The only way to leverage the opportunities available in trading markets, particularly in the Forex market, when you are disciplined in your actions. It is effortless to say this but difficult to follow. How can you make sure that you remain disciplined when you make any decision, from selecting a broker to closing a trade? One of the best ways to remain disciplined is to follow one trading strategy. Although the strategy is not tested and tried, it would be better to find a suitable one and stick with it. Once you find well-reasoned strategies that work and get you good results, it will be easier to remain disciplined.

Effective forex trading strategies are usually simple, the most common tried and tested strategies described in many trading books. All effective forex trading strategies follow strict rules regarding risk management, position-sizing, entry and exit position determination, technical and fundamental analysis.

It is important to look at the bigger picture when talking about trading strategy, as most people generally refer to one facet of the Forex trading strategies. A trading strategy is more than just finding the entry point. It is important that traders also consider the following:

- Risk management

- Position sizing

- Define entry and exit points

Risk in trading implies future uncertainty about deviation from expected earnings or expected outcome. Usually, the greatest risk for traders is uncontrolled loss of capital. High risk in the trading cause that around 95% of forex traders lose money.

What is position sizing?

Position sizing represents the procedure that determines the number of units invested in a particular security. In simple words, position sizing calculates how much capital traders or investors allocate to a given trade within a particular portfolio. Optimal position sizing reduces the portfolio’s risk, and it is a crucial procedure in trading risk management.

Forex Trading Strategies Types

Let’s begin by stating the obvious; there is no ‘best Forex strategy.’ You can search the whole world, and no trader or investor will ever tell you that a particular trading strategy is a key to all your answers. Different individuals have different FX strategies. So, to coin the right strategy for yourself, you need to align in with your personality and thought process. One Forex strategy does not work for every individual. Therefore, do not aimlessly copy someone else’s trading style.

Every year there are certain trading styles and strategies that become the rage. These may be destructive for you, while some long-forgotten strategies may become lucrative. You might have to experiment for a while in the beginning. Start with small investments and eliminate the ones that do not work for you in any case. During this process, focus on the time frame that you feel the most comfortable with.

Many trading strategies have proved their mettle. Some are good for a short period of time, while the others are good for a longer term. Traders and brokers have been relying on these strategies for years, and they remain relevant and popular to this day. If you want to be the best at your game, you need to be aware of these and other strategies. Only after understanding and experimenting with these styles and strategies, you would be able to find your right fit. Let’s take a look at these strategies:

- Scalping: Scalping is a trading strategy where the trader profit after small price changes; generally, after a trade is executed and becomes profitable. Scalping is regarded as one of Forex’s most advanced trading strategies because a person must be speedy to take advantage of it. Scalping refers to making short-lived trades that don’t last for more than a few minutes. A scalper quickly beat the offer spread or the bid and uses a few pip movements to profit and exit the trade quickly. Traders who use this strategy employ a low time-frame chart, which can be found on the Supreme Edition package of MetaTrader 4 and its likes.

- Day Trading: Day trading represents the short time frame practice of buying and selling various financial instruments within the same day or even multiple times over the course of a day. This trading strategy is perfect for beginners as they get to avoid overnight exchange rate fluctuations. As the FX market operates 24 hours a day, there are always chances that a currency may become volatile. While you are sleeping, things can go in the opposite direction, changing everything overnight. Day trading lasts for a few hours where a 1-2 hour time frame is used.

- Swing Trading: Swing trading is a trading style that attempts to capture gains in any financial instrument over a period of a few days (more than 1 day) to several weeks. You can make profits using short-term patterns created by prices. For this, you need to hold a position for several days. This is known as swing trading. Swing traders keep a constant eye on the bars, revisiting them after every half an hour or so.

- Positional Trading: Long-term trading or position trading refers to trades that can be opened for days, weeks, months, or years. One needs to be really patient and disciplined to reap the maximum benefits of this strategy. This is a long-term trading strategy where the trader chases trends for a long time to maximize their profits by leveraging major price shifts. A trader is required to look at the charts when the day ends. This strategy is not ideal for beginners. You need the immense fundamental knowledge to speculate if holding a position for a prolonged time is beneficial or a waste of time.

Here is a list of tested Forex trading strategies. You can read about them and give the ones that you feel comfortable with a try.

1. Half Daily ATR Strategy

Buy currency pair if the price is above the last 24 hours High. Stop loss is Half the Daily ATR value, target Half Daily ATR value.

Sell currency pair if the price is below the last 24 hours Low. Stop loss is Half the Daily ATR value, target Half Daily ATR value.

For the last 14 days, the Daily ATR value represents the average distance from daily high to daily low based on the ATR indicator.

This is one of the latest strategies in the world of Forex. It aims at leveraging the early market pip movements of some currency pairs that are highly liquid. The most popular currency pairs that fall under this category are GBP/USD and EUR/USD. Traders mostly use the Half Daily ATR for these two currency pairs.

This is all the input that is required from the trader’s side. Once it is done, everything else is played out by the market. This technique is used in scalping and day trading as both are short-term. But, one must keep in mind that greater risks are involved in short-term trading. Therefore, do not forget to enforce a risk management tool like stop-loss.

2. Daily Chart Strategy

Experienced Forex traders prefer daily charts over any short-term strategy. Daily market charts are very different from those one-hour trading charts or any other lower time-frames as there is less noise from the market. Since daily charts cover a longer time frame, you can even see even 100 pips move in a day, not possible in short-term charts. This can increase your chances of maximizing profits in just a single trade.

Trading signals given by daily charts are more reliable than other lower time-frame charts, which gives them their profit-making potential. Although it needs to be highlighted, even daily charts cannot guarantee anything. This strategy tilts towards fundamental analysis, which makes following daily news and looking out for random price fluctuations an important part of it. There are three main principles on which this method is based:

- Trend Location: there is a continuous cycle of new market trends, which then consolidate. The first step of using this trading style is identifying long-drawn moves that prevail within the market. One way to do that is by going through the Forex data worth 180 periods. You need to identify the swing lows and highs next. You have to use this data to find references on the current price chart. This will help you in identifying the market direction.

- Staying Focused: long-term strategies always demand patience. You need to hold your horses and get rid of the temptation of getting into the trading market. It would help if you stayed put and wait for bigger opportunities. Stay focused because patience is a virtue here.

- Larger Stop Losses and Less Leverage: there are large intraday swings that you need to know. It would help if you used larger stop-losses, but larger capital investments should not accompany that.

3. 1-Hour Forex Trading Strategy

This strategy is perfect for making the best of the one-hour time frame. While you can use this strategy for many currency pairs, it is more suitable for EUR/USD, GBP/USD, AUD/USD, and USD/JPY. Talking about the resources required for this, the MACD (Moving Average Convergence Divergence) is the most suitable for this. You can find this tool on both MT4 and MT5.

4. Weekly Trading Strategy

Intraday trading is the most preferred trading style because it allows you to capitalize on the market volatility that appears for a short period of time. Since the market remains volatile is short, traders prefer shorter time frames. This weekly strategy, however, offers more stability and flexibility. Weekly candlestick charts have extensive market information to offer. These strategies avoid help you avoid excessive risks as they are based on lower position sizes.

Engulfing candles and hammers are some of the most common price action patterns used for this trading strategy.

How to backtest forex trading strategy?

Forex trading strategy can be backtested using an automated expert advisor program or a manually backtesting process. On various freelancer websites, traders can create freelancers’ tasks and order expert advisors with entry and exit rules. Then, strategies can be tested for various time frames, currency pairs, indicator values. The best forex trading strategies can be chosen based on profitability, profit ratio, shape ratio, and various metric.

The Importance of Price Action in Forex Trading

What is Price Action?

Price action trading is a way of trading at the moment when price creates a strong move around important price levels. For example, price action is in the moment when price breaks support or resistance in strong movement, or when price touches an important price level and makes a sharp, strong reversal.

Price action forex trading strategy:

Watch strong resistance level or strong support price level. If price breaks a strong price level in a short time frame very fast, it is a signal to enter into trade and follow the main trend.

Fundamental analysis is an important part of Forex trading as certain conditions prevailing in and around a country directly or indirectly impact its currency. When it comes to fundamental factors, every trader uses them differently. However, the use of price action remains constant in all trading strategies. Using price action is a part of technical analysis. Technical analysis for currency trading involves two major styles – following trend and counter-trend. Both styles aim to recognize and exploit price patterns to increase profits.

To use price patterns accurately, one must understand a few other related concepts, for example, support and resistance. These two terms represent a market’s tendency to bounce again from previous highs and lows.

- Support shows the tendency of the market to rise from the previous low.

- Resistance shows the tendency of the market to fall from the previous high.

Just like demand and supply, support and resistance also supplement each other. Support and resistance are played out on the judgment formed by comparing subsequent prices with recent lows and highs. Consider the following two situations:

- If the market approaches the recent low, more buyers will be interesting as the currency will be available cheaper.

- The opposite will happen in the case of buyers when the market is approaching the recent high. In this situation, sellers will look for opportunities to lock in their profits by looking for currencies they view as too cheap. This makes the recent lows and highs the yardsticks against which the evaluation of current prices is done.

Let’s talk about the self-fulfillment aspect of these two levels. This plays out because traders, investors, and other participants continuously anticipate price action to behave in a certain way, and then they act accordingly. This can influence the market to behave in a way that mirrors their assumptions.

Note the three points given below:

- Support and resistance are based on the market participant’s natural behavior. It is a common sequence of actions rather than an ironclad rule.

- A trend-following system is beneficial when these two levels break down. It makes a profit off that.

- Counter-trending is the opposite of trend following system. These participants buy when a new low occurs and sell when a new high is reached.

Following Trends in Forex

Support and resistance are two levels that form the two ranges between which the market operates. Sometimes, the market moves above or below these levels, thus starting a trend. But how? When the level of support breaks, the market approaches a new low. Now, the buyers will begin holding off because they are constantly looking for lower prices. They will wait to make any purchase till they still see the opportunity for the price drop. From the other point of view, there will be traders selling because they would either be in a panic mode, or the other case would be that they are forced out of the trade by their tool.

This trend will continue till the selling gets depleted. This will lead to the consolidation of prices, and the buyers will start to believe that the prices will not drop any further. These trend-following strategies aim at encouraging traders to sell when the market has fallen through the support level and buy once the market has broken through the level of resistance.

It may not be as straightforward every time because trends tend to be dramatic and prolonged. Taking from the magnitude of moves, this system is deemed as one of the most successful systems in Forex trading. For this kind of strategy, indicators are used by the traders to keep themselves updated regarding which new trend is rising. Again, nothing is set in stone here as well.

But there is good news; if an indicator has established the time for better chances for the beginning of a trend, the odds might be in your favor. This indication of the formation of a trend is known as a breakout. In simple language, when the prices go beyond the highest high or below the lowest low for several days, this is called a breakout.

For example, if you see the prices move above the last 20-days’ highest high, there is an upside breakout. Traders need to have a different mindset when they are relying on trend-following mindsets. They have to witness the movements for a long duration of time. During this period, market swings can even make their profits disappear. Psychologically, these trades can be quite taxing. When the market is volatile, it would be difficult to spot trends as greater price swings usually disguise them. Therefore, this kind of system works best in quieter and trending markets and when the trader is patient.

The Donchian Trend system can be considered as a good trend-following strategy example. Richard Donchian, a futures trader, invented the Donchian channels. It is an indicator that a trend is being established. The Dinchian channel comes with a default setting that you can customize at your convenience. For this example, we are following a 20-day breakout. One of the following two things are suggested by the Donchian channel breakout:

- If the market price moves above the last 20-day high, you should buy.

- If the market price goes below the last 20-day low, you should sell.

How to use the 200 ema indicator?

200 EMA or 200 SMA is moving average with one of the most used long-term forex trading indicators. Price above 200 SMA or 200 EMA lines on the daily chart usually implies the bullish trend and below-line bearish trend.

How to set up 200 EMA?

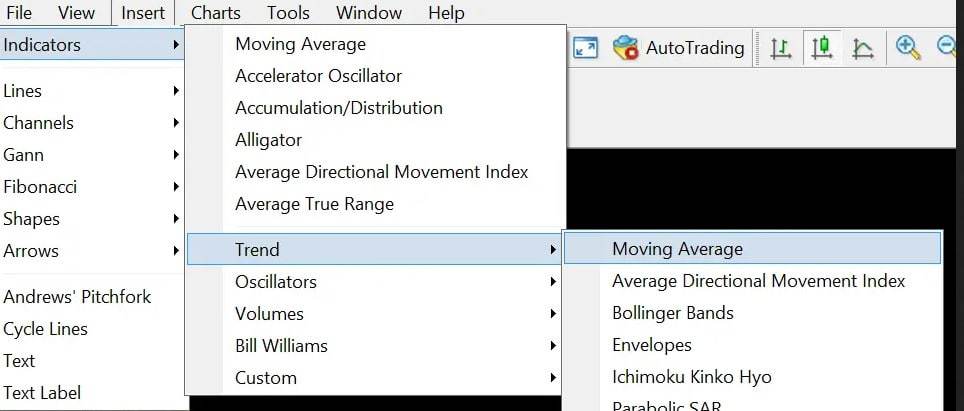

To set up 200 EMA indicators on the chart, go to the Metatrader platform, choose Indicators>Trend>Moving Average. Instead, a simple moving average, please add exponential moving average EMA and set the period to be 200.

It is widespread to find it difficult to differentiate between long and short-term trends. Many traders, especially the new ones, find it difficult to filter out the trends. If you want to be sure about it, you should consider the 25-day moving average. In addition to that, you can also look at the 200-day moving average. The former will determine the permitted direction. If you use this system, the rule dictates that;

- If the 200-day MA is higher than the 25-day MA, go short.

- If the 200-day MA is lower than the 25-day MA, go long.

You can follow a similar pattern to find the right exit also. This is possible if you are looking at the 10-day breakout. It means that if the market starts going lower than the previous 10-days low when you have opened a long position, it is time for you to either sell or exit the trade.

4-Hour Trading Strategy

The 4-hour strategy is also a trend-following strategy that is beneficial and profitable for swing traders. As the name suggests, a 4-hour base chart is used to find the location of trading signals with some potential. In this strategy, the 1-hour chart is employed for signals. It helps in determining where the actual position will be assumed.

You can also signal charts other than the 1-hour chart. However, it would help if you kept in mind that it has to be at least one hour below the base chart. You need two sets of MA (moving average) lines for best results, with one of them being the 34-period line and the other one being the 55-period line. To determine if the trend is worthy or not, trades see if the price action and the MA lines.

The following conditions must be fulfilled if there is an uptrend:

- The MA line is below the price action.

- The 55-MA line is below the 34-MA line.

- There is an upward slope of the MA lines.

The following conditions must be fulfilled if there is a downtrend:

- The MA line is above the price action.

- The 55-MA line is above the 34-MA line.

- There is a downward slope of the MA lines.

Forex Trading Using Counter-Trend Strategies

It is a fact that most breakouts don’t turn out to be long-term trends. The counter-trend strategy is based on this fact. Traders who follow counter-trend strategies try to take advantage of the fact that prices tend to bounce off the highs and lows previously established. In theory, these strategies seem to be the most profitable strategies that work in favor of traders.

Before you follow this route, understand that you need to be extra careful in risk management with these Forex trading strategies. The foundation for these strategies is the capacity of the support and resistance to hold their positions. There is a greater risk involved with these two level breakdowns. Traders need to keep a constant eye on the market. This makes these strategies unsuitable for those who cannot invest a lot of time in trading. You will find healthy price swings in this market but within a set range.

For example, while being stable, a quiet market may start trending. It becomes volatile with the development of the trend, but how the market’s state changes remain uncertain. You must look at its current state to understand if your trading style will align with it or not.

Finding the Perfect FX Trading Strategy for You

The advancement in the world of technology has made Forex trading more accessible and reliable. Many new technical indicators allow you to identify trends and keep your risks at the minimum level. These technical systems and indicators can be easily customized to fit individual trading styles.

Before you begin trading, understand that both winning and losing are parts of it. Irrespective of how successful your trading strategy is, you can never completely avoid the risk. There is no strategy out there that can guarantee overnight success or keep you protected from limitless risks. It would help if you stayed away from those quick money-making schemes that are always basking in false glory.

There are many well-established trading strategies, but finding the one that suits you the most can only be made visible after several trials and errors. You can sign up with different traders and open demo accounts to test your strategies. This will allow you to gain real trading experience but without risking real money.