Table of Contents

In economics, arbitrage refers to the practice of taking advantage of the price difference between two or more markets. It is a little different in trading. It is a tool that helps retail traders take advantage of the market inefficiencies that may occur now and then. Arbitrage means concurrently selling and buying the same type of securities, for example, currencies, to profit from their market price differences.

Arbitrage involves exploiting price discrepancies in different markets or financial instruments to lock in a profit without risk. Theoretically, these discrepancies shouldn’t exist in an efficient market, as prices would adjust rapidly. However, temporary inefficiencies can emerge due to factors like information lags, market frictions, or regulatory constraints.

What is Interest Rate Swaps?

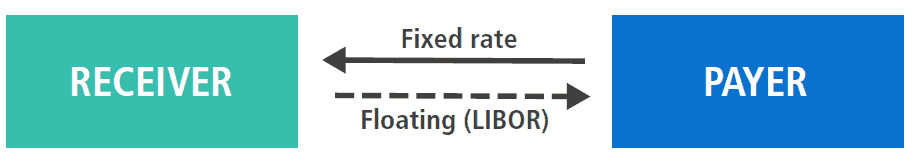

An interest rate swap is a derivative contract between two parties agreeing to exchange one stream of interest payments for another based on a specified principal amount (notional principal). The most common IRS involves a party paying a fixed interest rate and receiving a floating rate, usually based on the London Interbank Offered Rate (LIBOR) or another benchmark rate.

Motivations for Interest Rate Swaps:

Entities might engage in swaps for various reasons, including:

- Hedging against adverse interest rate movements.

- Speculating on interest rate movements.

- Managing funding costs and liabilities.

Interest Rate Swap Arbitrage Strategy

The basic idea behind IRS arbitrage is to exploit discrepancies between:

- a. The interest rate swap curve.

- b. The government bond yield curve or another benchmark curve.

Suppose an arbitrageur identifies a discrepancy between the IRS and government bond yield curves. In that case, they can enter into swap contracts and take opposing positions in government bonds to realize a profit.

Steps involved:

- Identification of Discrepancy: Recognize a situation where the swap spread (the difference between the fixed swap rate and the yield on a government bond of the same maturity) appears mispriced.

- Engage in Swaps: If the fixed rate on the swap is less than the yield on a government bond, the arbitrageur might receive the fixed rate in a swap and pay the floating rate.

- Take Opposite Positions in Bonds: Simultaneously, the arbitrageur would short-sell government bonds, essentially locking in the higher fixed yield from the bond.

- Reap Benefits: The arbitrageur benefits from the difference between the two rates (swap and bond rates).

- Unwind Positions: The arbitrageur can unwind their positions when the discrepancy closes or the swap matures.

Let us see one practical example of interest rate swaps arbitrage:

Scenario:

- Market Observation:

- A 5-year U.S. Treasury bond is yielding 3%.

- A 5-year USD interest rate swap offers a fixed rate of 2.8% against LIBOR.

- The current 5-year LIBOR is 2.5% and is expected to remain relatively stable.

- Identification of Discrepancy:

- There’s a 0.2% discrepancy between the U.S. Treasury bond yield and the interest rate swap fixed rate.

Steps for Arbitrage:

- Engage in an Interest Rate Swap:

- Enter into a 5-year USD interest rate swap agreement where you pay LIBOR (2.5%) and receive a fixed rate of 2.8%.

- Take a Position in U.S. Treasury Bonds:

- Simultaneously, sell short U.S. Treasury bonds worth a notional amount equal to the swap. By doing this, you lock in the higher yield of 3% from the bond.

- Arbitrage Profit:

- For every period (let’s assume annual payments for simplicity):

- You’ll receive a fixed 2.8% from the swap agreement and pay the floating LIBOR of 2.5%, netting 0.3%.

- You’ll pay 3% on the shorted Treasury bonds.

- Your net cost is 3% – 0.3% = 2.7%, which is still lower than the 2.8% you receive from the swap. Thus, your net profit is 0.1% annually.

- For every period (let’s assume annual payments for simplicity):

- Unwind the Positions:

- At the end of the 5-year term, or if the discrepancy disappears earlier, close out the swap and buy back the shorted Treasury bonds.

Potential Risks & Complications:

- LIBOR Movement:

- If LIBOR significantly increases, the cost of the floating payments you make might exceed the fixed 2.8% you receive from the swap.

- Liquidity & Market Risks:

- The U.S. Treasury bond market is very liquid, but selling short can have associated costs and risks. There could be a lack of available bonds to short or increased shorting fees.

- Operational Risks:

- Mistakes in executing the trades or an unexpected market event could impact the strategy.

- Counterparty Risks:

- The entity on the other side of the swap could default.

- Basis Risk:

- The difference between the reference rate (LIBOR in this example) in the swap agreement and the rate you might be paying elsewhere could vary.

Swaps and Arbitrage

Swaps refer to the opportunity that a trader takes by buying and selling forex and making a profit from the difference in interest rates associated with the two currencies. The difference between the interest rates of both countries ( of the forex pair) decides if the trader will make a profit or lose. When the trader exchanges the currency with a high-interest rate with the currency with a low-interest rate, he is on the positive side, i.e., he makes a profit. However, if the trader is inefficient enough to understand the situation and does the opposite, he may incur losses.

But the above situation is possible only when the trader can trade in forex without paying swap rates. Swap rates are the difference between the interest rate of the currencies being traded that the trader has to pay. This interest rate swap arbitrage can be exempted if the trader finds a broker to help him open a swap-free trading account.

If we consider this case, a retail trader will end up with a swap-paying account indebted with a net market loss and a swap-free account with a net profit. If the trader wishes to re-open any position, they must transfer money between the above-stated accounts and pay a transfer cost on the transactions. You can take advantage of this strategy when the currency pair is volatile.

Interest Rate Swap (IRS) arbitrage is a financial strategy that exploits discrepancies or inefficiencies in interest rate swap markets to realize a risk-free profit. Before diving deep into IRS arbitrage, it’s crucial to understand the basics of interest rate swaps and the typical reasons market participants enter into these contracts.

Interest Rate Arbitrage Swap Risks & Limitations

While IRS arbitrage might appear risk-free, there are potential pitfalls:

- Liquidity Risk: An arbitrageur might struggle to enter or exit positions due to insufficient market depth.

- Operational Risk: Mistakes or unexpected events in executing trades can result in unexpected losses.

- Counterparty Risk: The party on the other side of the swap might default.

- Basis Risk: The floating rate in the swap might not match the actual floating rate the arbitrageur receives.

Conclusion

IRS arbitrage can present sophisticated investors with profit opportunities, but these opportunities might be fleeting and come with risks. With the advent of technology and high-speed trading, many of these inefficiencies are identified and rectified quickly, leaving only brief windows for arbitrageurs. Still, those who can efficiently spot and act on these discrepancies can generate profit in an otherwise efficient market landscape.