Table of Contents

The relative strength indicator (RSI) is one of the most utilized indicators by traders, as it is a very accurate momentum indicator. It is good at finding signals to help traders lock in gains during intraday. However, some traders have raised concerns over the complexity of reading its infrequent trading signals. It is so because many intraday traders utilize this indicator to get profits through the high risk-reward ratio.

This indicator first made its appearance in the book “New concepts of technical trading” in 1978, and now it has become one of the most renowned signals to find bullish or bearish signals. This depicts the momentum of a trend by defining the “oversold” and “overbought” situations in the market.

Is RSI Good For Day Trading?

Yes, RSI is good for day trading if you use multi time-frame channel combination approach (M5, M30, H1, Daily) and if you draw RSI trendlines on the chart. RSI helps day traders to define the current trend and to evaluate trend strength at the same time.

Usually, day traders use M5 or M15 charts to develop their strategies. However, RSI is a fast indicator and you need to make a combination of a few charts. For example, you can monitor your asset on M15, M30, and Daily charts and make a better decision when you look broader picture – overall trend (Daily chart) and micro trend (M5 chart).

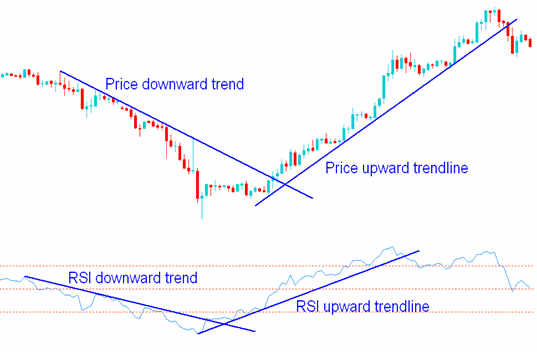

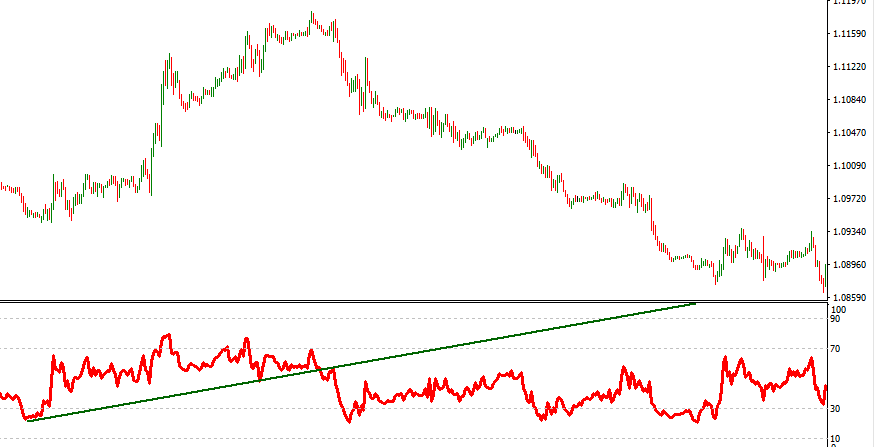

Additionally, the RSI trendline is an excellent tool to define stop loss and monitor current trends:

RSI Time-Frame for Day Trading

The best RSI time frame for day trading is the M30 chart time frame because it can catch small micro-movements in the last couple of hours on one side and avoid fast trend shifts of lower time-frames.

For major forex pairs, traders use the M30 chart time frame for day trading and H4 for swing traders. However, the Daily chart should watch both types of traders, because the overall trends need to be followed and monitored.

How does RSI work in day trading?

RSI is underestimated by rookies in the market who are unaware of its potential. If you want profits from RSI, you should be proficient in reading the charts. High-quality trades provide frequent gains when combined with RSI. To find such trades, the intraday traders apply the tactic of lowering the time frame for this oscillator which does have risks but also profits.

Trading through books is beneficial for sure, but in the long run, taking extraordinary steps is viable, if you want to see more and more gains over time. Hence, day traders use the RSI indicator for the high-income trading framework. Traders can also define the best entry/exit point with these indicators while also consolidating the markets.

RSI strategies for day traders

The default setting for RSI is usually 14. However, experts find it better if the settings were changed to 2-6. Expert day traders agree as it helps to increase or decrease the volume as per their choice. The ultimate pay to rake in good profits from an RSI is to figure out the timeframe predicament and set a timeframe that responds to your trading strategy. Hence, the timeframe is a crucial part of this indicator. If there is an uptrend in the market, a short trend is more reliable if you are looking for short-term trades. Here is how you can create a useful trading strategy.

- Gain more knowledge about reading the RSI signals that respond to the market trends through the technical trading charts.

- You should be aware of when to use and not use the RSI readings while trading in the forex. Trading through the indicator in the trading market is fruitful. However, you should do trading on forex mindfully to avert any significant losses.

- If traders become good at finding the high/low bidding conditions, to determine when to buy or sell. You should not rely 100% on the setting but know what works for you best.

- You have to keep an eye on your stocks with scanner tools that help keep a precise eye on the good assets. This will be beneficial because you will get more entry/exit opportunities.

- You should use RSI in combination with moving average indicators to find the best-performing assets in the market and stay away from the weak ones.

What are the ideal RSI settings?

Swing traders focus on reducing their losses by going for low profits by the time frame setting of 14, but this is not ensuring that it will work for everyday traders. The traders can test different timeframes on RSI and acquire the one that works the best for their intraday trading. This alters as per the profit of the trader and the knowledge they possess. ‘Data’ is also a crucial component for RSI signals, and it helps to find out when to enter or exit a trade in forex trading.