Trading huge trades comes with having good margins, and not everyone can have enough funds to gain a healthy margin. Who doesn’t want to trade with a million-dollar account, but covering just the basic required margin doesn’t give this luxury? However, that doesn’t mean that small trades are not sufficient. Trading in a small account requires a trader to be disciplined and strict about money management.

What is the Best trading strategy for small accounts?

Forex Small account strategies are based on rigorous risk management, a low number of trades, and low leverage. In addition, small account traders should trade only the best-analyzed trades, avoiding overtrading and unnecessary experimentation with live untested strategies.

The best trading strategy for small accounts should be based on the percentage increase or decrease in position size based on profitability. Trading rules should not be changed depending on whether the account is large or the trading account is small.

- Risk management is the most important aspect of any trading strategy, mainly when working with a small account. The goal is to minimize losses and protect capital, so it’s essential to use stop-loss orders to limit potential losses on any trade.

- Position sizing: When trading with a small account, being mindful of position sizing is essential. It’s generally recommended to risk no more than 1-2% of the account balance on any one trade.

- Discipline: Successful Forex trading requires discipline and a consistent approach. This means sticking to a trading plan and avoiding impulsive decisions based on emotions.

- Focus on high-probability trades: When trading with a small account, focusing on trades with a high probability of success is essential. This means looking for trades with a clear entry and exit strategy and a favorable risk-to-reward ratio.

- Leverage: While leverage can be a powerful tool for maximizing profits, it can also be a double-edged sword. Using leverage wisely and avoiding over-leveraging is essential, as this can quickly lead to significant losses.

- Use of demo accounts: Practicing trading strategies on a demo account before trading with real money is essential. This allows traders to test different strategies and hone their skills without risking real capital.

- Continuous learning: Successful Forex trading requires ongoing education and learning. Traders should be open to new ideas and strategies and continuously seek to improve their skills.

For example, if you have $500 in your margin account, you must be careful that your loss does not exceed it. If your loss exceeds it, you may not be able to trade at all until you deposit the additional margin requirement. Day traders who manage millions of dollars account for risk very often 0.5% per trade. Small account retail traders have less responsibility, do not operate with other people’s money, and can easily cover huge drawdowns.

But it is vital that manage risk appropriately. If a trader with small accounts, for example, risks 5% of the portfolio, his maximal equity drawdown can be more than 20%-50%, and then the trader generates a sure loss.

Forex’s small account strategy, minimal account day trading, must be carefully created. The best trading strategy for small accounts is based on the following:

- Traders need to Trade only the best setups because there is no room for experimenting.

- Decrease the risk—the properly managed risk where the maximum risk is 1% to 3% per trade.

- Avoid overtrading – each trade needs to be patiently planned.

- Trading rules for small and large accounts can be the same, but the strategy needs to be well-tested before live trading.

Forex Small Account swing strategy example

Buy order:

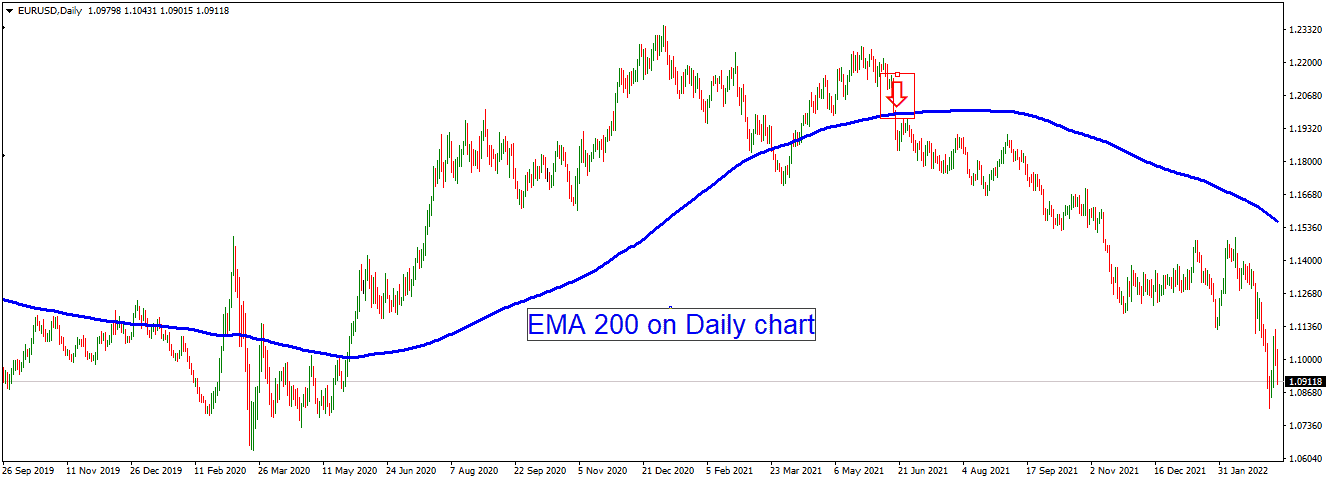

- Buy if the price touches the last 24 hours’ low AND the Price is above 200 EMA on the daily chart.

- Stop loss is last 7 days low.

- Target last 7 days high.

- The risk-reward ratio is at least 1:1.

Sell order:

- Sell if the price touches the last 24 hours’ high AND is below 200 EMA on the daily chart.

- Stop loss is the last 7 days’ high.

- Target last 7 days low.

- The risk-reward ratio is at least 1:1.

As you can see, this strategy, where the trader risks less than 1% of equity, does not overtrade and has enough room to stop loss and target the best for small accounts.