Table of Contents

Breakout strategies are foundational in trading, capitalizing on the principle that significant price movement often follows when a stock or currency breaches a predetermined resistance or support level. These strategies operate on the belief that a breakout may signal the beginning of a new trend or an extension of an existing one.

This upward or downward momentum can lead to potential trading opportunities. Timing is crucial, as entering a trade too early or late can drastically affect profitability. Accurate anticipation and recognition of the exact moment a breakout happens and acting promptly can be the difference between a prosperous trade and a missed opportunity. Thus, traders continuously hone their skills to align strategies with precise time moments, ensuring optimal position entry and exit.

What is the Opening Range Breakout Strategy?

The Opening Range Breakout strategy (ORB) represents a forex trading system where traders make buy positions above the opening range period high or sell below the opening range period low. The opening range period can be an hour market opening or a daily low-high period. Additionally, traders buy weekly opening range when they buy Monday high or sell Monday low during Tuesday.

Please see my video about Opening Range Breakout Strategy:

The Opening Range Breakout (ORB) strategy is a simple yet effective trading technique that involves determining a specific range within a given period and trading based on the breakout from that range. The fundamental idea is that the price movement following the breakout, whether upwards or downwards, often has momentum behind it, potentially leading to profitable trades.

Here’s a step-by-step explanation using EURUSD as an example:

- Determine the Opening Range Period: First, you need to decide on the period you’re considering for the opening range. It could be the first hour after the market opens, the entire first day, or the first week’s range, as in your Monday high and low example.

- Identify the High and Low: Once you’ve determined the period, the next step is to identify the highest price (high) and the lowest price (low).

- For instance, you’re considering the first hour of trading on the EURUSD after the market opens. If the highest price during that hour is 1.2000 and the lowest price is 1.1950, then that’s your opening range.

- Look for Breakouts: After identifying the range, you will monitor price movement to see if it breaks above the high or below the low of the range.

- If EURUSD moves to 1.2005 (breaking the 1.2000 high), it will trigger a buy signal based on the ORB strategy.

- Conversely, if EURUSD falls to 1.1945 (breaking the 1.1950 low), it would be a sell signal.

- Set Stop-Losses: It’s crucial to manage your risk. Traders often set stop-losses just outside the opposite end of the range.

- Using our example, if you go long (buy) at 1.2005, you might set a stop-loss just below 1.1950. If you go short (sell) at 1.1945, your stop-loss might be just above 1.2000.

- Set Profit Targets: Some traders might set a target profit based on a specific number of pips or use technical indicators or price patterns to determine when to exit the trade. For instance, if the range’s width is 50 pips (1.2000 – 1.1950), a trader might target a move of another 50 pips from the breakout point.

- Consider Additional Filters: Some traders enhance the ORB strategy with other technical indicators or conditions to filter out false breakouts or to confirm the breakout’s strength. For example, a trader might only consider a breakout valid if accompanied by a surge in trading volume or if a specific moving average supports the direction of the breakout.

The Opening Range Breakout strategy allows traders to capitalize on early momentum, especially for forex pairs like EURUSD. However, as with any trading strategy, it’s not foolproof, and it’s vital to use proper risk management techniques and always conduct your research and analysis.

EU session Opening Range Strategy Example

When the EU or London session starts at 7.00 a.m. GMT, I usually wait 30 minutes up to 2 hours each working day and market that time as the opening range period. Then, if I see that the price breaks the highest high of the EU opening range period, I make a BUY order. On the contrary, I make a sell order if the price breaks the lowest low of the opening range period.

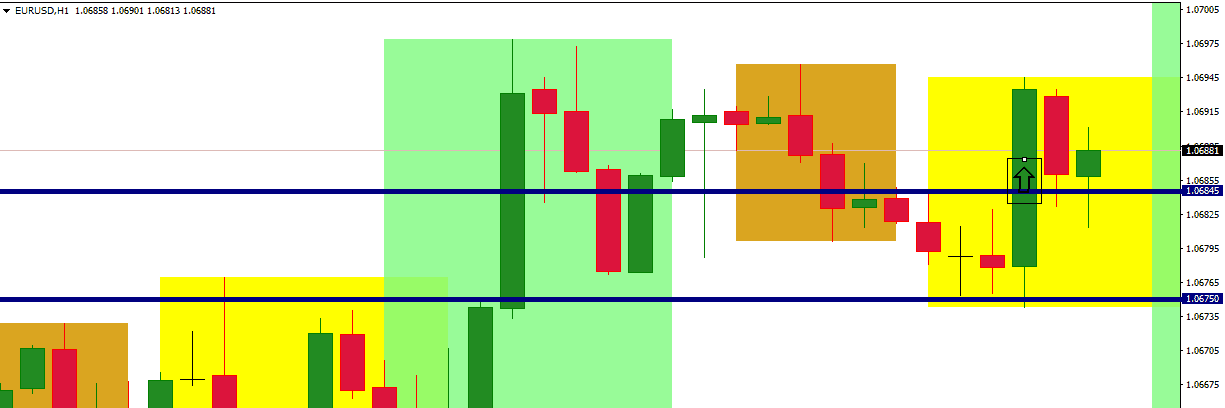

Below, you can see an image that I made a BUY order at 10 a.m., at 1.0684, when the price broke the EU’s highest high of the opening range period.

Whole Session Opening Range Strategy Example

The Opening Range (OR) Breakout Strategy is a popular trading strategy among Forex and stock traders, mainly when applied using different timeframes or sessions. The strategy you’ve described revolves around utilizing the range set during the Asian session to potentially capture breakout moves during the European (EU) and US sessions.

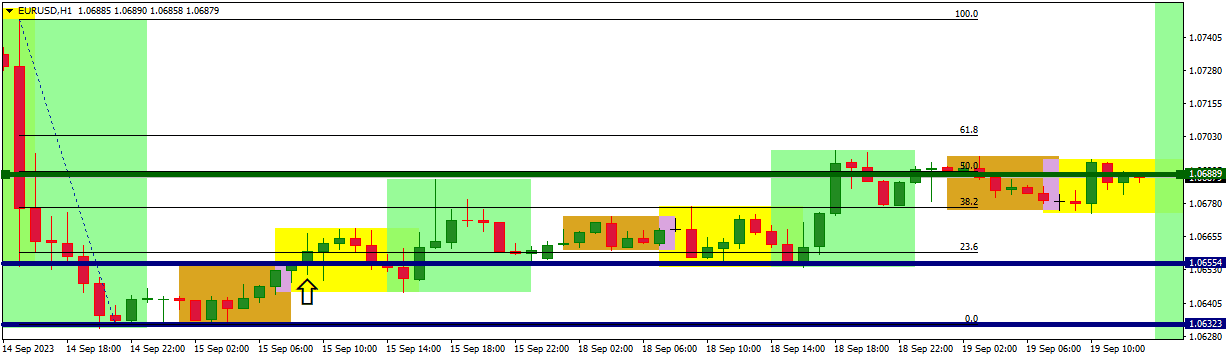

As shown in the image above, I found the lowest low and highest high during the Asian session (brown color). During the EU session, the price broke the Asian high, and I entered a BUY order (black arrow). Tartet was 50% retracement Fib. Level.

Whole Session Opening Range Strategy Explained:

- Definition of the Opening Range (OR): For this strategy, the OR is defined as the range between the highest high and the lowest low of a given session, in this case, the Asian session. This range is believed to set the tone for the subsequent session(s).

- Identifying the Range: At the close of the Asian session (before the EU session starts), identify the highest high and lowest low of the Asian session. These levels are your reference points for potential breakouts.

- Entry Points:

- Buy Order: If, during the EU session, the price breaks above the highest high of the Asian session, it’s considered a bullish breakout, and a buy order is triggered.

- Sell Order: If, during the EU session, the price breaks below the lowest low of the Asian session, it’s considered a bearish breakout, and a sell order is triggered.

- Stop-Loss and Take-Profit: It’s crucial to set risk parameters. A common practice is:

- Stop-Loss: Placed just below the highest high (for a buy order) or above the lowest low (for a sell order) of the Asian session.

- Take-Profit: Often set based on a risk-reward ratio (like 1:2) or using critical support and resistance levels.

- Reapplying the Strategy: If you wanted to apply the same logic to the US session, you would take the range from the European session and look for breakouts in the US session.

- Consideration of Fundamental Data: While this strategy is primarily technical, it’s essential to be aware of any scheduled economic releases, especially during the EU and US sessions, as these can cause significant volatility and affect breakout dynamics.

Advantages:

- Objective: The strategy is rule-based, which can remove some of the emotional and discretionary aspects of trading.

- Capture Volatility: Breakouts during the EU and US sessions can capture significant moves, especially when there’s a confluence of technical and fundamental factors.

Disadvantages:

- False Breakouts: Not every breakout results in a sustained move. Price can break the Asian session high/low and then reverse.

- Liquidity Differences: The Asian session, especially in Forex, might be less liquid than the EU or US sessions, making the highs and lows potentially less significant.

Tips:

- Volume or Volatility Filter: To filter out potential false breakouts, some traders use a volume (in stock markets) or volatility (like ATR – Average True Range in Forex) filter. If the breakout is accompanied by high volume or volatility, it might increase the chances of a sustained move.

- Multiple Session Analysis: While the strategy is centered on the Asian session range, analyzing the range and behavior of multiple sessions (like the previous EU or US sessions) can provide additional insights.

Weekly Opening Range Breakout Strategy Example

The weekly opening range strategy represents a system in which traders buy Monday high during Tuesday if the price breaks Monday high or sell Monday low price. Stop loss is usually Monday high for sell trade and Monday low for Buy trade.

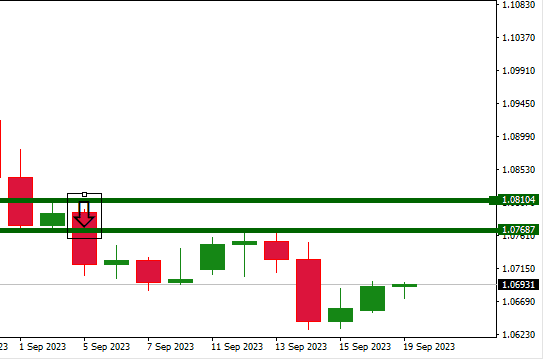

Below, you see the 4 September Monday candle at 5. September’s price broke Monday’s low, and I generated a SELL order at 1.0768 on Tuesday (Monday’s low).

Monthly Opening Range Breakout Strategy

The Monthly Opening Range Breakout Strategy is built on the premise that the range established during the initial phase of a period (in this case, the first week of a month) can set the tone for the direction of the price movement for the remainder of that period. This concept can be applied across various timeframes, from daily to weekly to monthly.

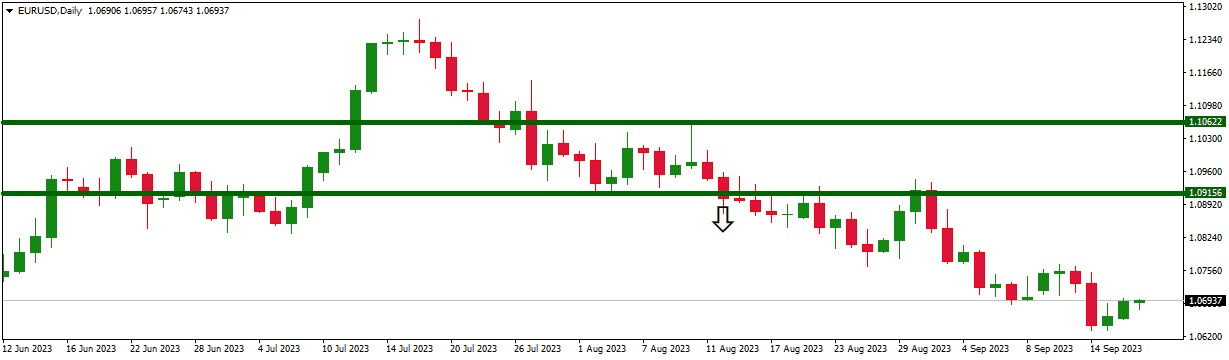

After the first week in August, I determined the lowest low price and highest high price in that opening range (green lines on the chart below). I entered a sell order when the price went below 1.0915 . I still hold that SELL order even during September.

Monthly Opening Range Breakout Strategy Explained:

- Definition of the Opening Range (OR): In this strategy, the OR is defined by the highest high and the lowest low during the first week of the month. This range is perceived as a potential area of consolidation or indecision, and a breakout from this range can signal the predominant direction for the month.

- Identifying the Range: At the end of the first week of the month, determine the highest high and lowest low for the week. These levels serve as your potential breakout markers.

- Entry Points:

- Buy Order: If, after the first week, the price exceeds the highest high set during that week, this suggests a bullish breakout. A buy order can then be triggered.

- Sell Order: If the price goes below the lowest low of the first week, this signals a bearish breakout, prompting a sell order.

- Stop-Loss:

- For a Buy Order, the stop-loss is typically set at the lowest low of the first week. If the trade reverses and goes against the presumed bullish direction, it will be automatically closed at a defined loss.

- For a Sell Order, the stop-loss is placed at the highest high of the first week. This protects against a potential bullish reversal after entering a bearish trade.

- Take-Profit: The profit target can be determined based on several methods:

- A predetermined risk-reward ratio, like 1:2 or 1:3.

- Critical support and resistance levels.

- A percentage gain.

- I am using trailing stops to capture potential trend movements.

- Other Considerations:

- False Breakouts: The strategy is straightforward but doesn’t guarantee success. Markets can often show false breakouts, where the price momentarily moves outside of the range only to reverse back. Risk management is crucial.

- Fundamental Factors: While this strategy is primarily technical, external events or data releases can cause significant price shifts. Being aware of major economic or company-specific news is essential, especially when trading on a monthly timeframe.

Benefits:

- Simplicity: The strategy offers a systematic and straightforward approach to determining entry and exit points.

- Capture Larger Moves: By focusing on a monthly range, traders aim to capture more significant trend movements rather than short-term fluctuations.

Drawbacks:

- Reduced Trading Opportunities: As this strategy operates on a monthly timeframe, the number of trading signals will be fewer.

- Exposure to Overnight and Weekend Risks: Especially in the case of stocks, holding positions for weeks exposes traders to risks that can occur outside of market hours.

Conclusion

The Opening Range Breakout strategy revolves around trading breakouts from the defined high or low timeframe, be it a session, day, week, or month. In a session-based approach, traders frequently observe the range set during the Asian session to predict breakouts in the following EU or US sessions.

For a weekly application, traders might employ Monday’s high and low as pivotal points to gauge the market’s direction for the upcoming days. On a monthly scale, the first week’s range can set the tone for potential monthly price movements. This technique, although systematic, requires a keen eye on false breakouts and an understanding of underlying market fundamentals. Combining both technical and fundamental insights can enhance the efficacy of the Opening Range Breakout strategy.