Table of Contents

Forex trading in Canada is a vibrant global foreign exchange market segment where currencies are bought, sold, and exchanged at current or predetermined prices. As the world’s fifth-largest trading nation, Canada’s forex market attracts investors from all over the globe. The Canadian dollar (CAD), affectionately known as the “loonie,” is one of the major currencies traded on the forex market, adding to the appeal for forex trading in Canada.

Regulated by several bodies, such as the Investment Industry Regulatory Organization of Canada (IIROC) at the federal level and securities regulators at the provincial level, the Canadian forex market operates within a robust legal and regulatory framework. This ensures high protection for traders and instills a sense of reliability and trust in the forex market operations.

Canadian residents have access to various domestic and international forex brokers, providing them with different trading platforms, tools, and educational resources to optimize their trading strategies. With its multicultural, multilingual population, the Canadian forex trading market is dynamic and diverse, making it a valuable component of the global forex trading ecosystem.

Forex in Canada

Canadian citizens can avail of this opportunity by engaging with brokers registered with Canada’s Investment Industry Regulatory Organization (IIROC). IIROC is a not-for-profit and apex financial regulatory body for the forex trading market in Canada. It is the forex regulation body. Canadian forex trading has recently attracted the media due to enhanced security measures and tight regulations for small businesses.

Being a global market in Canada and other countries, the Forex Market is famous with investors, banks, brokers, and finance-based companies and institutions. This also ensures Canadian citizens take care of their collateral and security, lose their entire capital, and suffer terrible investment losses. Canadian citizens can thereby avail this opportunity to raise their bar and use this effective forex trading system in their region, which can act as their greatest strength during difficult times. Trading Forex in Canada provides an excellent opportunity for its citizens. The Canadian government provides a straightforward and effective way to deal with forex trading. The government runs some agencies privately to regulate capital flow in the trading market. IIROC controls all disputes and work-related issues between brokers and citizens.

Canadian forex brokers offer reduced leverage in helping citizens gain maximum investment returns. Hedging options are minimized or negligible due to tight regulations and increased security. Investors must also raise decent and adequate capital to avoid risks and other forex scams that can affect transactions.

Certain norms are set up by the governing body to allow forex trading for an individual investor, depending on his income, assets, and financial ability. These restrictions, however, prevent the involvement of any individual in forex trading and limit his powers to invest in the forex market due to the unavailability of adequate funds required at the time of investment. Each province of Canada has a different forex trading regulatory framework. Trading Forex is essential to Ontario’s area, where forex arrangements are treated equally as securities and by-products.

Forex Trading Ontario policy says that all forex traders need to be registered as investment dealers. They are required to be members of the Investment Industry Regulatory Organization of Canada (IIROC). In Quebec, forex trading is governed by the Authorities Marches Financiers (AMF).

Is Forex Trading Legal in Canada?

Yes, forex trading is legal in Canada. Forex trading in Canada is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) at the federal level. The IIROC is a self-regulatory organization that oversees all investment dealers and trading activities on debt and equity marketplaces in the country.

Suppose a forex broker has at least one license from a regulatory body (any jurisdiction), legal structure, Tax Compliance, and legal compliance. In that case, we can tell that the brokerage company is legal.

Additionally, Canada’s ten provinces and three territories have separate regulatory bodies for securities trading. As such, forex brokers operating in Canada must comply with these regulations in the province or territory where they do business.

Traders can deal with brokers registered with the IIROC and the relevant provincial or territorial regulatory bodies to ensure maximum legal protection. These safeguards are designed to provide a secure trading environment, although they don’t eliminate the inherent risks associated with forex trading.

It’s also essential for traders to be aware of their responsibility for accurately reporting any profits from forex trading on their annual tax returns. The Canada Revenue Agency (CRA) considers money from currency trading as investment income, which must be reported accordingly.

So, while forex trading is legal in Canada, participants must be aware of the local regulations and tax obligations. As always, potential traders should be well-informed about the risks and have a sound trading and risk management strategy.

What is The Best Broker for Forex Trading in Canada?

The best forex broker in Canada is Avatrade. Many Canadian traders pick this regulated broker because of its excellent support. Additionally, Canadian traders give special attention to multiple Avatrade regulations and fast deposit and withdrawal processes.

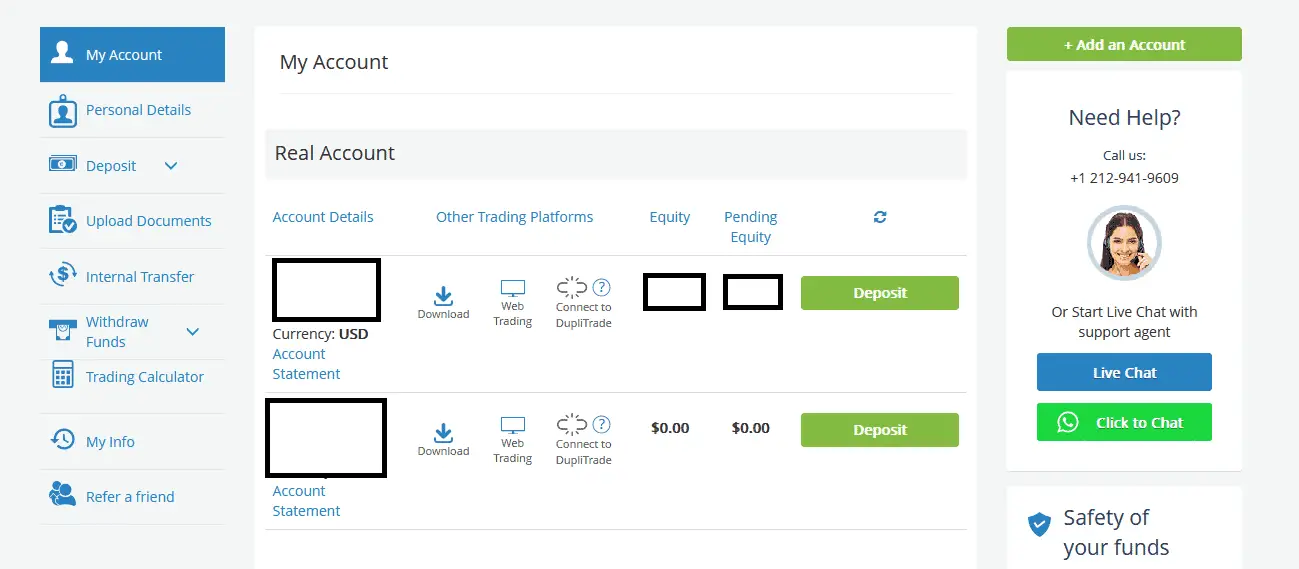

Please see my personal Avatrade dashboard (read my Avatrade Review):

Investors must check the authenticity and legal standards of forex trading in Canada before dealing with brokers and take responsibility for their own decisions. The maximum leverage depends on the exchange of foreign currencies and values. The leverage potential depends on the value of the currency.

It is directly proportional to the current limit; the more significant the currency value, the greater the leverage. Therefore, a more significant expansion has occurred in the forex trading market due to higher currencies and individuals willing to take additional risks to earn a high income and settle their future. Lower currency exchange rates decrease the leverage, but each country’s forex trading process differs. The government has made trade in the same currency mandatory, not with a different one per location.

Forex trading is considered legal in Canada, has an established presence throughout the country, and is popular with good investors and brokers. Forex Trading in Canada is a promising sign for investors and brokers who want to make the most of it and gain good profits. CFDs and FX comprise a greater risk of failure, resulting in a loss. Trading with CFDs and FXs has an additional risk of losing money, so proper attention and care should be taken to ensure investors know the risks and hazards of dealing with cryptocurrencies.

IIROC Forex Brokers in Canada

The best forex brokers in Canada are:

| Forex broker Review | Visit | Min. lot size | Max. leverage | Min. deposit |

|---|---|---|---|---|

Avatrade | VISIT AVATRADE | 0.01 | 1:400 | $1 |

HFM | VISIT HFM | 0.01 | 1:1000 | $1 |

Instaforex | VISIT INSTAFOREX | 0.0001 | 1:1000 | $10 |

FxPro | VISIT FXPRO | 0.01 | 1:500 | $100 |

IC Markets | VISIT IC MARKETS | 0.01 | 1:500 | $200 |

XM.com | VISIT XM | 0.01 | 1:888 | $5 |

| VISIT EXNESS | 0.01 | 1:2000 | $10 | |

| Octafx review | VISIT OCTAFX | 0.01 | 1:400 | $50 |

There is no guarantee that such investments can lead to business profits, although previous data has shown a good percentage of profits on investments made through these channels. The online brokers seem to work with the Forex team and solve accurate data diagnosis and reporting issues.

Canada offers forex trading with sound and better avenues for trading platforms, nice spreads, proper execution, and 24/7 support to its citizens. Therefore, Canada’s forex trading system is a blessing, helping millions of citizens reach their targeted revenue generation on investment in CFDs and forex trade. No restriction is imposed on a fellow citizen to trade with any particular regional broker, so the options are endless and depend on individual preference. Canada has a competitive edge over other countries related to Trading Forex, CFDs, and cryptocurrencies.

The different norms and regulations prevailing in certain provinces have made things look more secure and promising for investors to consider their investment potential, complying with good standards and practices. The investment rate is directly proportional to the currency value. Therefore, investors opt for higher amounts when deciding to go forex trading in their respective provinces and earn good returns and profits on their invested capital.

How do you open a Forex trading account in Canada?

In the first step, traders must read about forex brokers and their ratings. After that, please visit the Forex broker website and register. After verification, traders can get a trading account and start trading.

Forex Tax in Canada

Forex traders pay tax in Canada in two ways. If traders buy and sell equities as an investment, then traders report any profits or losses on a capital account. If traders profit short-term on small price fluctuations, any gains should be reported as business income. Usually, forex traders pay tax as business income. Forex traders can deduct tax if they report taking stock market trading courses to educational resources, purchasing a computer, monthly internet bill, etc. Forex tax in Canada is treated as an ordinary business tax, paid as a business income tax.

Therefore, trading forex in Canada is lucrative and profitable from investments and points. It has a good name in the country, helping its citizens raise their income standards and living potential.