Table of Contents

Forex trading can be profitable if you properly understand the market, have a good trading strategy, and manage your risk effectively. A critical aspect of trading strategy is trading close design. Properly working your trade close can make a huge difference in your overall profitability in the forex market.

To design a close trade strategy, it is essential first to have a good understanding of trading psychology. This involves learning how to manage your emotions when trading and being disciplined to stick to your trading plan. One of the biggest dangers in forex trading is letting emotions take over, leading to impulsive decisions and losing capital.

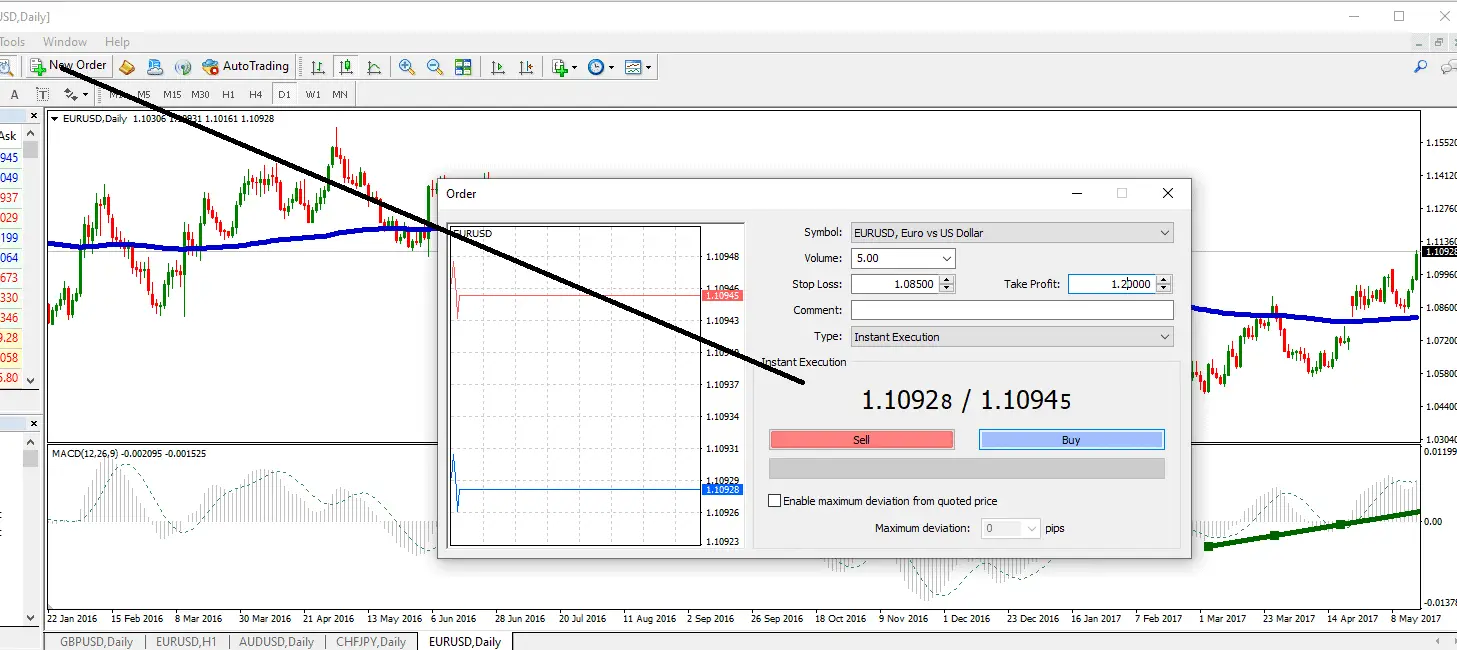

Once you understand trading psychology, developing a trading plan that includes specific rules for trade entry, stopping loss, and taking profit is essential. Thisarelan should consider your trading style, risk tolerance, and objectives. The plan should also be well-tested and backtested, ensuring it is effective and profitable.

Sell to Close or Buy to Close Orders

A Sell to Close order is used to close a long open position. For example, if you buy 100 shares, you would use a Sell to Close order to sell those 100 shares and close your position. This order is used to realize a profit or limit a loss.

A Buy to Close order is used to close an open short position. For example, if you shorted 100 shares of a stock, you would use a Buy to Close order to buy those 100 shares and close your position. This order is used to realize a profit or limit a loss.

Here’s an example to illustrate how these orders work:

Suppose you shorted 100 shares of a stock at $50 per share. Then, if the stock price falls to $40 per share, you could use a Buy to Close order to buy those 100 shares back at the market price of $40 per share. This would allow you to close your position and realize a profit of $10 per share (minus any transaction fees).

Similarly, suppose you bought 100 shares of a stock at $50 per share. If the stock price rises to $60 per share, you could use a Sell to Close order to sell those 100 shares at the market price of $60 per share. This would allow you to close your position and realize a profit of $10 per share (minus any transaction fees).

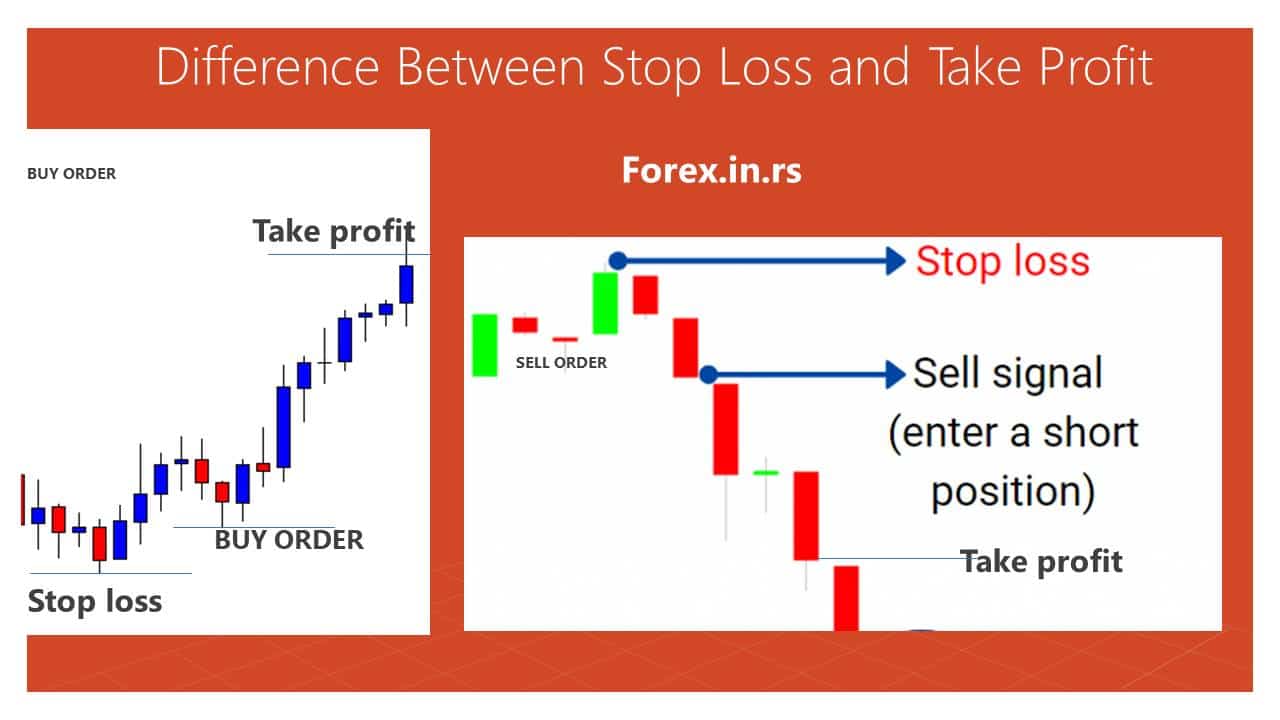

Take Profit Orders and Stop Loss Orders

Stop-Loss Order

A stop-loss order is placed to sell a security when it reaches a specific price. It is designed to limit potential losses in a trade. For example, suppose you buy 100 shares of a stock at $50 per share, and you don’t want to lose more than 5% of your investment. Therefore, you could set a stop-loss order at $47.50 per share (i.e., 5% below your entry price). If the stock price falls to $47.50 or below, your stop-loss order will be triggered, and your 100 shares will be automatically sold at the prevailing market price. This helps you limit your potential losses to 5%.

Take-Profit Order

A take-profit order is placed to sell a security when it reaches a specific price. It is designed to lock in profits on a trade. For example, suppose you buy 100 shares of a stock at $50 per share and expect it to rise in value. You could set a take-profit order at $55 per share (i.e., 10% above your entry price). If the stock price rises to $55 or above, your take-profit order will be triggered, and your 100 shares will be automatically sold at the prevailing market price. This helps you lock in a profit of 10%.

In summary, here are the examples of stop-loss and take-profit orders using $50 shares and 100 volume shares:

- Stop-Loss Order: If you buy 100 shares of a stock at $50 per share, you could set a stop-loss order at $47.50 per share to limit your potential losses to 5%.

- Take-Profit Order: If you buy 100 shares of a stock at $50 per share, you could set a take-profit order at $55 per share to lock in a profit of 10%.

Please read our article about stop loss vs. take profit orders.

Difference Between Sell to Close and Take Profit Stop Loss

Sell to Close orders are used to sell a security to close out an existing position, while Take Profit and Stop Loss orders limit potential losses and lock in profits. Usually, sell-to-close orders or buy-to-close orders we can see in options trading while stop loss and take-profit in forex and stocks trading.

Sell to Close Order: I bought 100 shares at a $50 price. I make a SELL TO CLOSE order at $55 to sell shares and lock profit.

A Sell to Close order is placed to sell a security that you own to close out your position. This type of order is typically used when you want to sell a security you own to realize a profit or limit a loss. For example, if you bought 100 shares of a stock at $50 per share and the stock has increased in value, you might place a Sell to Close order at $55 to sell your shares and lock in a profit.

Take Profit with Stop Loss Order: I bought 100 shares at a $50 price. Stop loss for $47.5. Take profit $55.

A Take Profit Stop Loss order is a type of stop-loss order that combines a stop-loss order with a take-profit order. It is used to both limit potential losses and lock in profits. For example, if you bought 100 shares of a stock at $50 per share and want to limit your losses to 5% while also locking in profits at 10%, you might place a Take Profit Stop Loss order at $55 per share.

If the stock rises to $55, your take-profit order will be triggered, and your shares will be automatically sold at the prevailing market price, locking in a profit of 10%. Conversely, if the stock falls to $47.50 (i.e., 5% below your entry price), your stop-loss order will be triggered, and your shares will be automatically sold at the prevailing market price, limiting your losses to 5%.

Regarding close trade design, there are different methods that traders can use. Some widespread trade close ways include trailing stops, fixed stop loss and take profit levels, and price action analysis.

- Trailing stops involve setting a stop loss at a fixed distance from the market price. Then, as the market moves in your favor, the stop loss level will move closer to the market price, allowing you to capture more profit while minimizing your risk.

- Fixed stop loss and take profit levels involve setting predetermined levels at which you will close your trade. This can effectively ensure that you capture profits and limit potential loss, but it may not be suitable for all trading scenarios.

Price action analysis involves analyzing the market price movements and making trading decisions based on this analysis. This can effectively identify key price levels, trend direction, and potential entry and exit points.

It is important to note that no one-size-fits-all approach to trade compact design exists. Every trader has a unique trading style, objectives, and risk tolerance. The key is to find a method that works for you and to stick to it consistently.

In conclusion, close trade design is an essential aspect of the forex trading strategy that should not be overlooked. By properly managing your trade close, you can increase your profitability and minimize your risk. Therefore, understanding trading psychology, developing a well-tested trading plan, and choosing a close trade method that works for your specific trading style and objectives are essential.