Table of Contents

Buy and sell indicators often confuse traders, especially when they are new in the forex trading, but worry not as that is not the only way you can trade forex. With forex no indicator trading, aka naked forex trading, you can trade forex without indicators very easily.

A few traders recommend using indicators up to 2, but most naked traders prefer to use none. It is important to note that the indicators themselves are not buying or selling signals as all they do is tell the market condition and a good time to trade. But if that confuses you, do not worry as forex without any indicators is your solution, which we would incorporate in this article to make your forex game strong.

What is Forex No Indicator Trading?

Trading forex without indicators or naked forex trading is buying and selling assets using price levels as the main trading criteria. Forex no indicator trading is usually based on the current market conditions when traders use price levels to enter and exit from trades such as Fibonacci levels, support, resistance, pivot points, and price levels from chart patterns.

Before you jump into the ocean of naked trading, you need to have a thorough understanding of various candlestick and chart patterns, like when they form, what they indicate, etc. It is an essential part of a naked trader to learn how to read them and analyze them for your benefit.

Some traders suggest learning forex no indicator trading before learning indicators, but in the end, indicators are useful only to analyze the past trends.

What is Price Action?

Price action trading is a way of trading at the moment when price creates a strong move around important price level. For example, price action is in the moment when price breaks support or resistance in strong movement, or when price touches an important price level and make a sharp, strong reversal.

Price action is related to naked trading, but it is not the same thing because “price action” has a broad meaning. Forex no indicator trading simplifies trading, as it cuts down the use of indicators and focuses on the current scene.

Forex trading without indicators or naked trading is technical analysis, as it involves analyzing and reading patterns. Still, the fundamental analysis is equally important here as big events can change the course of actions.

Many traders even prefer not to trade when such big events are expected, as, during those times, the forex market is susceptible and volatile.

You need to know one thing about no indicator forex trading that financial markets move forward or backward in cycles. In a standard cycle for markets, the opening is at a low point, which goes upwards and makes a crux, after which a downturn would occur- the same cycle would continue.

As a forex trader wishing to trade without indicators, you must understand these trends; such patterns can be seen on small and large scale charts. An ideal and experienced forex trader will go along with these patterns to dive into the forex market.

What About Market Emotions?

As a forex trader, you need to get inside the market and trade before dumb money enters. Well, it simply means that you need to identify trends faster and enter the market at an early stage before other traders notice the big candlestick pattern. Often traders enter the market while such a pattern is about to break because they follow the herd and don’t want to miss out. But what they forget is that the market has already discounted that fact, and a breakout is about to happen.

In such times, be smart money who sells when others buy to take advantage of high prices. As a pro trader, you also need to gauge the market’s speed and volatility to decide when to enter and exit.

The Support and Resistance Levels

Forex trading without indicators requires other tools, and support and resistance levels and trendlines are a few prevalent among them.

As a naked trader, you have to control the lines you draw for support and resistance, as too many lines would spoil things for you. You must not draw more than five lines, and draw them only when you are sure about it.

Remember that the recent lines represent the market more accurately than the old ones. At the same time, trading forex naked, such tools prove to be boons, as they help me identify great opportunities to enter and exit the market.

Who Can Trade Forex Without Indicators?

Every trader in the forex market should learn to trade forex without indicators, even if they are not planning to trade forex like that. A lot of traders believe in first analyzing the price action and then move to indicators.

Indicators help in confirming the trend and thus are called “Confluence.” It means that more than two signals are stating and confirming for you to take the trade. Forex trading without indicators saves your time as you deal with real-time scenarios and would not waste time doing deep research of indicators.

It makes it very simple and precise. It is not that simple because you would still have to create a trading plan, as, without that, forex trading with or without indicators is just gambling.

Two Popular Price Action Patterns

For trading forex without indicators, you must focus on your stocks’ price actions, and you need to learn to identify these two trendy price action patterns. Though please take note that these two patterns are objective in nature.

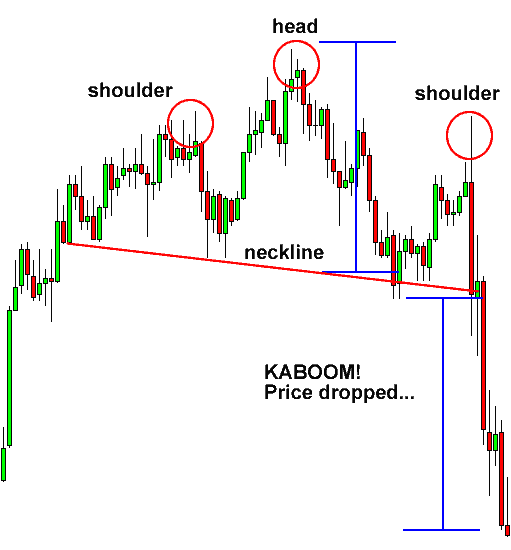

1. Head and shoulders

The head and shoulder pattern can be seen often during any trading day and is very important for traders to trade forex without indicators.

This pattern is derived from its shape – It makes two lower highs and one highest point, which appear like two shoulders and one head.

This pattern indicates that the upside trend will be converted into a downside or reverse trend. If you are long in a trend and see this pattern, you better sell your position.

The good thing about the head and shoulder pattern is that it works well in the downturn market as well; it suggests an upside reversal.

2. Wedge Pattern

The wedge pattern is also known as the triangle pattern. It suggests various things depending on how the market condition is at that moment.

In a wedge pattern or a triangle pattern, a single long side is followed by two prices getting closer to each other. These two sides can be created with two trend lines. When these prices get closer, it reflects the possibility of a breakout for a downward or upward trend.

If the prices are hiking in a triangle pattern, it would eventually result in a downward trend. If the prices are slumping, it would eventually end up in an upward trend. However, there are cases when a wedge pattern appears in a sideway market, making it difficult for traders to predict a direction.

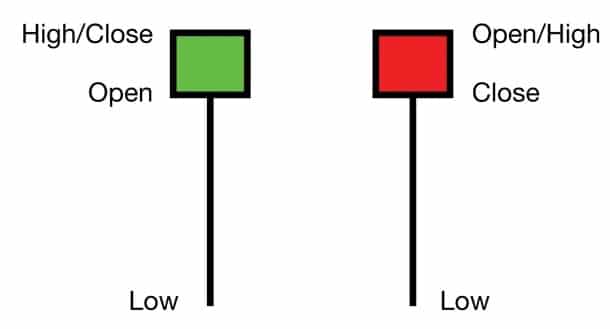

Two Popular Candlestick Patterns

Unlike price action patterns, candlestick patterns are based on candles appearing in charts and seen in groups of candles or individually. Just like price action patterns, these patterns are also subjective.

1. Hammer

The hammer gets its name as it appears like a hammer. It is a single candlestick pattern and is called a pin bar pattern by many traders. The hammer is prevalent for traders wanting to get into no indicator forex trading.

The pattern can be seen as a long wick just below the short body; it suggests that a reversal is about to occur, either upside or downside.

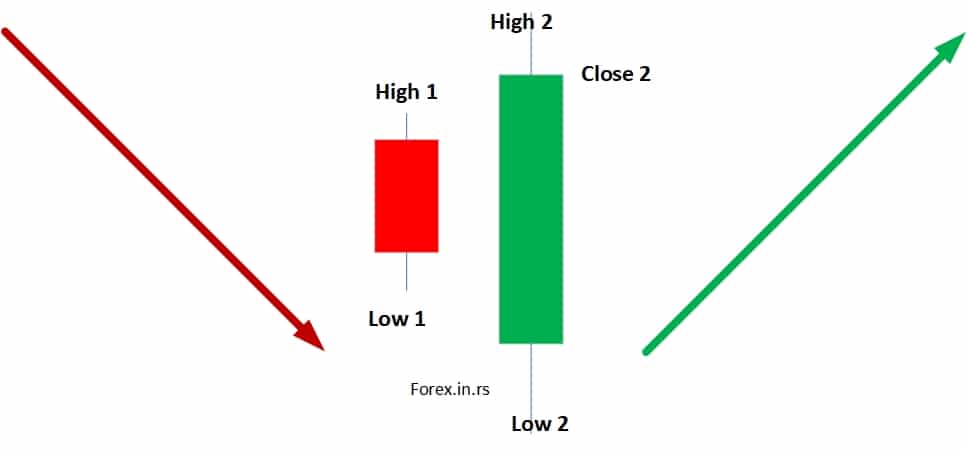

2. Engulfing Pattern

This is a candlestick pattern, consisting of two candles, where the second candle completely overshadows the first pattern.

The Engulfing pattern also signifies a reversal, either upside or downside.

Challenges of Trading Forex Without Indicators

- The first and foremost challenge for forex trading without indicators is that it is hazardous.

- Often, traders cannot take up the trends immediately as it takes time to identify the pattern.

- It is not as safe as indicators to be sure about a trend, which increases the risk.

- Many a time, it becomes tough for traders to be consistent in trading forex.

- You have to develop a strong game in forex trading to be intuitive about which trade to take and which one to avoid. It would get sharper only with time and practice.

The Bottom Line

Well, in the end, trading forex without indicators is like riding a vehicle. It would help if you learned it before you ride it. You can start trading with the indicators, and with enough experience, you can trade naked. Also, remember that one type of trading doesn’t work for all. Something that works great for you can be a disaster for the other.

Another thing you can do is to try trading forex on a practice account. It would ensure that you can trade the way you want, make mistakes, learn from them, and educate yourself while ensuring that you do not lose your real money.

Key Points to Remember:

Here are the key highlights of this article.

- Forex trading without indicators is what the name suggests – you make no use of indicators but can use tools like price actions, candlestick patterns, etc.

- As a forex trader, you have to learn the forex market cycle and go with the trend and not against it.

- You have to identify the popular price action and candlestick patterns occurring in the market to trade at the right time.

- There would be points when trading with indicators is better than trading without one. Indicators are useful as they confirm the trend for you.

- Trade first on a demo account, as you should not trade without indicators if you are new in this field. It would give you some good experience without making you lose your real money.