Table of Contents

In trading, traders often manage several accounts, or beginner traders receive signals from other traders.

What is mirror trading or copy-and-paste trading?

Copy and paste trading represents the use of mirror trading technology to copy other live traders’ real-time forex trades (forex signals). Forex Trading Copy and Paste methods involve practice. When some trader creates a trade in your platform, the trade will be executed. You are copying more experienced traders’ trades using a mirror trading platform.

See the HF Copy platform (visit HF Copy website) video example:

The best Forex Trade Copier Service is Zulutrade because it has the most extensive database of forex and stock traders, well-designed mobile and desktop platforms, and many filters and tools to pick the best signal provider.

Mirror trading platforms – signal providers list

1) Zulutrade is a Social Online Auto trading platform for the Forex market. Visit the Zulutrade website.

2) MQL5 is a Metatrader website that offers signals to all people who use MetaTrader 4 and 5. Visit the MLQ5 website signal section.

3) Collective2 is a mirror trading social network where traders can pick strategies. Visit Collective2 signal-providing a platform

4) HF Copy is a social network platform where traders can copy signals. Visit HF Copy

So we can set a better definition:

What is copy trading?

Copy trading represents the use of mirror trading technology to copy the real-time trades of other live traders. When a trader creates a trade and simultaneously, in the follower’s trading platform, the trade will be executed. You are copying the works of more experienced traders.

Forex copy-and-paste signal platforms work by allowing traders to copy the trading signals of other experienced traders. These platforms typically have a community of traders who share their trading strategies and signals, and other traders can then choose to copy their trades.

Here’s how it typically works:

- Traders interested in sharing their trading signals can join the platform and create a profile highlighting their trading experience and performance.

- Other traders interested in copying signals can browse through the profiles of the signal providers and choose one or more traders to follow.

- Once a trader has chosen a signal provider to follow, they can set up their trading account to automatically execute the signal provider’s trades on their behalf.

- The signal provider’s trades are then copied to the follower’s account in real-time, with the duplicate entry and exit points, stop loss and take profit levels, and trade size.

- The follower can then monitor the performance of their account and adjust their strategy based on the results.

Forex copy-and-paste signal platforms typically charge a fee or commission for the service, which is often based on the performance of the signal provider. The venue may also provide additional features like analytics and risk management tools to help traders manage their accounts and maximize their profits.

Overall, forex copy and paste signal platforms provide a convenient and efficient way for traders to benefit from other traders’ expertise and experience without spending time and effort developing their trading strategies.

Copy trading is a reasonably contemporary concept in the financial sphere that allows dealers to duplicate certain positions opened and administered by other traders or brokers. The history of copy trading dates back to 2005, when trades developed an exciting phenomenon of imitating several algorithms exhibited and matured through automated trading. SAs a result, systems formerly interconnected to particular traders had the potential to be copied automatically directly to their trading accounts.

Brokers realized this, and consequently, the regulation and monitoring of email signals or trading chat rooms were prevented. Copy trading is now provided by most of the social Forex and stock trading platforms. As the name suggests, traders can copy the pre-occupied positions by another trader, developing a connection between the two portfolios.

The networking of portfolios of different brokers allows them to copy the current positions available on the market on any decision or action they make thenceforth. Suppose the original traders open a new account or there is a noticeable movement within their budgets. In that case, the copied brokers will also experience the same changes and follow the link account. If they close, the accoureport sit on the copied trader’s account. However, this does not disregard the presence of authority or control on the conclusion. Even if you have developed an association or connection through copy trading, you will still have the right and influence during trade closure.

Copy trading is gradually taking the lead within the financial market because it allows the followers to make new money and enrich their portfolios based on their traders. Individuals and novice traders have mainly started investing in traders of a believable and rich portfolio instead of investing in stocks or Forex. Specific strategies, Forex techniques, and investing abilities are copied, linking the trader’s funds to the copied investor. This highlights the benefit of teaching technology in the trading and investing domain. The replication of specific trades will directly reflect your portfolio for the brokerage account.

Various techniques are used in the forex market to improve the profit factor. But it is difficult to find the best tricks to increase profits in forex trading as millions of people try their luck in this field. Many brokers offer interested traders trading accounts with high leverage in the forex market. Many brokers also provide helpful information about this market to allow traders to make attractive profits. To let Some platforms usually sell trading signals to their customers to let some traders make money at the initial stage of their career, some cent years, using forex trading signals has become very popular among investors as most do not want to waste time reading and analyzing charts. We are trying to break the misconceptions about the notorious techniques many investors use in this write-up. It is a significant article for you if you are amongst the investors using the free-riders strategy to profit in the forex market. We will gradually break these misconceptions so that you may understand that nothing is available for free in this world. It will help if you read this article patiently. Then, you may realize things slowly but surely and accept that the information provided in it is entirely different from the ideas you were following until now.

The forex market is a zero-sum game, a “mathematical representation of a situation in which the losses or gains of the utility of the other participants exactly balance each participant’s gain or loss of utility.”

While using this clever method, the thing that comes to your mind is making enormous money. But intelligent traders can understand the facts within no time that the brokers with ill reputations have set tricks. If this method performs and it was publicized, they should also use it to improve their profits. There can be many excuses to answer such issues, but none can be close to reality. This write-up would not have existed if rich had been as easy as it seems.

Is Social Trading Profitable?

No, social trading is not profitable based on brokerage account statistics, where more than 80% of all traders lose all their money, and less than 5% are profitable. The biggest problems with social and copy trading are high-risk trades and bad money management.

Reasons to lose trades with trading signals.

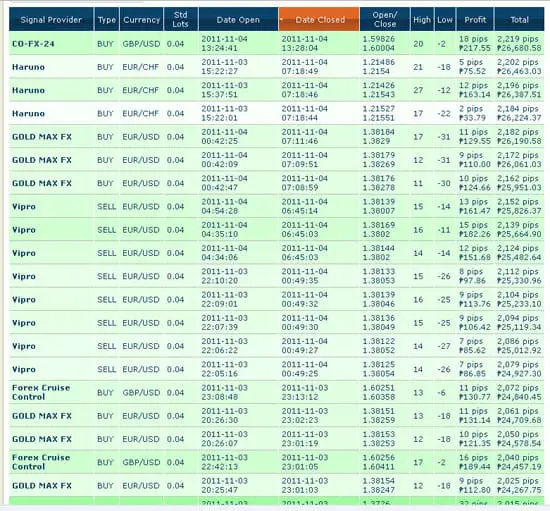

The main reason traders lose money using trading signals is that they do not know how to pick the right trading strategy, calculate risks, and measure performance. In addition, trading signals platforms often do not offer important information about the portfolio and trading strategy (some platforms do not show absolute drawdown. Beginner traders do not understand how drawdown is essential compared to how many pips some trading strategies made in the past.

Here is an example of a lousy mirror trading platform performance measurement:

The trader opened BUY trade EURUSD at 1.3. After 14 days, he closed the trade at 1.31.

After that trader created another BUY trade at 1.31 and closed at 1.305.

The mirror trading platform will show you a drawdown of 50 pips and a profit of 100 pips, making these two trades profitable.

But this is not true! So you do not know one important fact.

During the 14 days in the first trade, the signal provider created a 300 pips drawdown. The price went to 1.27 and then again go up to 1.31. This trading strategy was dangerous. The strategy provider does not like to cut losses. But you do not know that stats do not monitor equity from stats because the system showed only close trades.

Equity drawdown is important and not closed losing trades drawdown.

Though Forex signals to make profits in forex trading seem good, the service providers will provide signals after analyzing the forex market. According to service providers, you need not do anything, and money will start coming into your pocket just by receiving text alerts and emails. But that is not the right way to trade in the forex market. It is not as easy to make money in the forex market as displayed by forex signals providers. According to experts, the forex signal’s service is not as good as it has been promoted as it may not allow you to achieve your goal.

Most of the forex traders using trading signals lose their trades because they do not have self-confidence. These signals may not be suitable for your trading style, and you may not be able to take responsibility for your failure as you have followed the signals provided by the service provider.

Today you can find some successful traders providing Forex trading copy-and-paste services of mt4 though very few successful traders follow them. Compared to signal service providers, these traders are several thousand times better. When you follow mt4 services, you are sure that your funds will be handled very carefully as there is a master account to which your trading account will be attached.

Now to make huge profits, you need not make goals for the long term. The forex trades will be copy-pasted to your trading account, and the professional traders will do the hard work. However, if you consider forex trading as an optional source of income only, then you should follow this technique. You may not control the factors affecting your profits unless you are confident to trade independently. It is like you are spending your own money on someone else. You can lose your money if he fails to perform as expected. So, it would be best if you tried to learn things properly in this regard.

Mirror trading in forex involves copying the trades of experienced traders in real time. This can be done manually or through automated trading software. Here are some of the benefits and disadvantages of mirror trading:

Benefits:

- Saves time and effort: Mirror trading saves time and effort that would otherwise be spent researching and analyzing market conditions, identifying trading opportunities, and executing trades.

- Access to expertise: Mirror trading allows inexperienced traders to benefit from the expertise and experience of more successful traders without spending time and effort developing their trading strategies.

- Diversification: Mirror trading allows traders to diversify their portfolios by copying trades across multiple markets and asset classes.

- Reduced emotions: Mirror trading can reduce the emotions that often accompany trading, such as fear, greed, and anxiety since the trader is simply following the trades of an experienced trader.

- Transparency: Mirror trading provides transparency into the trading strategies and performance of experienced traders, which can help traders make informed decisions about who to follow.

Disadvantages:

- Risk of losses: Mirror trading carries the risk of losses, just like any other form of trading. Traders should carefully review the performance and risk management strategies of the traders they are copying and be prepared to incur losses.

- Hidden fees: Mirror trading platforms may charge fees or commissions for the service, which can affect the trader’s profits.

- Limited control: Mirror trading involves giving up some control over trading decisions since the trader is following another person’s trades. This can limit the ability of the trader to respond to changing market conditions.

- Lack of customization: Mirror trading may not allow traders to customize their trades to their specific risk tolerance or investment objectives.

- Reliance on signal providers: Mirror trading relies on the performance and reliability of the signal provider. If the provider’s performance deteriorates, the trader may incur losses.

MQL5 Copy Paste Forex Signals

Here are the general steps to copy signals from the MQL5 website:

- Create a MQL5 account: To copy signals from the MQL5 website, you will need to create a MQL5 account. You can do this by visiting the MQL5 website and clicking on the “Register” button in the top-right corner of the page.

- Choose a signal provider: Browse through the list of signal providers on the MQL5 website and select a provider whose trading signals you would like to copy. You can use various filters to refine your search, such as performance metrics, risk parameters, and trading strategies.

- Subscribe to the signal: Once you have selected a signal provider, click on the “Subscribe” button on their profile page. You will then be prompted to select a payment method and choose a subscription plan that meets your needs. The subscription fee will depend on the signal provider’s performance and the duration of the subscription.

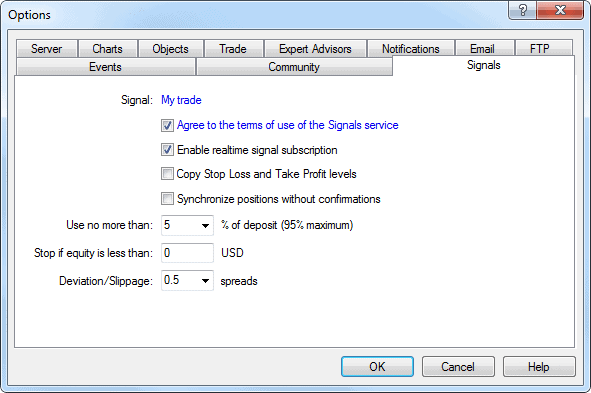

- Install the MetaTrader platform: To copy signals from the MQL5 website, you will need to install the MetaTrader platform on your computer or mobile device. You can download the platform from the MQL5 website or from your broker’s website.

- Connect your account: After installing the MetaTrader platform, you will need to connect your trading account to the MQL5 website. You can do this by entering your account details in the “Signals” section of the platform and selecting the signal provider you subscribed to.

- Start copying signals: Once you have connected your trading account to the MQL5 website, you can start copying the signal provider’s trades. The trades will be executed automatically on your account, and you can monitor your account’s performance and adjust your risk management settings as needed.

It’s important to note that copying signals from the MQL5 website involves risks, and you should carefully review the signal provider’s performance and risk management strategies before subscribing to their signals. Additionally, past performance is not indicative of future results, and you should always be prepared to incur losses when trading in the forex market.