Table of Contents

Hedge funds are investment partnerships between a fund manager and investors where the fund managers actively manage alternative investments that may also utilize non-traditional investment strategies or asset classes. Hedge funds are more expensive than conventional investment funds and less regulated than mutual funds. You can read our article about the Average Hedge Fund Trader Salary and Hedge Fund Meaning.

Hedge funds are an alternative investment vehicle designed for high-net-worth investors, who often require the ability to invest in strategies and financial instruments not commonly available to the general public. Many of these funds employ sophisticated trading strategies and take advantage of global markets, such as foreign exchange (forex) markets, to generate profits for their investors. Here is an overview of how hedge funds approach forex trading.

The forex market is attractive to hedge funds because it allows them to benefit from volatile price movements in currency pairs. These funds typically look for opportunities to buy a currency pair at one price and then sell it higher later by exploiting the differences between different exchanges. To do this, they use fundamental and technical analysis techniques to determine which currencies offer favorable conditions in which to invest.

When trading forex, hedge fund managers use various tools, including leverage, short selling, and derivatives trading. Leverage allows them to increase their exposure and potential returns on tiny fluctuations in exchange rates. Short selling involves borrowing a currency pair from a broker or bank using a margin account and then selling it with the hope that prices will fall so they can buy back the pair at a lower rate later on—generating a profit. Derivatives trading enables fund managers to speculate on the future direction of markets without owning the underlying asset; instead, they trade contracts representing an agreement between two parties regarding an investment or security at a predetermined price at some point in the future.

In addition to using these tools, hedge traders employ sophisticated algorithms that allow them to quickly identify profitable opportunities within the forex market so they can act fast and capitalize on short-term price moves before other traders can respond accordingly. Algorithmic trading systems have grown increasingly popular due to their ability to scan numerous data points simultaneously—a process that would be impossible for humans alone—and zero in on potentially lucrative trades quickly and accurately.

Though often considered risky investments due to their volatile nature, forex trades can be lucrative sources of return for hedge fund investors when appropriately managed. Hedge fund managers must have extensive knowledge about markets and their associated risks and access powerful analytical tools if they wish to make successful investments in this arena; however, with proper preparation, these vehicles can yield significant rewards over time when used judiciously.

A hedge fund is a pool of investments that allows traders to manage the risk of trading. The volume of trades fluctuates, which cannot be easy to check, but you will control it by hedging. You can also learn several trading strategies practiced by hedge funds and incorporate them into your system.

How Do Hedge Funds Trade Forex?

Most hedge funds trade forex long-term using position trading strategies, including fundamental and technical analysis and rebalancing strategies at monthly or quarterly levels.

Hedge funds trade forex differently because each is different; some are dedicated long-term investments, and some are short-term speculation. However, most hedge fund managers use simple forex strategies without technical indicators except price levels and fundamental approaches.

This is possible because of hedge funds’ right mix of strategies. These funds make sure that they get the best price difference that exists between different currencies. As it is a larger organization than a single trader, they have more workforce to find the markets’ inadequacies and take advantage of that. Trading strategies differ with different hedge funds. Some hedge funds have more open systems to evolve according to the current market situations; others are particular about their course of action.

Many traders equate hedge funds to mutual funds. Though there are a lot of similarities between the two, the dissimilarities couldn’t be more prominent. Hedge funds require more stringent minimum investments. Their strategies are not set in stone, which makes them riskier. Hedge funds are not required to disclose their entire process to their clients. This ambiguity can be dangerous.

Hedge Fund Currency Trading Strategies Types

Different hedge funds use different strategies, but a few standard methods make them successful. These are:

- Long/Short Strategy: This is a low-risk strategy involving lower leverage. You must simultaneously maintain long and short trading positions when you buy currencies that may be undervalued and sell the currencies considered overvalued. Pledging is an extended part of this strategy.

- Market Neutral Strategy: Some hedge funds neutralize the market to reduce the risk. They hold equal long and short positions to do so. This involves lower risk and subsequent lower returns.

- Macro-Economic Trends: Many hedge funds use macroeconomic trends to create trading strategies. This is a popular strategy. This strategy is based on the fact that the economic condition affects the value of its currency.

- Foreign Currency Options: This option allows you to trade currency at a future date, but unlike equity swaps and ETFs, there is no obligation. Short-term trades get protection using this strategy. Some strategies are bull spreads, bear spreads, long-term straddle, and long-term strangle.

- Momentum Strategies: The hedge fund strategizes using historical patterns that involve a level of support, level of resistance, moving averages, and more. The hedge fund studies the patterns and looks for more scope.

- Carry-Style Strategy: The speculators look for a currency that might be depreciating as it entails a lower borrowing cost. They allow the fund to buy higher-yield currencies, like USD and GBP.

Hedge funds use one or more of these strategies at one go. Sometimes, they don’t even use a single strategy from the above list to keep evolving their strategies according to the market condition. For example, one of the most popular carry-style strategies was buying USD, which flopped in recent months.

This proves that while hedge funds help curb the risk of trading Forex, they cannot eliminate it. A hedge fund’s success depends on a country’s political and economic condition and government policies. If you do not want to invest in a fund, you can learn these strategies and trade with a hedge fund.

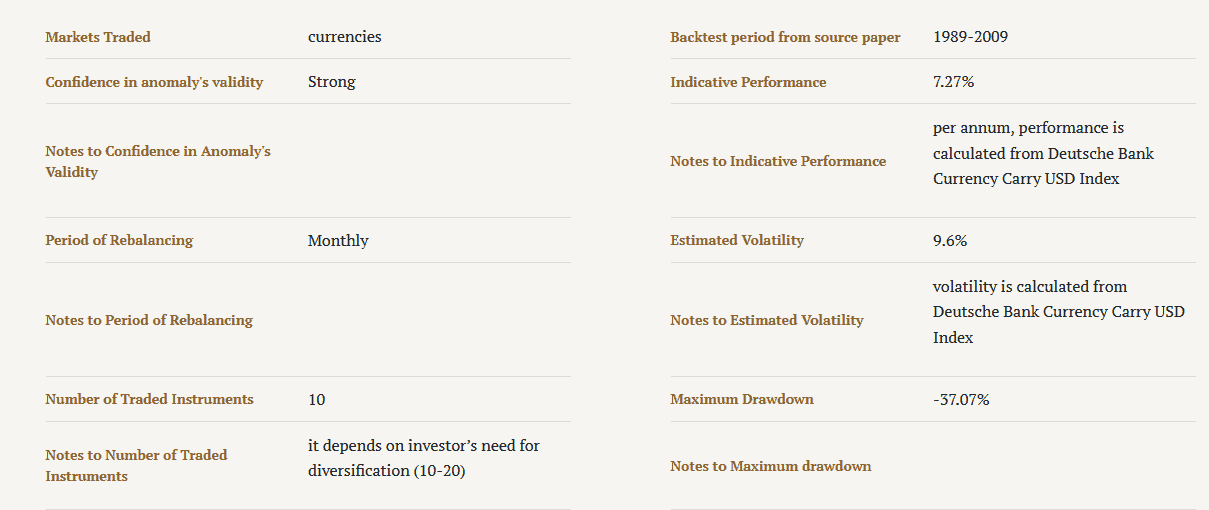

Carry-Style Strategy Example of how hedge funds trade forex

The carrying trade forex strategy is a popular investment technique that allows investors to benefit from the differences in interest rates between two countries by exchanging one currency for another. Traders can capitalize on these rate differentials by going long on currencies with high-interest rates and shorting on those with lower rates. This investment method can be applied to any number of currencies, and it is not uncommon for investors to build portfolios that include 10-20 different currencies.

One way to apply the carrying trade forex strategy is by selecting three currencies with the highest central bank prime rates and going long on them while simultaneously selecting three currencies with the lowest effective bank prime rates and going short on them. The cash not used as a margin can then be invested in overnight rates. This strategy is typically rebalanced monthly.

Strategy:

- Go long three currency pairs with the highest central bank prime rates

- Go short three currency pairs with the lowest influential bank excellent rates.

- Rebalance monthly.

When executing this type of forex investment strategy, it’s essential to consider both macroeconomic factors and microeconomic indicators that could influence the exchange rate between two currencies. For example, investors should weigh factors like inflation expectations and GDP growth when selecting which currency pairs to trade. Additionally, it’s essential to factor in geopolitical risks that could disrupt the flow of capital or change the value of a currency versus its peers.

From a technical perspective, investors should also look at historical chart patterns to help identify potential buy or sell signals within their trading range. Technical indicators such as moving averages and trendlines can also provide helpful information when trading decisions are based on price movement over time.

For investors unsure about their ability to successfully execute this type of trading strategy, various online platforms offer automated algorithmic trading services where users can select predetermined systems designed for carrying trade forex investments. These services often come with portfolio management tools so users can track their progress over time and adjust their investment decisions accordingly.

Overall, the carrying trade forex strategy effectively allows investors to take advantage of discrepancies in global interest rate differentials to maximize their returns from international investments. As with any financial decision-making process, traders must understand the macroeconomic environment surrounding the particular asset class in question and more granular factors, such as individual currency pair correlations, before executing any trades or building out any portfolios using this technique. Additionally, leveraging algorithmic trading services or other automated tools can be helpful when managing risk associated with these types of investments over extended periods.

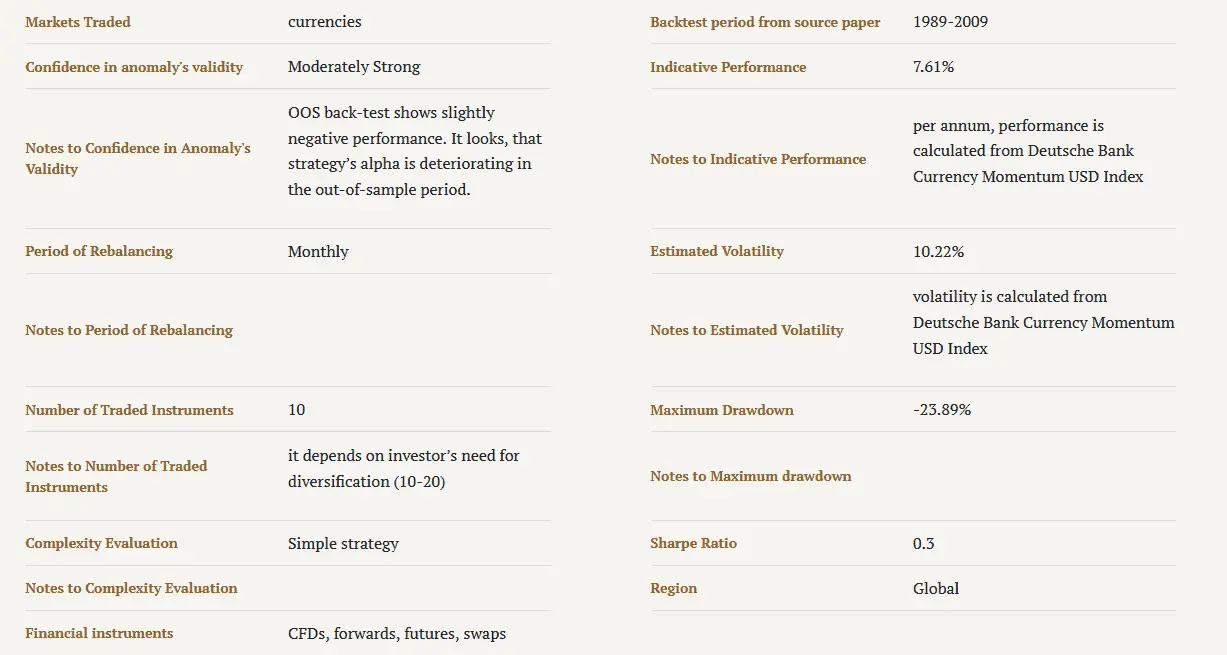

Momentum Strategy Example of how hedge funds trade forex

Momentum strategy :

- Go long three currencies with the highest 12-month (yearly) momentum against the USD

- Go short three currencies with the lowest 12-month momentum against the USD.

- Rebalance monthly.

Momentum trading is a popular strategy employed by many Hedge Funds that seek to benefit from the opportunities presented by market trends. This type of trading involves buying and selling currencies that show positive or negative momentum against the US Dollar. By taking long positions in currencies with high 12-month momentum and short positions in those with low 12-month momentum, investors aim to capture gains from the resulting currency pairs. Furthermore, they may use cash not used as a margin to invest on overnight rates while rebalancing their portfolios monthly.

This article will look at an example of how hedge funds trade forex using a momentum strategy. First, let us consider the concept of ‘momentum’ concerning currency pairs. Momentum measures the rate at which prices change over a period (e.g., 12 months).

A pair showing strong momentum would be one where the price has been increasing rapidly in recent months and therefore has positive momentum; conversely, a pair with weak momentum would be one where prices have been declining despite its traditional trend over more extended periods. The goal for traders employing this strategy is to buy those currency pairs exhibiting strong positive momentum and sell those with weak negative momentum to take advantage of short-term trends that could generate gains for them.

Let us now return to our example involving Hedge Funds trading forex using a momentum strategy. To do this effectively, these firms must select three currency pairs that have strong positive 12-month momentum against the US Dollar and three which have weak negative 12-month momentum against it; these six pairs can then be traded according to the strategies outlined above – i.e., going long on those with strong positive momentum and shorting those with weak negative momentum – for the fund to benefit from any ensuing trends among them.

As well as taking long/short positions on these six pairs, Hedge Funds may also use any cash not used as margin investment on overnight rates; this allows them greater control over their risk levels and helps ensure they don’t overexpose themselves should there be sudden fluctuations in any underlying markets they are trading within. Finally, they can also rebalance their portfolios regularly (e.g., monthly) – either manually or automatically – to keep them up-to-date with any changes in market conditions and thereby maintain an optimal position throughout their investment journey.

Overall, while trading based upon market trends can often prove lucrative for investors such as hedge funds who employ such strategies correctly, it is also essential that they understand precisely what drives such movements before entering into any trades; furthermore, it is always wise for investors engaging in this kind of activity to protect themselves via stop losses and other similar measures designed to limit their losses should things go awry unexpectedly due to unexpected news or events impacting whatever markets they are operating within.

Despite all this, though – when employed correctly – a Momentum Strategy can be an excellent tool for profiting from short-term fluctuations among various financial instruments, including Forex currencies; indeed, many successful hedge funds have reaped huge rewards from following such approaches over recent years!

Conclusion

Hedge funds typically trade forex long-term, focusing on positioning themselves to generate the highest returns possible. These strategies often involve using fundamental and technical analysis to identify opportunities and regularly rebalancing portfolios on a monthly or quarterly basis.

Such approaches are designed to take advantage of market trends, considering economic conditions and geopolitical events, as well as financial instruments such as stocks and bonds. By combining these elements through careful research and analysis, hedge funds can develop an understanding of how certain currencies may perform over time. This knowledge helps them reduce risk while maximizing returns from their investments in the foreign exchange market.