Step into the world of financial freedom with Robinhood, the commission-free stock trading and investing app on a mission to democratize finance for all. Since its launch, Robinhood has been reshaping the financial landscape by offering a platform that breaks down the barriers to investing and provides users with the tools they need to take control of their financial future.

This pioneering app emerged with a radical proposition—making stock trading accessible, eliminating commission fees that once made investing inaccessible to many. But it’s not just about cost-effectiveness. Robinhood has simplified the often complex world of finance, wrapping it up in an intuitive, user-friendly design that appeals to novice and seasoned investors.

From buying and selling stocks, options, and ETFs to the more adventurous realms of cryptocurrency, Robinhood’s free trading platform has redefined accessibility in the financial marketplace. Pair that with real-time market data, customizable news alerts, and a suite of straightforward financial learning resources, and you’ve got an app enabling the masses to build and manage their investment portfolios.

On this forex website, we wonder if traders can trade forex on Robinhood and what conditions are compared with CFD and Metatrader trading.

Can You Trade Forex on Robinhood?

No, you can not trade forex on Robinhood because Robinhood doesn’t support foreign exchange trading, mutual funds, fixed-income products, or futures. You can trade on Robinhood-only U.S. exchange-listed stocks and ETFs, ADRs for over 650 globally-listed companies, and Options contracts for U.S. Exchange-Listed Stocks and ETFs.

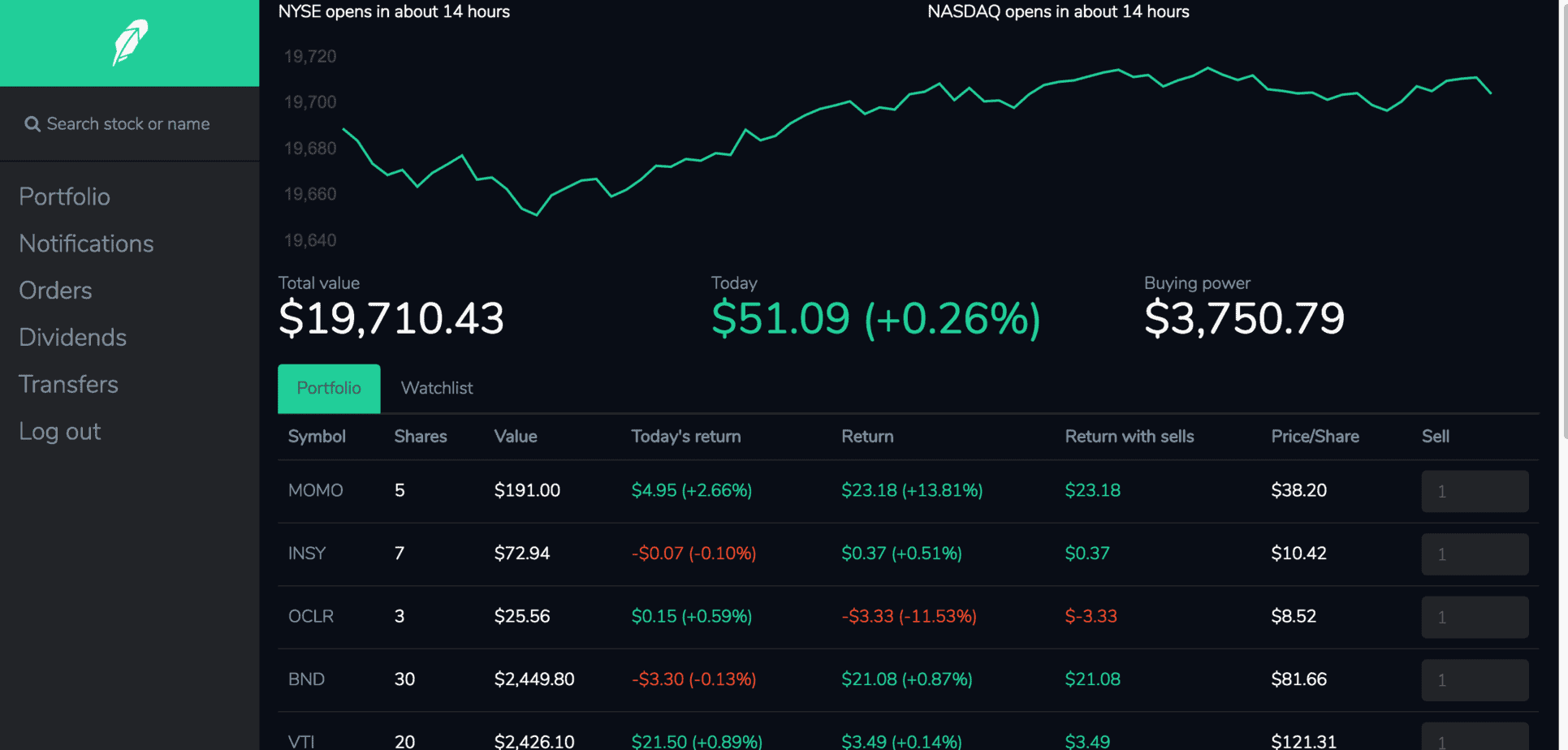

As you can see, traders usually use Robinhood for U.S. stocks, ETFs, and U.S. stocks-ETF options. See the dashboard screenshot:

At its core, Robinhood is a platform designed to democratize investing, making it accessible to the everyday individual. While the app currently offers trading in stocks, options, ETFs, and cryptocurrencies, it does not provide foreign exchange (forex) trading, and there are several reasons for this.

The main reason you highlighted, and indeed a significant factor, is leverage. In the world of forex trading, leverage is often essential to realize meaningful profits, particularly for smaller traders. Leverage in forex can be as high as 1:100 or even 1:1000, meaning traders can control prominent positions with relatively small amounts of money. This, however, is a double-edged sword—it also means traders can lose significant amounts of money quickly.

Offering such high leverage poses a substantial risk for both the brokerage and the customer, particularly for a platform like Robinhood, which is aimed primarily at less experienced investors. The high risk inherent in leveraged forex trading can lead to rapid, significant losses if the market moves against the trader. This isn’t quite in line with Robinhood’s mission of democratizing finance ‘for all’ – it doesn’t fit their model of providing a safe and understandable platform for new and casual investors.

Furthermore, the regulatory environment for forex trading in the United States differs from other securities like stocks and ETFs. The Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) regulate forex trading in the U.S. these agencies have strict rules and regulations that Robinhood would need to comply with to offer forex trading. These include higher capital requirements and detailed reporting requirements, which could be a barrier to entry.

If you want to start trading forex, it is better to try our best CFD brokers instead of Robinhood.

Robinhood has undeniably disrupted the investing landscape, making trading more accessible to the masses than ever before. The commission-free model and the app’s user-friendly interface have made it a game changer, removing some of the traditional barriers to entry into the world of finance.

While the platform does not currently support futures or forex trading, Robinhood’s track record shows a willingness to innovate and expand its offerings in response to user demand and market trends. Notably, the platform’s recent shift to support 24-hour trading points to its evolving nature and potential capacity to accommodate the round-the-clock nature of forex markets.

Moreover, Robinhood’s core mission—democratizing finance for all—has driven it to evolve and adapt continuously. It is not out of the realm of possibility that we could see the platform venture into other realms of the financial marketplace, such as forex and futures trading, provided they align with the company’s mission and comply with regulatory standards.

Should Robinhood decide to branch out into these areas, it could open up these complex and traditionally intimidating markets to a broader audience, furthering its mission to democratize finance. This is a hope that many in the Robinhood community share and look forward to seeing realized in the future.