Table of Contents

Forex is one of the most popular securities among traders and has the world’s largest trading market. Traders use many strategies, and one of them is the forex grid strategy based on several position sizing methods.

What is forex grid trading?

Forex grid trading represents a trading strategy where traders typically select a base price or a price range and establish fixed intervals above and below this base. They then place buy and sell orders at these intervals, creating an orders grid. The spacing between grid levels can be determined based on market volatility, support, resistance levels, or technical analysis indicators.

Forex grid trading is a popular trading strategy used in the foreign exchange (forex) market. It involves placing buy and sell orders at predetermined levels above and below a base price, creating a grid-like pattern on the trading chart. The strategy is based on the expectation that the price will fluctuate within a specific range or channel.

Here’s a step-by-step explanation of how forex grid trading works:

- First, determine the base price: Choose a price level around which you want to build the grid. This price is often chosen based on technical analysis, support, and resistance levels.

- Set the grid spacing: Decide on the distance between each grid level. For example, you may place buy orders at fixed intervals of 20 pips above the base price and sell orders at 20 pips below the base price.

- Place initial trades: Enter buy and sell orders at the predefined grid levels. For instance, if the base price is $1.2000, you might place buy charges at $1.2020, $1.2040, $1.2060, and so on, and sell orders at $1.1980, $1.1960, $1.1940, and so on.

- Manage the grid: As the market moves, some orders will get triggered while others may not. When an order is started, you may choose to take profit by closing the position or to set a stop loss to limit potential losses.

- Adjust the grid: Depending on market conditions, you can modify the grid spacing or add new orders. For example, if the price moves significantly in one direction, you may add charges to capture potential profits.

One of these strategies that forex traders use is the Forex Grid trading strategy.

Unfortunately, many grid forex trading strategies do not define stop loss and can produce huge losses. For example, poor trading expert advisors offer a grid forex trading strategy with almost unlimited stop loss, whereas EA waits for mean reversion. This practice is wrong because risk management plans need to be clear, defined, and well-analyzed.

The Forex Grid trading strategy is one of the most self-sufficient trading methods. This automation removes away the burden of manually opening or closing an. In addition, tuition. This acts as a visual aid for the traders as they see every movement. Ho, because it is popular among traders, it does not guarantee success.

The Forex Grid system allows you to set it up to place trades automatically using it. Even if the market conditions are volatile, return to your investment whimpossibleossible with a trading treading addition system. It saves you from making predictions about the market’s direction. All you need to know is when the market will make its next move, and your automated strategy will do the rest. Another reason for the popularity of the grid system is that it works efficiently in trending markets too.

What Does Forex Grid Trading System Mean?

The forex grid trading system is a trading strategy where expert advisors or traders generate pending buy and sell orders above and below the entry position. Forex grid strategy is averaging down method type based on successive trades with the final goal to reduce drawdown and increase position exposure to follow the primary trend.

Forex Grid trading is a system that depends on the natural movements of the market. Traders aspire to make profits by employing stop-and-sell orders. This is done on a leg (a set market distance), a fixed take-profit size, and no stop-loss. You do not have to concentrate too much on the variables affected by the market’s price movements. However, the downside of this system is that you have to deal with complex money management conditions.

Forex grid trading EA free download

Below you can download for free: forex grid trader Ea download

Forex grid trader EA download

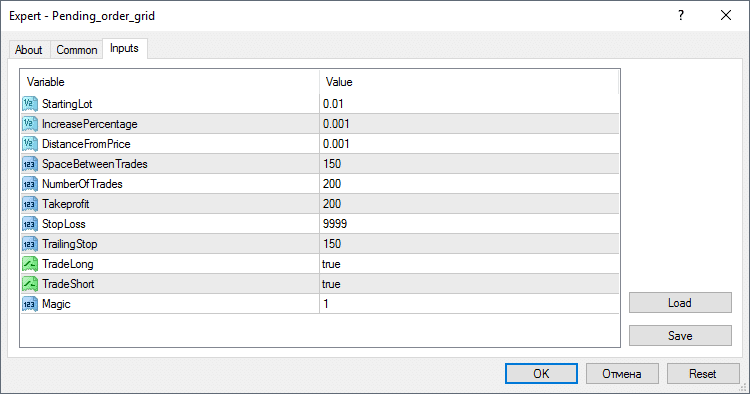

This EA forex grid trading system is a simple system that Opens a grid of Bu,y Stops, and Sells Stops at a specified distance from the price. It is semi-automated, and traders need to enter information as presented in FigurSo below:

How Does the Forex Grid Trading System Work?

Just like you need time to adapt to any new trading tool or system, you will need time to get comfortable with the Forex Grid. The first step of this system is to choose a starting point. Next, you can select the current price of your chosen currency pair.

In the Figure below, we can see When traders trade in the bullish trend market, they set orders above-set prices:

The figure below shows that they set orders below-set prices when traders trade in the bearish trend market.

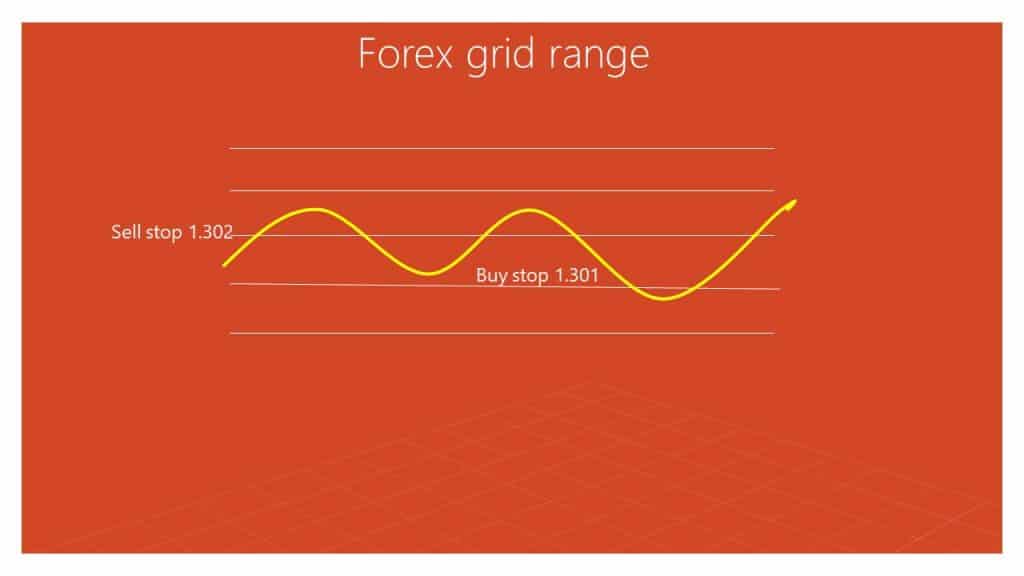

The figure below shows that traders buy orders below the set price and sell orders above-set prices to profit from range markets.

There are some numbers of Forex Grid system levels. Each level has a different order type, entry, and take-profit. You can refer to the table given below for a better understanding. Now, you need to place three buy-stop or sell-stop orders. Note that the former has to be above the current,t price, while the latter has to be below the current price. You can even take the help of support and resistance levels, chart formations, and pivot charts to plot these points. These levels are not restricted. The size and the number of trades depend on you.

Once you are done placing the orders, you can witness three possible scenarios. These are:

- The price may go either up or down. All the trades will get liquidated, and the price moves will hit your take-profits. You can go ahead and close your stop-orders.

- The system will open all the orders, and they will hit your take-profits.

- The price movement may open some positions but not hit the take-profits.

It is clear from the explanation that the last scenario is not a favor, be one, as you will suffer losses there. What happens in the final situation shows one of this system’s most significant guest drawbacks. It is also high that traders must always be prepared to face losses.

Conclusion

Forex grid trading aims to profit from price oscillations within the defined range. By placing both buy and sell orders, traders aim to benefit from upward and downward price movements. However, it’s important to note that forex grid trading carries risks, and careful risk management, including appropriate position sizing and stop-loss orders, is crucial to mitigate potential losses.

It’s also worth mentioning that there are variations of grid trading strategies with different rules and approaches. Traders may incorporate additional indicators or filters to refine their grid trading system based on individual preferences and market analysis.