Table of Contents

This article takes a deep dive into a detailed study conducted by forex.in.rs, which found that the Simple Moving Average (SMA) of 76 periods is the best-moving average for 4-hour charts in the trading of major forex pairs like EURUSD, GBPUSD, USDCAD, and USDJPY. The study was conducted by an expert advisor who opens a buy trade when the price is above the SMA76 on the H4 chart and opens a sell trade when the price is below the SMA76 on the same chart. The stop loss and target were calculated using the Daily Average True Range (ATR).

As we know, the most used SMA for the daily charts is a 200 moving average.

What is the Best Moving Average for 4 Hour Chart?

The best-moving average for the 4-hour chart is SMA76 because it provides the best Profit Factor of 1.17 in the testing case study. However, the best result in the moving average cross-over strategy showed EMA20 cross with EMA 50 of 1.21 Profit Factor.

Before we dive into the specifics of the research and its findings, it is crucial to understand some basic concepts related to forex trading and the parameters involved.

Moving Average

A moving average (MA) is a commonly used tool in technical analysis that helps to smooth out price data by creating a constantly updated average price. The moving average is calculated by adding a currency pair’s price over specific periods and dividing it by the number of periods.

There are two primary types of moving averages: Simple Moving averages (SMA) and Exponential Moving averages (EMA). In this case, we’re focusing on the SMA. The SMA76 indicates a Simple Moving Average that considers the past 76 periods.

4-Hour Chart (H4)

A 4-hour or H4 chart is a graphical representation of the price movement in which each point or bar represents the price data of a continuous four-hour period. Traders use it to analyze the intermediate trend of a forex market.

Average True Range (ATR)

Average True Range (ATR) is a technical analysis volatility indicator originally developed by J. Welles Wilder Jr. It measures market volatility by decomposing the entire range of an asset price for that period. In the context of this research, the ATR is calculated daily.

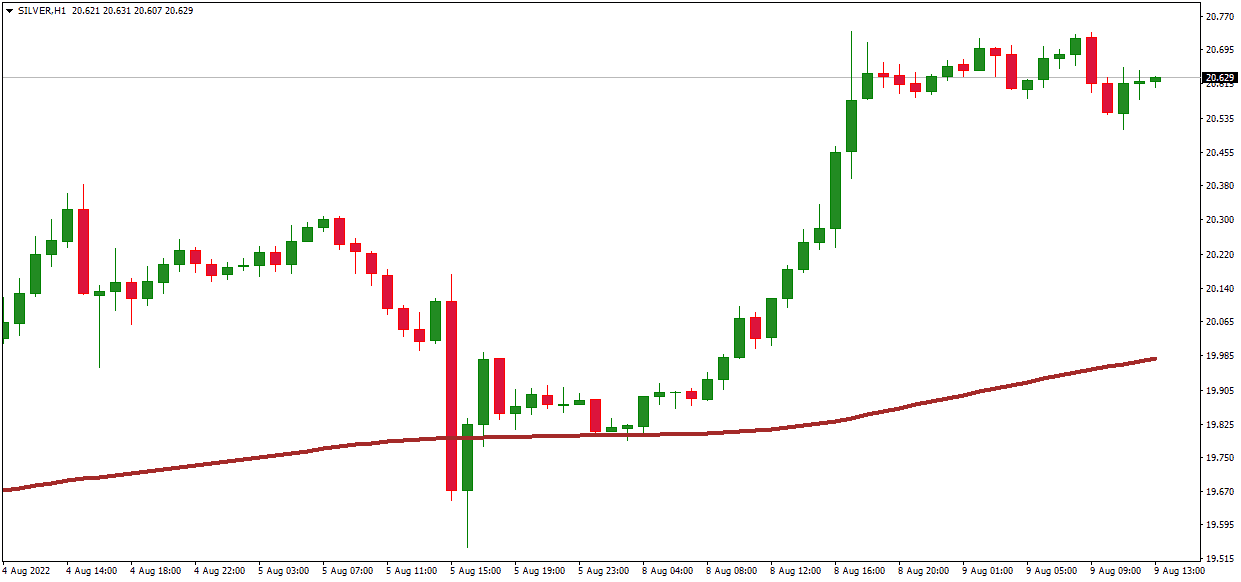

The SMA76 Strategy

According to the research conducted by forex.in.rs, the optimal moving average for a 4-hour chart is the SMA76. Their expert advisor based the strategy on the principle that if the price is above the SMA76, it indicates an uptrend and, thus, a buy signal. Conversely, if the price is below the SMA76, it indicates a downtrend, signifying a sell signal.

Stop Loss and Target Points

In this strategy, the stop loss and target are determined by the Daily ATR. Stop loss helps limit potential losses and is placed at a predetermined distance from the opening price, based on market volatility, as measured by the ATR.

Similarly, the target, also known as take profit, is the level at which the trader wants to close a position to realize a profit. The target is also based on the ATR, allowing potential profits to scale with market volatility.

Why SMA76?

The researchers at forex.in.rs found that SMA76 produced the best results for the major currency pairs EURUSD, GBPUSD, USDCAD, and USDJPY on a 4-hour chart. This specific length helps capture significant market movements while avoiding excess market noise in lower-period moving averages.

Furthermore, the use of the Daily ATR in determining the stop loss and target allows for a dynamic strategy that adjusts to the market’s current volatility. This is crucial as it allows traders to manage their risk effectively, increasing the stop loss during high volatility periods and decreasing it during low volatility periods.

Case Study Findings

In applying this strategy to the 4-hour chart, the researchers found that it produced consistently profitable results. The system showed a net profit in all the significant currency pairs analyzed. These results support that SMA76 is the best moving average for a 4-hour chart.

- SMA10 provides a Profit factor of 0.9

- SMA20 provides a Profit factor of 0.97

- SMA30 provides a Profit factor of 1.05

- SMA40 provides a Profit factor of 1.03

- SMA50 provides a Profit factor of 1.06

- SMA60 provides a Profit factor of 1.05

- SMA70 provides a Profit factor of 1.07

- SMA76 provides a Profit factor of 1.17

- SMA80 provides a Profit factor of 1.11

- SMA90 provides a Profit factor of 1.12

- SMA100 provides a Profit factor of 1.07

However, it’s essential to note that while this strategy has proven profitable in the case study, all trading strategies carry risk. There’s no foolproof system in trading, and it’s crucial to use proper risk management, including not risking more than a small percentage of your trading capital on any trade.

Best Moving average Cross Over strategy for a 4-hour chart

The case study conducted by our forex.in.rs team presents some intriguing results when applying an EMA (Exponential Moving Average) crossover strategy. This strategy has been implemented with a comprehensive understanding of how the 20-EMA, 50-EMA, and 200-EMA indicators can influence decision-making in trading.

The EMA crossover strategy is a famous method forex traders use to identify when the market trend is likely to change. As the name implies, it involves two EMAs: a short-period EMA (in this case, the 20-EMA) and a long-period EMA (the 50-EMA). The trader’s decision is guided by the position of the short-period EMA relative to the long-period EMA.

When the 20-EMA is above the 50-EMA, this is interpreted as a bullish trend, indicating it might be an appropriate time to buy. On the other hand, if the 20-EMA is below the 50-EMA, the trend is considered bearish, suggesting a potential sell opportunity. Using the 200-EMA further refines the strategy, providing a longer-term perspective on the trend.

After conducting the case study, the researchers found a Profit Factor of 1.21, which emerged as the highest profit factor for the EMA crossover strategy. A Profit Factor above 1 indicates that the strategy is profitable, with a Profit Factor of 1.21 showing that for every dollar risked, the strategy returned approximately $1.21.

In the context of negative 20/50-EMA crossovers in the intermediate term, the strategy also involves using the 200-EMA. If the 20-EMA crosses below the 50-EMA but is still above the 200-EMA, the trend might be considered bearish in the shorter term but still bullish in the broader perspective. This would signal a neutral change, suggesting the trader should hedge or keep cash or a bearish change, leading to a sell or short decision.

The positive results of this case study suggest that the EMA crossover strategy, when applied in this way, can potentially yield profitable outcomes. However, it’s essential to consider other market conditions and individual risk tolerance when applying these findings. While promising, a Profit Factor of 1.21 does not always guarantee successful trades. As always in trading, caution and calculated decision-making are vital.

Conclusion

The research by forex.in.rs provides an insightful look into using SMA76 as the optimal moving average on a 4-hour chart for forex trading. By coupling this moving average with the Daily ATR for stop loss and target points, traders can create a dynamic trading strategy suited to the market’s volatility.

However, remember that the best moving average or trading strategy may vary depending on the trader’s style, risk tolerance, and specific market conditions. The SMA76 strategy is a tool in the toolbox of a forex trader, and as with all tools, its effectiveness ultimately depends on the skill and understanding of the person wielding it.