Table of Contents

Dealers and financial backers who need to restrict potential misfortunes can utilize a few kinds of orders to get into and out of the market now and again when they will most likely be unable to put in a request physically. Stop-misfortune orders and stop-limit orders are two instruments for achieving this. Be that as it may, it is essential to comprehend the distinction between these two apparatuses.

Stop Loss vs. Stop Limit Order

The difference between stop-loss and stop-limit orders are:

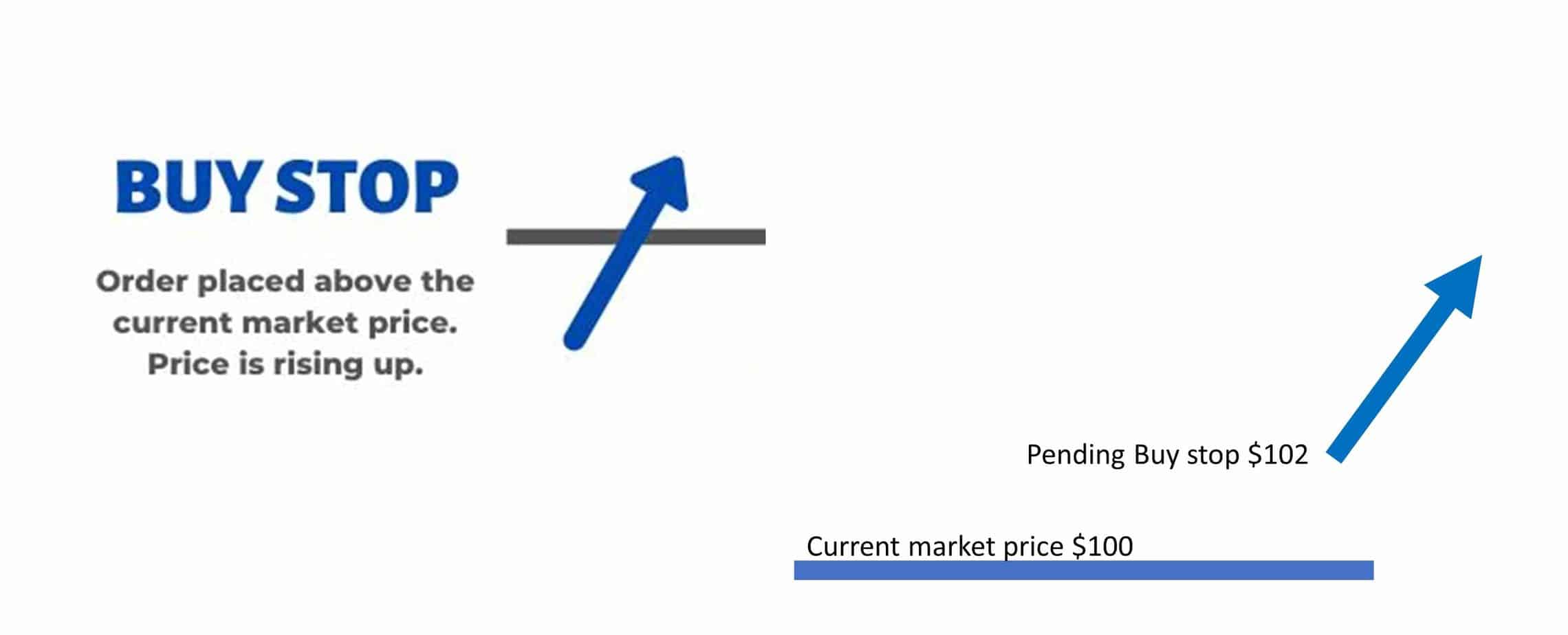

- Buy stop pending orders will be created ABOVE the current market price as a BUY order.

- Sell stop pending orders will be created BELOW the current market price as a SELL order.

- Buy limit pending orders will be created BELOW the current market price as a BUY order.

- Sell limit pending orders will be created ABOVE current market price as a SELL order.

Stop orders

Buy-Stop Orders

Buy stop orders represent pending orders that will be created above the current market price. For example, if the stock’s current market price is $100, the trader can set a buy-stop pending order the will be realized at $102, stop loss at 99, and target at $105. In this case, a buy stop pending order at $102 is the price above the current market price of $100.

Buy stop order

Sell-Stop Orders

Sell stop orders represent pending orders that will be created below the current market price. For example, if the stock’s current market price is $100, the trader can set a sell-stop pending order the will be realized at $98, stop loss can be at $102, and target can be at $95. In this case, the sell stop pending order at $98 is the price that is below the current market price of $100.

Sell stop order example.

Limit Orders

Buy limit order

Buy limit orders represent pending orders created below the current market price when traders expect a pullback. For example, if the stock’s current market price is $100, the trader can set a buy-limit pending order the will be realized at $98, stop loss at 95, and target at $104. In this case, the buy limit pending order will wait for a pullback at $98 and then be realized.

Sell limit order

Sell limit orders represent pending orders created above the current market price when traders expect a price rise. For example, if the stock’s current market price is $100, the trader can set a sell-limit pending order the will be realized at $102, stop loss at 105, and target at $95. In this case, the sell limit pending order will wait for a raise at $102 and then be realized.

Stop-limit orders are like stop-misfortune orders. In any case, as their name states, there is a breaking point on the cost at which they will execute. There are two costs determined in a stop-limit request: the stop value, which will change the request over to a sell request, and the breaking point cost. Rather than the request turning into a market request to sell, the sell request becomes a breaking point request that will execute at the cutoff cost or better.

There is no assurance that this request will be filled, particularly if the stock cost is rising or falling quickly. Therefore, stop-limit orders are in some cases utilized because if the cost of the stock or other security falls beneath the cutoff, the financial backer would not like to sell and will trust that the cost will ascend back as far as possible cost.

For instance, we should accept ABC stock never drops to the stop-misfortune cost, yet it proceeds to rise and, in the end, comes to $50 per share. The merchant drops his stop-misfortune request at $41 and places in a stop-limit request at $47, with a restriction of $45. Assuming the stock value falls underneath $47, the request turns into a live sell-limit request. On the off chance that the stock value falls underneath $45 before the request is filled, the request will stay unfilled until the value moves back to $45.

Numerous financial backers will drop their breaking point orders if the stock value falls underneath the cutoff cost. They set them exclusively to restrict their misfortune when the cost was decreasing. Since they messed up their opportunity to get out, they will trust that the cost will return. They may not wish to sell at that cutoff cost by then if the stock keeps on rising.

Similarly, as with purchase stop orders, purchase stop-limit orders are utilized for short deals, when the financial backer will hazard trusting that the cost will return if the buy isn’t made at the breaking point cost or better.

It’s significant for dynamic dealers to take the appropriate measures to secure their exchanges against critical misfortunes.

Difference between stop price and limit price?

- The stop price is a price level that is always below the current price level if traders make a BUY order, while the limit price is a price level that is always above the current price level if traders make a BUY order.

- The stop price is a price level that is always above the current price level if traders make a SELL order, while the limit price is a price level that is always below the current price level if traders make a SELL order.

Advantages and Risks of Stop-Loss and Stop-Limit Orders

Stop-misfortune and stop-limit requests can give various sorts of security to financial backers. Stop-misfortune orders can ensure execution; however, cost and value slippage frequently happen upon performance. Most sell-stop orders are filled at a cost beneath the strike value; the distinction generally depends on how quickly the cost drops. A request may get filled at an impressively lower cost if the cost is falling rapidly.

Stop-limit requests can ensure a value limit, yet the exchange may not be executed. This can burden the financial backer with a significant misfortune in a quick market if the request doesn’t get filled before the market value drops through the cutoff cost. On the off chance that terrible news comes out about an organization and the cutoff cost is just $1 or $2 beneath the stop-misfortune value, at that point, the financial backer should clutch the stock for an uncertain period before the offer value rises once more. The two kinds of orders can be entered as one-day or excellent until-dropped (GTC) orders.

Picking which kind of request to utilize reduces choosing which type of danger is more thoughtful to take. The initial step to using either request effectively is to survey how the stock is exchanging deliberately.

On the off chance that the stock is unpredictable with generous value development, a stop-limit request might be more successful on its value ensure. Assuming the exchange doesn’t execute, the financial backer may trust that the cost will rise once more. A stop-misfortune request would be proper if, for instance, terrible news comes out about an organization that provides reason to feel ambiguous about questioning its drawn-out future. For this situation, the stock cost may not re-visitation to its present level for quite a long time or years (on the off chance that it at any point does). Financial backers would, along these lines, be savvy to cut their misfortunes and take the market cost on the deal. A stop-limit request may yield extensively more considerable trouble on the off chance that it doesn’t execute.

Another significant factor to consider while submitting either request is setting the pause and breaking point costs. Specialized investigation can be a valuable instrument; stop-misfortune costs are regularly positioned at technical help or opposition levels. Financial backers who put in stop-misfortune requests on consistently climbing stocks should take care to give the stock a little space to fall back. If they set their stop cost excessively near the current market value, they may get halted out because of a moderately minor retracement in cost. They may likewise pass up a great opportunity when the value begins to rise once more.

The spread between stop-loss and stop-limit orders is either premium or discount, based on the stock’s current levels and stop limit and stop-limit orders. When a stock crosses its stop limit or stops trading before the top of its price band (either standard or negative), the stop-loss or stop-limit order is executed at the very top of its stop limit, where the trader has the best chance of delivery of the contract at that price.

A market request is requested to purchase or sell a stock at the market’s present best accessible cost. A market request ordinarily guarantees an execution; however, it doesn’t ensure a predetermined cost. Market orders are ideal when the fundamental goal is to execute the exchange immediately. A market request is by and large fitting when you think a stock is estimated right, when you are sure you need a fill on your request, or when you need quick execution.

A couple of warnings: A stock’s statement typically incorporates the most elevated offer (for vendors), most minor offer (for purchasers), and the last exchange cost. Notwithstanding, the previous exchange cost may not be current, mainly because of less-fluid stocks, whose last exchange may have happened minutes or hours prior. This may likewise be the situation in quick business sectors when stock costs can change altogether in a brief timeframe. This way, while putting in a market request, the current offer and offer costs are of more considerable significance than the last exchange cost.

For the most part, market requests ought to be put distinctly during market hours. When markets are shut, a market request would be executed at the following business sector open, which could be altogether higher or lower from its earlier close. Between market meetings, various elements can affect a stock’s cost, like the arrival of profit, organization news or financial information, or unforeseen occasions that influence a whole industry, area, or the market overall.