Many traders embarking on their financial journey often start with limited capital, with only $10 to $50 to invest in trading. This financial constraint doesn’t deter their ambition; instead, it necessitates a more strategic approach to trading, focusing on low-cost instruments or platforms that accommodate small trades.

These individuals leverage high leverage, affordable brokerage options, and the potential of volatile markets to turn modest sums into meaningful gains. Despite the inherent risks, this demographic of traders demonstrates that with the proper knowledge and strategy, entering the financial markets doesn’t require vast wealth. Their participation underscores a democratization of trading, where the barriers to entry are lowered, allowing more people to try their hand at investing, regardless of their initial financial status.

But there are two ideas!

How do you trade a $10 Forex Account?

If you invest in a cent account, you can trade only a $10 – $50 account. If you invest $10, you will get a $1000 account balance. Of course, if you make a profit of 100% and have a $2000 account size, you can withdraw only $20. Another idea is to invest in a prop trading account.

Please see my video:

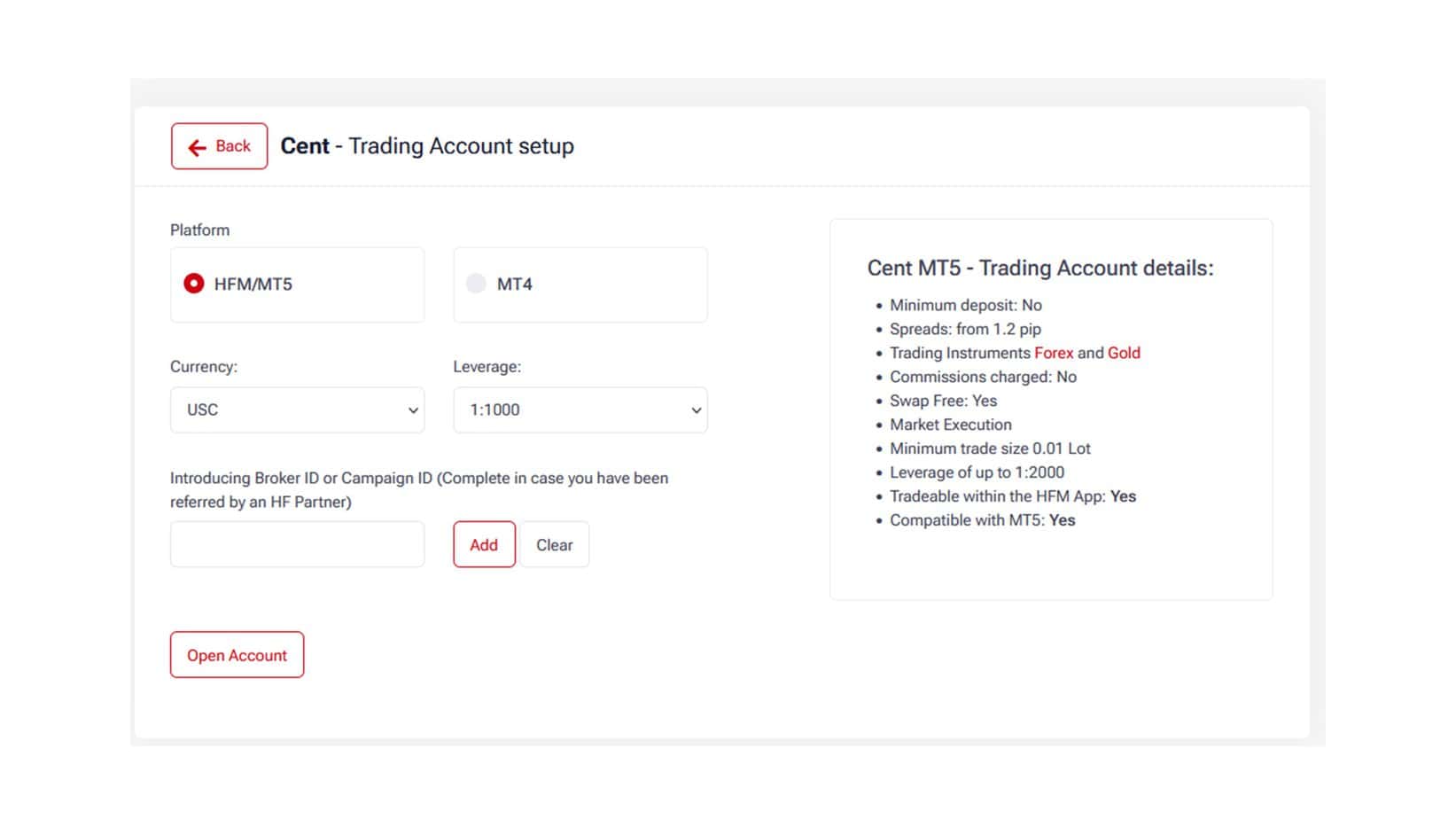

Below is a screenshot of how you can open a Cent account :

Opening a cent forex account, designed for traders who want to trade with less money, is a straightforward process involving several vital steps. Here’s how to do it:

- Choose cent account Broker: Research forex brokers offering cent accounts. Look for reputable and regulated brokers by recognized financial authorities to ensure the safety of your funds.

- Compare Account Features: Compare the features, fees, leverage options, and trading platforms of various brokers. Pay special attention to the minimum deposit requirements, spread sizes, and whether the broker supports your interests in trading pairs. I prefer 1:500 leverage and a tight spread account.

- Please register for an Account: Once you’ve chosen a broker, go to their website and start the registration process. This typically involves filling out an online application form with your personal information, such as name, address, and email.

- Verification: As part of the registration process, you’ll likely need to verify your identity and address. This usually requires uploading documents such as a government-issued ID (passport, driver’s license) and a utility bill or bank statement as proof of address. The verification process helps the broker comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

- Make a Deposit: After verifying your account, you must deposit funds. If you deposit $10, you will get a 1,000-cent account, a 100-times increased balance. The required deposit is usually small since you’re opening a cent account. Brokers often accept various funding methods, including bank transfers, credit cards, and e-wallets. Choose the method that’s most convenient for you.

- Download Trading Platform: If you haven’t already, download the trading platform supported by your broker. Most brokers offer popular platforms like MetaTrader 4 or MetaTrader 5. Install the platform on your computer or mobile device.

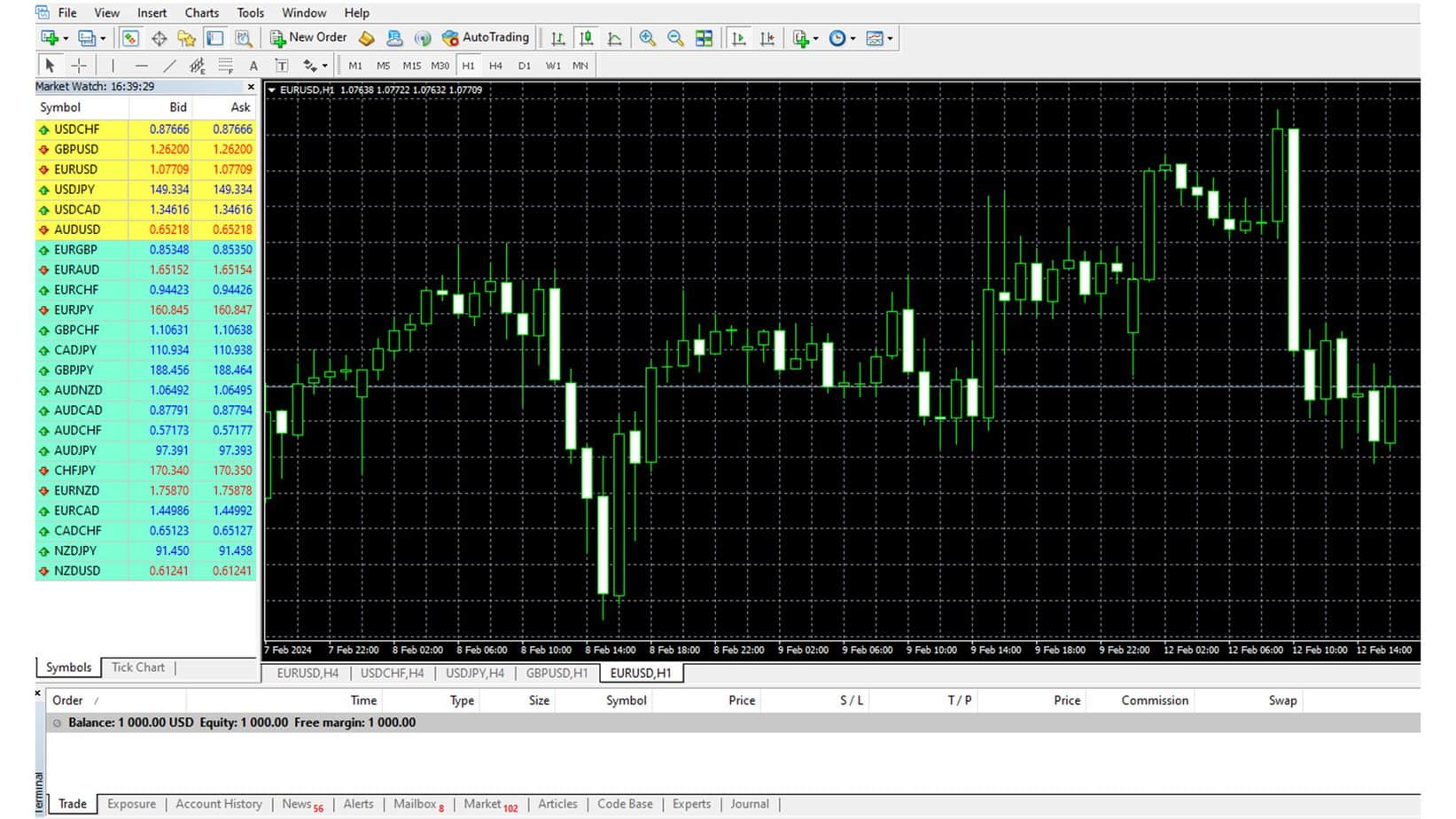

See my 10-cent account with a $1000 balance:

Idea 2: Try low deposit prop company investment

Proprietary (prop) trading firms have introduced innovative models that allow traders to access significant trading capital for a relatively small investment, leveraging the skills of individual traders for mutual benefit.

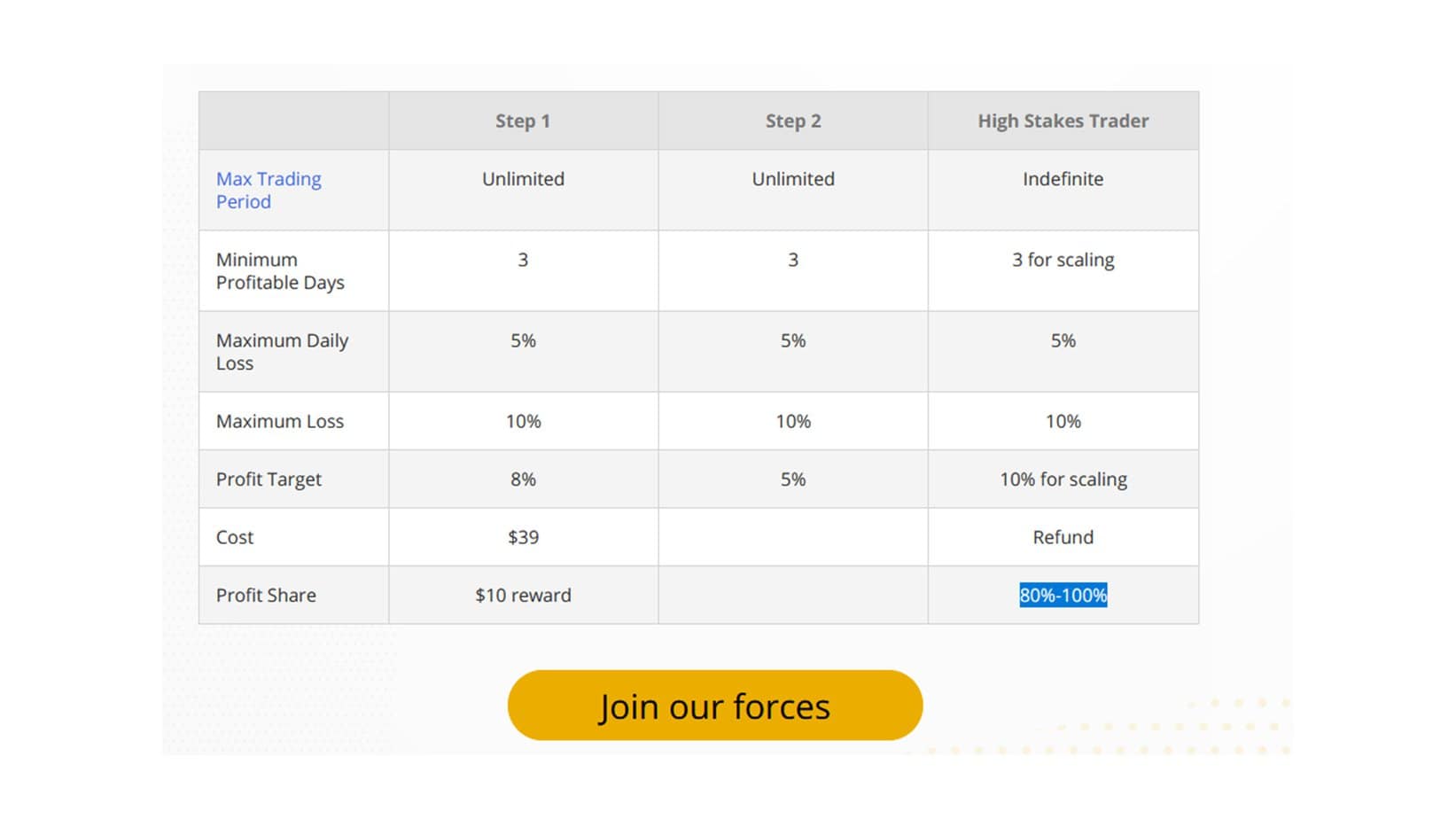

For example, you can pay a $39 fee to get a $5000 demo account, and if you make two challenge phases, you can be funded as a real trader.

Here’s how the model you described typically works:

- Initial Investment: Traders pay a fee—such as $39 in your example—to participate in an evaluation program or challenge. This fee grants them access to a simulated or real trading account with a predetermined balance, such as $5,000.

- The Trading Challenge: The trader aims to demonstrate their trading skills by meeting specific objectives set by the prop firm. These objectives usually include achieving a specific profit percentage (e.g., 8%) within a specified timeframe while adhering to other trading parameters and risk management rules.

- Risk Management: One crucial rule is the maximum drawdown limit, often set at 10% of the initial account balance. If the account’s value drops by more than 10% from its peak, the trader may fail the challenge and need to restart the process, often by paying another participation fee.

- Scaling Up: Successful traders who meet the profit target without breaching the drawdown limit or violating other rules can progress to the next level. This next level comes with a more extensive account size, which could scale to significant amounts like $500,000 through successive stages. Each stage requires the trader to meet similar profit targets and adhere to risk management rules.

- Profit Sharing: Once traders trade real funds and meet the profit objectives, they typically enter into a profit-sharing arrangement with the prop firm. The specific terms vary by firm, but traders can keep a substantial portion of the profits they generate, sometimes up to 80% or more, while the rest goes to the prop firm.

This model is attractive to both parties: traders get to trade with more capital than they could likely afford on their own, which can potentially lead to higher earnings, and the prop firm leverages the skills of a diverse group of traders while managing its risk through strict trading parameters and sharing in the profits generated. It’s an innovative way of democratizing access to larger capital pools, but it requires discipline, skill, and adherence to the firm’s trading guidelines to succeed.

These rules outline a comprehensive framework for traders participating in a proprietary trading firm’s program, aiming to manage a more significant trading account through a structured progression system. Let’s break down the key components in detail:

- Activity Requirement: Traders must engage in trading activity within 21 consecutive days of registration. Failure to trade within this period expires the account, emphasizing the firm’s focus on active trading participation.

- Leverage: The program offers a leverage ratio of 1:100, allowing traders to control a position size up to 100 times greater than their actual account balance. This can amplify both profits and losses.

- Profitable Day Definition: A day is considered profitable if the closed positions result in a net profit of at least 0.5% of the initial account balance. The profit calculation is based on the lesser of the midnight balance or equity minus the balance from the previous day. This rule encourages consistent, profitable trading without excessive risk-taking.

- Daily Loss Limit: The maximum allowable loss in a day is capped at 5% of the higher of the day’s starting equity or balance. This rule is crucial for risk management, protecting the account from significant losses in a single day.

- Incentives and Refunds:

- Step 1 Completion: Traders receive HUB credits for internal use, rewarding progress within the program.

- Step 2 Completion: Traders earn a withdrawable refund, providing a tangible incentive for advancing through the program’s stages.

- Trading Conditions:

- Overnight and Weekend Holding: Positions can be held overnight and over weekends, offering flexibility in trading strategies.

- Indices and Swaps: While holding indices over the weekend is permitted, it incurs a high swap fee, indicating a cost for the leverage provided over the non-trading days.

- News Trading: Trading around high-impact news is restricted to prevent excessive risk-taking during volatile market conditions. Orders cannot be executed from 2 minutes before to 2 minutes after such news events.

- Available Assets: The MT5 Hedge platform allows traders to operate with various assets, including FX, metals, indices, oil, and cryptocurrencies, providing a wide range of trading opportunities.

- Profit Split and Salary: Traders enjoy a generous profit split ranging from 80% to 100%, plus a monthly salary, aligning the interests of the trader and the firm by rewarding successful trading.

- Account Limitations and Scaling: Each trader is limited to one $5K account and one additional account of any size, possibly scaling up to $500,000 based on performance.

- Payouts: Traders can request payouts anytime, independent of the 10% growth target. The first payout is available 14 days after receiving a funded account, and subsequent payouts are every two weeks. The payout cycle resets with each new scaled account.

Investing $10 to $50 in either a cent account or a proprietary trading (prop) account represents a viable entry point for aspiring traders to embark on their journey toward becoming real, proficient traders. These initial investments, though modest, open up the world of trading without requiring substantial capital, making the financial markets accessible to a broader audience.

Cent Accounts offers a practical way to experience live trading with real money, albeit with significantly reduced risk. By trading in cents rather than total dollars, traders can learn the mechanics of the forex market, develop strategies, and understand risk management principles with a lower financial stake. This approach is an invaluable educational platform, allowing traders to gain confidence and skill without the pressure of significant losses.

Proprietary Trading Accounts, on the other hand, present an opportunity to leverage a small investment into access to substantial trading capital. Through structured evaluation programs, traders can demonstrate their proficiency and risk management ability in a controlled environment. Achieving specified profit targets and adhering to risk guidelines can scale a trader’s access to capital from thousands to up to half a million dollars, offering a path to professional trading status. These programs often include educational resources, mentorship, and a community of traders, which can accelerate a novice trader’s development.

Both avenues emphasize the importance of disciplined trading, risk management, and continuous learning. The low entry barrier allows individuals to test and refine their trading approach with actual market conditions, providing practical experience invaluable for growth. Success in these initial stages requires patience, persistence, and a willingness to learn from successes and failures.

In conclusion, investing $10 to $50 in a cent or prop trading account can be the first step toward becoming a real trader. This approach demystifies the trading process, equips individuals with the necessary skills, and, most importantly, instills a trader’s mindset. With dedication and strategic learning, what starts as a small investment can evolve into a professional trading career, demonstrating that entry into the trading world is not reserved for those with substantial capital but is accessible to anyone with the determination to succeed.