Table of Contents

The EUR/USD is one of the world’s most widely traded currency pairs, and the best time to trade it can depend on various factors, such as market volatility, liquidity, and economic events. Here are some insights into the best times to trade EUR/USD during the opening hours till noon GMT, and the US trading session overlaps with the London session.

EUR USD best trading hours

The best time to trade EUR/USD for momentum strategy (and trend strategy) is the period from EUR USD opening hours till GMT noon (London open till noon) and the period when the US trading session overlaps the London session (12.00 GMT – 16.00 GMT).

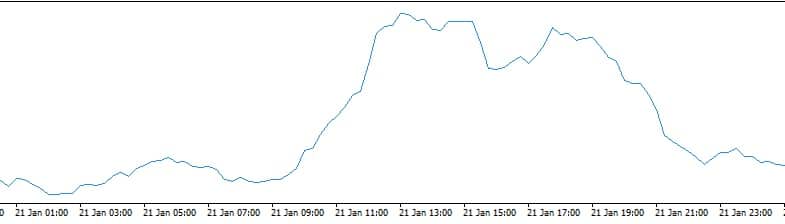

Below is typical EURUSD daily volatility:

Forex trading session times are presented in the table below:

| Session | Major Market | Hours (GMT) |

|---|---|---|

| Asian Session (GMT) | Tokyo | 11 p.m. to 8 a.m. (23:00 - 8:00) |

| European Session (London session forex time GMT) | London | 7 a.m. to 4 p.m. (7:00 - 16:00) |

| North American Session (US session) | New York | noon to 8 p.m. (12:00 - 20:00) |

Opening Hours till GMT Noon (London Open till Noon)

The European trading session, which begins with the opening of the London market at 8:00 a.m. GMT, is usually the most active and liquid session for trading the EUR/USD. During this time, market participants actively buy and sell the euro and the US dollar, which leads to increased volatility and trading opportunities.

The best time to trade the EUR/USD during this period is typically between 8:00 a.m. and 12:00 p.m. GMT, which is the time when the London and European markets overlap. This overlap creates a significant amount of liquidity in the market, which can lead to tighter spreads and more favorable trading conditions.

During this period, traders should also pay attention to economic releases and announcements, such as the European Central Bank (ECB) interest rate decision, which can significantly impact the EUR/USD exchange rate.

US Trading Session Overlap with London Session (12.00 GMT – 16.00 GMT)

The US trading session, which begins with opening the New York market at noon GMT, overlaps with the London trading session, leading to increased trading activity and liquidity.

The best time to trade the EUR/USD during this period is typically between 12:00 p.m. and 4:00 p.m. GMT, which is the time when the US and European markets overlap. During this period, traders can use the increased liquidity and volatility to execute trades with tighter spreads and better trading conditions.

Traders should also pay attention to economic releases and announcements during this period, such as the US Federal Reserve interest rate decision and non-farm payroll data, which can significantly impact the EUR/USD exchange rate.

In conclusion, the best time to trade EUR/USD during opening hours till noon GMT is between 8:00 a.m. and 12:00 p.m. GMT. The best time to trade during the US trading session overlaps with the London session, generally between 12:00 p.m. and 4:00 p.m. GMT. However, traders should also consider economic events and market conditions to make informed trading decisions.

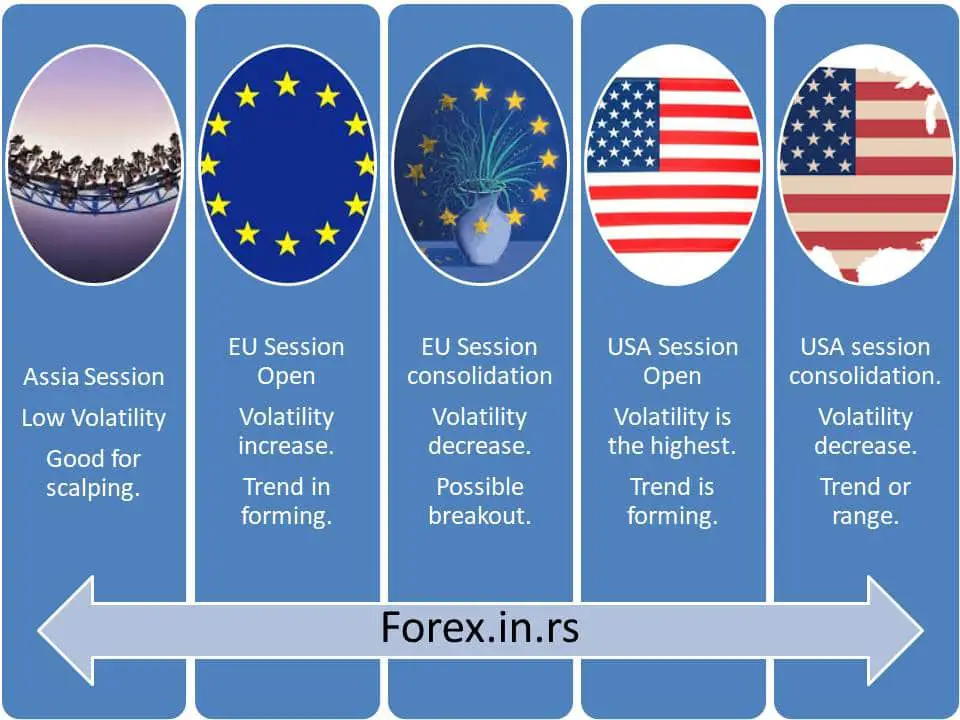

- Assia session: This is a low-volatility period. Suitable for scalping forex strategy.

- London session (forex time GMT): The EU or London session starts at 7.00 a.m. GMT and closes at 4.00 p.m. GMT (London and Germany stock exchange starts then). Volatility dramatically increases in that period. One hour after the EUR USD opening hours trend is formed, and volatility increased. Till noon, volatility and the movement should be in the same direction (this is the most common scenario but not the rule).

- EU session consolidation: this is the period from noon till the USA market opens in GMT. In this period are the most common breakouts or range periods.

- USA markets open – at 14.30 GMT, USA markets open. The trend is formed in this period, and the next several hours continue. This is USD trading time.

- USA session consolidation – this period starts from 18.00, and the volatility of the next several hours decreases until the USA market closes and the Asia session opens.

One of the main advantages of day trading in foreign exchange (forex) is that the trader can trade 24 hours a day. However, a trader is likely to make money only when there are many transactions in the forex pair he is trading. Therefore, many traders want to find the best time to trade forex GMT, especially for the famous EUR/USD forex pair.

During these hours, the forex pair should be volatile enough to generate more profit than the commission or spread, which has to be paid to the broker. Since working long hours can reduce efficiency, the traders will usually determine when the forex pair will fluctuate most and then trade only during these three to four-hour periods.

London session forex pairs

Most liquid London session forex pairs are presented below, and their average daily pip movement:

| Major forex pairs | Forex average daily range in pips |

|---|---|

| EUR/CHF | 35 |

| NZD/USD | 39 |

| USD/JPY | 41 |

| EUR/USD | 44 |

| USD/CHF | 44 |

| EUR/GBP | 50 |

| EUR/JPY | 55 |

| USD/CAD | 56 |

| GBP/USD | 82 |

| GBP/JPY | 94 |

| Average pip movement | 54 |

Market timings, EUR/USD price Volatility, and EUR USD intraday strategy

During the week, the forex market is open 24 hours a day since time zone differences ensure that a global market is always open. However, traders should know that the forex pairs traded in each market will differ. Hence, the peak time for the activity for each forex pair will be different. For example, when the European forex markets are open, forex pairs with the British Pound (GBP) or euro (EUR) are traded extensively.

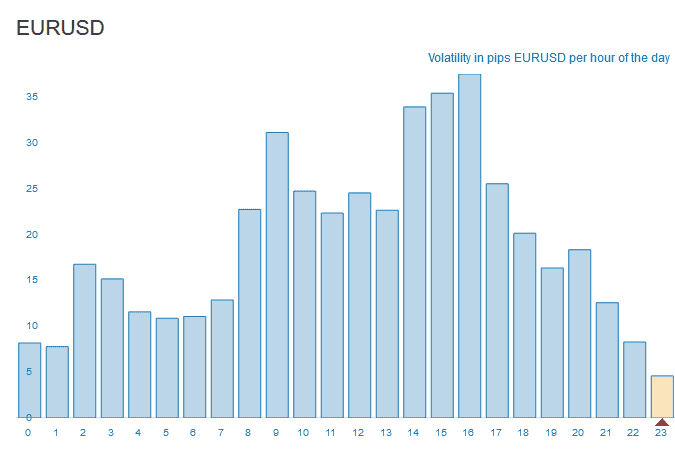

See EURUSD pips per hour statistics:

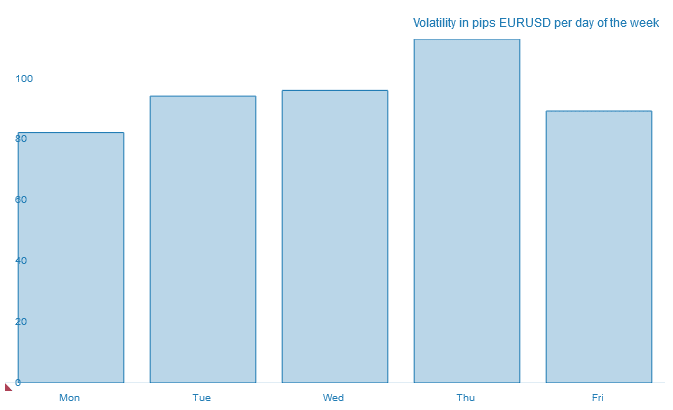

EURUSD volatility during the week:

Acceptable timing for day trading in EUR/USD

Volatility charts show the EUR/USD pair’s pip movement for different hours of the day in GMT. It is observed that the pip movement will increase significantly starting from 0700 hours daily and continue to remain higher to 20.00 hours. The pip movement for each hour then reduces significantly, so there is less volatility, which the traders can profit from. Hence, day traders should place their orders between 0700 and 2000 hours GMT. If they trade outside these hours, the pip movement is usually insufficient to compensate for the broker commissions. Though the forex market volatility varies daily, the times when the markets are most volatile do not change. In some areas, daylight saving time may affect forex traders’ trading hours.

The best time frame to trade EURUSD

The best time to trade EURUSD is 4 hours, and the Daily chart time frame. However, the small volatility makes EURUSD unsuitable for overtrading and trade using small time frames such as a 5-minute chart. Though a forex trader can start trading in the 13 hours starting from 0700 hours GMT, most people have a busy schedule and cannot spend all their time in forex trading. Hence, the forex traders want to determine when the market is most active. According to statistical data, the market is most volatile when the London and New York forex markets are open for three hours between 1300 and 1600 hours GMT. Since the number of forex trades in both markets is high, the spreads are the lowest, making it easier for a forex trader to make a profit since he has to pay lower commissions. Also, the forex market’s volatility is highest during this period, making it easier for a day trader to profit.

The best time interval for day trading

Trend traders must trade when the EU session opens and when the EU and USA sessions overlap. Breakout traders must wait for important news or periods when the trend consolidates. Finally, scalpers can use Asia session small volatility to make better profits. Of course, all these tips are not rules, and different strategies and trading habits can give various outcomes.