What is the Volume Weighted Moving Average Indicator?

Volume Weighted Moving Average Indicator represents an indicator that displays a merge of volume data along with the price’s moving average. This particular indicator functions very much like a standard moving average. The significant difference is, it gives a lot of priority to high volume bars as contrasted with bars with lower trading volume.

Below you can Download Volume Weighted Moving Average Indicator MT4:

VWMA is an adaptable and versatile pattern following the indicator of trade. The newbies and the professionals with expertise believe the MT4 indicator is primary and straightforward for identifying market trends. In addition, a volume-weighted moving average can likewise be treated as a unique resistance/support price level.

Volume moving average suits a wide range of periods in MT4. Progressed traders apply VWMA in multi-time periods for a superior appraisal of the market’s sentiment. Additionally, this indicator upholds the trading a wide range of monetary instruments, including forex, cryptos, stocks, products, metals, and many more than you could have imagined.

Do you wish to know more about it? Then, continue reading this article for more!

Trading with Volume Weighted Moving Average

Once you download VWMA Indicator MT4, your outline will be displayed to you. In addition, the indicator will be visible as a standard moving average. If you’re acquainted with SMA and EMA, you’ll discover that VWMA is very simple to trade with.

To learn more about moving averages learn the difference between smoothed moving average and simple moving average.

The response strategy for the marker is somewhat not quite the same as the simple moving average. For the most part, a moving average responds depending on the open, high, low, and close of every candle. Be that as it may, VWMA picks the light with high trading volume to identify every asset’s moving average value.

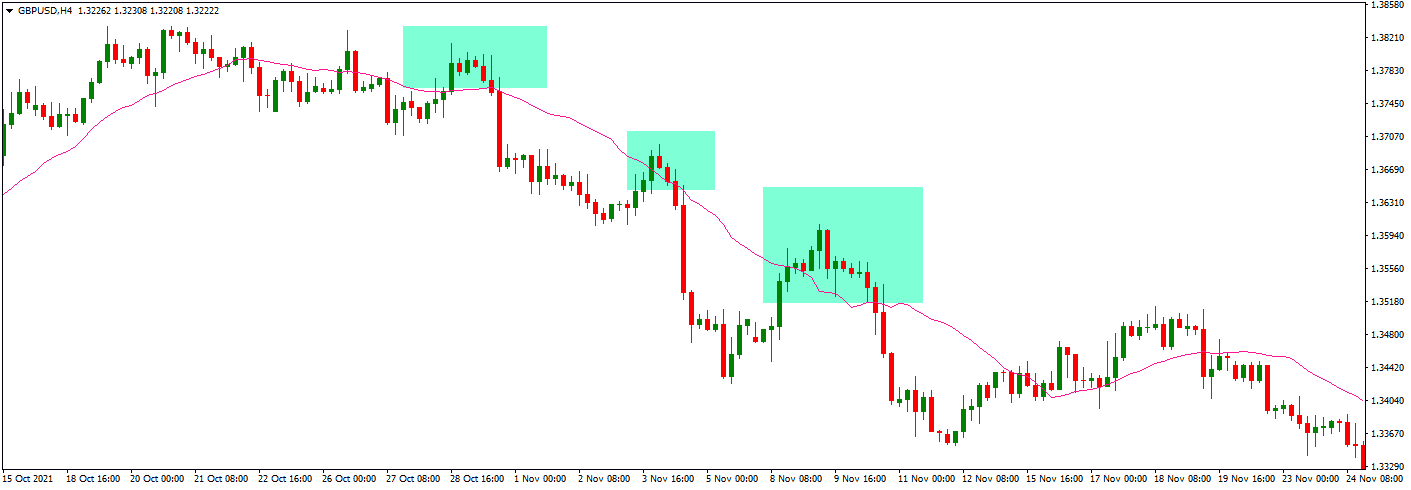

We decide the market pattern according to the communication between the price and VWMA value. The pattern is bullish when the cost is more on a higher note in comparison to the indicator value. Contrastingly, the market trend is considered bearish when the value dips under the present value of VWMA.

When you recognize a market trend accurately, you can apply different price-action methodologies for opening a trade inside the trend path. For instance, in an upswing market, you might enact a purchase request when the price regards the slope of VWMA as an aid.

Oppositely, for sell orders, first, the price needs to break underneath the volume-weighted level of the average. Then, further ahead, the price ought to treat the VWMA line as a point of resistance at whatever phase it backtracks to the level of the pointer.

Traders with aggression utilize the volume-weighted average as a powerful price breakout level. This implies that each time the price breaks, a VWMA level is a potential breakout trading opportunity.

In Conclusion: Is the indicator worthwhile enough?

The VWMA Indicator is a multi-practical indicator of the moving average. Other than recognizing the market pattern, it likewise displays the expected levels for trade entries. In addition, you can utilize the VWMA lines as the crucial stop-loss level for your existing orders. Also, you can apply it close to your cherished moving average for plotting the crossover signals of trend.

To use an indicator like this, one must understand the entire concept. If you find the indicator exactly suits your requirements, you must go ahead with it.