Table of Contents

Regarding your desire to know the differences between stop loss and profit, this article will provide insights into the difference between stop loss and take profit to help provide more clarity for you regarding this issue.

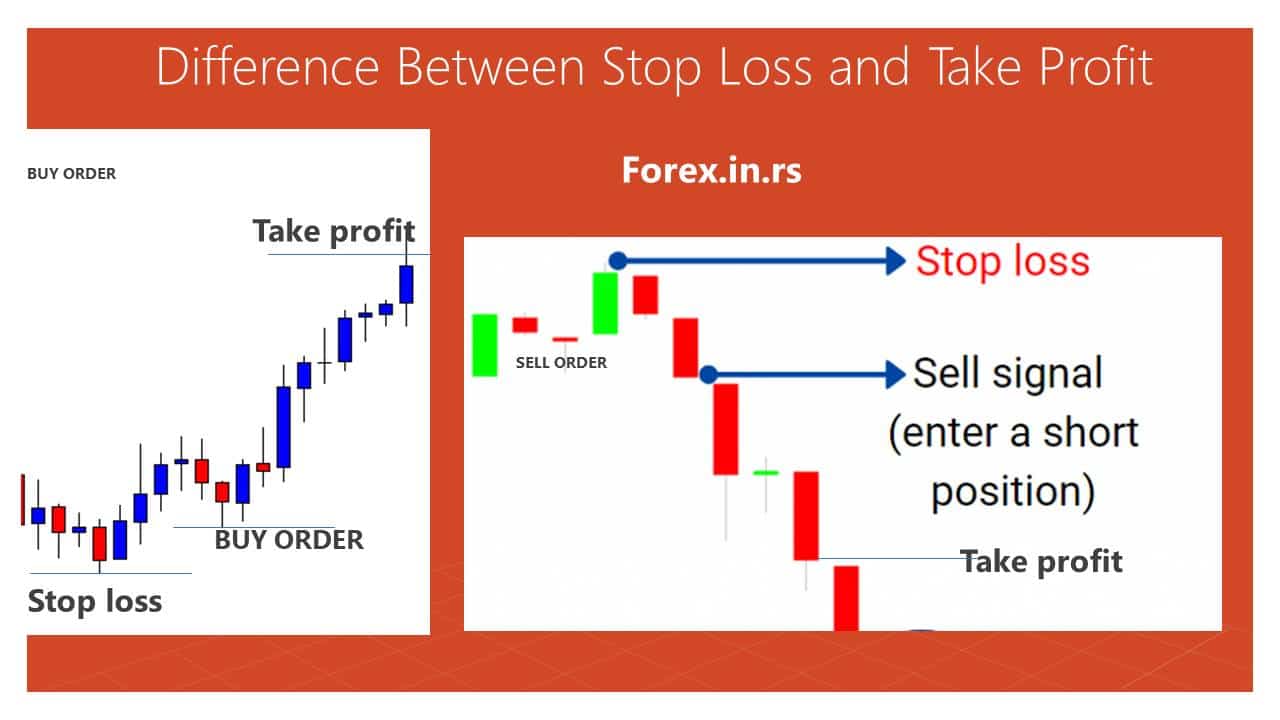

Difference Between Stop Loss and Take Profit

A Stop Loss Order is a trading order that automatically closes a losing trade at a certain price level. On the other hand, a Take Profit order allows you to complete a profitable trade automatically at a certain price level. So, the difference between a stop loss and a take profit order is that stop-loss order closes a losing trade, and a taking profit closes profitable trade.

To learn more about the Difference Between Sell to Close and Take Profit and Stop Loss, read our article.

If the current price is $100 and we have BUY trade, then the stop-loss order can be, for example, $99 (price level below current price), and the Take profit order can be forex, an example, $101 (price level above current price).

Stop-loss vs. Take profit.

Stop-loss:

- A stop-loss is a type of order a trader places to limit potential losses if a market moves against its position.

- It is an order to sell a security or asset when it reaches a specific price level the trader sets.

- Stop-loss orders protect traders from excessive losses, especially in volatile markets.

- A stop-loss aims to help traders exit a trade before they suffer significant losses.

Take-profit:

- A take-profit order is a limit order that traders place to lock in a profit when a security or asset reaches a certain price level.

- It is an order to sell a security or asset when it reaches a specific price level the trader sets.

- Take-profit orders help traders take profits on successful trades and avoid the temptation to hold onto a winning trade for too long.

- A take-profit aims to help traders lock in gains and exit a trade before the market moves against them.

Graphic example:

Stop-loss vs. Take profit Example

Stop-loss order example: Suppose you buy a stock at $50 per share and are willing to risk losing no more than 5% of your investment. You would set a stop-loss order at $47.50 (i.e., 5% below your entry price). If the stock price drops to $47.50, your stop-loss order will be triggered, and your shares will be automatically sold at the market price to limit your losses to no more than 5%.

Take-profit order example: Suppose you buy a stock at $50 per share, and you expect it to increase in value. You might set a take-profit order at $55 (i.e., 10% above your entry price). If the stock price reaches $55, your take-profit order will be triggered, and your shares will be automatically sold at the market price, locking in your profits. This helps you avoid the temptation to hold onto a winning trade for too long, potentially giving up some of your gains.

Difference Between Stop Loss and Take Profit – Discussion

With this perspective in mind, it is, therefore, realized that an order that is regarded as being a stop loss is an order that has as its objective the automatic closing of a trade that is not profitable due to the experience of a loss at a price point that is designated for the sake of being able to ensure a limitation to the amount that the trader loses. Indeed, it is comprehended that this kind of order can benefit you as a trader as one of the primary tools for risk management. This is proven mainly to be the case if you are not routinely conducting your account’s follow-up.

When an order is classified as taking profit, this type of order permits you to conduct the automatic closing of a trade that is considered profitable for a price point that you set. This type of order is also regarded as one of the primarily highly beneficial tools for risk management in such cases that you are not in the practice of checking your account regularly. In the article, what is a stop-limit order, we gave more details.

In more detail, an order regarded as taking profit is considered a kind of order with limitations set in place. It sets forth the specification regarding the designated price to close a position open to achieve the result of a profit. The reality is that most traders engage in the usage of order that take profit in alliance with their use of charge that is noted as being stop loss to conduct the management of their positions that are regarded as open.

If there is an increase in the security regarding the point for the order that takes profit, the order for the take profit undergoes execution, and there is the closing of the position to achieve gain. In such cases, there is a drop in security about the point of stop-loss. The s/l order undergoes execution, and there is the closing of the position that experiences a loss. The variation concerning the market value and these two particular points helps determine the ratio of risk to reward for the trade.

When it comes to the benefit of using an order that takes profit, it is noted that the trader does not have to consider any executions that are done manually, and there is no need to engage in bouts of second-guessing. Indeed, orders noted as taking profit are conducted for the most optimal pricing point without any particular security behavior. As a result, there could be a higher level of breaking out for the stock. However, the order that takes profit may be conducted at the commencement of the breaking out period, resulting in high costs for this unique opportunity.

It is best for traders who take profit to be implemented by traders who conduct trades noted as short-term when they want to be extra careful when managing their level of risk. This is based on the premise that the traders can do away with a trade when reaching the planned profit target, as this will result in the prevention of risk concerning a potential decline in the market sometime in the future. On the other hand, traders who usually engage in applying a strategy that is regarded as long-term tend not to hold high regard for these types of orders due to acknowledging that they tend to provide some cutbacks on the profits they achieve.

There is no denying that there are many things to consider when wondering what stock to purchase. However, it can seem relatively simple to overlook the small stuff. One of those little elements is regarded as the order classified as a stop loss.

Though it is regarded as a small thing that can often be overlooked, it is also compelling in engendering a beneficial difference for traders. This is because most people who make investments can gain some real advantage when applying this tool.

Yes, it is great news that most of those who make investments can derive good benefits when they implement an order categorized as a stop loss. See, the stop loss has been formulated to grant the provision of limitations for the loss experienced by investors concerning the position of security that forges ahead with a move that is considered unfavorable.

A valuable benefit of the order categorized as stop loss is that you don’t need to monitor your account daily. However, on the other hand, it is realized that there is a disadvantage to this type of order as well, which is acknowledged as being a fluctuation in the price for a short term could, in actuality, result in the activation of the stop that would thus produce a sale that is not necessary.