Table of Contents

The forex market operates continuously, 24 hours a day, with trading centers rotating around the globe. This perpetual trading environment means the forex market is always open somewhere in the world, providing ample opportunities for traders.

How Forex Trading Works Forex trading involves buying one currency while simultaneously selling another to profit from fluctuations in exchange rates. To participate, you must open a trading account with a broker that provides access to the forex market. After setting up your account, you must deposit funds to start trading.

Initiating Trades With funds in your account, you can begin placing buy or sell orders for currency pairs via your broker’s trading platform. This platform will offer real-time pricing data and charts to help you make informed decisions. A successful forex trading strategy typically considers market conditions, news events, and technical analysis.

Trade Sizes and Orders Trades are conducted in lots, with a standard lot representing 100,000 units of the base currency. For example, a buy order for USD/CAD implies a bet on the U.S. dollar appreciating against the Canadian dollar, known as an extended position. Conversely, a sell order indicates a short position, betting on the Canadian dollar appreciating against the U.S. dollar.

Analysis and Strategy Forex traders often rely on technical analysis, using tools and indicators to predict price movements. Fundamental analysis, which examines economic indicators and news events, also plays a role in assessing currency strengths. Effective risk management involves using stop-loss orders and proper position sizing.

Step 1: Understanding the Forex Market

1.1 Learn Forex Basics

- Understand what forex trading is and how it works.

- Learn critical concepts like currency pairs, pips, spreads, leverage, and margin.

1.2 Choose a Reliable Forex Broker

- Research and select a broker that suits your trading needs.

- Ensure a reputable authority regulates the broker.

- Compare brokers based on trading platform, fees, customer service, and available tools.

Step 2: Setting Up Your Trading Account

2.1 Open a Trading Account

- Visit the broker’s website and open a trading account.

- Fill out the required forms and provide the documentation (ID, proof of address, etc.).

2.2 Fund Your Account

- Deposit funds into your trading account using the broker’s accepted payment methods (bank transfer, credit card, e-wallets, etc.).

Step 3: Preparing for the Trade

3.1 Choose a Trading Platform

- Download and install the trading platform provided by your broker (e.g., MetaTrader 4, MetaTrader 5, cTrader).

- Familiarize yourself with the platform’s interface and features.

3.2 Perform Market Analysis

- Use technical analysis tools like charts, indicators, and trend lines to analyze price movements.

- Conduct fundamental analysis by examining economic indicators, news, and events that might affect currency prices.

Step 4: Placing the Trade

4.1 Select a Currency Pair

- Choose the currency pair you want to trade (e.g., EUR/USD, GBP/JPY).

4.2 Determine Your Trade Size

- Decide on the number of lots you want to trade. Ensure the trade size aligns with your risk management strategy.

4.3 Set Entry and Exit Points

- Set your entry point (the price you want to buy or sell).

- Determine your exit points using stop-loss and take-profit orders to manage risk and lock in profits.

4.4 Choose the Type of Order

- Market Order: Execute the trade immediately at the current market price.

- Limit Order: Execute the trade at a specified price or better.

- Stop Order: Execute the trade once the price reaches a specified level.

4.5 Place the Trade

- Enter the details (currency pair, trade size, order type, entry price, stop-loss, and take-profit levels) into the trading platform.

- Confirm and place the trade.

Step 5: Managing the Trade

5.1 Monitor the Trade

- Keep an eye on your trade and market conditions.

- Adjust stop-loss and take-profit levels if necessary based on market movements.

5.2 Close the Trade

- Close the trade manually if you reach your target or if market conditions change.

- Alternatively, the trade will close automatically if it hits your stop-loss or take-profit levels.

Step 6: Reviewing and Learning

6.1 Review Your Trade

- Analyze the outcome of your trade to understand what went well and what didn’t.

- Keep a trading journal to record your trades, strategies, and lessons learned.

6.2 Improve Your Strategy

- Use the insights from your trade review to refine your trading strategy.

- Continuously educate yourself and stay updated with market trends and news.

By following these detailed steps, you can place a forex trade with confidence, and im

Using the Trading Platform

The first step while trading in forex for the first time is to log in to the forex account on the trading platform selected

Opening the chart

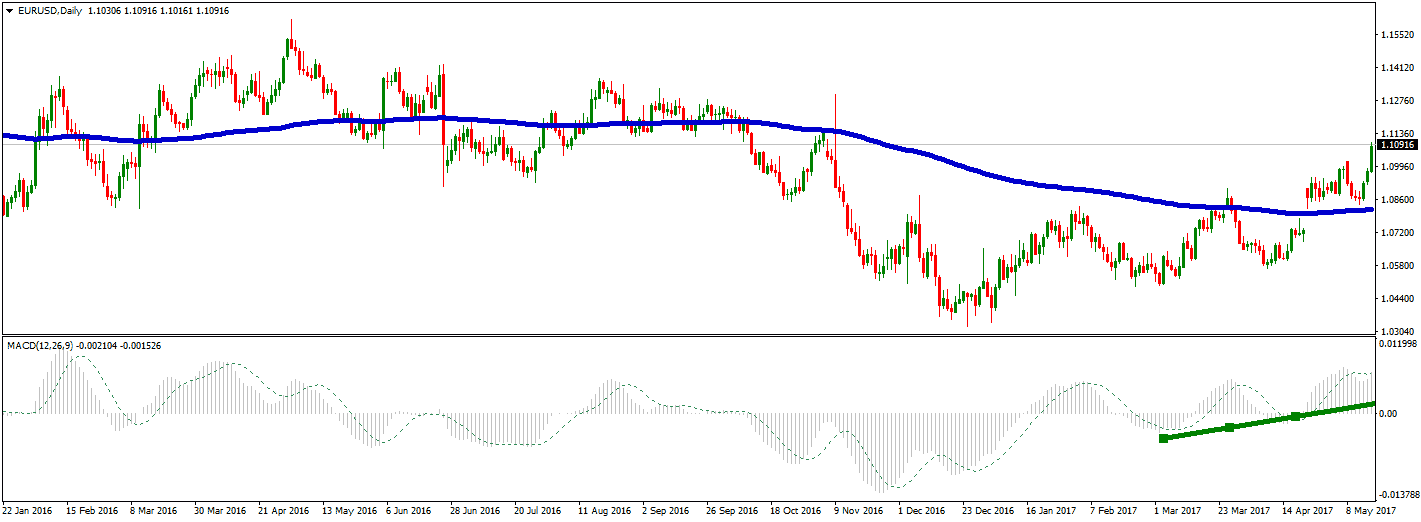

A currency pair should be chosen, and the chart should be opened. The trader should also choose a timeframe, using the time frame for D—daily since it represents candlesticks on the chart.

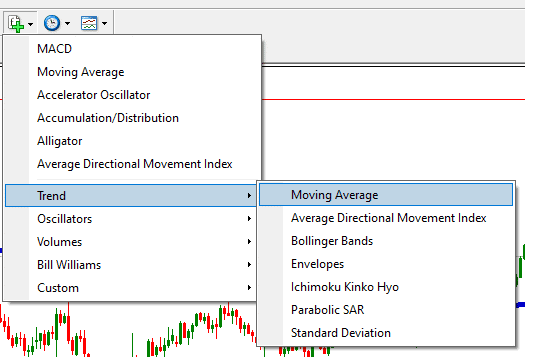

Adding indicators and planning the trade

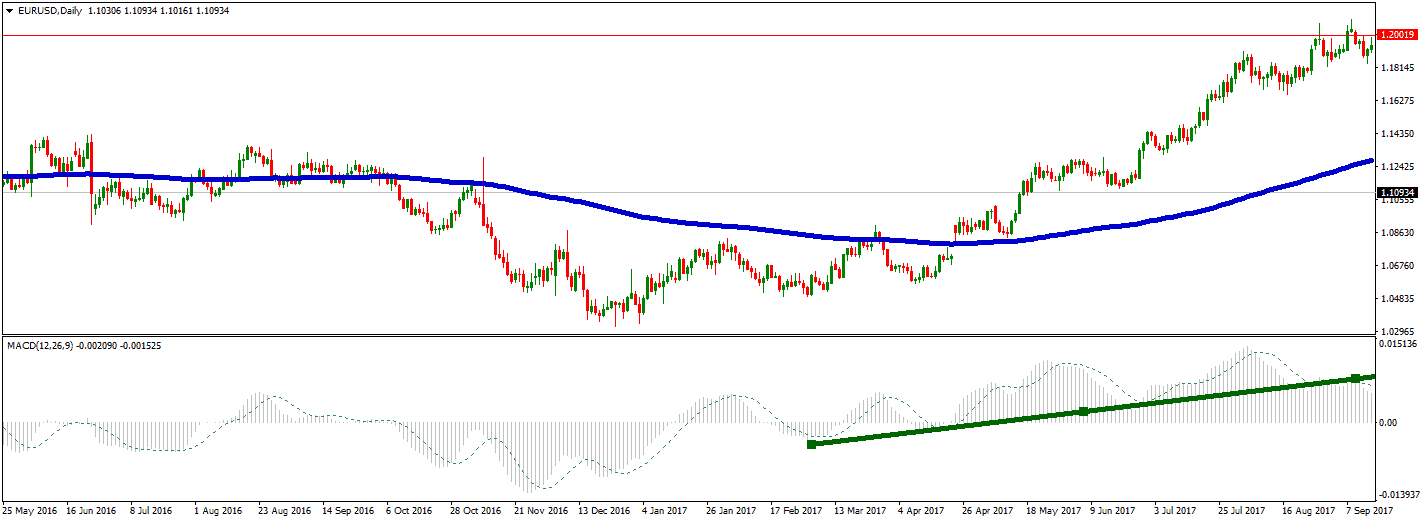

Some technical indicators are added to the chart to help with decision-making. Typically,, traders add the MACD and two hundred exponential moving average (EMA) indicators. For testing, let us assume (for example) that if the 200 EMA is above the line, the forex rate will continue to rise, and if it is above the line, the rate will increase (this is a hypothesis).

MACD indicator we can set like this:

The MACD is also monitored to confirm the trend; we can see the GREEN UPSIDE direction of the MACD indicator below:

This is a long-term bullish signal.

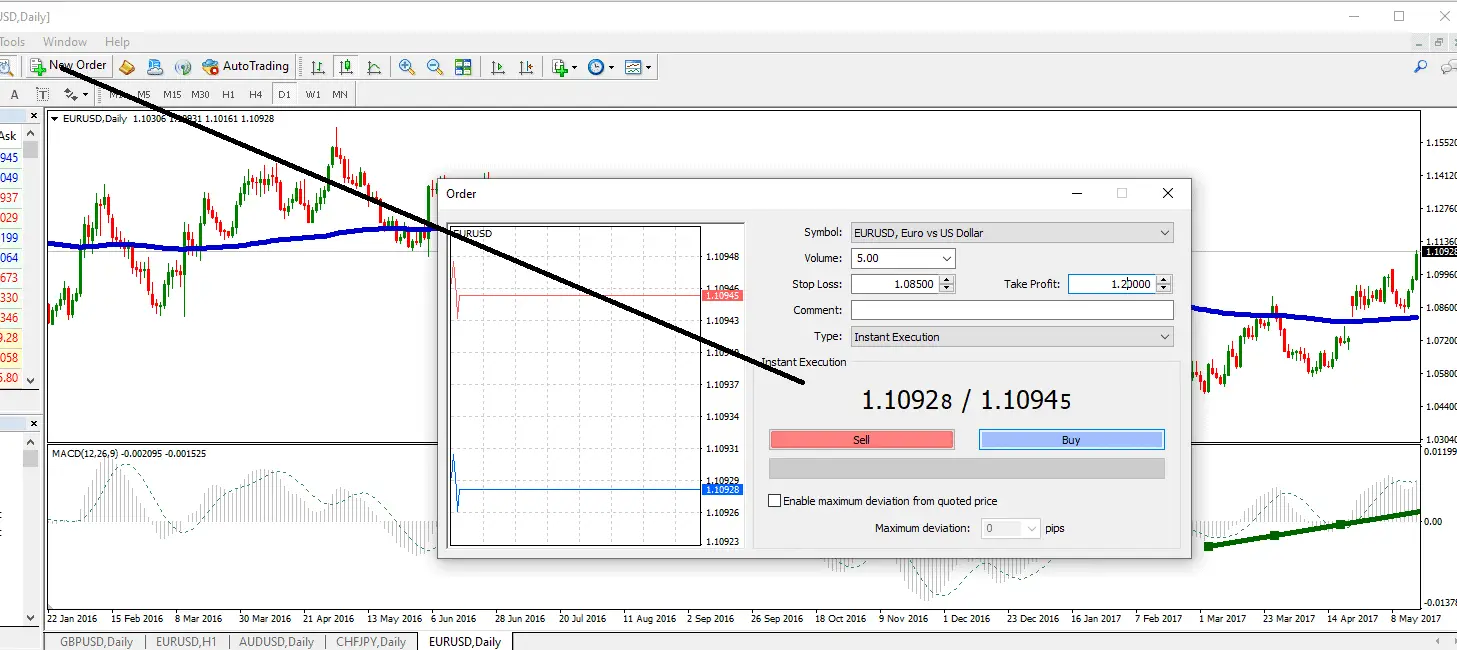

Place the order

Trade idea :

BUY EURUSD for 1.094 because the price is above EMA 200 and MACD shows a bullish direction (green line)

After the trend is confirmed, the order will be placed. A stable, rising trend is noticed. Since the trader is making the trade for the first time, it is better to place a smaller order for 10000 currency units, which is called a mini-lot. I am making 5 lots position below on my live account :

The setting takes profit and stop-loss levels.

The stop loss is 1.086 because it is the last swing, previous resistance, and new support.

The target is 1.2 – round number and strong resistance in the last 365 days.

Though specifying the take-profit and stop-loss levels is optional, traders should take this step. Based on their experience, traders have found that they can profit if they specify a stop-loss on the last swing (in this case, it is above 1.086). This ensures that even if the trader cannot predict the forex trend accurately more than half the time, he will still make some profit. If the stop loss level is specified, the trader’s losses will be reduced if the forex rates do not move in the expected direction. If the take profit level is specified, the forex trader exits the market and makes a profit when the market starts moving uptrend. It is usually advisable to set the levels when making the trade since the fluctuating forex rates make decision-making difficult. The target is 1.2, but I plan to change this target level based on market conditions.

Confirming the order

The trader can then submit his order and wait for a confirmation, which includes a ticket number. The forex broker will require the ticket number to resolve any trade-related problem, including an execution-related error by the broker. If there is an error, the trader must contact the forex broker, who will rectify the error and refund the money.

Waiting period

After the forex trade order is placed, there is usually a waiting period before the order is executed. Some traders will switch off the trading screen instead of worrying about looking at the forex rate fluctuation. Instead of worrying about a specific trade, it is advisable to think long-term. After 4 months, the target is reached, and I am closing the trade.

Profit is more than 900 pips (around 5x$9.000= $45.000).

Completing the trade

The trade will be completed if the forex rates reach the take profit or stop-loss levels. Some trades cause a loss to the trader, and they should limit the risk they take. In our case, the profit is positive. The trade will be automatically closed when the price reaches the 1.2 level.