HF Markets allows traders to take advantage of higher leverage levels than other brokers usually offer. With HF Markets, traders have access to maximum leverage of 1:1000, allowing them to open more prominent positions with smaller amounts of capital. This higher level of leverage can benefit traders who can manage risk effectively and want to increase their profits from smaller price movements.

What Leverage Does HF Markets Offer?

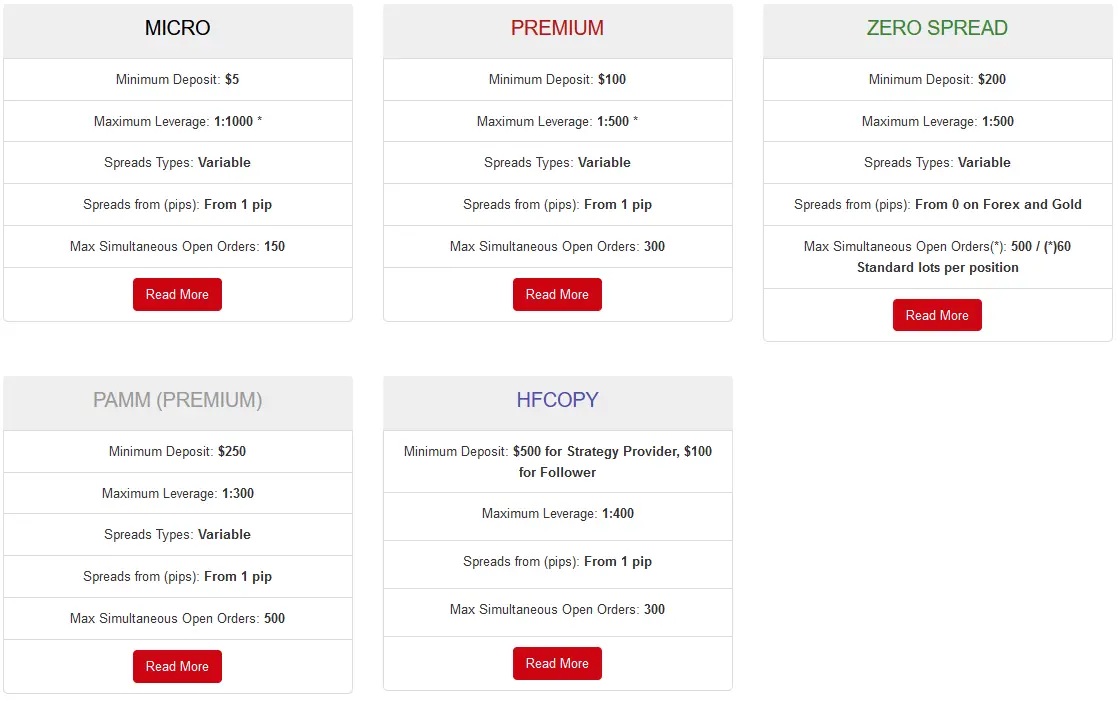

HF Markets offers 1:1000 leverage for micro account users. Additionally, users that trade on Premium and Zero-spread accounts have 1:500 leverage. However, if you want to invest, then for PAMM accounts, leverage is 1:300, and for HF copy accounts, 1:400.

Please read the HF markets review to learn more about HF markets accounts.

The typical leverage that HF Markets offers is 1:1000, which provides enough flexibility for most traders. This ratio means that for every dollar a trader invests in an asset, they can use $100 worth of position size. For example, if a trader invested $1000, the position size would be $100,000 worth of the asset.

To calculate leverage, you need to follow these 5 steps:

- Determine your account currency: Before calculating leverage, you need to know the currency of your trading account. This will typically be USD, EUR, GBP, or another primary currency.

- Determine your trade size: Decide how much of a currency pair you want to trade. This is typically measured in lots. For example, if you want to trade 1 lot of EUR/USD, you would trade 100,000 units of the base currency (EUR).

- Determine the margin requirement: Margin is the money you need to set aside to open a position. The margin requirement will vary depending on the broker and the currency you are trading. It is usually expressed as a percentage of the total trade size. For example, if the margin requirement is 2%, and you are trading 1 lot of EUR/USD, you would need to set aside $2,000 in the margin.

- Calculate the maximum leverage: To calculate the maximum leverage available, divide the total trade size by the margin requirement. For example, if you are trading one lot of EUR/USD with a margin requirement of $2,000, your maximum leverage would be 50:1 ($100,000 / $2,000).

- Determine the effective leverage: Effective leverage is the amount you use in your trades. To calculate this, divide the total value of your open positions by the margin you have set aside. For example, if you have $10,000 in open places and $2,000 in the margin, your effective leverage would be 5:1 ($10,000 / $2,000).

The amount of leverage you choose will depend on your trading style and risk tolerance. Lower leverage may suit you if you prefer a conservative approach and want to minimize risk. However, if you’re comfortable taking on higher risks in exchange for potentially greater rewards, you may opt for the higher leverages available at HF Markets.

When using high leverages such as 1:1000, traders must have appropriate risk management strategies in place,e as this type of trading can result in significant losses should the market move against your position. It is essential that all traders understand the risks involved when using high leverages and only invest an amount they’re comfortable with losing.

At HF Markets, traders can adjust their leverage levels any time they wish – providing more control over their trades and helping them better manage their risk exposure. Allowing traders to customize the amount of leverage they use helps ensure that investors stay within their comfort zone when trading with higher risk-reward ratios.