Table of Contents

If you think from the title that the most exotic forex pair means the lucrative pair, you are partially correct because just as they are lucrative, they are riskier. Forex trading always involves risk, but how much to take depends on the trader. This article will help you understand the nature of the most liquid and exotic pairs and how you can trade them.

Exotic Forex Pairs

There are various currency pairs (forex is traded in pairs). Some are the major ones that are easily traded, while the minor ones may take time to execute.

Exotic currency pairs are quotations that consist of one major currency (USD, EUR, GBP, JPY, etc.) and one currency from a developing country (SEK, TRY, ZAR, HUF, MXN, etc.). Exotic currency pairs are less liquid than major currency pairs and usually more volatile than major fx pairs in the foreign exchange market. Examples of exotic currency pairs are USDSEK, USDNOK, EURSEK, EURNOK, GBPSEK, GBPNOK, USDMXN, EURMXN, USDZAR, EURZAR, etc.

Please watch this video about volatile forex pairs:

Talking about the exotic pair, any pair that is not major or minor can be considered exotic. When we refer to exotic pairs, it is more about how popular the pair is and not how developed or advanced it is. Also, being exotic doesn’t mean that the current is valued poorly, and it doesn’t matter whether the currency pair is minor or major. In the end, how much volume is traded by the traders makes a current pair exotic.

Forex trading is a popular investment option for many traders, but knowing which currency pairs to focus on is challenging. There are two main categories of currency pairs: major and exotic. Major forex pairs are the most widely traded currencies due to their high liquidity, meaning they have higher trading volumes and tighter spreads.

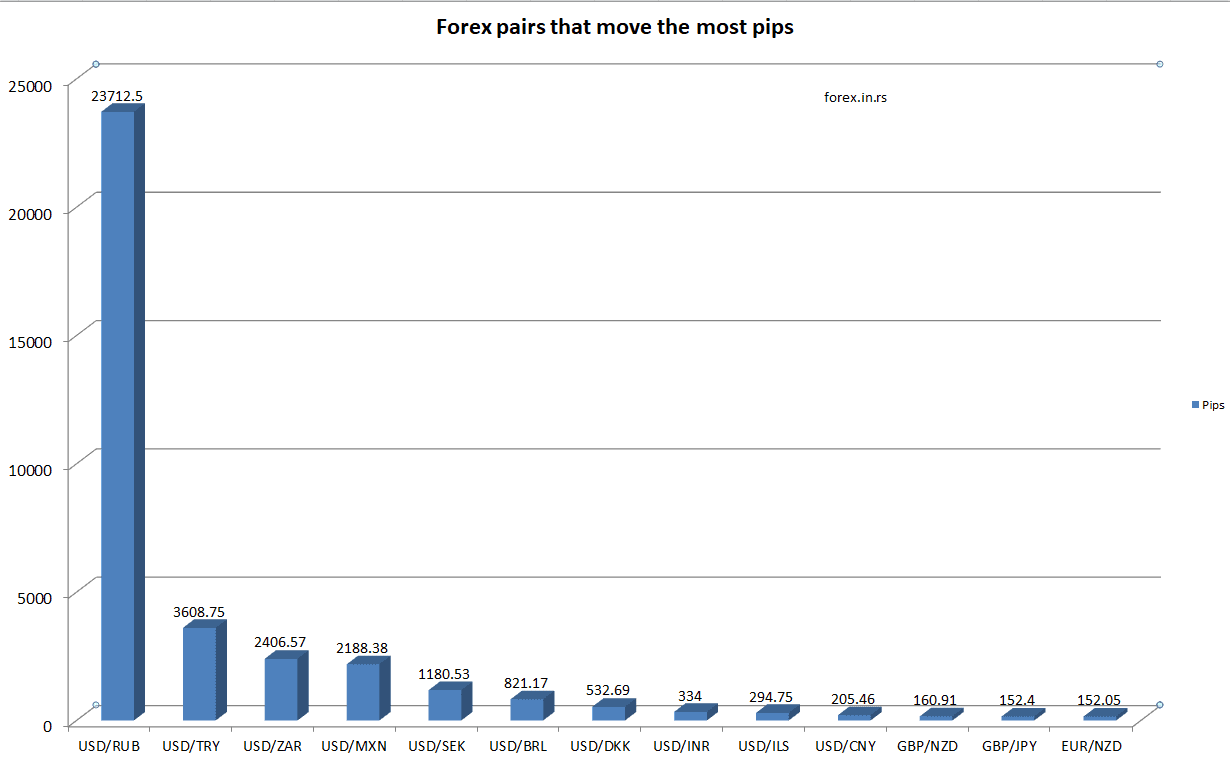

Please check the below chart with forex pairs (some exotic) that move the most pips:

Because of the higher liquidity level, the seven major currency pairs that make up nearly 80% of all forex trades tend to be less volatile than other pairs. They are:

- EUR/USD

- USD/JPY

- GBP/USD

- AUD/USD

- NZD/USD

- USD/CHF

- USD/CAD.

Exotic forex pairs consist of a primary currency paired with one from an emerging or smaller economy. These usually carry more risk and higher transaction costs due to their low liquidity. Exotic currencies are not as widely traded as major currencies, so their prices can be more volatile than major currency pairs. Some examples of exotic currency pairs include EUR/TRY (Turkish lira), USD/SGD (Singapore dollar), and GBP/NOK (Norwegian krone).

One key difference between these two types of currency pairs is volatility. Major forex pairs tend to be much less volatile than exotic currency pairs due to their higher liquidity levels. This means that when trading these currencies, you may face less risk when compared to trading an exotic pair with considerably lower liquidity levels.

Another difference between the two types is the transaction costs associated with each pair type. Because major forex pairs have higher liquidity levels, they generally have tighter spreads, leading to lower transaction costs for traders than exotic pairs, which typically have wider spreads, resulting in higher transaction costs for traders who wish to trade them.

Finally, there’s also the availability issue regarding these two types of currency pairs. At the same time, most brokers offer access to all major forex pairs; some may not provide access or offer limited access to exotic pairs. Thus further restricting accessibility for traders looking for exposure in this area.

As a trader, you can trade any pairs you want if you are sure and intelligent enough to trade them. Exotic pairs are highly volatile, which can also help you earn more. But it can also be the reverse if you are a novice.

Volatility is the term used to state how frequent the price changes are. High volatility is always significant for day trading, and in forex trading, it is valued too. The reason is simply that if the currency price doesn’t change, a trader would not sell and make a profit.

If you want to jump into this fascinating ocean of the most liquid and exotic pairs, we suggest you first trade in the most popular exotic pairs.

What are The Best Exotic Forex Pairs to Trade?

Liquidity means the pace at which transactions occur for an asset. If the transaction occurs frequently, the liquidity will be high as you will find a match to buy or sell the currency at your preferred rate quickly.

However, in exotic pairs, liquidity is less, as finding a trader matching your preferred prices can be challenging. Meanwhile, in major and minor currency pairs, transactions are of large volume, making them easy to trade.

The best exotic forex pairs to trade are the most liquid, such as USDSEK, USDNOK, USDMXN, GBPSEK, USDZAR, MXNJPY, and GBPTRY. During long trends, these exotic pairs have high volatility, average spreads, and often potential profitability. However, you must control your risk because exotic pairs can make strong movements and burn your account.

Suppose you want to analyze exotic currency pairs. In that case, you can go to TradingView forex screener, set the filter to exotic currency pairs, and add volume and technical trend indicators on the screen.

The best exotic currency pairs are the FX pairs with strong bullish or bearish trend potential in the current trading period. If traders see a clear trend direction and increased volatility, there are opportunities for a trend-following system for that exotic currency pair.

The easiest way is to have the American dollar as one of the currencies. If you look at the price charts of exotic pairs having the US dollar, you will notice identical price patterns, making it easy for traders to gain profit. The US dollar is a strong currency and dominates the changes occurring in other currencies. So, if you have good analytical skills and an understanding of the US dollar, you can also overwhelm your trades.

Compared to the US dollar, other currencies like the British pound are hard to predict, but still, it depends on the trader to trader.

It is also true that exotic pairs are highly associated with technical analysis. So, if you are a pro in technical analysis, it becomes much easier for you to analyze the breakouts and enter the market at the right time.

Risk Involved in Exotic Pairs

Exotic currency pairs highly depend on factors such as interest rates, the country’s economy solid-wise, direct investment from foreign, and many more. The first step you should consider before entering exotic pairs is understanding the risk involved. You can do so by understanding the relations between those two countries and how they affect each other.

Most traders from developing countries are trading exotic pairs. That gives them an upper hand in knowing the nation’s economy and how it would affect trading.

Many currency pairs are volatile and riskier to trade than other major or minor forex pairs. Also, exotic pairs are less liquid than major and minor ones.

Brokers Matter for Trading in Exotic Pairs

Before trading any exotic pair, you must check with your broker for their services. Many brokers charge high for trading exotic pairs, while many only offer major and minor pairs.

It is also a risky investment for brokers to provide exotic pairs, so they charge higher for them to make a profit in the end. A few brokers also prefer their traders to have a prominent position to balance it for lower pip value.

On the other hand, many brokers suggest that a little more extended trade would benefit more – it can be a swing trade or a carry trade. As a trader, you should know that you will need wider spreads in exotic forex trading, increasing your risk, fees, and capital requirements to enter the trade.

The Big Mistake – Lack of knowledge

As a trader of exotic pairs, the biggest mistake you can make is to ignore the risk involved.

Many exotic pairs are from economies you may not know of, and staying updated with the news becomes crucial.

Political ties and changes also affect nations, so you must be aware of that. Such changes can often create substantial price fluctuations, affecting the forex market.

You also need to have risk management in place. Like, most brokers trade an exotic currency for a major currency to reduce the risk. That is also the brokers’ option; brokers rarely offer two exotic currencies in a pair. As a result, you may notice a currency of developing nations trading against the developed nation’s currencies.

Being a trader, you can try it and decide what prefers you the best.

Stick to Major and Minor Currencies as a Novice

Exotic pairs are fascinating, but you should stick to the major and minor currencies if you are new to this field. They have smaller spreads and require less margin while giving higher leverage; it makes it safer.

The volatility is also very high in exotic pairs, which can scare traders from entering the market. Ultimately, you should be able to make consistent profits rather than making big profits casually. If you stay in the market, you can turn things in your favor in the long run.

As a beginner trader, you are advised to stay aware and updated with the news and information available in the market to make informed decisions based on your analysis and sustain yourself in this arena.

Several strategies can be applied to trading exotic currencies. The top three systems that traders use for exotic currencies are mentioned below. These strategies have been very beneficial to many traders.

Trend trading exotic pairs

Trend trading encompasses a procedure that involves studying the market trend very precisely. On identifying the exotic currency trend, you can opt to go for long or short, which entirely depends on the direction, whether it is bullish or bearish.

Trend trading is a technical analysis that is ascertained after studying the market trend. Though it is not a fundamental analysis, it is still an excellent way to build strategies for trading exotic currencies.

Based on scientific research (On Optimising Risk Exposures with Trend-Following Strategies in Currency Overlay Portfolios), exotic pairs tend to have longer trends. Trend following and carry trade strategies on emerging and developed currencies, where findings reveal trend-following rules to work better for emerging market currencies.

Another science research paper (Do exotic currencies improve the risk-adjusted performance of dynamic currency overlays?) points out that a more significant gain potential is available from exotic currency hedging using trend-following techniques than with major currency pairs to the US dollar.

Top Points to Remember

For your reference, here are the top points for you.

- Any pair that is not a major or minor forex pair can be referred to as an exotic forex pair.

- Exotic pairs are more predictable than major or minor pairs, giving trades who can read between the advantages of the line.

- There is not much information and research available in the market for exotic pairs; there are also language barriers as most exotic pairs are from nations with English as a first language.

- It would help if you were updated with the events in exotic nations to know the expected changes in exotic pairs.

- As a beginner trader, you should trade in major or minor pairs rather than exotic pairs, as they are less risky.