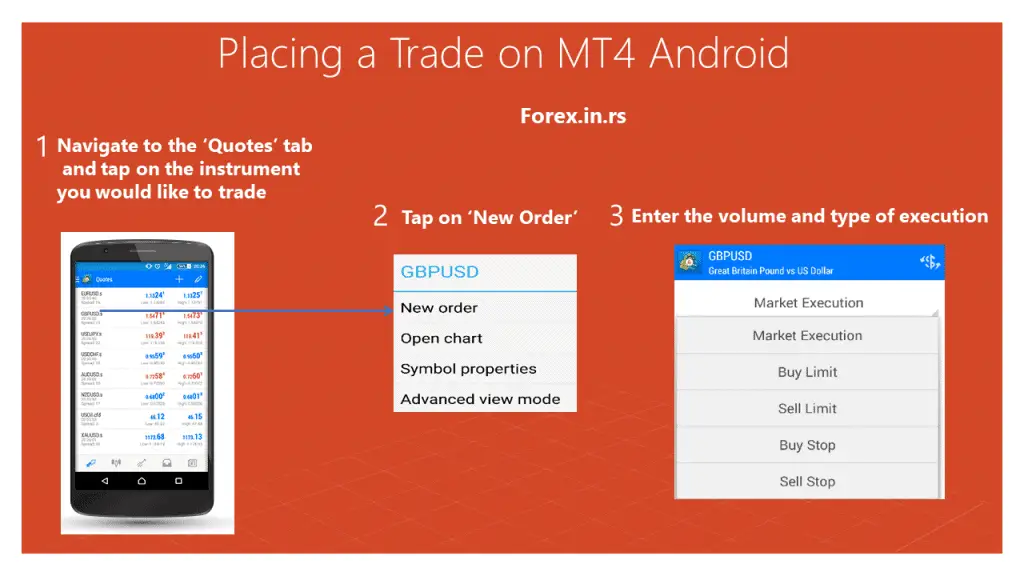

In the image below is described the process of stop-loss placing in MT4 Android platform:

Now let us see what theory says.

Stop-loss is a brilliant tool that can help you in protecting your investment. Once you learn all about the key levels, you can easily define price action strategies and find a risk-reward ratio suitable for you. Once everything is set, it is time to use a stop-loss to take your trading style to a different level.

What is a buy-stop order in Metatrader?

Buy stop order represents the pending type of order above the current market price. Order is placed in advance, and If the asset price reaches the specified buy stop-loss price, the trade will be executed. Sometimes, buy-stop orders can protect trading accounts against unlimited losses of an uncovered short position.

What is a sell-stop order Metatrader?

Sell stop order represents the pending type of order below the current market price. Order is placed in advance, and If the asset price reaches the specified sell stop-loss price, the trade will be executed. Sometimes, sell stop orders can protect trading accounts against unlimited losses of an uncovered long position.

Now let us see other platforms.

How to set stop loss on Webull?

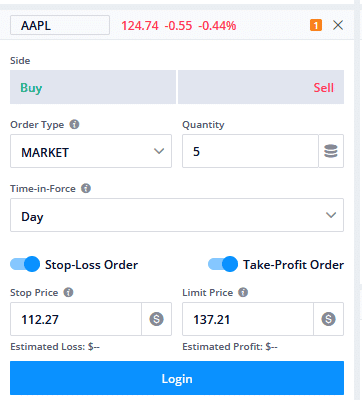

To set stop loss on Webull trading platform when you create live market order you need to choose Market order type, set Quantity, and then enable Stop-loss order slider. You can enable and take profit slider so after primary market order is executed once stop price is reached trade will be closed. See the image below:

Webull orders execution is similar to the MetaTrader concept so you can easily create a market, stop limit, and stop-limit order.

How to set a stop loss on Thinkorswim?

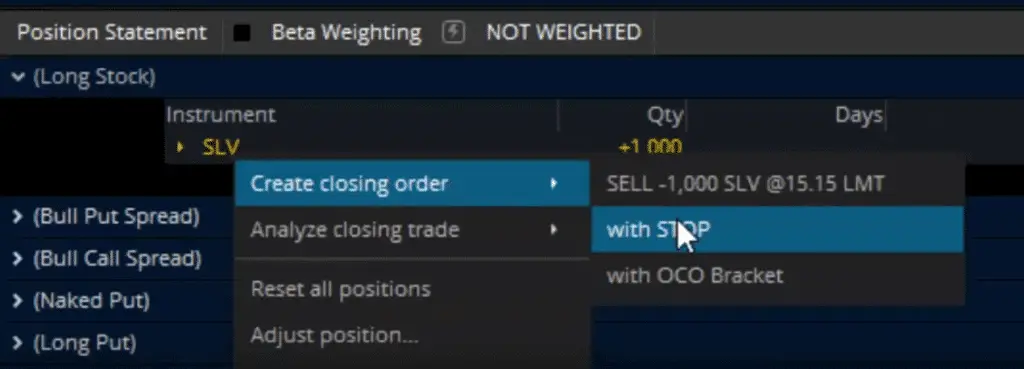

To set stop loss on the Thinkorswim platform you need to go to the Monitor tab, then press instrument (see image below) and finally choose “Creating closing order” “with STOP”. After that trader can set the price value in a red field “Price”.

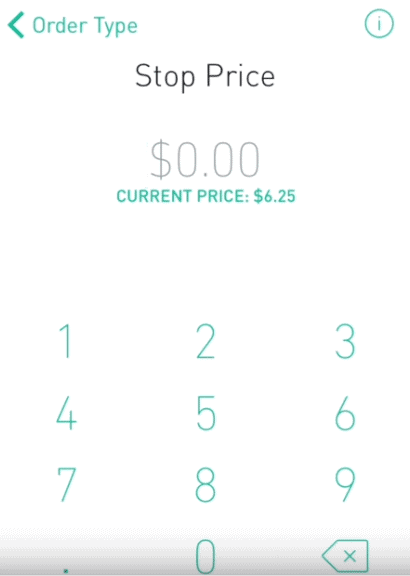

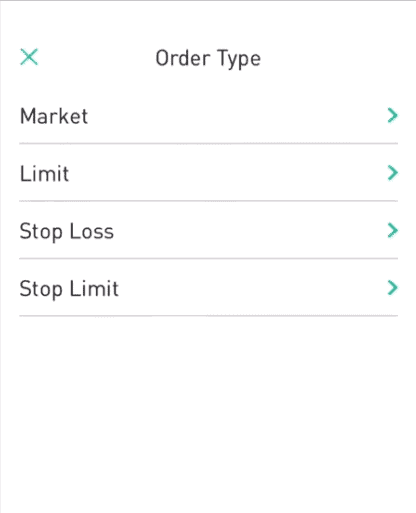

How to set stop loss on Robinhood?

To set stop loss on the Robinhood platform you need to create a Market order, execute, and then edit the order and set stop-loss price value.

You can choose Market, Limit, Stop Loss, and stop-limit order at Robinhood platform.

What does moving the stop loss to breakeven mean?

Moving the stop loss to the entry point or moving the stop loss to breakeven represents a strategy when traders move the stop loss to the same price as a trade entry-level to disable any chance to make a loss in trading. In that case, if you get stopped out, there is no way you will lose any money, and the trader can open a new position. However, if traders do this too often and too quickly, the portfolio can show bad results because the price fluctuates.

Principles to apply:

The stop-loss price level can be set based on previous low or high (or Fibonacci levels).

It cannot be denied that there are various principles that you should apply for guidance when you are making decisions regarding the placement of a stop loss. You may use a particular direction when you conduct trade long-term, like a swing trade. But then you may decide to use a diverse principle, yet when you are running a trade that is classified as being intraday. The principles that we mention will function well when utilized precisely with the proper trade type.

Where to place a stop loss?

A stop loss should be placed where there will be the invalidation of your trade perception. Essential price levels are the best approach to determine the stop-loss level. Previous high or previous low or Fibonacci levels are excellent entry, stop loss, and target levels. For example, traders can BUY a currency pair if the price is above yesterday’s high. The excellent stop loss value can be yesterday’s low price level.

This principle is noted as the primary one that consideration must be given to when you are deciding regarding the spot for your stop placement. If you are conducting trade in the long term, you should attempt to ensure the stop loss placement so that when the price achieves its level, then trade in the long term would not be feasible. In other words, your stop loss must experience placement at a spot when the price achieves its level; this sets up the trade in the long term and experiences invalidation. This allows you to have space for the setting up of trades in the short term.

The Stop-loss level can be determined as a trend invalidation price level. For example, If the trader’s analysis shows that the bullish invalidation level is between 1.3 till 1.303 price level range, in that price range, a stop-loss can be set. Usually, the price invalidation level can be moving average. For example, if the daily close is above some critical price level, it is a bearish invalidation price level. If the daily close is below some critical price level, it is a bullish invalidation price level.

How to place stop-loss orders examples

Below are presented examples of how to define stop loss order level, entry, and target level.

Trading example:

Trader BUY EURUSD at 1.35 when the daily close is above SMA200.

After 5 days, the price is at 1.38 and SMA200=1.365.

A trader can move stop loss at 1.365 and set SMA200 as the stop-loss price level.

It is noted that this is also true concerning trades in the short term in such cases that there is the placement of an order for stop loss at a spot that when the price is achieved, this results in the changing of the prince trend. This means that there is no longer support for a trade in the short term but rather trade in the long term. Due to the reality that this is the primary and most relevant principle in terms of considering the placement of an order for a stop loss, it is needful for you to think of it first before applying the usage of other factors and principles.

Risk reward ratio and stop-loss – Consideration is given to the risk ratio compared to the reward.

Recently, we explained the risk-reward ratio. This principle is regarded as the second in terms of a high level of importance in such cases that you are deciding where the placement of your stop loss should be. Many traders prefer entering into the conducting of trades that possess a ratio for the risk compared to the rewards being 1:2. This indicates that for each dollar’s risk (pip), there is the possibility to gain two dollars (2 pips) in such cases that the trade is directed in their favor. It is noted that this ratio about the risk in comparison to the rewards is not the only one that you can apply due to the reality that there are some setups for trades that may permit you to opt for a ratio for the risk in comparison to the reward at a rate of 1:5. Moreover, there is an even smaller ratio possible for risk than reward at a rate of 1:1.5 based on where your entrance into a trade is and your possible target. Read more about stop-loss and take profit in our article.

When you are careful to apply this principle, it is imperative for the placement of your stop loss to be situated in such a manner so that it will permit you to attain your possible target based on the setup of the trade.

Take into consideration, for example, that if you are conducting trade for the sake of a breakout that has the possibility of collecting one hundred pips in such a case that this is noted as being the amount of distance to get to the following level of support, you could dare to engage in the risking of fifty pips for this particular trade to the opportunity to collect a profit of one hundred pips, which is regarded as a rather substantial ratio of 1:2 for risk in comparison to reward.

Thus, it is realized that this same type of rationale is administered to target pips less. It is noted that there could be an impact of the placement of the stop loss to preserve the ratio preference in terms of risk compared to the reward.

Caution must be taken.

It is the tendency for many traders to have a fixation regarding the ratios of their risk compared to reward. The fixations can be so strong that they fail to heed the first principle of placing the stop loss at a spot where the trade idea will experience invalidation in such a case that the price reaches the designated level.

It is wise to avert engaging in the placement of a stop loss at distances that are noticeably short of augmenting the ratio for the risk compared to the reward at the sacrifice of permitting the grade ample space to be directed for your benefit.

While no stop-loss strategy will work the same for every trader, here are some tried and tested ones that you can use or learn from:

Best stop loss strategy

Below are presented best stop-loss strategies:

- set stop loss based on the important price level (bullish, bearish price level invalidation)

- place stop loss based on the pin bar and inside bar

- set and forget

- Move a Stop Loss to Breakeven

Set stop-loss based on the important price level

To set stop loss based on the important price level, a trader needs to decide where is previous strong support or resistance. Several daily highs or several days lows are excellent price levels. In this case, the trader is trying to determine bullish, bearish price level invalidation.

Pin Bar and Inside Bar

Every trader can set the stop-loss as they see fit, but experienced traders and brokers recommend it in some places. For the pin bar strategy, irrespective of whether the market is bearish or bullish, the stop-loss must be placed behind the pin bar tail. The pin bar trade will become invalid as the prices hit the stop-loss there. This proves that traders must not panic when prices hit the stop-loss. It is not always a negative thing. This is the market’s way of telling you that you need to set a stringer pin bar.

The latter offers two options for a stop-loss placement if we compare the pin bar strategy with the inside bar FX trading. You can place it behind the inside bar’s low or high, or the mother bar’s low or high. The second option is safer. Like in the pin bar strategy, if the prices hit the inside bar, the trade will be invalid. This is considered a safer strategy due to a larger difference between the entry and the stop-loss. If you are trading a choppier currency pair, the buffer created by this strategy will allow you to stay in the trade for a substantial period of time.

The placement of a stop-loss behind the inside bar’s low or high is beneficial as it offers a better risk-reward ratio. This strategy’s negative is that your trade can be stopped even before it gets the chance to reach its full potential of ending in your favor.

While the second option is riskier because of less difference between the entry point and the stop-loss, which strategy will be more suitable for you will still depend on your overall trading strategy, risk tolerance, the currency pair you are trading, and other factors.

The Set and Forget

The set-and-forget stop-loss strategy or the hand-off strategy is straightforward to understand. The trader has to decide where to put the stop-loss and once they have done it, just let the market move as it feels. Unlike the previous strategy, where you were susceptible to getting stopped before the trade could move, this strategy mitigates that problem by retaining the stop-loss at a safe distance.

Investors and long-term position traders use the “Set and Forget” strategy very often. Usually, they risk less than 0.5% from their portfolio, put wide stop-loss and wide targets, and do not change stop-loss sometimes several weeks or months.

Traders feel liberated when using this hands-off strategy as they are not required to keep a constant eye on their strop-loss. You give the market a chance to run its course while you sit back and watch it happen. It is simple to understand and does not require constant attention; it is perfect for novice traders.

One of the most prominent drawbacks of this strategy is the maximum allowable risk that persists from start to end. This means that when you put a part of your capital at risk, you actually stand a chance to lose it should the market does not move in your favor. When you enter the trade and close, you don’t get the opportunity to protect your capital. Once you have set the stop-loss, it will run its course.

The other disadvantage of this strategy is that you can be tempted to move your stop-loss. This is not is human nature to sit idle when their money is on the line. As the strategy works well when you set the stop-loss and forget about it, many traders will not do this.

Move a Stop Loss to Breakeven

This strategy is different from the other two because the traders can finally allow the market to organize a strategy. They can read the market vans analyze the amount of capital that they need to defend. You can use the 50% strategy on a pin bar setup. Let’s assume that you enter a bullish pin bar when it’s time for a daily close or entry. The market finishes a little higher the following day than your entry.

Like every other strategy, this one isn’t perfect either. It offers protection to only half of your investment while the other half is at risk. This can sit differently with different traders. We cannot consider it an actual downside as some traders prefer to take this risk. If you are one of them, this strategy will be perfect for you.

However, the risk of trade stopping prematurely is still there, especially if you are trading a choppier currency. Since the market plays a crucial role in this strategy, whether your stop-loss strategy is acceptable or not will also be decided by the Forex market.

Considering the same example as used above, had the market closed around the low on the second day, this strategy would not have worked. This is because the stop-loss would have moved too close to the prevailing market prices. If you are in such a situation, a better option would be to leave the stop-loss at its original position. The 50% stop-loss strategy becomes riskier when trading an inside bar.

How do I set stop-loss?

In the first step, I define previous high and low price levels and define one of that levels as stop loss. I always try to have a minimal stop loss of at least 50% of the daily average true range. Stop-loss need to be an important price level, strong support, or resistance.