Table of Contents

The trading world has always been competitive, where every participant strives to earn profits. However, certain players in the financial markets seem to have an unfair advantage when making profits. These are the big players with large liquidity who have been observed to earn significantly more than their retail counterparts. Liquidity refers to the ability of these players to buy and sell large volumes of assets without causing any significant price movements. This ability gives them an edge over small retail traders who operate with limited capital and cannot influence the market as much.

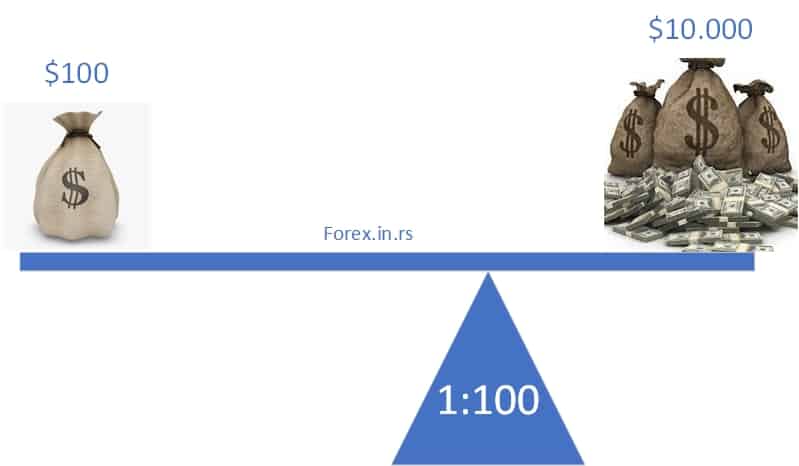

Can we, small retail traders, manage large amounts of money?

We tried to give a leverage definition in our article What is 1:100 Leverage Meaning?

What is leverage in forex trading?

Leverage in forex trading represents brokerage credit that enables traders to open larger positions than they could with their funds alone. For example, 1:100 leverage means a trader with a $1,000 account balance could open a position worth up to $100,000. This magnifies potential profits and losses, making leverage a double-edged sword.

Brokerage accounts allow leverage through margin trading; in other words, brokers provide borrowed funds to traders to increase trading positions. Leverage can use a small amount of capital in traders’ accounts controlling a larger market. Therefore, leverage in forex trading is a financial tool that allows traders to increase their market exposure beyond their initial investment or capital. It is essentially borrowed capital provided by brokers, which enables traders to open larger positions than they could with their funds alone.

While leveraging can lead to more significant gains, it also increases the risk of losses. Therefore, traders must be aware of the risks of using leverage and implement proper risk management strategies to mitigate potential losses.

Please see my video about leverage from the fxigor youtube channel:

What is the best forex leverage to use?

I use 1:10 leverage when I trade for prop companies! Theoretically, the best forex leverage is the biggest, such as 1:500 or 1:1000, because it enables traders to manage more significant amounts of money. However, in practice, you can trade on high-leveraged accounts, but you need to risk small amounts of money and never trade on margin.

High leverage allows traders to control larger positions with a smaller amount of capital, which can lead to higher profits but also increases the risk of losses. As a result, experienced traders with a solid understanding of the risks should only use high leverage.

It’s also important to note that the maximum leverage offered by brokers can vary and may be regulated by the country or region where they are located. For example, some countries have imposed restrictions on leverage due to the high level of risk involved.

Generally, traders should choose a leverage ratio that suits their trading style and risk tolerance. It’s recommended to start with lower leverage ratios and gradually increase them as they gain experience and confidence in their trading strategy. Traders should also regularly assess their trading performance and adjust their leverage accordingly to ensure they are not taking excessive risks.

To choose proper leverage, please you can follow the tips:

- But first, understand your risk tolerance: Before selecting a leverage ratio, assessing your risk tolerance is essential as determining how much capital you are willing to put at risk.

- Consider your trading strategy: Different trading strategies may require different leverage ratios. For example, scalping strategies may require higher leverage, while swing trading may require lower leverage.

- Start with lower leverage: If you’re new to trading or not yet comfortable with high-risk trading, it’s recommended to start with lower leverage ratios and gradually increase them as you gain experience.

- Check the broker’s regulations: Brokers may have different regulations regarding leverage ratios, so it’s essential to check with your broker what leverage they offer and whether they are regulated.

- Consider market conditions: Market volatility can impact your trading results and risk, so adjusting your leverage ratio is essential. For example, higher volatility may require lower leverage, while lower volatility may allow for higher leverage.

- Regularly assess your trading performance: It’s essential to evaluate your trading performance and adjust your leverage ratio accordingly to ensure you are not taking excessive risk.

- Use risk management tools: To help manage risk, consider using risk management tools such as stop-loss orders, take-profit orders, and position sizing.

ESMA trading leverage

ESMA (European Securities and Markets Authority) trading leverage 1:30 means that traders in the European Union who are trading with regulated brokers are limited to a maximum leverage ratio of 1:30 for significant currency pairs and 1:20 for non-major currency pairs, indices, and commodities.

For every €1 of trading capital, traders can open a position with a notional value of up to €30 for major currency pairs and €20 for non-major currency pairs, indices, and commodities. This is a lower leverage ratio than some brokers previously offered, which could go up to 1:500 or even higher.

The ESMA introduced these new leverage restrictions in August 2018 to improve investor protection and reduce the risks associated with leveraged trading. The lower leverage ratios aim to limit the potential losses that traders can incur and encourage them to adopt more responsible trading practices.

It’s important to note that traders outside the European Union may still have access to higher leverage ratios. Still, they should be aware of the risks and take appropriate risk management measures.

Is high leverage good in forex trading?

High leverage can be good in forex trading because you can manage more considerable capital. However, this question is very similar to the question: Is a lot of food in your house suitable for your health? You can put a lot of food in your house, but you do not need to eat everything you have. The same principle is in trading.

A trader’s possibility of significant leverage can be advantageous in trading, especially when the market is in the small range. But, most importantly, traders do not risk a lot of money and trade on a margin because that can bring vast and fast losses.

Another example is a fast car. If you have a fast car, driving at the speed limit is not bad. The same thing is with leverage.

Conclusion

Understanding the risks and rewards of leveraged trading before engaging in it is crucial. An important aspect to consider is the margin call, which occurs when a trader’s position moves against them, and they don’t have enough funds to cover the losses. This can result in the loss of the entire investment and even more significant debt.

Moreover, leverage should not be the primary factor in decision-making processes. Instead, proper risk management should involve determining the appropriate leverage level for each trade, not exceeding it, and having a stop-loss order to minimize potential losses.

There is no wrong or good forex leverage. I trade 1:10 leverage for prop companies but 1:500 in my individual trading account. Everything is the same for me because I risk less than 1% of my portfolio in both cases!!!