In trading, regardless of the asset (be it stocks, gold, or any other instrument), “long” and “short” describe the direction of a trade based on an investor’s outlook on the asset’s price movement. When a trader goes “long,” they buy the asset expecting its price to rise. Conversely, when a trader goes “short,” they borrow and sell the asset, anticipating its price will fall, intending to repurchase it at a lower price later. Both long and short positions aim to profit from correctly predicting the asset’s future price direction.

In forex trading, going “long” means buying the base currency of a currency pair with the expectation that its value will rise relative to the quoted currency. Conversely, going “short” means selling the base currency with the expectation that its value will fall relative to the quoted currency.

1. Long (Going Long):

- When traders go “long” on a currency pair, they buy the base currency and sell the quote currency.

- The trader anticipates that the value of the base currency will rise relative to the quoted currency.

- If the currency pair’s value increases, the trader can sell it at a higher price for a profit.

- For example, if a trader goes long on EUR/USD, they buy the Euro and sell the US Dollar, expecting the Euro to appreciate compared to the US Dollar.

2. Short (Going Short):

- When traders go “short” on a currency pair, they sell the base currency and buy the quote currency.

- The trader anticipates that the value of the base currency will fall relative to the quoted currency.

- If the currency pair’s value decreases, the trader can repurchase it at a lower price for a profit.

- For example, if a trader goes short on EUR/USD, they are selling the Euro and buying the US Dollar, expecting the Euro to depreciate compared to the US Dollar.

In both cases, the objective is to profit from anticipated changes in the relative values of the two currencies in the pair. Forex traders use various tools, charts, and strategies to predict and analyze market movements. A long position in trading means taking a “buy” stance, indicating the belief that the asset’s price will rise. Conversely, a short position represents a “sell” stance, reflecting the expectation that the asset’s price will decline.

Also, leverage is often employed in forex trading, allowing traders to control a more prominent position with less capital. However, while leverage can amplify profits, it can also amplify losses, making risk management crucial in forex trading.

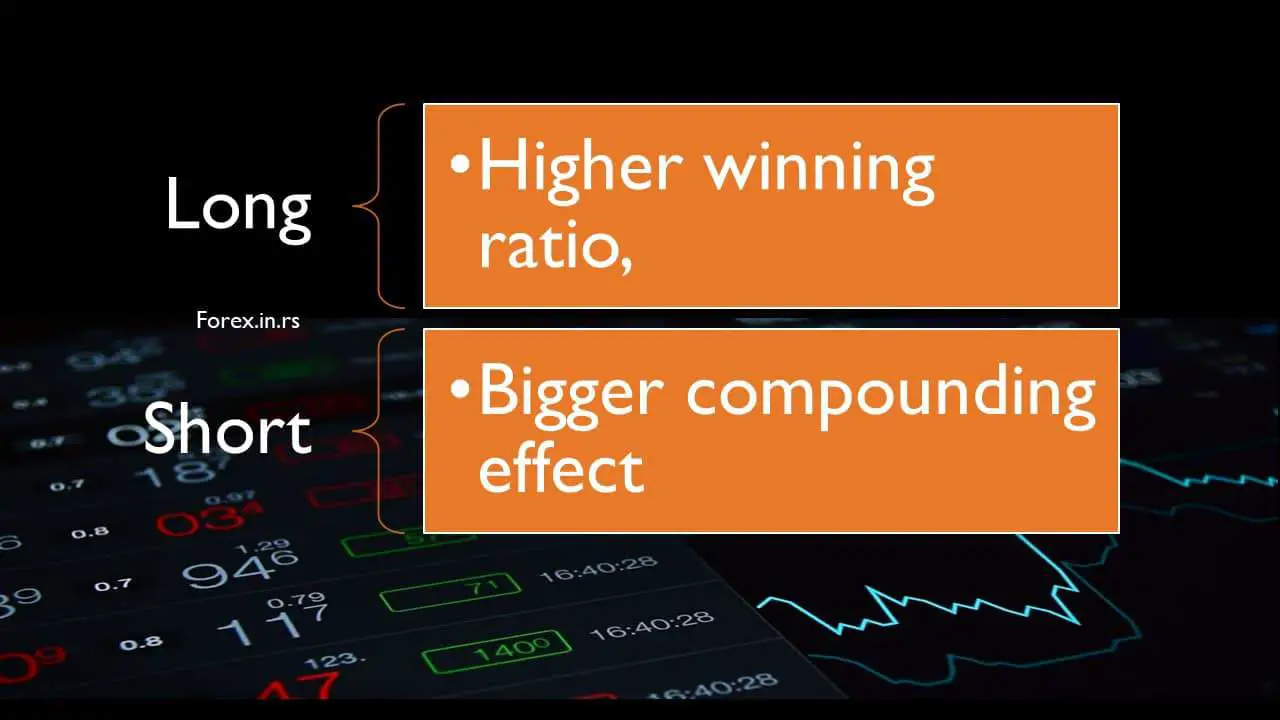

Short-term forex trading or long-term forex trading? In Forex, both short-term and long-term trading have advantages and disadvantages. Usually, Forex’s long-term trading has a better winning ratio and profitability, but short-term trading has a more significant compounding effect.

Long vs. Short Forex Trading

If you trade stocks or indices, Long trading is more beneficial than Short trading because usually, during the years and decades, companies’ businesses grow, and stock values rise. However, in the forex market, it is equal present long and short trading, and long trading positions have no clear advantage over short trading positions.

For several reasons, Long trading, or taking a “buy” stance on share assets, is often viewed as more advantageous than short trading. Firstly, bear markets, favorable for short selling, tend to be short-lived, averaging around 9.6 months. In contrast, bull markets, where long positions thrive, last considerably longer, with an average duration of 2.6 years for US stocks. This longer duration provides traders extended opportunities to profit from rising asset prices. Additionally, historically, markets have shown a propensity to rise over time, aligning long positions with this overarching trend.

However, when we trade forex and currency pairs, we do not have a instrict value of currency or cash. We have one price based on the market price, and we can not calculate real vs. market currency price.

But we need to make a difference in the expression of long-position trade and long-term trade.

Is Forex trading more profitable in the short or long term?

Long-term Forex trading can be better during solid trends. However, long-term traders can keep their position for several months and break even during the range market. Traders who are nimble in trading and have excellent developed short-term trading strategies can be more profitable than long-term traders. On the other hand, short-term traders have a more considerable commission loss and can lose money because of overtrading.

Short Term Trading

Short-term trading represents a trading style in stock, Forex, futures, or any financial derivatives markets where the trading time duration between entry and exit position is within a few seconds to a few weeks. Short-term trading during the day session is called day trading or intraday trading.

In that case, is swing trading short or long-term trading?

Is short-term trading worth it?

Short-term trading can be worth it and profitable but, at the same time, hazardous. However, if traders do not overtrade, carefully calculate trading commissions during short-term trading, and plan each trade, this style can be profitable. For example, if a trader trades as a day trader, creating short-term forex trading positions, and his risk and reward are 20 pips, his trading strategy needs to be more than 55% accurate because the trader’s commission can be 5%.

What is long-term trading?

Long-term trading represents a trading style in stock, Forex, futures, or any financial derivatives markets where the duration between entry and exit positions ranges from a few weeks to months, even years. Simply put, long-term or position trading refers to trades that can be opened for days, weeks, months, or years.

It differs from short-term trading as you must wait weeks to months to profit. In addition, an investor needs not to care about the update of trading daily as this investor’s focus will be for the long term. Thus, this sort of trading is considered less time-consuming, and those who do not have much time to spend can go for it.

Whether you are thinking of short-term or long-term trade, there are chances of profit or loss. Thus, it would help if you did the trading sensibly and patiently.

Traders in the long term are classified by the length of time that the trade endures. Moreover, they are defined by how the position is handled during the holding session. This does not indicate that such traders are static. They do engage in managing their positions. They may maintain a holding session for several weeks or months.

It is necessary to be cautious concerning misguided information. However, when something seems too good to be realistic, the bottom line is that it is usually invalid.

Trading in the short term does have some disadvantages. But many people ignore them. There are two reasons why this is so.

Short-term and long-term trading can be profitable, and success is not related to the type of trading but to personality, trading strategy, and market environment. For example, if the market is in the range and the long-term trader can not gain big because of the market environment. On the other hand, in strong trading markets, long-term traders can create more significant profits.

There are lots of people who are interested in trading. So, those interested in trading need to understand how it is done. You can easily read articles and books to learn about trading. A lot of technical as well as fundamental analysis is involved in trading. So, those interested in trading must understand it not to lead to a big disaster correctly.