Scalping is a strategy used in financial markets where a trader makes numerous trades to profit from small price changes, typically over a concise time frame. This approach relies on the premise that small price movements are more accessible to catch than large ones. Scalpers aim to accumulate small gains that add substantial profits while minimizing risk exposure.

What is considered scalping in forex?

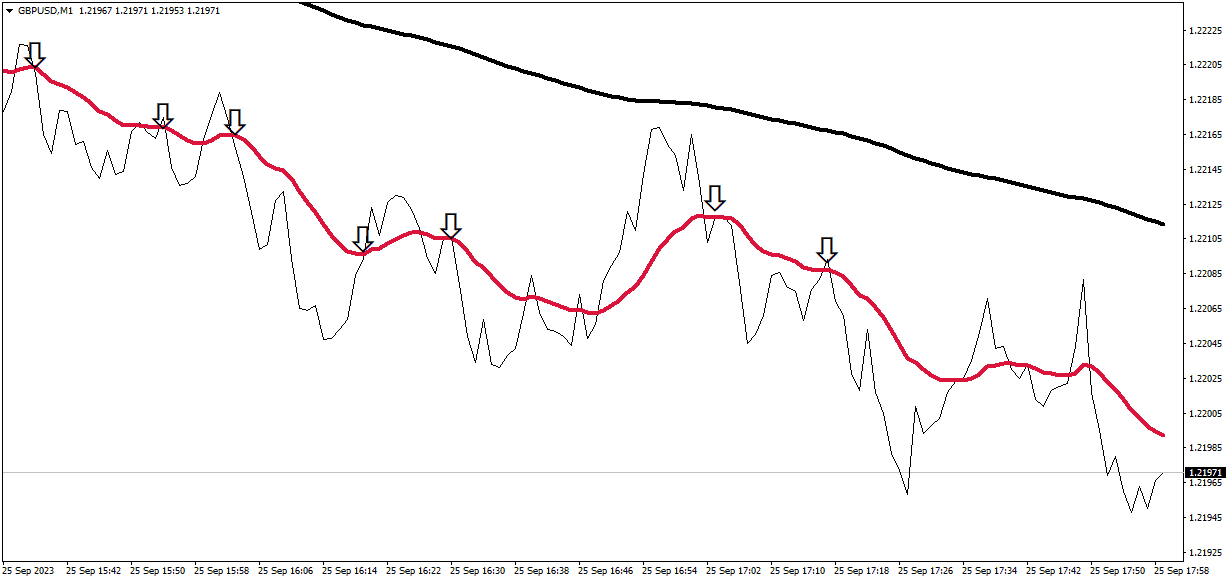

Scalping is a trading strategy where the trader makes a profit after small price changes, usually after several pips. The more general definition is that scalping traders keep their trades from a few seconds to several minutes.

Some corporations define scalping when traders trade 25% from the daily average true range; some traders define scalping when taking a couple of pips. For HFT companies, we are talking about tick profit.

Can You Make Money Scalping Forex?

The scalping strategy usually can not bring much money because of trading costs (frequently, trading increases cumulative commissions based on spreads value ) and overtrading problems. However, many professional traders in corporations and prop companies use well-designed scalping strategies that can be retweeted many times over the day and can be profitable.

Scalping can be profitable due to its focus on small, frequent gains from minor market movements, capitalizing on the cumulative effect of these gains over time. However, the strategy demands high discipline, quick decision-making, and constant market monitoring, which can be challenging for most traders. Additionally, the high volume of trades, associated transaction costs, and the risk of significant losses from even small market shifts often make consistent profitability difficult for most traders engaging in scalping.

When is scalping a dangerous game?

Scalping is dangerous when traders do not have the correct risk-reward ratio when they risk much more than the expected profit.

Scalping trading example:

It can be a reasonable strategy if you risk 4 pips and your targetyou4wons.

The strategy is unreasonable if you use 150 pips and your target is two.

Scalping becomes a dangerous game in the following situations:

- Incorrect Risk-Reward Ratio: When the potential loss (risk) is significantly more significant than the potential gain (reward). For instance, risking 30 or 150 pips to gain only two pips.

- Frequent Trading with High Leverage: Scalping often involves using leverage, which can amplify losses, making it risky if not managed carefully.

- Overtrading: Scalpers make many trades in a day. Overtrading can lead to fatigue, poor decision-making, and increased transaction costs.

- Market Volatility: In highly volatile markets, small price movements can quickly turn against the trader, leading to substantial losses.

- Lack of Discipline: Scalping requires strict discipline in following trading plans. Deviating from the plan due to emotions or impulses can be risky.

- Insufficient Capital: Scalping with insufficient capital can limit the ability to absorb losses, leading to the rapid depletion of trading funds.

- Dependency on Technology: Scalping often relies on the fast execution of trades, making it risky if there are technical issues or delays.

- Slippage and Transaction Costs: Frequent trading increases exposure to slippage (difference in expected and executed price) and high transaction costs, which can erode profits.

A more reasonable scalping strategy would be risking an amount equal to the expected profit, like risking six pips to gain 6 or 10 pips, which balances the risk and reward.

Many people believe forex trading is an easy way to make fast money. However, you cannot realize the impact unless you lose your money a few times. You might make some money. But, in the end, you might find that you have lost more than your wins. It is easy to lose money in the minor. You might lose all your money if you use the forex scalping minimum.

The scalping method is not always helpful—some traders use this method without being aware of the outcome. You can use position trading to make sis some money from your investment. In position trading, investors put many trades on a single currency pair. They usually end up with a standard price. Having more minor positions can be more effective in minimizing the loss.

How to Manage the Risk in Forex?

Managing risk in forex scalping trading strategy involves several vital practices:

- Set a Strict Risk-Reward Ratio: Establish a risk-reward ratio that aligns with your trading goals, at least 1:1, where potential gains equal potential losses.

- Use Stop-Loss Orders: Implement stop-loss orders to automatically close positions at a predetermined loss level, preventing more considerable unexpected losses.

- Limit Leverage: While leverage can amplify gains, it also increases risk. Limiting leverage helps to manage potential losses.

- Trade During Optimal Times: Scalp during high liquidity and lower volatility, typically during significant market overlaps, to reduce spread and slippage costs.

- Keep Trades Small: Limit the size of individual trades relative to your total capital to avoid significant losses on a single trade.

- Implement a Daily Loss Limit: Set a maximum limit to prevent continuous trading during unfavorable conditions.

- Regularly Review and Adjust Strategies: Continuously assess the effectiveness of your scalping strategy and make necessary adjustments in response to market changes.

- Avoid Overtrading: Be mindful of the number of trades you make, as excessive trading can lead to mistakes and increased transaction costs.

- Stay Informed: Keep up-to-date with market news and economic events that can cause sudden price movements.

- Use a Demo Account for Practice: Before trading with real money, practice with a demo account to refine your strategy and decision-making skills.

- Emphasize Emotional Discipline: Maintain emotional control to avoid impulsive decisions driven by fear or greed.

- Diversify Trading Strategies Don’t rely solely on scalping; consider incorporating other trading strategies for a diversified approach.

Whether en we talk about risk, we are talking about portfolio risk and must in. The dangerous thing when the risk-reward ratio is bad when traders risk much more than the expected profit is.

For scalping, we can have a 1/1 risk-reward or 1/2,1/3 strategy, where we risk 100 pips to make 1 pip profit, which is very bad.

Below is the account risk and how much intelligence is needed to recover loss:

Before discussing the risk and how you manage it, first, you will have to realize that forex trading is not an easy way to make money. You can lose all your hard-earned money by mainvestecisions. If you want to minimize the risk, you will have to control and favor your emotions; you can have the possibility to make a smart decision.

You can decide on a suitable investment if you keep emotions aside. Emotional decisions are not favorable in forex trading. When you prefer forex scalping, you can choose a random direction and end up investing in larger unfavorable; you will not open if the market condition does not go in your favor. You cannot do much except having an empty account.

Scalping Is Not Fun Always

Scalping is not always fun. You might find this method in the beginning when results are positive. However, in the end. Winni should avoid positions that make scalping fun. But when the result is not favorable, you are not going to enjoy forex scalping. You can lose a lot of money even without realizing it.

By nature, we want to outsmart the market and bring favorable results. But we cannot change the market condition and cannot convert a losing trade into a winning one. Therefore, it is suggested to avoid forex scalping. But when it is a must, you can consider the following.

Always start with a small investment. You might be tempted to invest a big to make some easy money. If you do so, you might put yourself at risk. Start with small and observe the market condition.

Set a stop to decide the maximum loss. When stopped out, move on.

Scalping is linked to risk. So, be familiar with the trade and then invest. Learn the industry skills to avoid a significant loss.

In my trading experience, I met great forex and stock scalpers. They are good at their job, and scalping can be profitable. Their strategy is to risk a tiny portion of their portfolio and have at least an intelligent reward 1:1. Usually, they specialize in just a couple of assets (a few stocks, energy, gold, major forex pairs, etc. ). So, is scalping trading profitable? Yes, but only for some professional traders. Usually, the scalping strategy is not for beginner traders.

Forex trading can be profitable when you understand the industry and know how to minimize the risk. The key is to make smart decisions and avoid emotional trading. If you are using forex scalping, first, understand the trade and set a stop. You should never invest more than you can afford.