Table of Contents

Reaching a juncture in one’s career where the allure of financial markets becomes irresistible is a defining moment for many. Leaving a stable job to venture into trading full-time is both exhilarating and daunting.

Trading as a profession requires skill, knowledge, and the financial cushion to absorb the inevitable ups and downs. For those who successfully navigate this transition, the freedom to earn a livelihood from market dynamics can be both liberating and rewarding.

Can forex be traded for a living?

Trading forex for a living is a possible solution for traders who manage more than $100,000 and have excellent risk management and tested strategies. Forex trading, like any asset trading, requires enough capital for traders. Traders can not earn a fixed amount of money every month and often have losing strikes.

In my opinion, this year, 2024., forex trading is realistic and highly profitable because many prop companies offer up to 4 million dollars in funding.

You can start to manage a $ 100,000 portfolio by investing only $95 or manage $ 250,000 by investing only $295.

You need a substantial amount of money if you want to trade without other jobs and live only based on trading skills.

The cost of living comfortably in the U.S. varies considerably based on location, lifestyle, and personal obligations. Urban areas like New York City or San Francisco are more expensive than rural regions. On average, a single person might spend between $30,000 and $54,000 annually, considering expenses like housing, food, transportation, and healthcare.

Many aspire to make a living from forex trading by managing large portfolios. One method to achieve this without risking personal capital is to utilize funds from proprietary trading companies, often called prop firms. Before you can access such capital, you’ll need to understand the intricacies of forex trading, including how to analyze markets, trade forex pairs, utilize leverage, and manage risks.

The first step on this journey is to build a consistent and profitable trading record. This track record showcases your skills and capabilities as a trader. Many proprietary trading firms require evidence of consistent profits before they allocate funds for you to manage.

Once you have a solid record, it’s time to research and select a reputable prop trading firm.

You can start either getting an instant funded account where you need to deposit a 5% portion of the managing portfolio, or you can trade forex in a few evaluation phases and get from a $250K managing portfolio and start earning from $6K up to $100K per month.

Each firm has its own model for how it works with traders. Typically, they start by having you trade a demo account to evaluate your skills. If you prove yourself on this platform by being profitable and adhering to their risk management rules, they’ll provide natural capital for you to trade. The profits generated from trading are shared between you and the firm.

As you become more successful and show consistent profits, these firms might allocate even more significant sums for you to manage. With more substantial portfolios, even relatively small percentage gains can lead to significant earnings. For instance, if you manage $100,000 and secure a net return of 3% in a month, you could make $3,000. From this, a prop firm might take a cut, say 20%-30%, leaving you with $2,100-$2,400 before any other costs or taxes.

However, it’s crucial to emphasize the importance of risk management. Prop firms usually set stringent guidelines on permissible drawdowns and daily loss limits. Exceeding these could lead to losing capital allocation, making risk management paramount. Along with managing risks, you should be committed to ongoing education. Markets are constantly evolving, and as a trader, it’s vital to stay updated and adjust your strategies accordingly.

Lastly, always be aware of the costs and fees involved in forex trading. These can range from spreads and commissions to overnight fees and any additional charges the prop firm imposes. Being mindful of these expenses ensures that you clearly understand your actual profits.

My personal opinion – Can I make money in forex trading or Forex Lies?

Suppose you think you can put $500 and make 5 million in a few years – No. This is a small probability event. There is no holy grail or strategy you can follow to earn money in the trading industry.

After 14 years of trading and working for several prop companies, I can say that it is a tiny chance to succeed in a trading industry with small capital. I believe in Prop trading, managing portfolios, and 10%-20% gain per year.

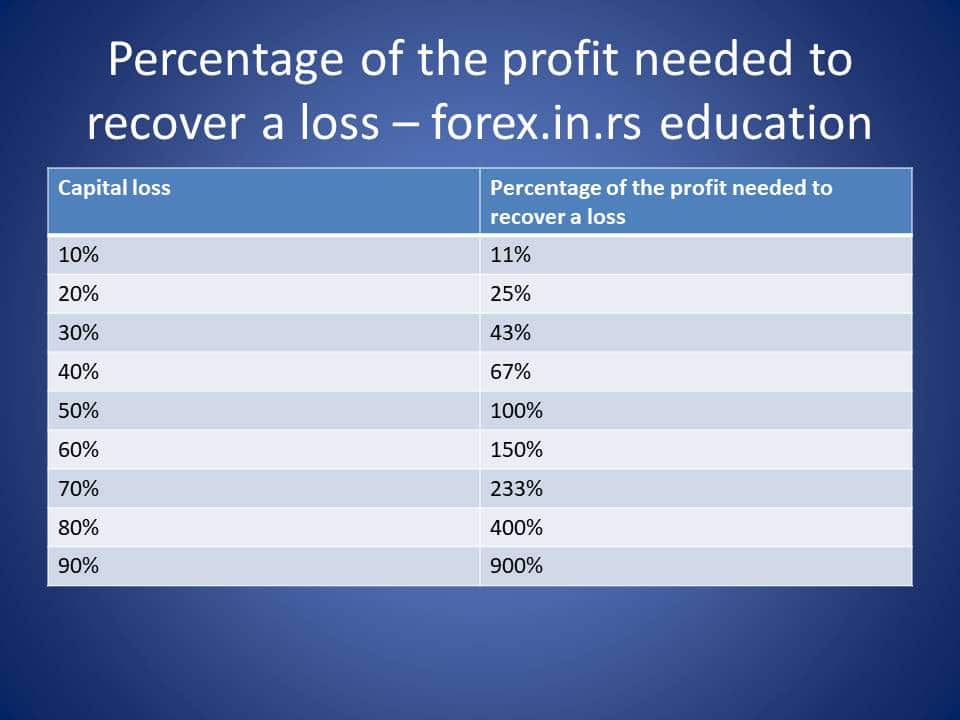

Why I think like this – see the Table above this text. This is the most crucial Table for every trader who trades. It shows the percentage of the profit needed to recover a loss.

Example 1 :

You risk 1% of your portfolio. If you trade and you have a 10% loss after a few months, you can recover as much as you made a loss. So after an 11% gain, you will be break-even.

Example 2:

You risk 5% of your portfolio. If you trade the same positions as in Example 1, you will have a 50% loss after a few months. So after a 100% gain, you will be break-even.

Example 3:

You risk 9% of your portfolio. If you trade the same positions as in Example 1, you will have a 90% loss after a few months. So after a 900% gain, you will be break-even.

Trading for a living might be seen as a risky adventure that no one should go on. Some people think having a job offers more security, but for others, there is nothing secure about working for a boss who can change your heart and fire you at any time. These persons will constantly learn about the many ways in which they can be the best trader to make a lot more money than the salary they would get if they had a job.

Having a job puts people in a position where they will always be job seekers until they retire; being an investor/ trader means you will constantly be looking for and finding opportunities to earn more than the job offers. You will be putting yourself in a position to be the boss as you can constantly improve your ability to earn by simply learning more about the skills you’ll need to increase your investment. You can look at the many earning opportunities you will have when you become a trader. So, can forex be a career? The final answer is yes!

Do people make money in forex? Yes, but can they be successful several years in the future, not just a few months?

Proprietary Trading- the Pros, Cons, and More Important Information

Some day trading firms offer traders trading with a capital pool instead of their own money to benefit all the parties involved. You’ll be entitled to a cut of the profits generated through trades. However, some challenges sometimes make it difficult for people to generate profits.

When proprietary day traders make a few trades daily for more significant gains or many small transactions per day, you can work as a contractor for them. If you have been making profits and are seen by people as an experienced trader, you can work from home with these proprietary trading firms, but these firms might still hire you before you have earned that reputation. During this time, you will be asked to pay for training, as the firm uses this method to eliminate persons who are not serious about trading.

You will need to decide on your preferences to put yourself in the position you want to be in. You will think about the type of trading you are best at and find ways to improve your knowledge about that way of trading so you don’t waste time learning about everything you could be earning and becoming more experienced in one area.

Technology has caused a change in the way people can work for these firms, and some work for firms while they are with their children at home, as markets can be accessed easily.

However, it can take several months before you are experienced enough to earn a living from trading, so if you are in a job, it is not suitable for you to leave it too quickly.

Forex for a living and psychology of trading

When you are willing to do what it takes to overcome the many challenges and learn about the psychology of trading, remember that fear and greed are two emotions you should avoid because they will harm your ability to make profits; you will also need to know about trading strategies and risk management techniques, how to bounce back after a trading loss, to pursue profits so you will be one of the experienced traders who earn a living by trading as a proprietary day trader.

Even though firms are now online as they reduce their costs and you won’t be sitting among experienced traders when you are starting to trade, chat rooms and Skype are useful tools, but getting answers to your questions might be complicated, competition for seats on a physical trading floor is now higher than before, retail day traders access trading platforms, and internet speeds rival most proprietary resources, the fees charged to traders by some firms could reduce your profits and be a deterrent.

Persons who do full-time trading and have advanced degrees and a lot of experience are not confined to working in investment banks, and you don’t need a lot of expendable time and a considerable amount of capital to start trading.

However, people who are not university graduates can start trading and get on the path that leads to wealth creation.

Persons can trade independently by choosing the easiest and most flexible ways, including trading in their daily lives and changing from their homes. Even though your home’s trading stocks are a very capital-intensive arena, as the lowest equity requirement for the trader who is designated day trader is $25000, this amount will have to be maintained.

Suppose the balance should go below the prescribed amount. In that case, the trader will not be trading until the lowest amount needed is restored when money or securities are deposited in the account.

New traders need to be aware of all the markets, as a lower barrier-to-entry that requires less capital can sometimes be a better option.

The currency markets or forex markets offer several alternatives these days. When traders can open accounts for as low as $100 with leverage, a considerable amount of funds can be controlled with just $100; during the week, the market is now open 24 hours per day. Persons who cannot trade during the daytime can trade when it is convenient for them.

Who trades forex for a living? For me, only people who develop strategy figure out market inefficiency and make forex trading a business. This is the only approach that can give trading results consistency during the long-term period in trading.

Can forex make money?

Yes, forex trading is the same as stock trading or bond trading. There is no considerable difference in profitability compared with other trading assets.

How much do forex traders earn?

Forex traders who manage around 1 million dollars in portfolios earn an average of $ 150,000 annually. Today, prop companies offer up to 4 million dollars in portfolios, so without certification or diploma, you can start trading and live from that job.

When you work for a prop company, an average trader who manages $ 100,000 accounts can earn an average of $ 1,000 monthly. It is around 1% per month. So when you make $2000, you must split and share money with the Prop company. Senior Traders manage more than 1 million dollars in smaller companies, and they work much more in large corporations.

If you are a trader and trade your own money and risk more than 2% of your portfolio based on data from brokers, you will lose money instead of earning 94% all of the time. I worked for one year as an affiliate manager for one reputable broker, and I saw that from the 3,000 traders I tracked in one year, 98% of them had more considerable losses than profits.

Brokers are not guilty – risky traders are!

Conclusion

Trading Forex for a living is a challenging yet rewarding venture demanding mastery of technical and fundamental market analysis. While the potential for lucrative returns exists, it requires strict discipline, ongoing education, and robust risk management strategies.

Partnering with proprietary trading firms can offer a stepping stone, but they come with their guidelines and expectations. Consistency, patience, and continual self-improvement are essential, as they are in any profession. Venturing into full-time forex trading is not just about predicting market movements but building a sustainable financial strategy for the long haul.

You can start to manage a $ 100,000 portfolio by investing only $95 or manage $ 250,000 by investing only $295.