Table of Contents

Any new Forex trader or trader of any financial instrument is often worried about several things. They have several concerns, and their main goal is to learn as much as possible in the shortest period and not lose money. New traders often do one of two things: they either know about the art of trading from ground zero, hire someone who can trade on their behalf, or, at the least, provide them with their expert opinion.

Now the question is, is the second option viable for everyone?

Can I Pay Someone to Trade Forex for Me?

Yes, you can pay other traders to trade forex for you. You can hire a professional freelancer trader to manage your account or invest in a PAMM account or any Copy Trading Platform. In that case, fund managers will manage your portfolio for a small fee and get a percentage (15%-35%) of your profit.

However, I believe you can achieve best if you trade as your own. You can trade long-term positions using weekly and monthly charts even if you do not have time. Usually, you will be disappointed when you see a terrible money manager decision or when you see that the paid trader keeps losing positions for too long.

Please see my video about this topic:

The best part is there are several brilliant Forex traders in the market. They can quickly help you out with your needs. This allows you to capitalize on expert knowledge that you do not possess. Most newbie Forex traders prefer this technique because it will significantly enable them to avert risk. This also reduces their chances of going into debt, a possibility in every trading market. Another great advantage of hiring an expert is that you can follow their actions and learn while managing your account.

How do I pay someone to trade forex for me?

Yes, you can pay other traders to trade forex for you in the following ways:

- Invest in a Forex-Managed Account PAMM account where successful traders trade instead of you.

- Invest in a mirror trading platform where you can follow traders from several trading experts.

- Invest a large amount of money in a hedge fund or trading prop company where professionals trade for you.

- Pay a trader freelancer to manage your portfolio (the worst decision).

The best way to avoid problems with fund managers is to use platforms for mirror trading or PAMM. In that case, you pay fund managers and give a profit percentage when you make money.

Paying unknown signal services is not a good idea because most of those services burn trading accounts.

Hiring a Professional Freelancer Trader

- My Experience: I’ve considered contracting an experienced trader to manage my forex trading account. This involves finding a freelancer with a strong background in forex trading who offers their services for a fee.

- How I Approach It: I would need to give the freelancer access to my trading account, trusting them to execute trades on my behalf to generate profits.

- My Considerations: I must carefully vet the trader’s track record, understand their trading strategy, and establish clear guidelines on how they should manage my account.

Investing in a PAMM Account

- My Understanding: PAMM (Percentage Allocation Management Module) accounts allow me to allocate some of my funds to be managed by experienced traders or fund managers.

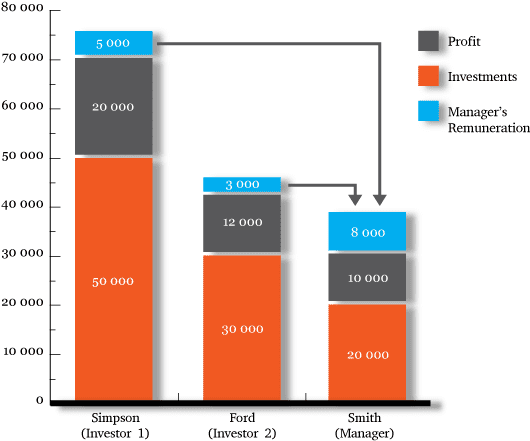

- How It Works for Me: The manager trades with their capital and the invested funds, and any profits or losses are shared among investors like me based on our percentage contribution to the pooled capital.

- My Take on It: Investing in a PAMM account could offer me diversification and access to professional trading expertise. However, I’m aware it involves fees and sharing a portion of my profits with the manager.

Copy Trading Platforms

- My Perspective: Copy trading platforms offer a way for me to mimic the trades of other successful traders automatically.

- My Strategy: By selecting traders to follow based on their performance metrics and risk profiles, I can have their trading actions automatically replicated in my account whenever they make a move.

- What I Consider: This method lets me leverage the expertise of seasoned traders, but I realize it requires me to make careful selections and understand the risks involved.

My Preference for Self-Trading

- Why I Prefer Self-Trading: I’ve found that trading on my own allows me to maintain complete control over my investment decisions and trading strategy. The idea of seeing a money manager make poor decisions or hold onto losing positions for too long is something I wish to avoid.

- My Approach to Long-Term Trading: Given my limited time, focusing on long-term positions using weekly and monthly charts seems like a viable strategy. It minimizes the need for constant market monitoring while still offering a potential for profitable outcomes.

What is forex account management?

Forex account management represents a trading process where the money manager (trader) manages the trading on the client’s behalf. Usually, money managers are granted only access to the account while the investors have complete control over it. The account managers typically take around 20% of the profits as a commission for their work.

My Personal opinion

For the last 15 years, I have been monitoring the internet and many fake gurus trying to manage other people’s money. Unfortunately, it is almost impossible to find a person who can trade instead of you, manage your account, make decisions, follow strict risk rules, and make you profit.

The only way is to find some portals where PAMM traders and portfolio managers trade for you, but some organizations control them. The most crucial trading segment is risk and maximum drawdown. When they manage your money, most traders open a lot of positions, do not close losing trades, wait for losing trades to recover, and blow your account if they don’t.

The best options are PAMM account managers or professional prop companies (or hedge funds). If you usually receive signals, you will have a significant drawdown. Traders usually blow accounts, open new signal accounts, and continue to “hurt” investors’ portfolios.

PAMM account

What is PAMM in forex? The PAMM or Percentage Allocation Management Module is a trading platform that simultaneously administrates unlimited managed accounts where investors and traders use the same broker.

The best PAMM account forex brokers are:

Getting a Forex-Managed Account

A Forex-managed account is one that professional brokers or Forex traders manage. This account will be in your name but managed by someone else. You can easily find a reliable and experienced broker online. Hiring a money manager or an expert trader can save a lot of time you would have otherwise invested in studying the market or doing research. This is an excellent way of making extra money for those who treat trading as their side hustle.

Most of your work is done once you have hired a professional trader. They will most likely ask you basic questions like how much money you are willing to invest and the degrees of risk you are ready to take. Once sorted, your expert will manage your account by looking for trading opportunities. Your hired expert will apply their knowledge and make transactions under your name.

If you are still confused about a managed Forex account, you can equate it with an investment equities account. Managers also handle these accounts.

Before you hire a professional Forex trader, you and the money manager (trader in this case) come into a signed contract. This document or signed agreement has all the terms and conditions of this professional relationship. This contract declares that someone else will be trading with your money and under your name on your behalf. Once this contract is signed, it is the responsibility of the Forex expert to take it forward. If all goes well, you will get the desired profits even without working technical knowledge of this field.

This is an excellent way of creating a new source of income without putting in too much effort. You only need to ensure you are hiring a trusted and reliable expert. We all know nothing, especially trading, is positive or negative. Similarly, hiring a professional to trade in place has advantages and disadvantages. Let’s discuss them.

Mirror trading or Paste Trading

Copy and paste trading represents the use of mirror trading technology to copy other live traders’ real-time forex trades (forex signals). Forex Trading Copy and Paste methods involve practice when some trader creates a trade simultaneously in your platform; the trade will be executed. Using a mirror trading platform, you copy more experienced traders’ trades.

Hotforex Copy is a social network platform where traders can copy signals. Visit HF Copy

Advantages of Hiring an Expert Forex Trader

This is how a professional trader benefits you:

1. Less research is required

The Forex market sees the maximum number of transactions in a day. It is highly volatile and operates 24 hours a day, five days a week. In addition to that, it requires extensive research work. The only way you can make some profit is through thorough research, which involves a lot of time and effort. Hiring an expert can save you from all this trouble and allow you to invest your time in other productive activities. In addition to this, this research work involves reading a lot of charts. If you are uncomfortable with that, your research will ultimately lead you nowhere. Thus, it is better to hire an expert in this case.

2. No time spent studying

You can only profit by trading Forex by continuously educating yourself. This is because currencies are directly linked to their respective economies. While stocks are affected by a single entity’s performance, currencies affect the entire country’s performance. Traders need to conduct a mix of technical and fundamental analyses. You need to constantly look at the news and read statements and reports released by the countries’ financial institutions. Even a slight change in the monetary policy can change the whole game. Professional Forex traders have access to a more extensive database and know which news or report to follow. This will save you time and keep you from chasing unproductive events.

Disadvantages of Hiring an Expert Forex Trader

This is what you should be cautious about while hiring a professional trader:

1. Additional Cost

You need to pay them for their services if you hire someone! This is one of the most significant disadvantages of getting a professional Forex trader. Depending on their level of expertise, you often pay their commission, which can be pretty high.

2. Not Everyone is Reliable

Asking someone to trade on your behalf would mean that you are extending a part of your identity to them and giving them access to your trading account and money. Doing this is only possible when the other person is reliable. While many reliable and good Forex traders exist, several con artists exist. Therefore, you must know someone’s credibility before handing them your investment and account.

We have seen what hiring someone else to trade on your behalf would be like. If you prefer, you can choose a professional trader. However, there is a third option: You can trade yourself! This, too, has some advantages and disadvantages. Let’s discuss them now.

Advantages if you Trading by Yourself

First, we would not recommend this to anyone without prior trading knowledge. If you do have some experience and you would like to handle your account on your own now, these are the pros of it:

- No more payments and commissions: By trading yourself, you can eliminate the biggest downside of hiring someone else: commission. The services of professional traders are not cheap. You are liable to pay them whether you make profits or losses; these commissions can take away a substantial chunk of your earnings. When you trade yourself, you don’t have to pay anyone else. Whatever you make remains yours.

- No more trust issues: Several expert traders are in the market, each with a different strategy. You must employ a trial and test method to find a trader that suits your needs and matches your trading style. This can take a while. You also have to run a background check to ensure that the trader you have selected has all the certifications. You must make sure that someone reliable is taking care of your investment. All these additional steps can be avoided when trading yourself, and you can begin trading as soon as possible.

Disadvantages of Trading by Yourself

These are some of the challenges you might face while trading by yourself:

- You need to upgrade your technical skills

Forex trading requires a lot of research work. To further your earnings, you must read several charts and reports, all of which are pretty technical. The research work is time-consuming and demands a certain degree of technical knowledge. It could be messy and lengthy if you do not have it and plan to start from scratch.

- You have to learn a lot.

Forex traders constantly add to their existing knowledge. At the same time, expert traders know the basics; they only need to process new information. Such is not the case with newbies. You can build your knowledge base from level zero, which could take months or years. Without this knowledge base, you cannot hope to grow your bank balance via Forex trading.

- You will need time.

Analyzing market setups and monitoring essential news is time-consuming. Daily or weekly, you must work several hours to check the report, analyze charts, and make plans and strategies.

Conclusion

While hiring a professional trader, investing in PAMM accounts, or utilizing copy trading platforms present ways to tap into forex trading expertise and potentially profit, I recognize they come with their own risks and costs. My preference for self-trading stems from my desire for control, the ability to develop a personalized strategy, and my wish to steer clear of the disappointment that can come with poor management decisions. However, I understand that what works best for me may not be the ideal approach for everyone, as it greatly depends on individual goals, risk tolerance, and trading knowledge.

The simple answer to the question, ‘Can I ask or hire someone else to trade Forex for me?’ is ‘Yes.’ By hiring an expert Forex trader, you can trade without any worry or stress. Someone else will do all the market research or look at data charts instead of you.

While hiring a professional is great, ensure you are with the right trader. Never give anyone who is not reliable access to your money and account.