Traders often experience losses. A common but risky response to this is attempting to recover losses by making additional trades, often with increased stakes or additional positions. This approach, known as “revenge trading,” can lead to a dangerous cycle where each loss leads to further high-risk trades in hopes of a single win to recover all previous losses. Unfortunately, this behavior can escalate quickly without a disciplined trading strategy and risk management. The result is often a series of compounded losses that can deplete a trading account entirely, sometimes called “burning” the account.

Below, you can see an example where a trader adds a new sell order after to recover from a previous loss, keeping all trades and adding new trades :

Practice where traders add new positions with similar stop loss and target, which we call “stacking” (to arrange things in an ordered pile).

What is Stacking in Forex Trading?

Stacking is a trading system based on opening multiple trades with similar stop loss and targets like the first open trade. The best results can be achieved when traders manually or using Expert Advisors open trades when the first and previous trades are in profit.

Please watch my YouTube video with a detailed explanation:

In my personal experience, I tested multiple Expert Advisors, and the best stacking strategy is a system where if the first trade is profitable, I am adding a new trade at a calculated distance from the first trade entry position and target.

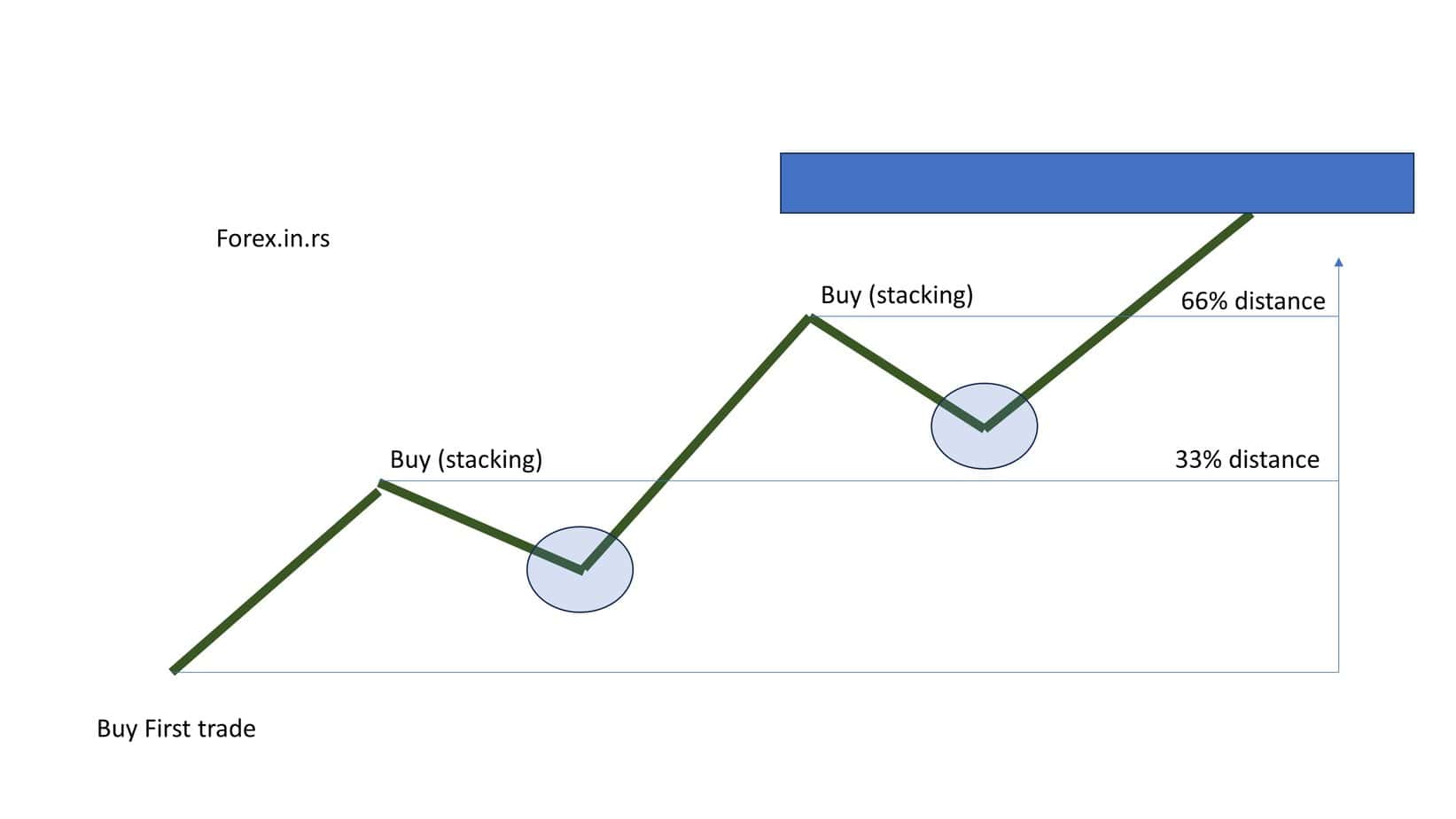

For example, after the first trade, I can add two new trades after a 33% distance between the entry position and the target. See the example below:

When you create a trading strategy with a 30-pip goal from entry to target, you can initiate a second position after the first trade gains ten pips. If the first trade continues to profit, reaching 20 pips, and the second trade gains ten pips, it’s an opportune moment to open a third trading position.

Stacking strategy Expert Advisors

To create an Expert Advisor (EA) that capitalizes on optimizing a single trade before implementing a stacking strategy, start by focusing on developing a solid base for that initial trade. This involves detailed backtesting and optimization to ensure the first trade has a high probability of profitability. Once the initial trade is in profit, the EA can be programmed to automatically initiate additional trades, maintaining similar stop loss and target levels as the first. This stacking approach leverages the momentum of the initial successful trade, potentially multiplying profits while keeping risk parameters controlled.

So, I always optimize and backtest my strategy with one trade per time and a fixed number of lots. I try to minimize the drawdown and increase the net profit.

Next, I add stacking trades at fixed distances (X pips from the entry price). After optimization, I am getting an improved system.

Incorporate logic into your EA that allows for real-time analysis of open trades, ensuring that additional positions are only added when the existing ones are profitable. This requires the EA to have a dynamic risk management feature that adjusts according to the performance of the current trades. The stacking system’s efficiency lies in its ability to scale up winning strategies without exponentially increasing risk, given that all trades share similar risk and reward settings.

See a backtesting graph of 1 trade:

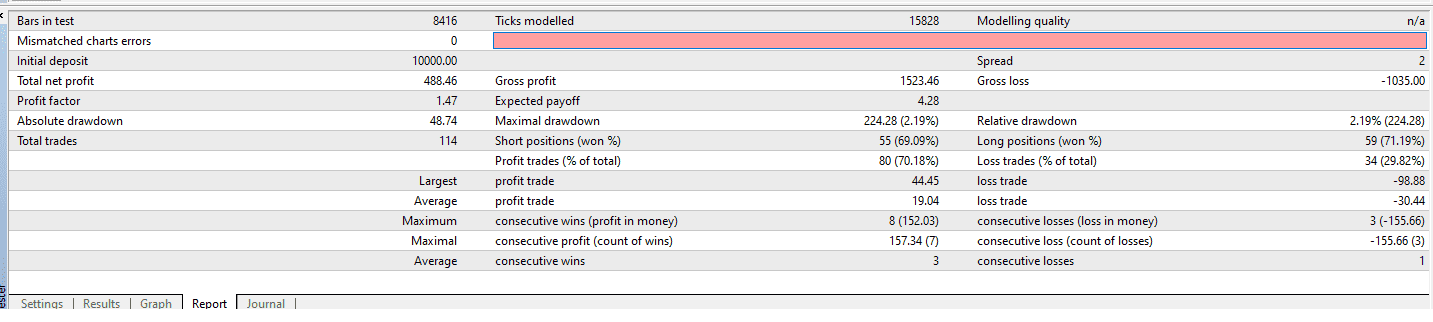

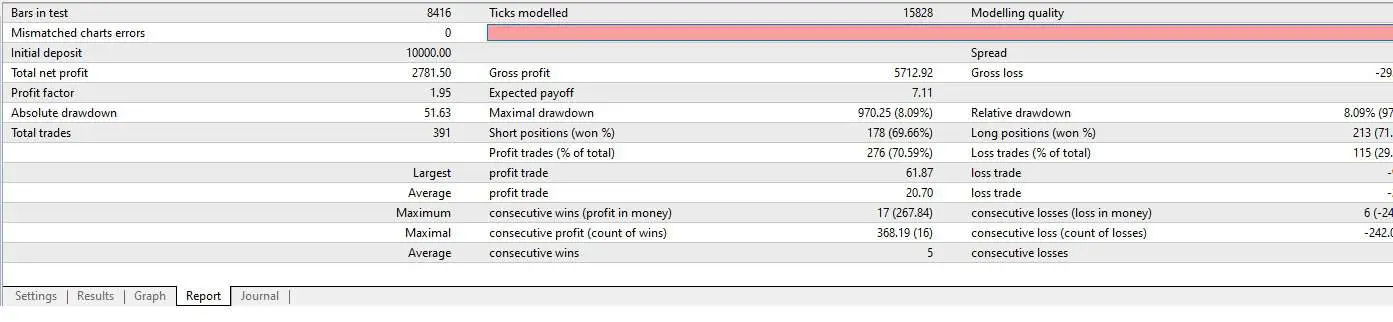

Now see the report for one trade per time system:

By comparing an EA that operates on a single-trade basis with one that utilizes the stacking method, you may notice that the stacking system exhibits a 50% better profit factor (see my video). This improvement is attributed to the compound effect of multiple profitable trades working in synergy. However, it’s crucial to implement a robust risk management strategy within the EA to prevent significant losses, especially during volatile market conditions or when a series of trades might not perform as expected. This approach ensures that while maximizing profit potential, the downside is kept within acceptable limits.

Below, you can see the report:

Conclusion

The stacking strategy, when compared to a single-trade approach in Expert Advisors (EAs), demonstrates a significant performance improvement, boasting a 50% better profitability in my case study. This success largely stems from the compounding benefits of aligning multiple profitable trades, enhancing overall gains through synergistic effects. However, the key to harnessing the full potential of this strategy lies in integrating an intelligent risk management framework within the EA.