Table of Contents

Richard Demille Wyckoff (November 2, 1873 – March 7, 1934) was an American stock market investor and the founder and onetime editor of the Magazine of Wall Street. Richard Wyckoff introduced the Wyckoff method in the 1930s. He pioneered the development of a series of principles, strategies, and methodologies to assist traders and investors in pursuing long-term financial goals. Most of his work is derived from modern technical analysis, where he dedicated much of his life to teaching the basics of reading and investing. Initially, this method was directed and focused on stocks, but now, this principle can be seen in all practical applications of financial markets.

Most of Wyckoff’s work obtained inspiration from other forerunners in the trading industry, especially Jesse Livermore. He holds the same prominence and status as other critical principles in the industry, such as Charles Dow and Ralph Elliot. The early 20th-century icon was interested in studying, exploring, and researching the specialized trading methodology. He is currently well known and is considered one of the ‘five titles’ of technical evaluation and art analysis. He inaugurated his professional journey when working in stocks as a stock donor for New York Brokerage. Later, he became the head and chief officer of the brokerage firm, where he was known to be an active trader and tape reader.

The fluctuations and existing developments within the stock operators’ market activities and financial campaigns were observed under his leadership, including JP Morgan and Jesse Livermore. He was interested in interviewing and analyzing the strategies observed by high-profile traders. Consequently, he was able to implement the teachings of big-time dealers. He gathered lucrative principles and strategies of trading methodology, money, time management, and the mental tenacity required for the process. Understanding the Wyckoff distribution process, traders and stock experts can acquire lucrative deals before the market reverses. By apprehending this progression, traders can easily cash out and accept maximum profits from shorting. Distribution is a detailed process involving distributing and selling a financial asset at an appropriate price for an unknown period. Thus, distribution is opposite to accumulation, where traders and traders are looking for an asset to buy at the minimum profitable cost.

Wyckoff Forex Method

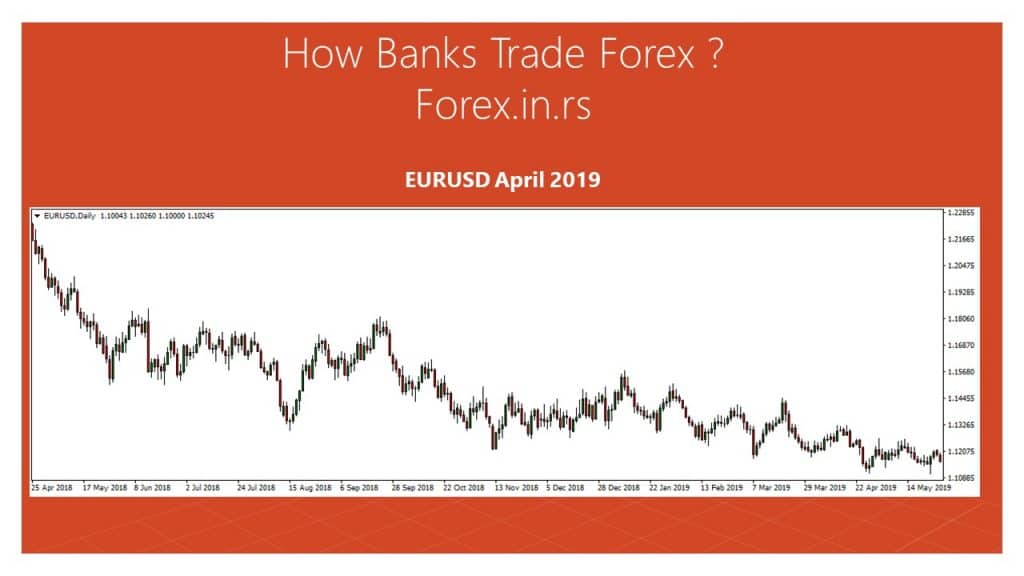

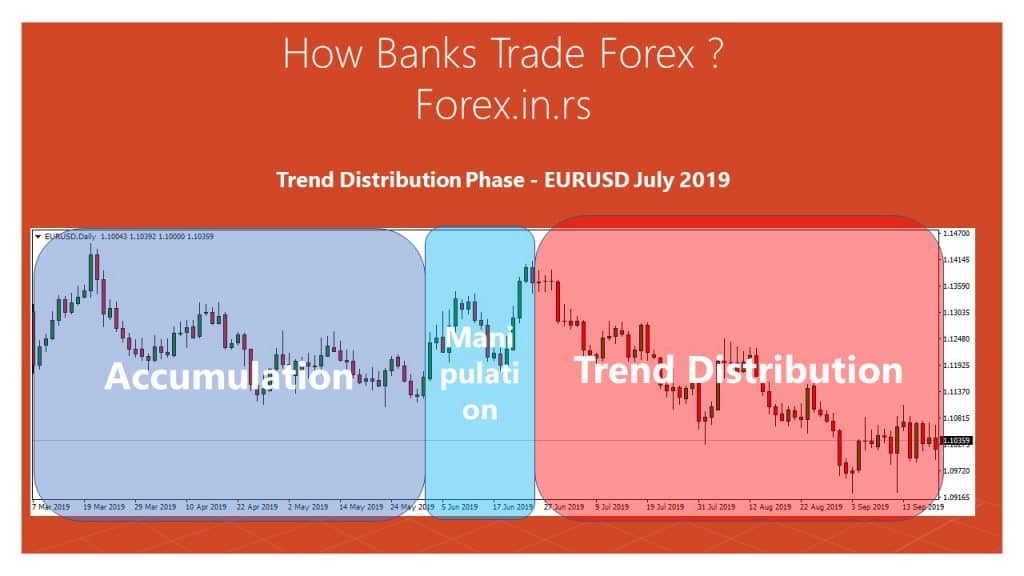

Wyckoff Forex Method is based on the Wyckoff and Elliott Wave strategy, where trading opportunities generate based on accumulation and distribution phases in trading. Thus, traders follow the cycles, wait for the accumulation phase, generate trades, and do not close trades during the manipulation phase (false breakout). This approach is most similar to a bank trading strategy

Wyckoff was able to perform extensive research on the following topics: Three fundamental laws, the composite main concept, and methodology for evaluating charts, also known as V cops schematics, and a five-step approach to the market. He was also considered prominent for developing the approach for specific buying and selling tests and establishing a specific charting method based on point and figure charts.

Wyckoff was able to perform extensive research on the following topics: Three fundamental laws, the composite main concept, and methodology for evaluating charts, also known as V cops schematics, and a five-step approach to the market. He was also considered prominent for developing the approach for specific buying and selling tests and establishing a specific charting method based on point and figure charts.

Wyckoff Accumulation

ichard Wyckoff, a pioneer in the study of market structure, created the Wyckoff Method, which involves the analysis of market phases and the interplay between institutional investors (“Composite Man”) and the general public. While his theories are typically applied to stock markets, the principles can be adapted to the forex market as well. The Wyckoff Method identifies vital structural elements in a market’s price evolution, using volume and price movement to infer future price direction. The method divides market activity into distinct phases: accumulation (preparation for a bull market), distribution (preparation for a bear market), markup (bull market), and markdown (bear market).  Here, we will focus on the Wyckoff Accumulation phase and its related concepts as adapted to forex trading:

Here, we will focus on the Wyckoff Accumulation phase and its related concepts as adapted to forex trading:

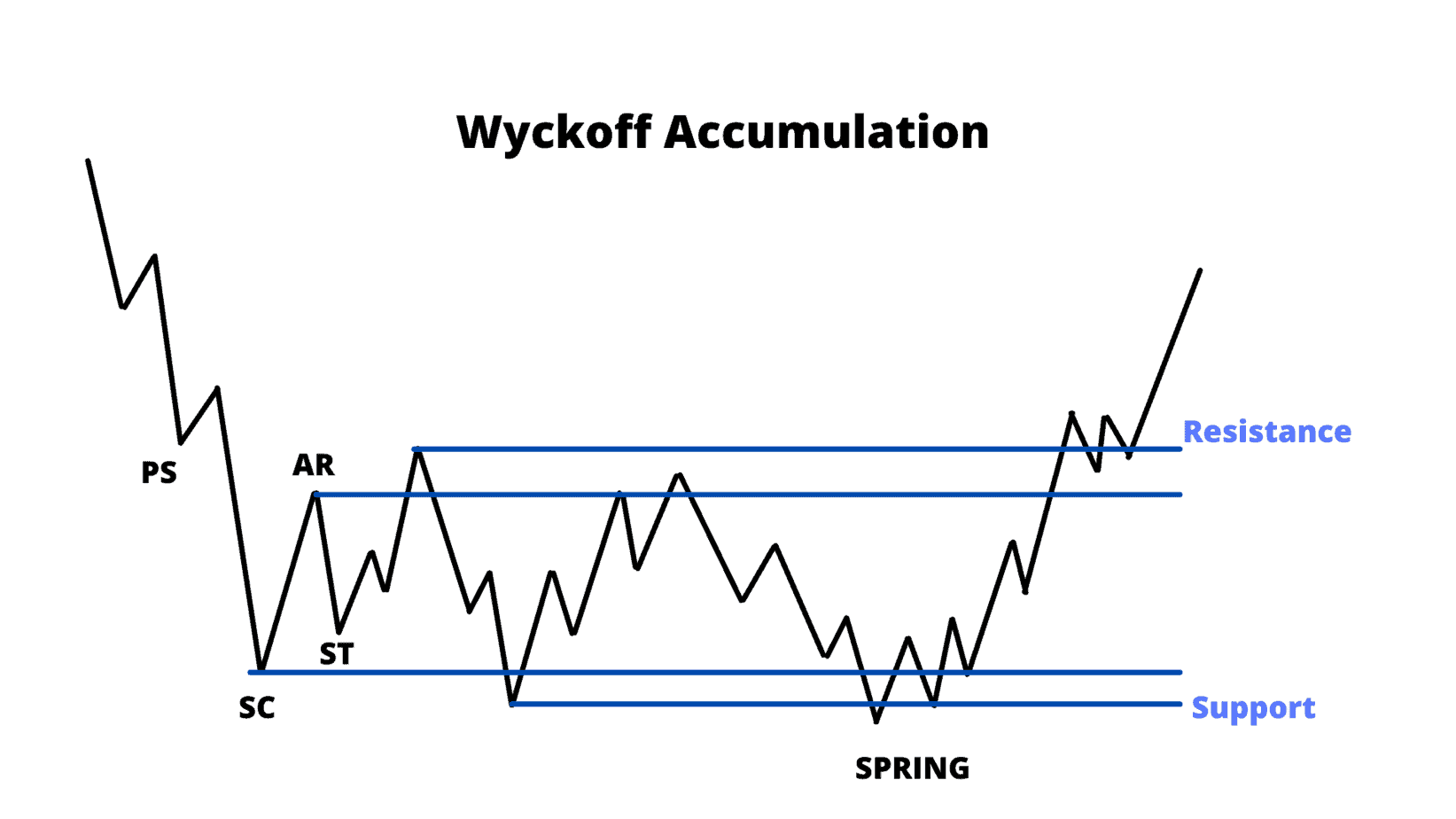

1. Accumulation Phase

Accumulation is the phase where institutional investors (“smart money” or the “Composite Man”) are believed to be discreetly buying (or “accumulating”) positions. This phase occurs after a decline in prices and precedes the start of an upward trend (markup). For the forex market, this implies that major players are taking positions in a particular currency pair, expecting its value to rise in the near future.

2. Key Characteristics of Accumulation Phase

- Preliminary Support (PS): After a downward trend, this is the initial halt of price decline, marked by increased volume.

- Selling Climax (SC): Following the PS, there is typically a sharp selling spree which culminates in a significant volume surge and price reversal. The SC is where panic selling reaches its peak.

- Automatic Reaction (AR): After the SC, a rebound in price typically occurs, driven by the buying from the Composite Man.

- Secondary Test (ST): Prices retest the SC levels on reduced volume. The ST is meant to test the supply and demand balance left behind from the SC.

Between AR and ST, a range is established, which can be used to gauge the boundaries of the accumulation zone. Inside this range, you might see various upthrusts and tests, but the main characteristic of the accumulation phase is that prices don’t make new lows beyond the Selling Climax.

3. Signs of the End of Accumulation

- Spring (or Shakeout): This is a price move below the SC level, which quickly reverses and moves back into the range. The Spring shakes out weak holders, making way for the markup phase.

- Sign of Strength (SOS): A price breakout above the accumulation range on increased volume.

Application to Forex Trading:

- Spotting Accumulation: Identify the above stages on a forex chart. Look for phases where a currency pair stops declining and enters a sideways range, exhibiting the characteristics of Preliminary Support, Selling Climax, Automatic Reaction, and Secondary Test.

- Volume: In forex, true volume data isn’t universally available like it is in stocks. However, tick volume (number of price changes) can be used as a proxy.

- Entry Point: A conservative approach would be to wait for the Spring and the subsequent SOS as confirmation before going long.

- Stop-Loss: Below the Spring or Selling Climax, since prices shouldn’t revisit these levels if the markup is about to start.

- Take Profit: Use traditional tools like resistance levels, trendlines, or technical indicators to set targets during the subsequent markup phase.

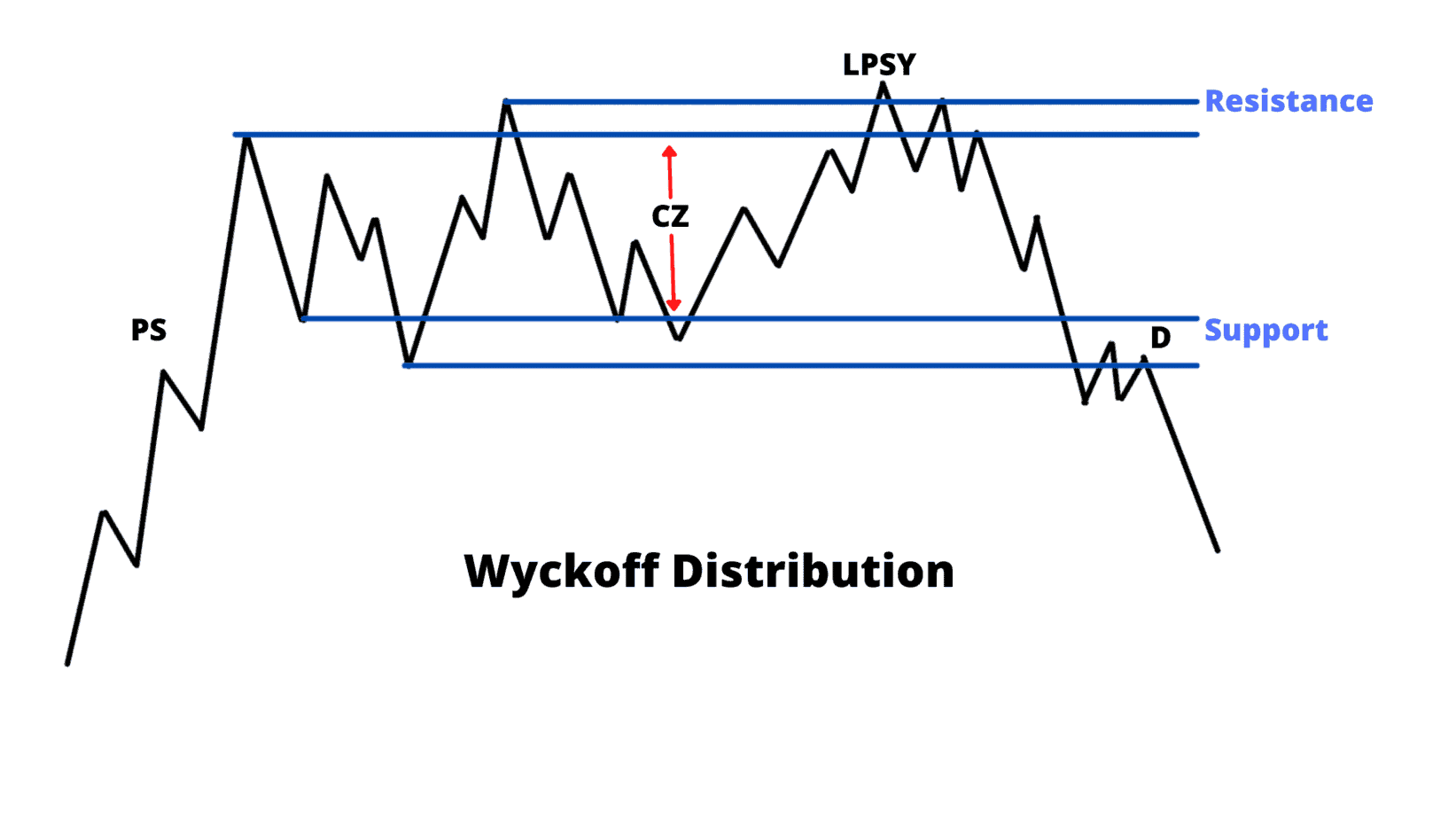

Wyckoff distribution

The Wyckoff distribution is a concept that is found sideways and consists of a range of trading. It is usually observed after a consistent and long-drawn-out uptrend. This trading area allows the high profile traders to perform short positions and build them to distribute long positions and break retail traders. The distribution of positions occurs slowly to prevent the fluctuations of price movement.  Wyckoff believed that to become a skillful trader, fathoming the phases and events happening within the phases is important. These are the parameters that result in the distribution phenomenon. By being a ridiculous examiner, the standing concept of buying or selling of stocks and the accurate time to perform would allow the traders to have ample understanding of events and faces.

Wyckoff believed that to become a skillful trader, fathoming the phases and events happening within the phases is important. These are the parameters that result in the distribution phenomenon. By being a ridiculous examiner, the standing concept of buying or selling of stocks and the accurate time to perform would allow the traders to have ample understanding of events and faces.

- Preliminary supply: This trend is observed as an uptrend when prices surge with wide up bars, and the volume is augmenting. The price is then reimbursed to normal after correction. As per the Wyckoff principle, the wide up bars and surging volume are prominent during the selling of large interest. The correction needed to correct it is worse voice profound than the previous corrections noticed in the uptrend. Therefore, the time observed during the correction process was more and longer than the prior one.

- Buying climax (BCLX): this phase is observed with wide price bars and a sudden increase in volume. During this process, public buying and trading are on an increased level. As a result, there is a noticeable increase in market volume and price range and the presence of spontaneous and heavy buying by the public and professional interest at prices reaching near the top. This buying climax is often coinciding with exceptional earnings reports or other positive phases.

- Automatic reaction (ER): An automatic reaction emerges after the buying climax and the sudden increase in buying. The low point of this sell-off assists in understanding the lower boundary of the distribution R.

- Upthrust after distribution (UTAD): The upthrust after the distribution is reported to the Spring and terminal check out during the accumulation TR. This is observed in the end stages of the TR and gives a concise test of new demands after the emergence of the breakout above TR resistance. It requires a structural element that is analogous to springs and shakes out.

The functionality of the Wyckoff principle: In the paper, the Wyckoff method is apt; however, in practical trends, these models occasionally fail to perform accurately. The accumulation and distribution schematics fluctuate in multiple ways. Despite that, this principle has a lot to offer for traders and stock experts. It provides reliable techniques, and his work is highly worthwhile to proficient and novel investors, traders, and analysts. This method initially emerged before the century but is still considered practical. It is highly used today and has much more to offer. It is considered much more than a TA indicator, consisting of many principle strategies and trading techniques. This method allows investors and traders to make logical and coherent decisions. It allows them to shield and protect the decisions from emotions and impatience and delivers techniques for minimizing risks, generating more profit, and, eventually, success. If traders familiarize themselves with this methodology, it can be highly profitable and reliable. This approach works very well for day trading, and his profits are mentioned in multiple books and articles. That’s because principles can be easily applied to any freely traded market commodity in which multiple institutional establishments and traders operate, including boards and currencies.

Wyckoff vs. Elliott Wave Forex Strategy

The Wyckoff Method and the Elliott Wave Principle are analytical approaches to understanding market behavior. While they have distinct foundations and structures, they can be combined to offer traders a comprehensive view of market dynamics. Here’s a comparison of the two methods and how they can be integrated in a Forex strategy:

Wyckoff Method:

- Foundation: Based on the idea that institutional investors (Composite Man) drive markets, their actions can be deciphered through price and volume analysis.

- Phases: The market moves through distinct phases, namely Accumulation, Markup, Distribution, and Markdown.

- Key Concepts: The method revolves around understanding supply and demand dynamics. Events like the Selling Climax, Automatic Rally, and Secondary Test in an accumulation phase (and their counterparts in distribution) are essential.

- Application: Traders using the Wyckoff method look for confirmations of these events and phases to enter or exit trades. For instance, a trader might wait for a breakout (Sign of Strength) to go long after spotting an accumulation phase.

Elliott Wave Principle:

- Foundation: Proposed by R.N. Elliott, this method is based on the idea that markets move in fractal patterns, with repetitive cycles driven by mass psychology.

- Waves: The market is seen to move in waves: five impulsive waves (numbered 1-5) in the direction of the primary trend, followed by three corrective waves (labeled A, B, C) against the trend.

- Key Concepts: Within each primary wave, there are secondary waves. Recognizing the wave pattern can help predict future price movement.

- Application: An Elliott Wave trader might look to enter a long trade at the end of Wave 2 (after a correction) or Wave 4, anticipating the next impulsive move.

Wyckoff vs. Elliott Wave in Forex Strategy:

- Confluence of Signals: If, for example, a Wyckoff Markup phase coincides with an Elliott Wave 2 correction ending, there’s a strong case for a long trade, expecting the commencement of Wave 3, which is usually the most potent impulsive wave.

- Volume Validation: While Elliott Wave mainly focuses on price patterns, incorporating Wyckoff’s emphasis on volume can add an extra layer of confirmation. A breakout after a Wyckoff accumulation with increasing volume might coincide with the beginning of an Elliott impulsive wave, offering a robust signal.

- Risk Management: Both methods can aid in setting stop-loss and take-profit levels. For instance, a trader might set a stop below the last low if entering after a Wyckoff Sign of Strength. If this move also coincides with the start of Elliott Wave 3, the anticipated impulsive wave can be used to set a profit target.

- Timeframe Compatibility: Both methods can be applied across different timeframes, from intraday to daily or weekly charts. This adaptability allows traders to find wave patterns and Wyckoff phases at both macro and micro levels.

Caveats:

- Subjectivity: Both methodologies can be subjective and are open to interpretation. Traders must practice and backtest their interpretations before committing capital.

- Complexity: Combining the two can offer powerful insights but adds complexity. Traders need to ensure they don’t become paralyzed by over-analysis.

- No Certainties: Like all trading methodologies, neither Wyckoff nor Elliott Wave offers surefire predictions. Always use risk management and never risk more than you’re willing to lose on a trade.

In conclusion, while the Wyckoff Method and Elliott Wave Principle stem from different philosophies, their integration can provide a holistic understanding of market dynamics, helping traders navigate the complex world of forex trading more confidently.