Table of Contents

When traders look at a Forex trading chart or any other security, they want to understand the trend and predict the price movement in a given period. There are many available indicators and technical tools that can help them get their answers about trading. The leading reason traders require these tools is to understand the market sentiment and trends.

A market trend is a direction in which the market is moving. Fundamentally, there are two trends; bullish and Bearish. These trends keep on changing based on the sentiments of the market and the traders. Also, the trading strategy of the traders changes as the trend changes. Thus, it becomes essential for traders to check on these changes.

Trends are recognized mainly by waves in the price movement. The upward and downward waves symbolize bullish and bearish trends. There are tools and indicators available for traders to understand these movements. These tools can even help them to predict the changes in trends well in advance. One such tool is the Elliott Wave Count Indicator.

Please read this article to understand what Elliott Wave Count Tool is and how traders use it while trading, using the MT4 platform.

Download Elliott Wave Indicator

DOWNLOAD ELLIOTT WAVE INDICATOR

What Is the Elliott Wave Count Indicator?

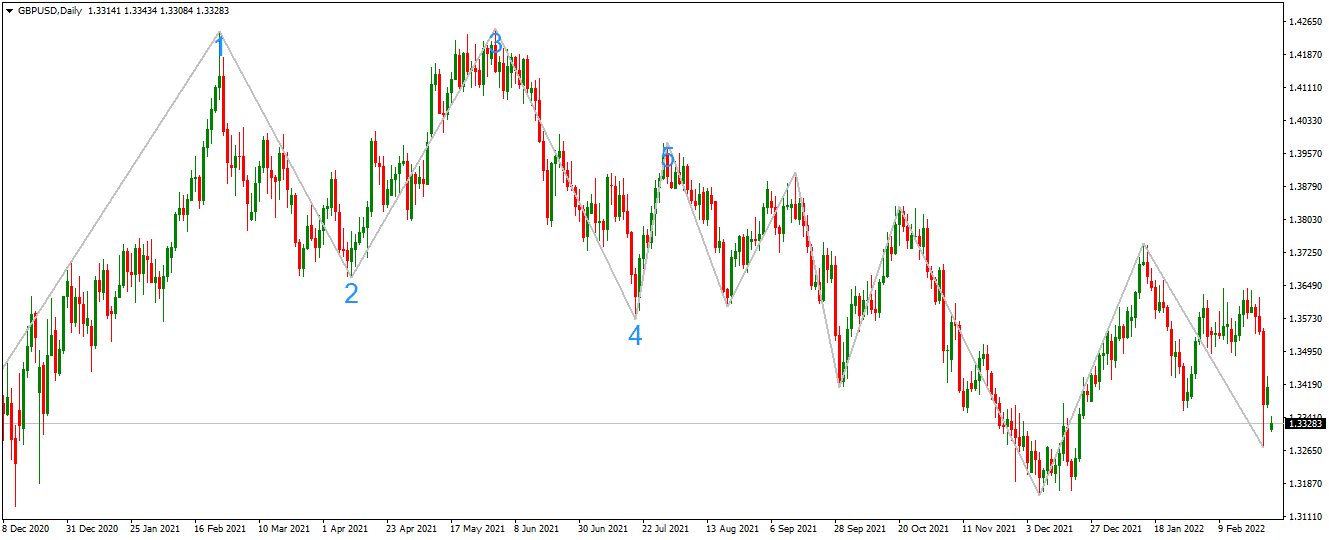

To understand the trend movements or determine if or when a trend gets replaced, traders watch the waves in the Forex price chart. The Elliott Wave Count Indicator uses the Elliott wave software to classify and count the waves on the MT4 terminal.

The Elliott wave theory states that traders can identify the cycle of market price movements by reading the movements of the waves in the price chart. These can easily be identified using the Elliott Wave Count Indicator while trading on the MT4. With the help of these wave counts, traders can quickly identify the market trend, if it’s Bullish or Bearish. This indicator also assists traders in determining the buying and selling points.

Its ability to automatically calculate and display the number of waves makes it suitable for both beginner and experienced traders. Moreover, it can be easily downloaded and applied to your MT4 terminal. However, it is advisable to use other indicators like the Fibonacci indicators and technical tools to support the Elliott Wave Count indicator results.

How To Trade Using the Elliott Wave Count Indicator?

Trading with the Elliott Wave Count Indicator is not complicated. You can apply it to your MT4 terminal and start using it. First, however, traders must possess the fundamental knowledge of trading: how to trade in each trend.

Applying the Elliott Wave Count Indicator to the price chart marks numbers on all the waves. Let’s take an example. If the wave starts with a bullish trend, the ideal is to take the buy position when the second wave ends. As per the technical strategy for trading forex, the first wave’s swing low is the best place to put the stop loss. On the contrary, if the wave starts with a bearish trend, the start of the third wave is ideal for taking the selling position. And the stop loss can be placed at the first wave’s swing high.

While using this indicator, it is advisable to ignore the waves that move opposite the current trend or market sentiment. Traders can take positions at the beginning of the ideal waves and hold these positions during the counter-trend waves.

As the Elliott Wave Count Indicator uses the principle of 5 waves, traders can recognize the swing low and swing high in these waves as resistance and support. Also, this indicator supports traders to trade in whichever time frame, whether it’s a multi-timeframe strategy or an intraday strategy.

Conclusion

The Elliott Wave Count Indicator is the best indicator to count waves using the MetaTrader platform. It simplifies the work for traders by calculating the waves and helping them determine the market trend and the positions to place the stop loss and take profit. However, it is advisable to apply the price action to verify the wave counts along with their start and endpoints.

Ideally, traders should not rely only on the wave count indicator, as there is always a need to confirm these waves and market trends to derive a trading strategy.