The BIS Triennial Central Bank Survey provides news and statistics about the size and structure of global foreign exchange (FX) and over-the-counter (OTC) derivatives markets since 1986. In addition, we can see currency market data for 2019 in OTC derivatives outstanding ReportBased on statistics; we can see how much money circulates in the forex every year.

Let us see how much money circulates in forex:

How much money is traded in forex daily?

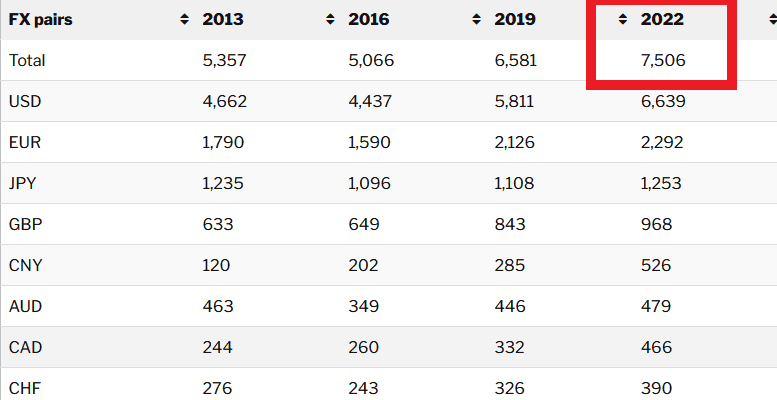

According to the Central Bank Survey report of May 2023, the forex market size is $7.5 trillion daily average turnovers in the last year. However, the most significant daily average turnover was in September 2022, of 9.5 trillion dollars.

So, the forex is the most actively traded market globally, and more than $6 trillion is traded on average every day. By comparison, this volume exceeds global equities trading volumes by 20-30 times.

Please see the latest research in our article How Much is the Forex Market Volume Per Day?

In that research we see that:

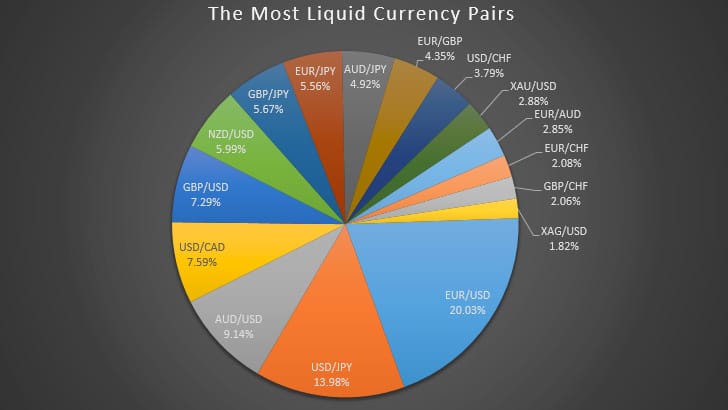

The most significant daily turnover of the global foreign exchange market for the most liquid 40 world currencies was 7506 billion dollars (7.506 trillion dollars). 88.46% of daily turnover in the previous year, or 6639 billion, belongs to US dollars.

Here’s a more detailed breakdown:

- Spot transactions: These are single outright transactions that involve the direct exchange of currencies and are typically settled “on the spot” or within two business days. Spot transactions account for a significant proportion of Forex market turnover.

- Forward transactions: This involves the buying and selling of currencies for delivery at a future date. Traders use forwards to hedge against potential currency fluctuations.

- Swaps: These are the most common type of forward transaction. In a swap, two parties exchange currencies for a specific time and agree to reverse the trade later. These are not standardized contracts and are not traded on an exchange.

- Options: In this case, a trader has the chance (but not the obligation) to exchange currencies at a future date. Options trading can be more complex, but it offers flexibility for advanced strategies.

- Futures are similar to forwards in that they are contracts to buy or sell a particular currency at a specified price on a specified date. The critical difference is that lots are standardized and traded on a central exchange.

The daily trading volume of the Forex market vastly outstrips that of the stock market. For comparison, the average daily trading volume in the global equities markets is only a fraction of that of the Forex market. This high liquidity can result in lower transaction costs (spreads), but the market can absorb large trades without significantly impacting currency rates.

It’s also worth noting that trading in the Forex market is concentrated in a few key financial centers, including London, New York, Tokyo, and Singapore. The vast majority of Forex trading takes place over-the-counter (OTC), which means transactions occur via a network of computers rather than on a centralized exchange.

The daily turnover in the Forex (foreign exchange) market tends to increase over time due to several reasons:

- Globalization: As the world becomes more connected, the volume of international trade continues to grow. This increases the demand for currency exchange, which, in turn, increases Forex turnover.

- Financial Market Integration: Financial markets are becoming more integrated globally. This encourages more cross-border investments and transactions, increasing currency trading.

- Technology Advancements: The advent of online trading platforms and technologies has made Forex trading more accessible to retail traders worldwide, increasing overall trading volume.

- Market Volatility: Economic uncertainties and volatility often lead to an increase in Forex trading as traders seek to profit from fluctuations in currency values.

- Interest Rates Differentials: Central banks worldwide adjust interest rates to manage their economies. These changes can cause significant movements in currency pair values, leading to increased Forex trading as traders try to capitalize on these movements.

- Speculative Trading: A significant portion of Forex trading is driven by speculation. Traders attempt to predict future movements in currency pairs and profit from them. As more people engage in such speculative trading, the turnover in the Forex market increases.

- Hedging Activities: Companies involved in international trade often use the Forex market to hedge against potential losses caused by fluctuations in currency values. Global growth business has increased such hedging activities, contributing to higher Forex turnover.

In conclusion, the daily turnover in the Forex market reflects a complex interplay of various factors, including globalization, financial market integration, technological advancements, market volatility, interest rates differentials, speculative trading, and hedging activities.

Being the most significant financial market globally, the Forex market’s daily turnover has consistently grown, reaching an average of $8.04 trillion, according to the BIS Central Bank Survey report of May 2023. This high liquidity and 24-hour operation make the Forex market attractive to various participants, from large financial institutions to individual retail traders.

However, the high daily turnover also points to the significant risks associated with Forex trading, including heightened volatility and the potential for substantial financial loss, particularly given the everyday use of leverage in Forex trading.

For these reasons, anyone considering trading in the Forex market should do so cautiously, armed with a thorough understanding of the market dynamics, a well-planned trading strategy, and a clear understanding of the potential risks involved.