Table of Contents

Intraday trading is a fast-paced strategy where traders capitalize on small price movements by buying and selling securities within the same trading day, aiming to close all positions before the market closes to avoid overnight risk. It requires quick decision-making, a good grasp of market trends, and the ability to act swiftly on real-time information. Swing trading, on the other hand, takes a more measured approach, holding positions for several days to weeks to capture significant price swings in the market. This method relies heavily on technical analysis to identify potential trends and reversals, balancing the rapidity of day trading and the patience required for longer-term investment strategies.

Some trades are in the grey zone between intraday and swing trade.

Intraday swing trading is a strategy that combines aspects of intraday and swing trading to capitalize on price movements within a single trading day. Usually, an intraday swing trading strategy is based on buying from the bottom or selling from the top against the current several-hour trends, where traders keep trading for around 24 hours.

The best performance traders can get if they follow a significant time frame trend (H4 or daily chart) and trade swing trade against the hourly trend. However, a trader can buy or sell against the significant trend if the price is on a meaningful level (for example, yearly or monthly low or high).

Intraday swing trading is a strategy combining trend, swing, and day trading to enable the trader to buy or sell any financial instrument after a pullback. Swing trading does not mean only purchasing or selling against a significant trend. But we will talk later about complicated intraday swing trading strategies.

In the first step, we will try to analyze significant types of trading.

The best strategy for beginners is to study these three main active types of trading. These types of active trading are;

- Day trading.

- Swing trading.

- Intraday Trading.

The distinguishing factor between these three types of trading is the duration. Each represents the length of time one holds an open market position. Let us study in detail the difference between the three.

What is Intraday swing?

Intraday swing represents a trading strategy in which the day trader waits for a pullback of the significant trend, enters into a trade, and keeps the trade for a few hours (intraday trading) or several days (swing trade).

Intraday Trading

This trading activity takes place within a concise time frame, as the name suggests, “intraday.” Intraday traders are mostly referred to as day traders. The trading period is mainly in seconds, minutes, or an hour. Intraday traders always open and close the trade on the same date to capitalize on rapid fluctuations in exchange rates.

The intraday activity comprises many trade strategies since they are primarily involved in technical analysis. These strategies include;

Scalping: scalping is a trading strategy to generate profit from a slight price change in the stock price or currency value. Traders involved in dealing with several trading units believe that the slight difference in each unit of exchange’s price leads to a substantial amount at the end of the day when dealing with several trading units. Traders practicing this method are called scalpers. They always employ an exit strategy to avoid possible losses from continuous trading.

High-frequency trading (HFT): High-frequency trading is an algorithmic trading mode that involves high-speed trading with high turnover. It is mostly done by using developed electronic systems integrated with financial software. This kind of trading system always works with short-term investments.

Order flow analysis: This kind of analysis can be described as a game. It is a game within a game. The trader’s strategy follows the game rules but is not based on other traders’ market decisions.

Intraday strategy always relies on these factors so that its small profits can be used to realize maximum profits by limiting the risks.

Day trading (short-time trading)

Unlike intraday trading, day trading involves dealing with high volumes of trading units identified early in the trading day and then executed session by session. The popular types of trading for daily time frames are;

Trend following: this is taking advantage of short-term, medium, or long-term moves that appear to be playing out in various markets.

Momentum trading is when the trader acquires and sells depending on the recent price strength.

Range: This is the strategy that a trader uses to identify overbought and oversold areas. They buy the oversold and sell the overbought areas.

The day trading markets are described by inherent volatility and range, while intraday trade relies mainly on liquidity and daily analysis.

Swing Trading

Swing trading is buying and selling securities that focus on profiting from changing trends in price action. The determinant of swing trading is that the positions are held through an independent session at a time. The trading takes place everywhere between six days and several weeks. The swing trader needs to adhere to the following considerations.

Carry and finance costs: this is the cost of storing physical commodities, which can also constitute insurance costs.

Systematic risk exposure is the risk that can affect all commodities in the market. It can also be referred to as “undiversified risk.”

Account for extensive margin requirements: extensive margin is the range of the resource applied or utilized. For example, several individuals carry a specific task under a certain extensive margin.

Swing trading is characterized by its popular application in determining agricultural futures and forex. Central bank policies, seasonality, and corporate earnings usually employ this policy in their trade operations.

The trading type is the crucial factor, depending on the available resources, market size, and personal traits needed to achieve the market goals and success in trading. However, any type of trade is applicable and productive.

Intraday trading vs. swing trading

The difference between intraday trading and swing trading is that intraday trading involves making many trades in a single day, while swing trading occurs over days or weeks.

Intraday Swing strategy explanation

Daily personal analysis is also a critical factor in trading. Since you are the only important factor in your business, you should analyze your daily activities, feelings, and deviations from profit-making and note them in your daily diary. Having these essential factors at hand, one can explore different trading strategies in the trading field. Beginner traders can encounter most difficulties in deciding which trade methodologies to use.

This struggle to discover different success methods depends on how often the new trader researches these three trading activities. Research on various analyses and methodologies regarding the product market and exchange rates is vital for active futures traders. It is used in critical decision-making, like when to buy and hold the commodity until the next peak period.

Intraday Swing strategy description:

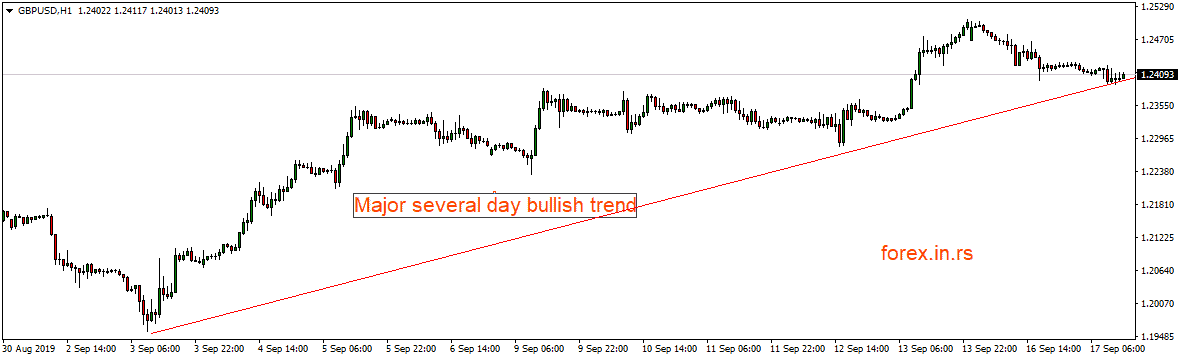

Let us see in September 2019 on the GBPUSD chart bullish several days major trend.

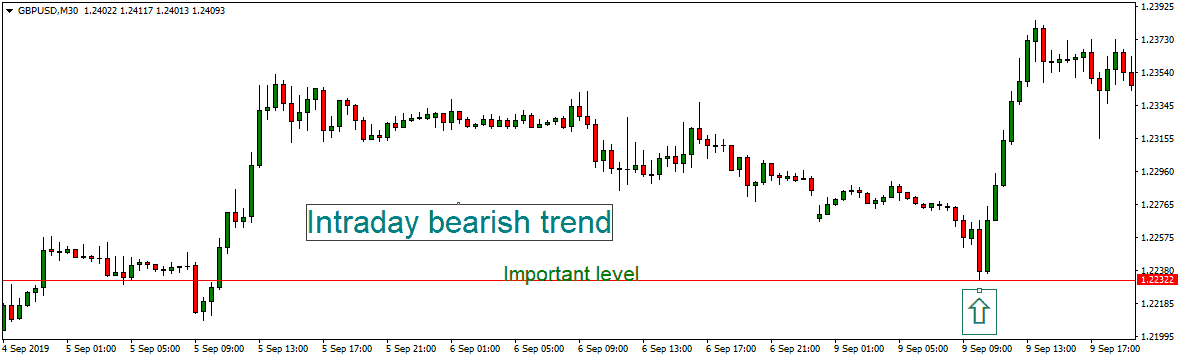

If we see on the 30-minute chart, intraday several hours bearish trend, we can wait for the price to pull back and then make a buy order like in the image :

This is an example of an intraday swing trade when we trade against an intraday trend and follow a significant several-day trend.

Conclusion

There are so many ways to practice discipline in trading. The most important and the first stage of trading discipline is having a trading plan before engaging in any activity. Also, the trader must centralize all the responsibilities to themself. You should be ready to face any situation and anything that might emerge against your trading activity. Always view these risks from all angles, especially from the extreme scenario. This will help you be bold enough to face any negatives that might come your way.

Intraday swing is just one of the strategies that traders use very often. If you trade against a major trend, you need to be careful because the price needs to be on a fundamental level, and you need to see the reaction to that price before you enter into a trade.