Table of Contents

Trading forex is a dynamic and potentially lucrative activity. However, for many individual traders and trading professionals, managing multiple accounts across different brokers has become essential to their operations. This has been driven by various reasons, such as risk diversification, access to different trading instruments, making the most of broker-specific offers, or even participation in trader funding programs.

Trading in multiple accounts can be particularly beneficial for traders in funded programs. These programs, offered by proprietary trading firms or ‘prop shops,’ provide traders access to the firm’s capital. By managing multiple accounts, traders can leverage their expertise across different funding programs, increasing their earning potential while minimizing their capital risk.

However, managing multiple accounts manually can be a complex and time-consuming task. Thankfully, technology in the form of trade copier software has emerged as a solution to manage multiple accounts effectively and efficiently. This allows trades to be replicated across accounts, ensuring consistency and minimizing the workload for the trader. As such, these technologies are becoming an increasingly essential tool in the modern forex trading landscape.

How to Copy and Paste Forex Signals?

Traders can copy trading signals from the master platform and execute on the slave platform using cloud-based online services or scripts on Virtual Private Servers. Cloud-based services, such as Duplikium Trade Copier, charge as pay per account or by the number of copied trades.

This article will present the top two script-based and cloud-based copiers.

Comparing both Forex trade copier solutions depends on several factors, including your trading style, budget, technological capability, and preference for customization or convenience.

Here’s a comparison of the two scenarios you described:

Script-Based Forex Trade Copiers

The least expensive solution to copy trading signals is to follow these steps:

- Pay $5 up to $10 for a Virtual Private Server (VPS): A VPS is a remote server that allows you to run your trading platforms and strategies 24/7 without the need to keep your computer on all the time. VPS services are often affordable and reliable.

- Install two MT4 platforms on the VPS (or MT5 ): After getting the VPS, you can install two instances of the MetaTrader 4 (MT4) trading platform. One instance will serve as the master account and the other as the slave account.

- Add Master and slave scripts: Once the MT4 platforms are set up, you must install scripts on both platforms. The master script will send out trading signals from the master account, and the slave script will receive and execute those signals on the slave account.

- Copy signals: With the master and slave accounts scripts in place, the trading signals generated on the master account will be automatically replicated and executed on the slave account. This enables the slave account to mirror the trades of the master account in real-time.

Following these steps, you can create a simple, cost-effective solution to copy trading signals between two MT4 platforms. This method is suitable for traders who want to copy signals from a successful trader or strategy without the need for complex and expensive third-party copy trading services.

However, you can use services such as multiple Forex Trade Copiers cloud-based platforms.

Let us see a few examples:

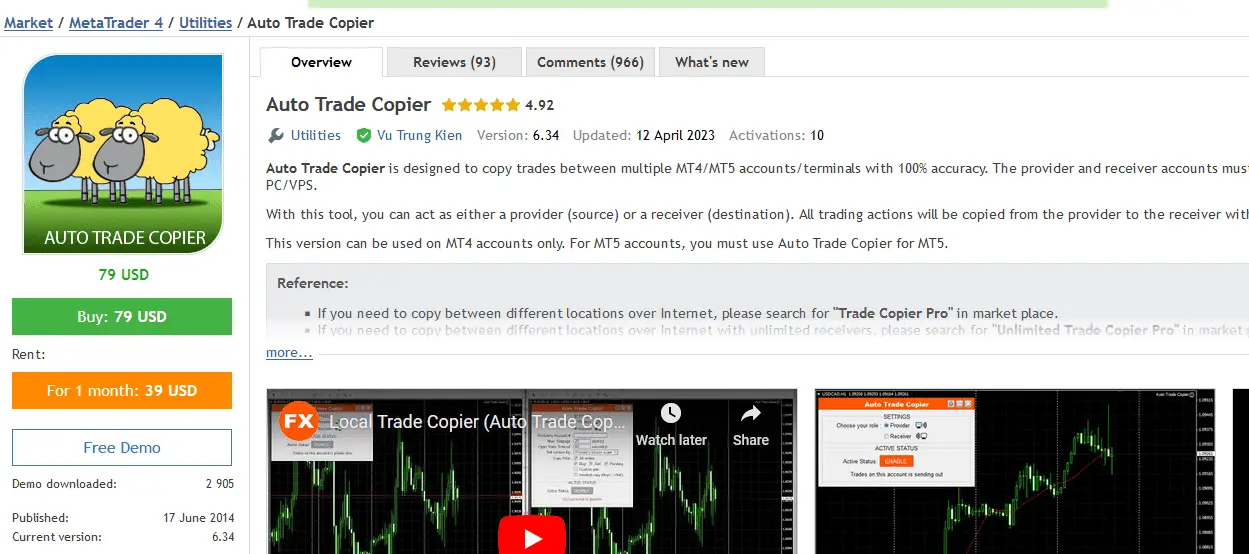

Auto Trade Copier Script

Auto Trade Copier represents MT4 Script, designed explicitly for MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular forex trading platforms. The primary function of this software is to replicate trades with 100% accuracy from one account (the provider or master account) to another (the receiver or slave account).

The auto trade Copier costs $79.

This trade replication occurs instantly, ensuring real-time alignment between the source and destination accounts.

Trade Copier

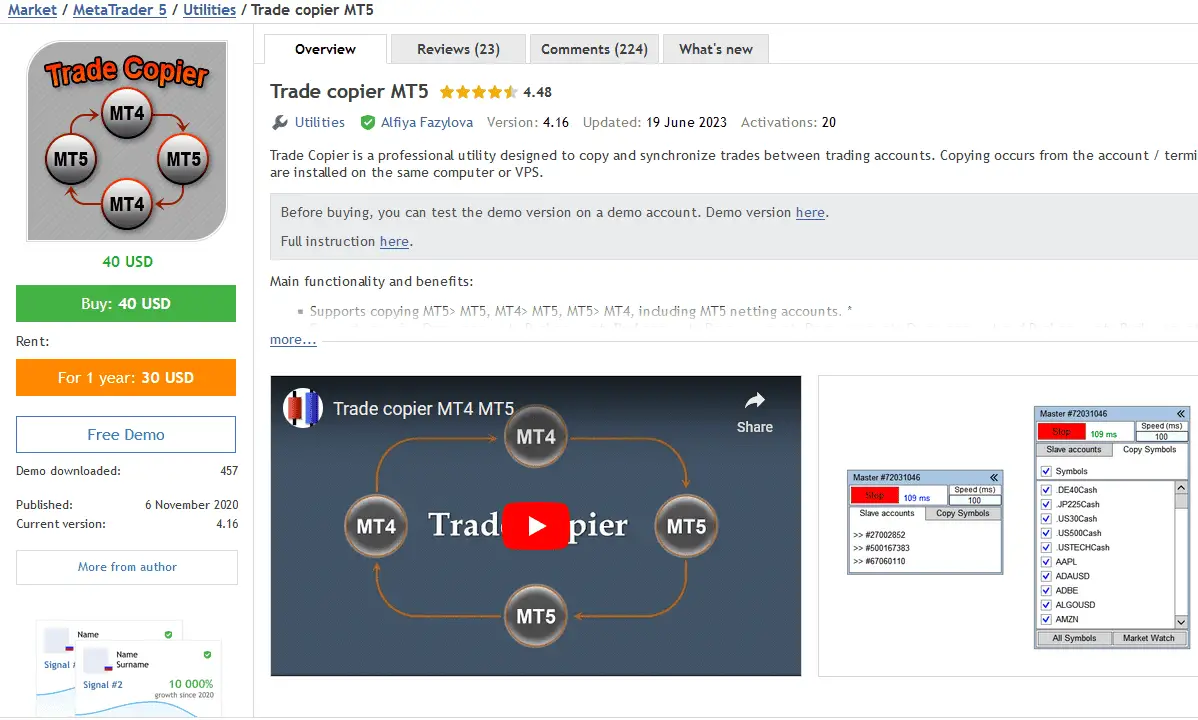

A Trade Copier is an MT4 script used primarily in Forex trading but can also be utilized in other types of trading. It is an MT4 Script that allows traders to copy trades from one account (the master account) to another (the slave account). This tool is handy for account managers and retail traders. The main idea is to replicate trades from a successful trader or trading algorithm and to implement the same trades on another trading account.

Here’s a basic breakdown of how a Trade Copier functions:

- Setup: The trade copier software is installed on the trading platform of both the supplier (also known as the “master” or “source” account) and the recipient (the “slave” or “destination” account). These accounts can be on the same computer or hosted on a VPS (Virtual Private Server) for better speed and reliability.

- Trade Execution: The software quickly copies the trade data when a trade is placed in the supplier’s account. This data includes information such as the asset being traded, the direction of the trade (buy/sell), the lot size, stop loss, take profit, etc.

- Trade Replication: The software instantly transmits this information to the recipient’s account and places an identical trade. The speed of this process is vital to ensure that both trades are placed at approximately the same market price.

- Trade Management: After the trade is placed, the software continues to monitor it. Suppose the supplier modifies the trade by moving the stop loss, taking profit levels, or closing the trade early. In that case, these changes are instantly replicated in the recipient’s account.

As for the cost, the $40 you mentioned seems to be the price for a script or software for this service. Prices can vary greatly depending on the functionality and reliability of the trade copier system. Some systems might have additional features, such as adjusting the risk level of the copied trades or copying trades to multiple recipient accounts.

Advantages and Disadvantages of Script Trading Copiers

Custom Script Advantages:

- Customization: You typically have more flexibility to customize your trading algorithms, styles, and parameters with a script. If you have programming skills or the willingness to learn, you can tailor your scripts to your unique trading style.

- Control: Your data and processes are under your direct control. You can set up your server, manage your connections, and run your strategies precisely.

- Fixed Cost: After purchasing the script, your ongoing costs will only include the monthly VPS charges, which can be relatively low and predictable.

Custom Script Disadvantages:

- Technical Expertise Required: To set up and maintain a VPS, run scripts, and troubleshoot any problems, you will need a degree of technical knowledge.

- Maintenance and Updates: You are responsible for all updates and fixes, which can be time-consuming.

- Security: Depending on the VPS provider, you may need to manage the security of your server to protect your trading activities from cyber threats.

- Potential Hidden Costs: While the upfront cost is for the script, you might pay for additional scripts, updates, or support.Cloud-Based Forex Trader Copiers (Pay-Per-Account or Copied Trades)

Cloud-Based Forex Trade Copiers

Cloud-based forex trade copiers take the concept of standard trade copiers and enhance it through cloud technology. Instead of installing and maintaining the software on your computer or VPS, these systems are hosted on the cloud, providing increased speed, reliability, and convenience.

Here’s a more in-depth look at how these systems work and their advantages:

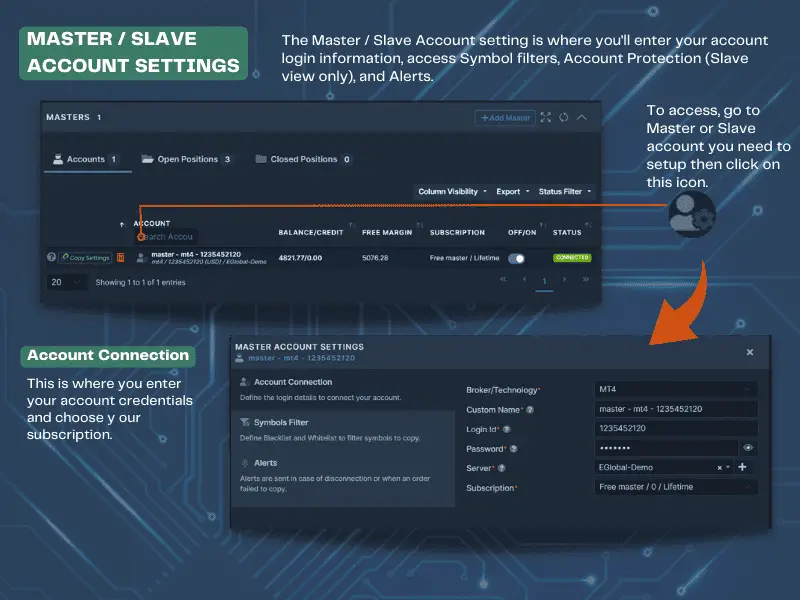

- Setup: Instead of installing the software on each trading platform, connect your trading accounts to the cloud-based service. You must typically provide your broker’s server address and account login details.

- Trade Execution & Replication: The service monitors the Master (supplier) account for any new trades. When a trade is detected, it’s copied and executed in the slave (recipient) accounts almost instantly. This process is often faster and more reliable than a standard trade copier, as it’s not affected by computer downtime or internet disconnections.

- Trade Management: Like with a standard trade copier, all changes made to the trade in the master account are replicated in the slave accounts. This includes changes to the stop loss and take profit levels, as well as early trade closures.

- Scalability: Cloud-based systems typically allow for greater scalability. They can copy trades to an unlimited number of slave accounts, making them an excellent choice for account managers or signal providers who have many clients.

- Security: This can increase security because your trading platforms are not exposed on a network or the internet (connected directly to the cloud service). Moreover, reputable services use encrypted connections and don’t store your trading account credentials.

- Pay-Per-Account or Copied Trades: With this type of payment structure, you only pay for the accounts you connect or the number of trades you copy. This can be more cost-effective than a flat-rate fee, especially for traders who don’t place many trades.

- Ease of Use: Since the cloud service handles all operations, these systems are often easier to set up and use, even for less tech-savvy traders.

Cloud-based forex copier Advantages:

- Ease of Use: These platforms are typically user-friendly and don’t require you to have much technical knowledge. They handle server management, software updates, and security.

- Support: You’ll likely have access to customer support if you encounter any issues.

- Scalability: Cloud-based solutions can be scaled quickly based on your needs.

Cloud-based forex copier Disadvantages:

- Ongoing Costs: Paying per account or copied trade can add up over time, especially if you are making a lot of trades or managing multiple accounts.

- Limited Customization: While some platforms offer a range of strategies and risk management settings, you may be unable to customize everything to the extent you can with your script.

- Dependency: You depend on the service provider for security, uptime, and performance. Any problems on their end could impact your trading activities.

Duplikium Trade Copier

In this review, one takes a close look at Duplikium, a cloud-based Trade Copier and Mirror Trading Platform, mainly focusing on its capabilities in High-Frequency Trading, multi-broker compatibility, and its support for multiple forex and CFDs brokers around the globe, including cTrader brokers, LMax, FXCM, among others.

Duplikium excels without the need for continuous VPS running and software installation. It simplifies the trading process by providing a robust platform for Forex, CFD, Crypto Asset Managers, Signal Providers, Mirror Traders, and individual traders to seamlessly copy or duplicate trades from Master accounts to Slave accounts.

A noteworthy feature is its multi-broker compatibility. Duplikium accommodates a variety of brokers worldwide, offering unparalleled freedom to mix brokers and technologies. It effectively supports accounts in various base currencies such as USD, EUR, JPY, CHF, and others, providing a truly global trading experience.

The platform impresses with its ability to handle multiple Slave accounts concurrently. No apparent restrictions offer heightened flexibility that can be incredibly valuable in managing diverse trading portfolios.

Regarding speed, Duplikium boasts an extra-low internal latency of 1-3ms, facilitated by the choice of four server locations. This feature positions it favorably for High-Frequency Trading, ensuring efficient and timely trade copies.

The provision for copying pending orders like Limit and Stop is a valuable addition. This feature allows traders to add, update, or remove their Pending Orders anytime. Furthermore, Duplikium fully supports protection orders like Stop Loss and Take Profit, providing the opportunity to manage risk effectively.

The Reverse Trading feature adds a layer of strategic depth. When the Master account buys, users can copy a sell order to the Slave accounts, potentially transforming a losing strategy into a winning one.

Duplikium’s support for partial close across all brokers can give traders greater control over their positions. The pricing is cost-effective, with the service being free for one Master and one Slave account and a reasonable charge of 4.2 EUR per account for unlimited trades after that.

In conclusion, Duplikium’s cloud-based Trade Copier and Mirror Trading Platform is a comprehensive solution that meets diverse trading needs with its versatile features, compatibility, and cost-effectiveness. It could be an excellent choice for those seeking to streamline their trading operations while maintaining flexibility and control.

Conclusion

Cloud-based or traditional Scripts have trading copiers revolutionized the way trading is conducted, especially in the Forex and CFD markets. They provide a powerful tool for traders, signal providers, and asset managers, enabling the synchronization of trade operations across multiple accounts, either within the same platform or across different platforms.

Cloud-based trade copiers, such as Duplikium, add a layer of flexibility and scalability, allowing for more efficient trade copying, better latency, increased security, and reduced need for technical know-how or resources. These attributes make them attractive for individual traders and large trading operations.