Table of Contents

Forex trading news is an integral part of the currency exchange market, as it helps traders and investors to stay up-to-date with market movements to make more informed decisions. News about global events, such as elections, geopolitical turmoil, central bank meetings, and more, can all impact the forex market.

Furthermore, economic data from around the world can provide timely information to investors and traders to help them anticipate price movements and capitalize on potential opportunities. By staying attuned to forex trading news, investors and traders can better manage risk, identify trading opportunities, and plan their currency exchange activities more effectively.

Currency traders must recognize the importance of keeping updated with relevant financial news. For example, financial reports from individual countries provide insight into how economic activity has been performing in that country which can influence future changes in the value of a particular currency.

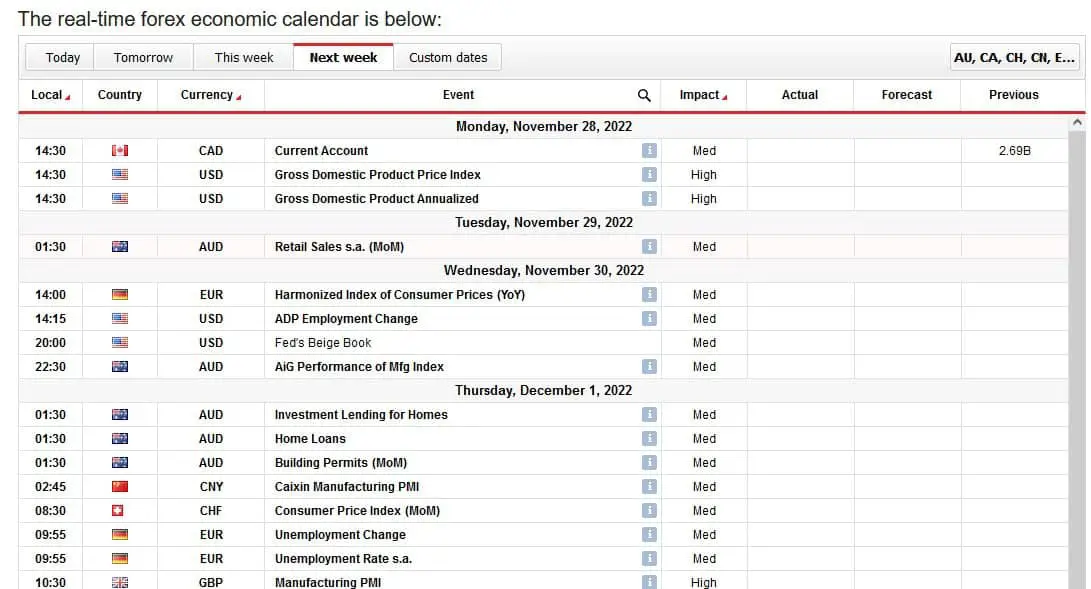

You can use our Forex calendar to monitor important Forex news, FOMC reports, and NFP.

When a government releases data below expectations or shows signs of weakening economic performance, these changes can cause investors to become nervous and sell off their investments quickly.

Please see my video about FOMC from the fxigor youtube channel:

Therefore, having up-to-date knowledge of financial data releases is essential for traders looking to capitalize on shifts in exchange rates. Moreover, political news can also significantly impact currency prices; uncertainty related to an election or political situation in a particular country or region can often lead to increased market volatility, which provides additional opportunities for active traders.

In addition, being aware of important events like central bank meetings or interest rate decisions by major central banks worldwide provides invaluable insight into potential price action for many currencies.

Central banks often publish minutes from their meetings which give detailed information about policy decisions and goals for growth within their respective countries, influencing investor sentiment and ultimately determining whether foreign exchange prices will rise or fall globally. Finally, being informed about international events like trade wars between nations or other significant geopolitical events can significantly influence markets’ near-term and long-term outlooks.

Therefore, staying up-to-date with forex trading news is critical for investors who want to make well-informed decisions about when to buy or sell currencies to maximize returns while minimizing risk levels. By regularly following relevant financial news sources and identifying potential opportunities before they occur, savvy traders can take advantage of profitable trends before others even know what’s happening in the market!

One of the important news is FOMC monetary news.

What does FOMC stand for?

The FOMC stands for Federal Open Market Committee and represents a Federal Reserve System branch that directs open market operations to determine the monetary policy’s direction.

What is FOMC?

FOMC, or Federal Open Market Committee, is a board of governors with seven members and five Federal Reserve Bank presidents. The main task of the FOMC is to control monetary policy.

The Federal Open Market Committee (FOMC) is a branch of the Federal Reserve System that plays arguably the most crucial role in setting economic policy for the United States. The FOMC comprises twelve members, seven from the Board of Governors and five drawn from Reserve Banks. This committee meets eight times yearly to discuss monetary policy and make decisions regarding interest rates, purchases of securities, and other tools used to influence the economy’s money supply and credit conditions.

Given its position as one of the most influential economic bodies in the country, citizens must understand how the FOMC works. The FOMC’s primary mandate is to maintain price stability and full employment. To do this, it sets short-term interest rates by adjusting the money circulating through the banking system. By increasing or decreasing this amount, they can encourage borrowing, which leads to increased economic activity and vice versa.

Moreover, they can purchase certain types of securities on open markets, such as Treasuries or mortgage-backed securities, as part of their policy toolkit. They are doing so influences market conditions by increasing or reducing liquidity available to market participants depending on whether they are buying or selling securities. All these actions have effects that ripple throughout financial markets worldwide, influencing currency exchange rates, stock prices, bond yields, and more.

In addition to setting monetary policy via the actions discussed above, members of the FOMC also use communication tools to share their views on current economic developments with Congress and public markets at large. For example, through statements released at regular meetings or press conferences following them, members seek to clarify expectations about future monetary policy moves – ensuring that all stakeholders understand why certain decisions were made or what trends might indicate going forward. This helps investors plan long-term strategies and gives ordinary citizens a way to stay up-to-date with policies affecting them directly and indirectly daily.

What does the FOMC do?

FOMC, or Federal Open Market Committee, conducts monetary policy for the U.S. central bank and acts as the Federal Reserve System’s economic policymaking body.

The Federal Open Market Committee, or FOMC, is the policymaking body of the Federal Reserve System, responsible for carrying out the nation’s monetary policy. This committee meets eight times a year to determine the economic and financial conditions that affect their decisions about setting short-term interest rates.

The FOMC was created 1933 under the Banking Act of 1933 and consisted of twelve members: seven from the Board of Governors and five from among the Presidents of Reserve Banks. The President chooses the Chairperson or Vice-Chairperson and is subject to Senate confirmation. The FOMC’s primary mandate is to promote maximum employment, stable prices, and moderate long-term interest rates to foster economic growth and stability.

To achieve these goals, the FOMC conducts monetary policy through three primary tools at its disposal: open market operations (the purchase and sale of U.S. Treasury securities), discount window lending (which provides funds to eligible depository institutions), and reserve requirements (which regulate how much money banks must hold). The FOMC sets monetary policy by adjusting these tools to meet its goals. For example, inflation may restrict access to discount window loans or raise reserve requirements to reduce financial liquidity if inflation rises too quickly.

The FOMC also works closely with other parts of the Federal Reserve System on various projects, such as research into new forms of payment systems and methods for conducting stress tests on large banking institutions. Additionally, the committee helps advise on foreign exchange rate policies and international financial stability initiatives such as Basel III capital regulations for banks worldwide.

Finally, one of the most critical functions performed by this committee is guiding future actions; this gives economic participants an indication of what may be coming down ahead and allows them time to prepare accordingly for any potential changes that could affect their plans or investments.

At each meeting, members discuss current economic conditions based on reports from regional Fed Bank presidents and statistical data, which they analyze thoroughly before deciding whether to alter their stance on monetary policy or keep it unchanged in light of new information. Following this discussion, each participant votes for one of four possible outcomes: approve a policy change; no change; wait for additional information, or take no action until more data is analyzed and discussed further during another meeting.

Overall, it is clear that FOMC plays a critical role in helping ensure that America has a strong economy supported by low unemployment levels while maintaining stable prices despite changing market conditions throughout different cycles. In addition, these efforts help build confidence among businesses looking to expand operations while allowing consumers to feel secure when making purchasing decisions knowing their money will have purchasing power over time with minimal fluctuations overall due largely thanks to this committee’s efforts towards promoting both sustainable growth and financial stability across our nation’s markets today.

Why is FOMC meeting important for traders?

The FOMC (Federal Open Market Committee) is an important day on every trader’s economic calendar. This meeting is conducted eight times yearly, and all the traders must prepare for it. In the subsequent paragraphs, we will explain how to trade FOMC.

The essential gauges of the United States economy’s future, the FOMC meeting can produce a significant market movement before and after it happens.

How often does FOMC meet?

FOMC holds eight regularly scheduled meetings during the year, around one about every six weeks, and other meetings as needed.

Therefore, the question is how to take advantage of this meeting and use it as an integral part of your trading policy. Your initial step will be to be fully aware of what is at stake in the meeting and what opportunities can be generated from the conference.

We have assembled all this information in the subsequent paragraphs to help you plan for the future.

What Is Going To Take Place In The FOMC Meeting?

As many as seven governors of the board are going to participate in every FOMC meeting, and 5 Federal Reserve Bank presidents will discuss and decide on the economic United States’ monetary policy mainly two purposes for this meeting: one will be to review the present financial information, and the other will be to decide what type of intervention will be required.

The committee’s decision will consider vast information, including fixed investment, household expenditure, employment growth, and inflation. Although the meeting will be held privately, significant findings will be declared immediately after completing the press conference meeting.

Three weeks following the completion of the meeting, the minutes will be published in full. The conference intends to stabilize the United States economy by increasing or diminishing interest rates.

The committee members can use much financial information to evaluate whether they would like to drive or slow down inflation regarding the supply of money and the target inflation rate of 2%.

It is a fact that the FOMC happens to be a significant indicator of the US’s economic health. The traders can use the committee’s decision to provide a broader context for their trading techniques. The decision of the FOMC can impact these particular trading instruments directly. For example, the FOMC and the Nonfarm Payrolls Report help to indicate the present condition of the United States economy. Traders might use the committee’s decision to provide a broad context for their marketing policies. The decision made by the FOMC directly impacts some trading instruments, which are as follows:

Dollar: If the FOMC decides to enhance the interest rate, demand might increase, and the dollar’s value will likely increase. Demand can increase if the FOMC chooses to improve the interest rates, and the dollar’s value might also increase.

- Gold: If the dollar becomes vital because of higher interest rates, it might decrease gold’s value. The traders can flock to gold if the meeting result shows a negative outlook for the US economy since it will be visualized as a stable asset that can hold its value during a turbulent period.

- Indices: The share prices can go down in the event of any increase in interest rates, which implies that the US indices are subject to movements because of speculation.

- Bonds: An overall bond fall might be due to enhanced interest rates. The US economy is the biggest economy on the planet, and therefore it is possible to feel the repercussions of the decision of the meeting globally.

Traders worldwide will focus on the decision, which will indicate the economic trends throughout the world and understand how other central banks can adjust their inflation policy.

Potential opportunities for trading can be opened up by this volatility surrounding the decision of the FOMC. In particular, their strategy might be adopted by the day traders to optimize the shifts that take place before and after the conference.

It is common to have speculation several weeks before the announcement, implying that the markets might be prepared for any outcome. However, it is essential for those who like to stick to long-term trading patterns to keep in mind that the decision of the FOMC might take a significant amount of time to influence the economy fully.

It might be possible for the traders to optimize the movements irrespective of the result by figuring out a trading technique that accounts for each meeting.

Swing FOMC Trading Strategy

To make a trade after the FOMC announcement, traders can prepare two possible scenarios (US dollar bearish and US dollar bullish scenario). If the US dollar is bullish, traders can trade a strong US dollar and a weak currency.

Please see my video from the fxigor youtube channel that describes FOMC Trading Strategy:

- Strong Currency: When a currency is “strong,” it’s worth more than other currencies. For example, if the U.S. dollar is strong, you get more foreign currency (like the Euro) for each dollar you exchange. This might happen if the U.S. economy is doing well, interest rates are rising, or the demand for dollars is high on the international market.

- Weak Currency: When a currency is “weak,” it’s worth less than other currencies. For example, if the U.S. dollar is weak, you get fewer units of foreign currency for each dollar you exchange. This might happen if the U.S. economy is not doing well, interest rates are falling, or demand for dollars is low on the international market.

Now, let’s talk about currency trading strategies following FOMC announcements, considering the U.S. dollar can be a strong or weak currency:

- The expectation of a Stronger Dollar: Forex traders might expect the U.S. dollar to strengthen if the FOMC announces policies that suggest a more robust U.S. economy or higher interest rates (like quantitative tightening or interest rate hikes). In this case, they could employ a strategy of buying dollars and selling other currencies. This would be profitable if the dollar strengthened since they could sell it at a higher price.

- The expectation of a Weaker Dollar: If the FOMC announces policies that suggest a weaker U.S. economy or lower interest rates (like quantitative easing or interest rate cuts), forex traders might expect the U.S. dollar to weaken. In this case, they could employ a strategy of selling dollars and buying other currencies. This would be profitable if the dollar weakens since they could buy back the dollar at a lower price.

Day Trading FOMC Forex Strategy

Day trading FOMC forex strategy is based on news strategy trading where traders can enter the market 5 minutes after FOMC news or when the hourly candle is closed.

There are two strategies that I use to trade FOMC news :

1) 5 minutes strategy when FOMC news is unexpected and when I see a strong price move.

2) Hourly close strategy based on the overall trend and FOMC news.

Scenario 1: Strong Move FOMC Forex Strategy

If an unexpected FOMC decision causes substantial volatility, I trade after 5 minutes (5 minutes after the news). As you can see in the image, I will buy after five bullish candles close and stop loss to be low that 5-minute candle.

Scenario 2: Unclear move FOMC Forex Strategy

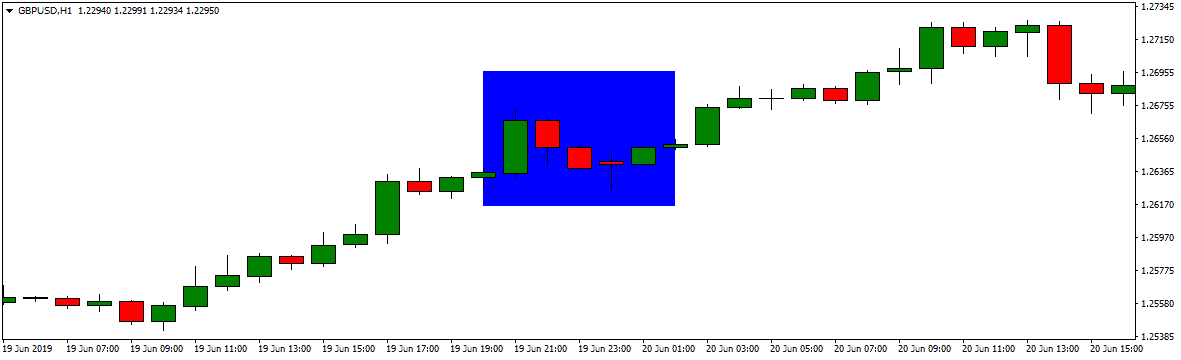

In this case, if there are no changes in interest rate, I do not trade using 5-minute charts and do not hurry in trading. Instead, I watch hourly close, then sell based on an overall trend and volatility. I follow the primary trend and want to see an increase in volatility.

Examples from the last FOMC decisions :

This chart shows a bullish trend and no changes in direction after the FOMC release. Therefore, I followed the primary trend and made a buy order after the FOMC decision.

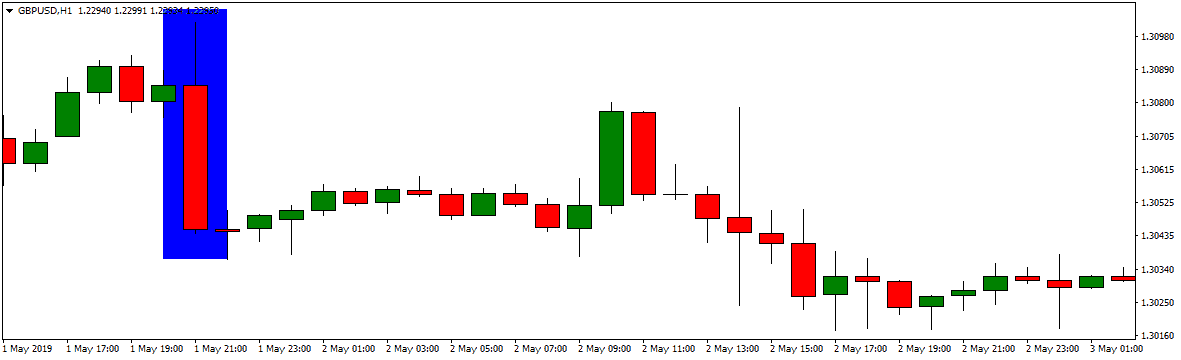

In May 2019. Federal Reserve officials agreed to “keep their benchmark interest rate unchanged at a target range of 2.25% to 2.5% and signaled comfort that their wait-and-see posture had steadied the economy after fears of a slowdown had sent markets reeling at the end of last year”.

USD started to be stronger, but there was no strong push below or above because the interest rate was unchanged. I waited hourly close to enter into trade. I made a SELL trade and put a stop loss on the price high just before the FOMC meeting.

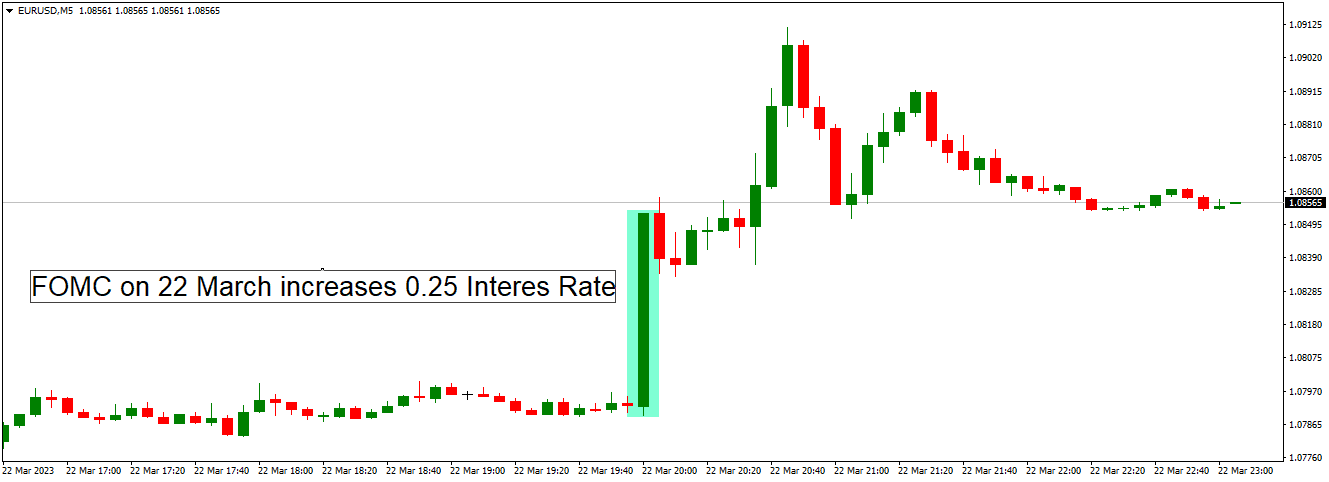

22. March 2023 Interest Rate Hike Strategy Example

On March 2023, FOMC decided to increase the 0.25 interest rate again. Based on the FED announcement, they suggest that the central bank’s hiking cycle is close to its end, which implies a bearish outcome for the U.S. dollar.

We can see 5 min. Bullish candle on the EURUSD chart after the announcement:

Discussion about FOMC forex strategy

FOMC Forex Strategy is a famous strategy forex traders use to capitalize on the news released by the Federal Open Market Committee (FOMC). This committee releases economic data on interest rates, quantitative easing, and other economic indicators directly impacting currency exchange rates. By understanding how these factors influence exchange rates, traders can create an effective trading strategy to capture profits in the forex market.

When FOMC news is unexpected, a 5-minute strategy may be employed when you trade FOMC trading news. Traders should quickly assess the information and determine its overall sentiment and direction. If it is seen that there will be significant price moves due to the news, then the trade should be executed quickly to capture profits in the volatile environment. The most important part of this strategy is anticipating the price’s direction before taking action.

In addition to a 5-minute strategy for reacting to unexpected FOMC news releases, a close hourly strategy can also be used as a longer-term trading approach. This technique involves waiting for the close of an hourly candle before entering into a position based on an overall assessment of market sentiment and available news from the FOMC. This allows traders additional time to analyze market conditions and make informed decisions about potential trades without reacting instantaneously.

When using either of these strategies for trading FOMC announcements, it’s essential to keep track of current events and understand how changes in interest rates or other economic factors may affect currency exchange rates. In addition, risk management techniques such as stop loss orders or trailing stops should consistently be implemented to protect against any unexpected losses due to unfavorable market conditions or otherwise unanticipated outcomes from FOMC announcements.

In conclusion, employing FOMC Forex Strategies can help traders take advantage of sudden movements in currency exchange rates due to Federal Open Market Committee announcements. Depending upon their level of experience, different strategies such as 5-minute reaction trades or hourly closing analysis may be used to maximize profits while managing risks appropriately. However, as with any investment activity, proper research and caution should always be taken when trading forex markets to ensure profitable returns with minimal losses over time.

Conclusion

The FOMC (Federal Open Market Committee) is essential in every business person’s financial calendar. This meeting, which occurs as many as eight times yearly, typically results in substantial market movements before and after the event. The question that might arise is how it will be possible to use this meeting as an integral part of your marketing policy. Below, we have mentioned all the essential steps to trade FOMC meetings effectively.

Throughout the world, traders will focus on the decision made by the FOMC as an indicator of global economic trends. In contrast, the inflation strategy adjustments made by the other central financial institutions will also be reflected.

The minutes will be published in full three weeks after the completion of the meeting. The FOMC will attempt to stabilize the economy by lowering or elevating the interest rates.