Table of Contents

In the exciting world of forex trading, where currencies fluctuate and fortunes are made, leverage’s a powerful tool that can help you maximize your potential gains. Like a magnifying glass for your trades, leverage allows you to control more prominent positions in the market using a fraction of the capital. In this magazine-style article, we will explore the concept of leverage in forex trading, its benefits, potential risks, and how to use it wisely to navigate the currency market confidently.

What is leverage in forex trading?

Leverage in forex trading is like borrowing money from your broker to control larger trades with a smaller amount of your capital. It allows you to magnify the potential profits and losses of your trades. For example, with a leverage of 1:100, you can control a position 100 times larger than your actual investment.

While leverage can enhance your earnings, it’s important to remember that it also increases the risk, so careful risk management is essential.

What is the Best Forex Broker with High Leverage?

HF Markets is the best forex broker with high leverage because it has a maximum leverage of 1:1000 and excellent trading conditions and support. However, the most significant trading leverage offers Exness Forex broker unlimited leverage for small accounts, while the maximum default leverage is 1:2000.

VISIT HFMBelow is the Table which presents

| Forex broker Review | Visit | Max. leverage |

|---|---|---|

| VISIT EXNESS | 1:2000 | |

HFM | VISIT HFM | 1:1000 |

Instaforex | VISIT INSTAFOREX | 1:1000 |

XM.com | VISIT XM | 1:888 |

FxPro | VISIT FXPRO | 1:500 |

IC Markets | VISIT IC MARKETS | 1:500 |

Alpari.com | VISIT ALPARI | 1:500 |

Thinkforex | VISIT THINKMARKETS | 1:500 |

| Easy Markets | VISIT EASYMARKETS | 1:500 |

Roboforex | VISIT ROBOFOREX | 1:500 |

Avatrade | VISIT AVATRADE | 1:400 |

| Octafx review | VISIT OCTAFX | 1:400 |

Dukascopy | VISIT DUKASCOPY | 1:100 |

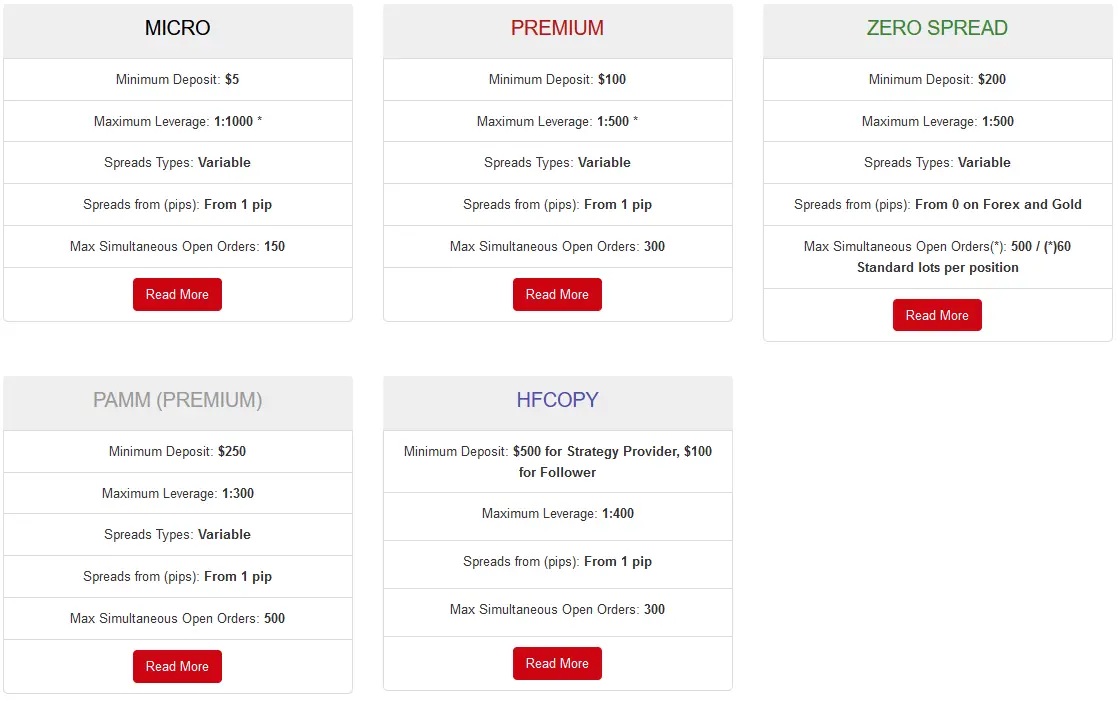

HF Markets Leverage

HF Market’s leverage is 1:1000 for micro-accounts. However, for larger accounts, the default leverage size is 1:500.

HF Markets, also known as HotForex, is recognized as an excellent broker in the forex industry for several reasons, one of which is its offering of 1:1000 leverage. Here are some key factors that make HF Markets stand out:

- Wide Range of Trading Instruments: HF Markets provides a diverse range of trading instruments, including major, minor, and exotic currency pairs, commodities, indices, and cryptocurrencies. This allows traders to access various markets and create diversified portfolios.

- Regulated and Reliable: HF Markets is regulated by reputable financial authorities, such as the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the United Kingdom. This regulation ensures that the broker adheres to strict standards, providing a secure trading environment for clients.

- Competitive Trading Conditions: The broker offers competitive trading conditions, including tight spreads and fast execution speeds. These factors are crucial for traders as they can affect trading costs and the ability to enter and exit trades at desired prices.

- Multiple Account Types: HF Markets offers a range of trading accounts tailored to suit different trader preferences and experience levels. These accounts may include options such as zero-spread accounts, Islamic accounts, and premium account services, providing flexibility and catering to diverse trading needs.

- Robust Trading Platforms: The broker provides access to popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their user-friendly interfaces, advanced charting tools, and automated trading capabilities. These platforms offer a seamless trading experience, allowing traders to implement their strategies effectively.

- Educational Resources and Support: HF Markets places a strong emphasis on trader education, providing a wealth of educational resources, including webinars, video tutorials, and market analysis. Additionally, they offer customer support services to assist traders with any inquiries or issues they may encounter.

- Leverage of 1:1000 for micro accounts: The availability of 1:1000 leverage can appeal to traders who seek the potential to control larger positions in the market with a smaller capital investment. This high leverage allows for greater trading flexibility and amplifies potential profits. However, it’s important to note that high leverage also comes with increased risk, and traders should exercise caution and proper risk management.

Exness forex broker leverage

Leverage is a financial tool provided by forex brokers that allow traders to control larger positions in the market with a smaller amount of capital. As a result, it essentially magnifies a trade’s potential gains and losses. In the case of Exness forex brokers, they offer different leverage levels based on the equity in a trader’s account.

Exness has specific leverage requirements based on the amount of equity in a trading account. When unlimited leverage is active, the maximum available leverage automatically changes as the equity increases to certain levels. Let’s break down the leverage requirements based on the provided data:

- Equity USD 0 – 999.99:

- If eligible, unlimited leverage is available.

- By default, the maximum available leverage is 1:2000.

- Equity USD 1,000 – 4,999.99:

- The maximum available leverage is 1:2000.

- Equity USD 5,000 – 29,999.99:

- The maximum available leverage is 1:1000.

- Equity USD 30,000 or more:

- The maximum available leverage is 1:500.

It’s important to note that unlimited leverage is not available for specific trading instruments on Exness, including exotic currency pairs, cryptocurrencies, energies, stocks, and indices. Therefore, for these instruments, the maximum leverage may be lower than the abovementioned levels.

Traders should be cautious when using leverage as it amplifies profits and losses. While leverage can enhance potential gains, it also increases the risk of significant losses. Therefore, understanding and managing the risks associated with leverage before engaging in forex trading is crucial.

Personal opinion about leverage

I do not think that leverage is an essential aspect for traders when choosing a broker as much as support, regulation, platforms, or payment methods.

Leverage can be enticing when choosing a broker, especially for traders with smaller account balances. Leverage allows traders to control larger positions than they could with their funds alone. However, leverage can also amplify losses just as it can amplify gains, which can be disastrous for inexperienced or risk-prone traders.

Here are reasons why leverage is not necessarily a good criterion for choosing a broker:

- Risk Magnification: High leverage can quickly deplete your trading account if a trade goes against you. It’s essentially a loan from your broker, and any losses must be paid back. If these losses exceed your account balance, you could owe your broker money.

- Overtrading: Higher leverage could lead to overtrading. Because you can take larger positions, you may be tempted to trade more often, which could lead to poor trading decisions.

- Misleading Indicator of Quality: High leverage doesn’t necessarily indicate a high-quality broker. Some regulatory bodies limit the leverage brokers can offer to protect consumers.

On the other hand, here’s why support, regulation, platforms, and payment methods are more reliable criteria:

- Support: Good customer support is crucial in trading, especially for beginners. A broker that offers 24/7 support can help you navigate issues, guide the platform’s features, and assist with account problems.

- Regulation: A regulated broker is supervised by a recognized financial regulatory body, ensuring they adhere to fair trading practices and protect their client’s money. This can provide peace of mind and security for your investment.

- Trading Platforms: The broker’s trading platform should be user-friendly, reliable, and loaded with all the necessary tools and features for effective trading. It should have good execution speed, real-time market data, and be compatible with your device.

- Payment Methods: A good broker should offer various easy, quick deposit and withdrawal options. This is particularly important if you need to fund your account or withdraw your profits quickly.

Remember, it’s crucial to consider all these aspects when choosing a broker to ensure they align with your trading needs and style.