Table of Contents

One unique attribute of the Forex global marketplace is its near-constant operation, running 24 hours a day, five days a week. As markets overlap and trading volumes shift, understanding the nuances of trading sessions can be the edge a trader needs. It’s not just about buying low and selling high. Indeed, successful trading is an intricate dance between the right price and the right timing.

Timing in Forex refers to the precise moment a trader chooses to enter or exit a trade. Various factors influence this decision, including market momentum, news events, and the inherent ebb and flow of trading sessions across the globe. A currency pair might be at your desired price point, but if it’s the cusp of a significant economic announcement or a critical market is about to close, the risk of that trade shifts.

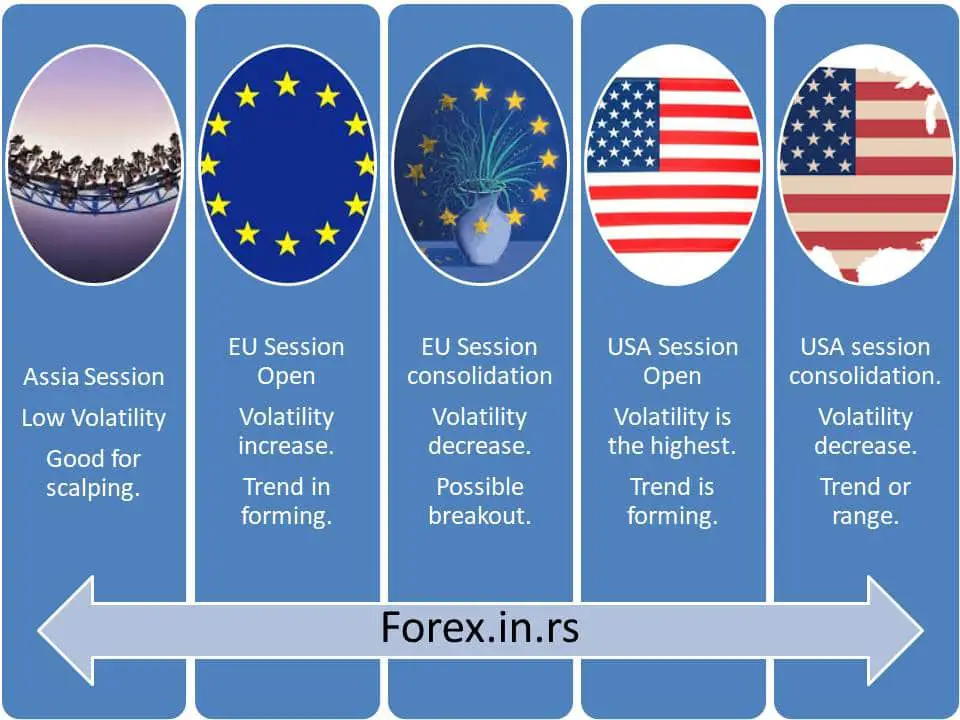

For instance, the same price level may offer different trading implications during the Tokyo session versus the London or New York sessions due to variations in trading volume, liquidity, and market participants. An opportunity seen during low liquidity might evaporate in high-volume times and vice versa.

What is The Worst Time to Trade Forex?

The worst times to trade forex are the late Friday and early Monday morning hours. Additionally, for trend traders, the Asian session can be the worst time for trading as well. Finally, trading during the holidays, important economic events, and low liquidity hours can be the worst trading moments for beginner traders.

The most crucial thing traders must understand is adjusting trading strategy to session timing.

Friday’s late hours are the worst trading period.

In my personal trading journal, I see that trading the trend when the U.S. market closes on Friday is usually my worst trading performance. I Never buy Friday high.

Friday late hours (especially for U.S. traders) are often considered suboptimal or even the worst time to trade for several reasons:

- Market Liquidity Drops: As the U.S. session winds down on a Friday, many traders and institutions start closing out their positions to avoid weekend risk. This reduction in active participants often leads to decreased liquidity, meaning fewer buyers and sellers in the market. Low liquidity can result in higher spreads and less favorable execution.

- Weekend Risk: Holding positions over the weekend presents risks because of potential events or news that can impact the markets while closed. This could lead to “gaps” in price when markets open on Sunday evening (U.S. time). Traders prefer to avoid or mitigate this uncertainty by closing out positions on Friday.

- Profit-taking: After a week of trading, many institutional and retail traders might close their positions to lock in profits, leading to unpredictable and sometimes erratic price movements.

- Limited Time for Recovery: If a trade goes against a trader late on a Friday, there’s limited time for potential recovery. With markets closing shortly, traders may be forced to exit positions at a loss rather than having the option to wait and see if the market reverses.

- Psychological Factors: By the end of the week, traders may be tired, leading to reduced concentration and potential mistakes. Making decisions in this state can be detrimental to one’s trading strategy.

- Reduced Economic Releases: Major economic data is typically not released late on Fridays. With fewer scheduled events to spark volatility, the market might be less dynamic, offering fewer trading opportunities.

- Banking Operations: As the week closes, operations slow down or halt until the following week. This can impact money flow and, by extension, currency movements.

Monday’s early hours are risky.

Monday early hours are unpredictable periods when the weekly trend is not yet formed, and traders can not be sure about short-time positions trades.

Trading on Monday’s early hours, especially as the Asian markets begin to open, can be considered a less favorable time for traders for several reasons:

- Weekend News and Gaps: Over the weekend, various political, economic, and unexpected events can occur, leading to price “gaps” when the market reopens. A gap is a significant difference between the Friday close price and the Monday open price, which can move against a trader’s position and result in significant losses.

- Uncertain Direction: The market direction on Mondays can sometimes be unpredictable. Traders are still absorbing and reacting to the weekend news, and the market sentiment may not be fully established.

- Lower Liquidity: While the Asian session is underway, it might not provide the same level of liquidity and volatility seen during the European or U.S. sessions. This can result in less favorable execution, with wider spreads.

- Cautious Institutions: Many large institutional traders and funds might take a more cautious approach at the start of the week, waiting to discern a clear trend or for significant economic data releases before making major moves.

- Late Reaction to Friday’s Data: Sometimes, economic data released late on Friday (after many traders have wrapped up for the week) can lead to reactions on Monday morning, making it harder for traders to predict movements.

- Psychological Factors: Just as the end of the week might bring fatigue, the start can come with its own psychological challenges. Traders may be out of sync after the weekend break or overreact to the previous week’s performance, leading to impulsive decisions.

- Anticipation of Upcoming News: Major economic announcements or events scheduled for the week might lead traders to hold off placing trades early on Monday, waiting for more precise signals.

Asian session worst period for trading for trend traders

Trading during the Asian session can be particularly challenging for trend traders. Here’s why:

- Lower Volatility: The Asian session, when compared to the European or U.S. sessions, typically experiences lower volatility. Trend traders thrive on volatility because it often accompanies establishing solid trends. In a less volatile environment, currency pairs may move sideways, offering fewer clear trend-based opportunities.

- Reduced Liquidity: While major pairs still see decent liquidity, some minor or cross-currency pairs can experience reduced liquidity during the Asian hours. Reduced liquidity can lead to wider spreads and slippage, which isn’t favorable for trend traders looking for precise entry and exit points.

- Consolidation Phase: After the U.S. session closes, the market often enters a consolidation phase during the Asian session. This period of consolidation can be challenging for trend traders, as currency pairs may move within a tight range without a clear direction.

- Economic Data Releases: While essential data is released during the Asian session, especially from countries like Japan, China, and Australia, the frequency and impact might not match the flurry of data from Europe and the U.S., which can set strong trends.

- Overnight Risk: For traders based in Europe and the Americas, trading during the Asian session involves keeping positions open overnight. This brings its risks, as positions can be affected by unforeseen events or news releases during the Asian hours. Spreads are bigger during Asian sessions.

- Bank Interventions: Particularly for pairs involving the Japanese Yen, there’s always the potential for unexpected interventions by the Bank of Japan or other Asian central banks, which can disrupt established trends. As a trader, you need to wake up to monitor all news and avoid losing trades.

Holidays trading is risky.

Trading during holidays can pose unique challenges to traders. Here are several reasons why trading during these periods can be considered suboptimal:

- Reduced Liquidity: One of the primary concerns during holidays is the significant reduction in liquidity. The volume drops substantially with many institutional traders and large banks off for the holiday. Lower liquidity can lead to wider spreads and less favorable execution conditions.

- Increased Volatility: Ironically, even with reduced liquidity, markets can experience sporadic bouts of high volatility. With fewer players in the market, large trades (if any) can cause significant price movements. These erratic movements can be challenging to predict and navigate.

- Limited Market Participants: During holidays, not only is the volume lower, but the diversity of market participants also narrows. This lack of variety can make the market behavior less representative of broader sentiment.

- Closure of Major Markets: Depending on the holiday, major markets like the U.S., Europe, or Asian markets might be closed. When one of these significant markets is out, the ripple effects are felt across the global financial system, further reducing liquidity and potential trading opportunities.

- Limited Economic Data Releases: Holidays typically see fewer economic data releases, reducing the catalysts that often provide direction to the market. Without these scheduled events, the market might be listless or directionless.

- Unpredictable Global Events: With fewer participants, the market’s reaction to unforeseen global events can be exaggerated during holidays. The impact might be easily absorbed in a regular trading environment, but during holidays, the reduced volume can lead to amplified responses.

Risky Trading During Major Economic Data Releases

Trading during Major Economic Data Releases is an endeavor fraught with challenges and can be risky for various reasons. Here’s why it’s often considered a difficult time to trade:

- Sharp Price Movements: Major Economic Data Releases can lead to abrupt and sizable swings in price within very short time frames. These swift movements can trigger stop-loss orders, leading to premature exits from potentially profitable positions.

- Increased Volatility: Economic data releases can lead to enhanced market volatility. This increased unpredictability can be challenging, especially for traders with shorter time horizons or those employing high leverage.

- Wider Spreads: Due to the uncertainty surrounding Major Economic Data Releases, brokers might widen their spreads to account for the increased risk of rapid price changes. Wider spreads can make entries and exits more costly and incredibly detrimental to scalpers and day traders.

- Slippage: This refers to the difference between the expected price of a trade and the price at which it is executed. Given the rapid price changes during Major Economic Data Releases, traders might experience significant slippage, meaning they don’t get the price they hoped for when entering or exiting a position.

- Unpredictable Reactions: Even if the economic data is precise (e.g., better or worse than expected), the market’s reaction might be counterintuitive. For instance, good economic news might lead to a currency dropping because traders anticipated even better results or reacted to another hidden facet of the data.

- Overemphasis on Short-term Noise: Major Economic Data Releases can introduce much “noise” into the market. Traders might overreact to these temporary blips, leading them to make decisions that don’t align with the longer-term trend or their trading strategy.

- Liquidity Concerns: While Major Economic Data Releases can increase volume, there might be moments before the release when liquidity dries up as traders await the news. This can result in unpredictable price movements.

- Whipsaw Movements: It’s common to see a currency pair spike in one direction post-release, only to reverse and move in the opposite direction sharply. These whipsaw movements can easily stop traders who jump in too quickly.

- Technical Analysis Breakdown: During Major Economic Data Releases, technical levels (like support and resistance) might not hold as they would during calmer market conditions. Traders who rely heavily on technical analysis might find their strategies less effective.

Conclusion

Times like the late hours of Friday, early hours of Monday, the quieter Asian session for trend traders, holiday periods, and moments surrounding Major Economic Data Releases underscore the importance of astute timing in trading decisions.

They often deemed some of the worst trading times, reduced liquidity, unpredictable price swings, wider spreads, and the potential for slippage hallmark these periods. Moreover, market psychology can become less predictable, and well-established strategies might not yield the same results.

However, it’s essential to remember that ‘worst’ is relative. With the right strategy, experience, and risk management, some traders can still find opportunities during these times. Yet, for many, especially those new to the markets, exercising caution or staying sidelined during these periods might be the best course of action.