We know that the best time to trade in stocks is around the opening and closing hours because the market is the most volatile. Most traders avoid the lunch hour as the trades take longer to complete. But what do we know about the forex trade market? What is the best time frame to trade forex? Is there even a time frame for it?

Many traders, especially the novice ones, often ponder this. Former stock traders ask this question and are accustomed to the time frame of day trading in stocks. In the forex, unfortunately, there is no magical trading time. This market sees movement for 24 hours. The important thing here is to focus on the strategy and style rather than a set period. We will tell you why.

The forex market is a play of currency pairs. Every trader has to choose a currency pair like AUD/JPY and EUR/USD. The first currency, AUD and EUR, is the base currency, and the second, JPY and USD, is the quote or counter currency. Every currency pair has a different volatile time frame. Every time frame is essential in the forex market. There are two standard time frames: long-term time frame and short-term time frame. These time frames are transmitted through trends and trigger charts. Trend charts are for long-term frames. They guide the traders in recognizing the trend. Trigger charts are for short-term frames as they show the traders the entry points for a trade.

What is the Best Time Frame to Trade Forex?

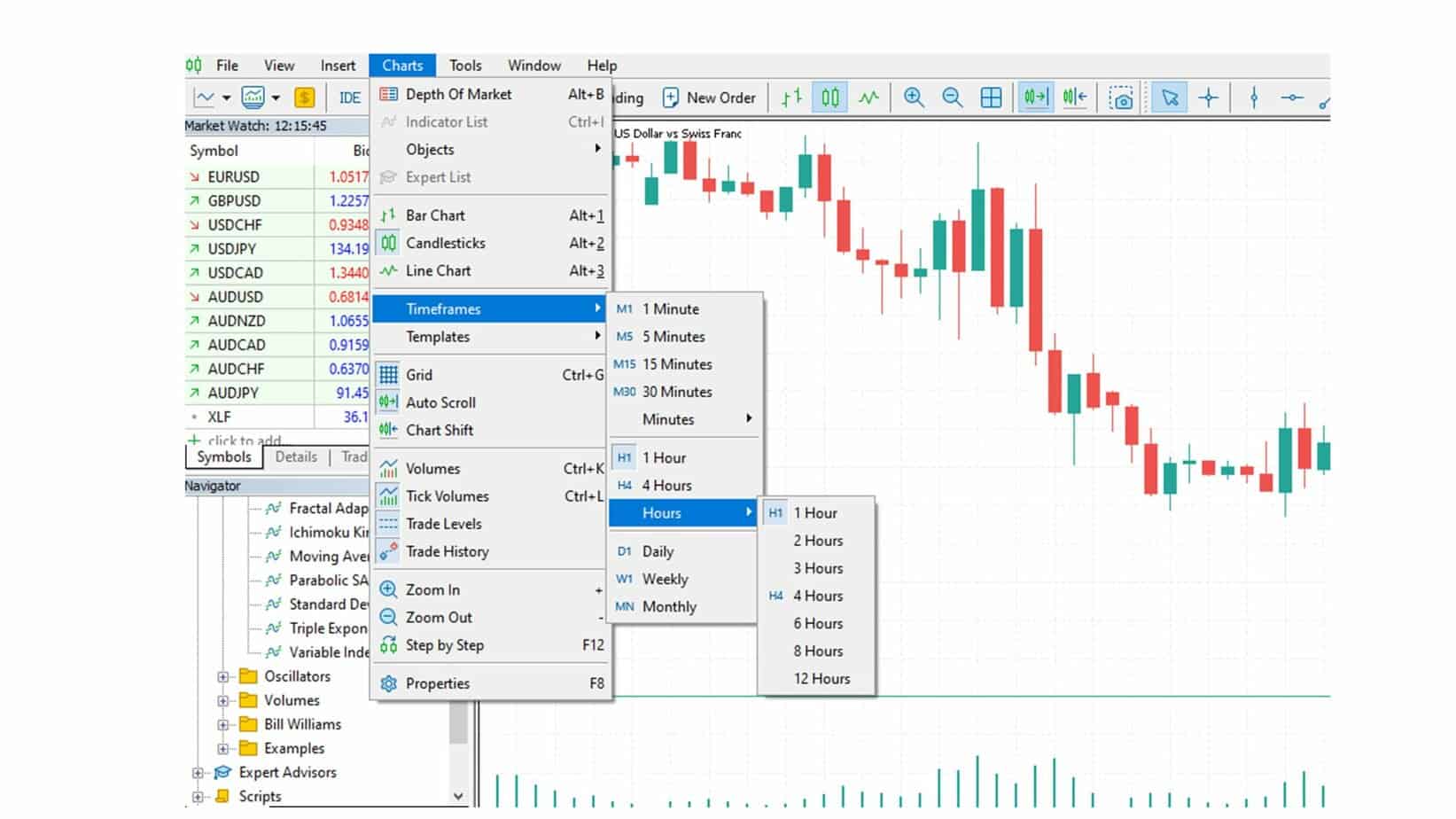

The best time frame for day trading is a 30-minute chart. For swing trading, traders usually use a 4-hour chart time frame or daily chart. The best time frame for positional trading is usually weekly and monthly.

- Day Trading:

- Preferred Time Frame: 30-minute chart.

- Reason: Provides a good balance between short-term market movements and larger trend patterns.

- Benefit: Allows traders to capture significant price movements within a single trading day.

- Swing Trading:

- Preferred Time Frames: 4-hour and daily charts.

- Reason: These time frames help identify medium-term trends and reversals.

- Benefit: Offers a broader view of the market, suitable for holding positions for several days or weeks.

- Positional Trading:

- Preferred Time Frames: Weekly and monthly charts.

- Reason: Used for identifying long-term trends and broader market directions.

- Benefit: Ideal for traders looking to hold positions for several weeks, months, or even years, focusing on substantial market moves.

Each time frame aligns with a specific trading approach and goals, reflecting the differing needs of day traders, swing traders, and positional traders in the Forex market.

If you are looking for entry points, you can take advantage of the trigger chart by spending 5-60 minutes on it for day trading. It takes 2-4 hours to determine entry points in swing trading. You should check the trigger chart daily if you are holding a position.

Prominent Time Frames for Forex Trading

Prominent time frames for forex trading depend significantly on the strategy and the trader’s position. Here is how different trading styles work:

Time frames for position trading

Many traders wonder what the best time frame for positional trading is. The answer is not very straightforward. As we explained above, it depends on the position that you are holding. If you hold a long-term position, this time frame could be as small as a day to as considerable as a year!

As the long-term position is time-consuming, many traders tend to avoid this approach, especially the new ones. The alternative is a short-term position, which is by no means more accessible. The short-term approach is tricker, and traders are likelier to make mistakes. You have to invest much time in curating a viable trade strategy.

As it is said, ‘good things come to those who wait.’

If you take the long-term approach, the monthly charts will give you the grading trends, while the weekly charts will tell you the trading points. Once you have determined the trend, you can look for trade entry options using the weekly charts. You can also use price action to determine the possible trade entry points.

Time frames for swing trading

The long-term approach may be time-consuming, but it is better if you master that first before moving to the swing trade. It follows a slightly shorter approach. One must be aware that shorter terms have more variability. You must address the money and risk management before operating within a shorter time frame.

Swing trade will help you to scale down the timeframe as it is neither long-term nor short-term. As traders can enjoy both worlds’ benefits, swing trading is one of the most popular approaches in the forex trading market.

The best time frame for swing trading is a 4-hour chart time frame or daily chart.

Swing traders don’t have to keep an eye on the market incessantly, which is impossible with the short-term position. They can check the chart a couple of times a day to see if there is any new trend in the market. They place the trade with a stop attached when they encounter any opportunity. They check the progress of the trade by monitoring it later on. The traders are still looking at the charts more frequently than in a long-term position. This way, the chances of missing an opportunity are minimal.

For example, swing traders use two charts – the daily chart to determine the trends or the general direction of the market and the four-hour chart to find the entry positions and placing positions. The daily chart depicts the daily highs and lows. Traders generally swing back in the direction of the preceding trade. Once the trader has used the daily chart to identify the trade direction, he will switch to the four-hour chart to find entry points. The trader will enter the trade once the candle closes or prices break above the designated resistance.

Time frames for day trading

Day trading is prevalent in stocks where the periods of volatility are somewhat defined. However, it is one of the most challenging approaches in the forex. This is not the turf for new traders, as one has to develop a new trading strategy frequently. Forex day traders have to continuously re-invent their trading decisions. If you are not accustomed to it, you will have huge losses. This is why new traders are advised to follow the approaches mentioned above.

So, what is the best time frame for intraday trading?

The best timeframe for intraday trading is 30 30-minute chart because this timeframe can track one-day price moves and present them best.

Since the time frame is short, the stops are tighter. If you are new to forex trading, get comfortable with the long-term and swing trading approach before moving to shorter timeframes.

Day traders can use hourly charts to find entry opportunities. This is done using the ‘minute’ time frames like one, five, or ten-minute time frames. It entirely depends on their trading strategy. The one-minute time frame is difficult to handle as its variability can be highly random, making it challenging to work with.

After determining the trend, traders can use technical indicators, price action, or other triggers to initiate a position.